Global Automated Storage and Retrieval System (ASRS) Market Segmentation, By Type (Unit Load, Mini Load, Vertical Lift Module, Carousel, Mid Load, Auto store), Function (Storage, Order Picking, Distribution, Assembly, Kitting, Others), Industry (Automotive, Metals and Heavy Machinery, Food and Beverages, Chemicals, Healthcare, Semiconductors and Electronics, Retail, Aviation, E-Commerce, and Others) - Industry Trends and Forecast to 2032

Automated Storage and Retrieval System (ASRS) Market Size

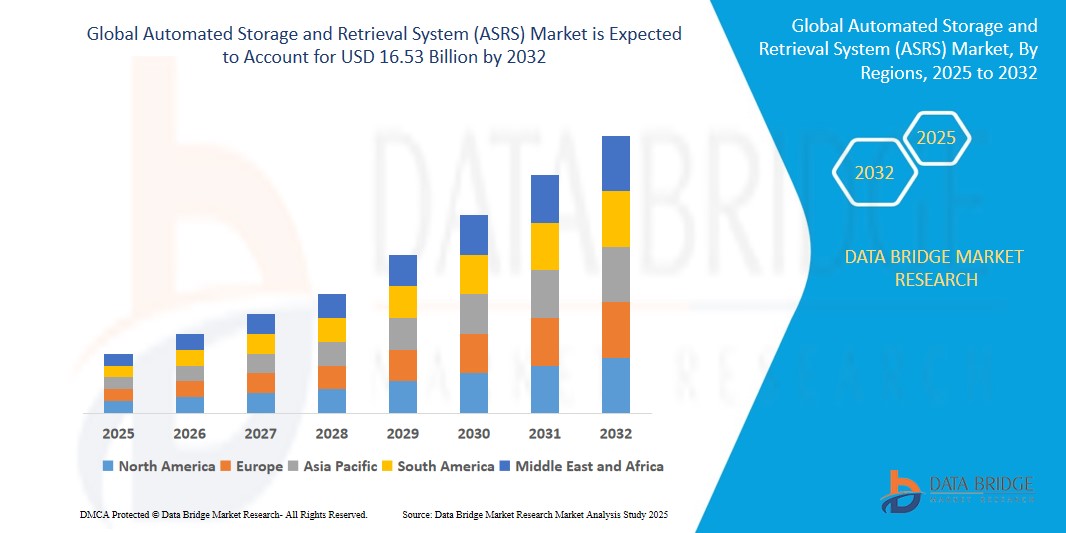

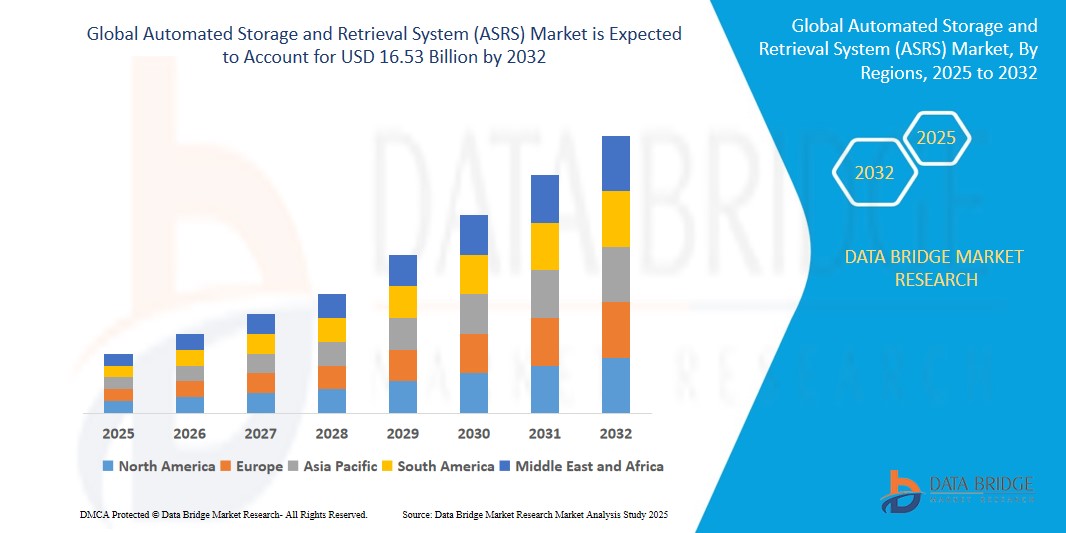

- The Global Automated Storage and Retrieval System (ASRS) Market size was valued at USD 3.67 billion in 2024 and is expected to reach USD 16.53 billion by 2032, at a CAGR of 8.4% during the forecast period

- This growth is driven by factors such as the E-commerce Expansion, Labor Shortages and Cost Reduction, and Technological Advancements

Automated Storage and Retrieval System (ASRS) Market Analysis

- The automated storage and retrieval system (ASRS) market is expected to witness market growth at a rate of 8.4% in the forecast period of 2025 to 2032. Data Bridge Market Research report on automated storage and retrieval system (ASRS) market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rise in the demand for automated storage and retrieval system in the automotive industry is escalating the growth of the automated storage and retrieval system (ASRS) market.

- Automated storage and retrieval systems (ASRS) is referred to be the main part of many warehouse automation system that has the aptitude to sequence, sort, buffer, and store an extensive range of goods into almost unlimited destinations. It is mostly comprised of retrieval and storage machines, conveyor interface, rack structure, and warehouse control system.

- North America dominates the automated storage and retrieval system (ASRS) market due to the increase in the acceptance of big data technologies amongst organizations to improve consumer target marketing and risk management abilities. Furthermore, the growth of the infrastructure and industrial development allowed the automated storage system manufacturers to expand their penetration in several countries will further boost the growth of the automated storage and retrieval system (ASRS) market in the region during the forecast period

- Asia-Pacific is projected to observe a significant amount of growth in the automated storage and retrieval system (ASRS) market due to the rise in the development of automotive, food and beverages, and healthcare industries in the advancing countries. Moreover, the occurrence of the major key player is further anticipated to propel the growth of the automated storage and retrieval system (ASRS) market in the region in the coming years.

- Unit load segment is expected to dominate the market with a market share of 46.31 % due to its high efficiency in handling large and heavy items, reducing manual labor, and optimizing space utilization in warehouses. Its ability to move full pallets or containers in a single operation makes it ideal for industries like manufacturing, automotive, and food & beverage, where bulk storage and retrieval are essential.

Report Scope and Automated Storage and Retrieval System (ASRS) Market Segmentation

|

Attributes

|

Automated Storage and Retrieval System (ASRS) Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players

|

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Automated Storage and Retrieval System (ASRS) Market Trends

“Rise of AI-Driven Smart Warehouses”

- The integration of Artificial Intelligence (AI) into Automated Storage and Retrieval Systems (ASRS) is transforming traditional warehouses into "smart" facilities.

- This evolution enables real-time inventory tracking, predictive maintenance, and optimized storage solutions, leading to enhanced operational efficiency.

- For instance, luxury retailers like Harrods and Hugo Boss are investing heavily in AI-powered warehouse technologies, including robotics and RFID systems, to streamline their supply chains and improve decision-making processes.

- These advancements are setting new standards in warehouse automation, pushing the industry towards more intelligent and adaptable systems

Automated Storage and Retrieval System (ASRS) Market Dynamics

Driver

“Labor Shortages and Rising Costs”

- Labor shortages and increasing wages are compelling businesses to adopt ASRS solutions to maintain productivity and reduce operational costs. In the United States.

- Demand for warehouse automation has surged as companies seek to mitigate the impact of workforce limitations.

- ASRS systems help reduce reliance on manual labor, cut operational costs, and enhance supply chain efficiency, making them a strategic investment for companies aiming to stay competitive in a challenging labor market

Opportunity

“Expansion in Asia-Pacific Markets”

- The Asia-Pacific region is experiencing rapid economic growth, leading to increased demand for efficient warehouse solutions.

- Countries like China, Japan, and India are investing heavily in ASRS to optimize their supply chains and meet the growing consumer demands

For instance,

- For instance, major retailers in these countries are adopting ASRS to enhance inventory management and reduce operational costs, presenting significant growth opportunities for ASRS providers in the region.

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- Despite the long-term benefits, the high initial investment and ongoing maintenance costs associated with ASRS can be a significant barrier for small and medium-sized enterprises (SMEs).

- The complexity of these systems requires specialized expertise for installation and upkeep, which can be resource-intensive.

- Additionally, the need for regular updates and potential system downtimes for maintenance can disrupt operations, posing challenges for businesses with limited budgets and technical resources

Automated Storage and Retrieval System (ASRS) Market Scope

The market is segmented on the basis By Type, Function, Industry.

|

Segmentation

|

Sub-Segmentation

|

|

By Type

|

|

|

Function

|

|

|

Industry

|

|

In 2025, the Unit Load is projected to dominate the market with a largest share in Type segment

The Unit Load segment is projected to dominate the Automated Storage and Retrieval System (ASRS) market in 2025, holding a significant share of approximately 46.31%. This dominance is attributed to the system's capability to handle large and heavy loads, such as pallets, drums, and racks, making it ideal for industries like automotive, manufacturing, and e-commerce. Unit Load ASRS enhances storage density, reduces manual labor, and improves operational efficiency.

The Mini Load is expected to account for the largest share during the forecast period in this market

The Mini Load Automated Storage and Retrieval System (ASRS) is projected to hold a significant market share of 42.65% during the forecast period. This dominance is attributed to its efficiency in handling small, lightweight items such as consumer goods, pharmaceuticals, and electronics. Mini Load systems are particularly advantageous in environments where space optimization and rapid retrieval are crucial. Their compact design allows for high-density storage, making them ideal for high-turnover inventory in industries like retail and e-commerce. The increasing demand for automation in these sectors further propels the adoption of Mini Load ASRS solutions.

Automated Storage and Retrieval System (ASRS) Market Regional Analysis

“North America Holds the Largest Share in the Automated Storage and Retrieval System (ASRS) Market”

- North America is projected to hold a significant share in the Automated Storage and Retrieval System (ASRS) market, with estimates ranging between 35% and 42.65% in 2025. This dominance is primarily attributed to the region's early adoption of advanced technologies, robust industrial infrastructure, and the increasing emphasis on automation across various sectors. Key industries such as e-commerce, automotive, pharmaceuticals, and food & beverages in the U.S. and Canada are heavily investing in ASRS to enhance operational efficiency and meet growing consumer demands. Additionally, the rising labor costs and workforce shortages are prompting companies to implement automated solutions to maintain productivity. The integration of technologies like IoT and AI further bolsters the capabilities of ASRS, enabling real-time inventory tracking and predictive maintenance. These factors collectively position North America as a leader in the global ASRS market.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automated Storage and Retrieval System (ASRS) Market”

- The Asia-Pacific region is expected to experience the highest growth in the Automated Storage and Retrieval System (ASRS) market, with a CAGR of 7.31% during the forecast period. This growth is driven by rapid industrialization, urbanization, and the increasing adoption of automation technologies in countries like China, India, and Japan. The growing e-commerce sector, combined with rising labor costs and the need for efficient warehouse solutions, is propelling the demand for ASRS systems. Additionally, advancements in AI and IoT are enhancing ASRS capabilities, further boosting market expansion. As businesses aim to improve operational efficiency and reduce costs, ASRS adoption continues to rise in the region.

Automated Storage and Retrieval System (ASRS) Market Share

The automated storage and retrieval system (ASRS) market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the automated storage and retrieval system (ASRS) market.

The Major Market Leaders Operating in the Market Are:

- WESTFALIA-Automotive GmbH,

- SencorpWhite, Inc,

- MIAS Group,

- IHI Corporation,

- Hänel GmbH & Co. KG,

- Automation Logistics Corporation,

- Vanderlande Industries,

- System Logistics Spa,

- Swisslog Holding AG,

- Mecalux,

- S.A.,

- KNAPP AG,

- Dematic,

- BEUMER GROUP,

- Bastian Solutions, Inc.,

- TGW Logistics Group,

- Fritz SchAfer GmbH,

- Kardex Group,

- Daifuku Co., Ltd,

- Nilkamal and Murata Machinery, Ltd.

- Heine Optotechnik (Germany)

Latest Developments in Global Automated Storage and Retrieval System (ASRS) Market

- In January 2024, Honeywell launched a new Automated Storage and Retrieval System (ASRS) that integrates artificial intelligence (AI) and machine learning. This system is designed to improve efficiency and accuracy in managing inventory, particularly in distribution centers and warehouses. With the power of AI, it automates tasks and optimizes workflows, reducing human error and enhancing overall operational performance. The innovation aims to streamline processes and support faster decision-making by leveraging intelligent algorithms. This advancement is a step forward in modernizing the supply chain and logistics industry.

- In January 2024, Honeywell launched a new Automated Storage and Retrieval System (ASRS) that integrates artificial intelligence (AI) and machine learning. This system is designed to improve efficiency and accuracy in managing inventory, particularly in distribution centers and warehouses. With the power of AI, it automates tasks and optimizes workflows, reducing human error and enhancing overall operational performance. The innovation aims to streamline processes and support faster decision-making by leveraging intelligent algorithms. This advancement is a step forward in modernizing the supply chain and logistics industry.

- In October 2024, SSI SCHAEFER joined forces with ALP to develop a cutting-edge automated facility in Selangor, Malaysia. The facility, named OMEGA 1 Bukit Raja, will be Southeast Asia’s largest automated warehouse. Covering an impressive 1.8 million square feet, it will feature a high-bay racking system, allowing for highly efficient storage and retrieval of goods. This state-of-the-art facility is designed to meet the increasing demands of modern supply chains in the region, offering superior capacity, speed, and flexibility. The project reflects the growing trend of automation in Southeast Asia, aiming to boost the region’s logistics capabilities.

- In February 2024, Skechers USA collaborated with Hai Robotics to improve its distribution center in Tokyo. The partnership focuses on implementing Hai Robotics' automated goods-to-person (G2P) technology, which increases operational efficiency and accuracy. By integrating this advanced system, Skechers can streamline order fulfillment and boost productivity in its Tokyo facility. The technology allows for faster and more precise retrieval of products, reducing manual labor and enhancing the overall speed of operations. This collaboration highlights the increasing demand for automation to optimize supply chain performance and improve customer service.

- In February 2024, Robert Group teamed up with Dematic Corp. to open Quebec's first fully automated cold storage facility. This facility, featuring 130-foot-tall cranes and capable of handling up to 60,000 pallets, is designed to store fresh and frozen products efficiently. The cutting-edge ASRS solution helps reduce labor costs and improve storage density, while maintaining the required temperature conditions for perishable goods. By automating the storage and retrieval process, the facility supports a faster, more reliable supply chain for food and beverage products. This innovation marks a significant advancement in the food logistics industry in Canada.

SKU-