Global Automated Material Handling Market

Market Size in USD Billion

CAGR :

%

USD

33.80 Billion

USD

71.56 Billion

2024

2032

USD

33.80 Billion

USD

71.56 Billion

2024

2032

| 2025 –2032 | |

| USD 33.80 Billion | |

| USD 71.56 Billion | |

|

|

|

|

Automated Material Handling Market Size

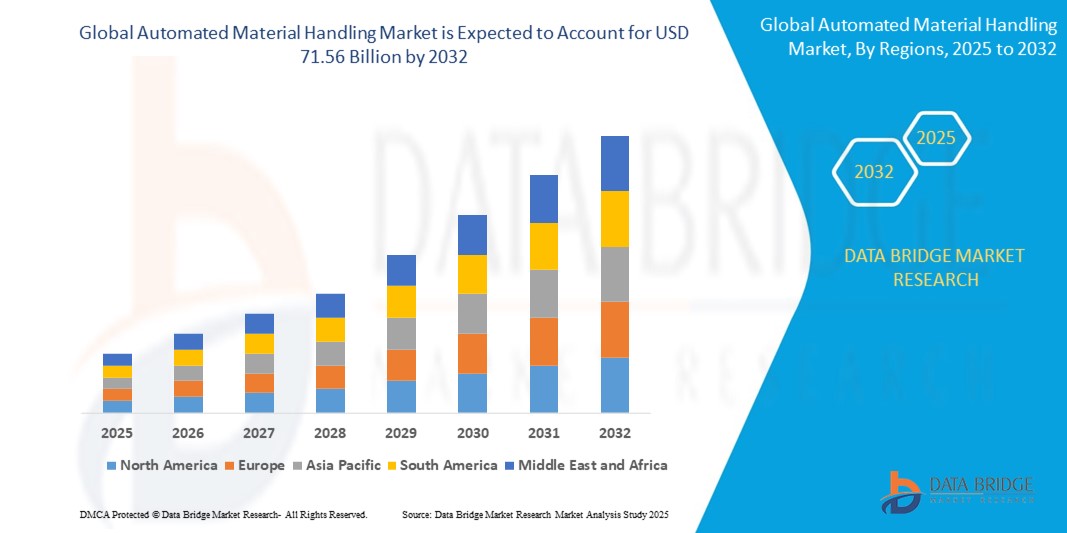

The global automated material handling market size was valued at USD 33.8 billion in 2024 and is expected to reach USD 71.56 billion by 2032, at a CAGR of 9.83% during the forecast period

This growth is driven by factors such as the increased demand for automation in logistics and warehousing, advancements in robotics and artificial intelligence, the rapid growth of e-commerce, rising labour costs, and the need for operational efficiency and safety in manufacturing and distribution centres

Automated Material Handling Market Analysis

- Automated material handling equipment can be referred to automate the most tiresome, unsafe and dull tasks in the manufacturing the line of various industries

- The equipment is utilized by the end users to develop the quality, flexibility, throughput, and consistency all along with the decline in the ergonomic hazards for employees

- North America is expected to dominate the automated material handlings market due to well-developed infrastructure, facilitating the widespread adoption of automated solutions

- Asia-pacific is expected to be the fastest growing region in the automated material handling market during the forecast period due to rapid industrial growth, increasing the demand for efficient material handling solutions.

- Unit load material handling segment is expected to dominate the market with a market share due to its activity involves moving and storing a single entity, including pallets and containers. It carries a single load despite the individual items that make it up. Unit load equipment carriers are economical and quicker to transfer many items simultaneously compared to moving each item individually

Report Scope and Automated Material Handling Market Segmentation

|

Attributes |

Automated Material Handling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automated Material Handling Market Trends

“Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Automated Material Handling Systems”

- The integration of AI and ML algorithms in automated material handling systems enables predictive maintenance, real-time decision-making, and optimization of warehouse operations. This leads to reduced downtime and improved throughput

- AI-powered systems can analyze vast amounts of data to forecast demand patterns, optimize stock levels, and automate replenishment processes, ensuring that inventory is managed efficiently and cost-effectively

- Machine learning allows robots to adapt to changing environments and tasks, improving their flexibility and efficiency in handling a wide range of materials and products

- The continuous collection and analysis of data from automated systems provide valuable insights into operational performance, helping businesses identify areas for improvement and make informed decisions

- The adoption of AI and ML in automated material handling systems is expected to drive significant market growth, with companies investing in these technologies to stay competitive and meet evolving customer demands

Automated Material Handling Market Dynamics

Driver

“E-commerce Boom and Demand for Efficient Logistics”

- The rapid growth of e-commerce has led to an increase in order volumes, necessitating the need for automated material handling systems to manage and fulfill orders efficiently

- Consumers' expectations for quick delivery times have pushed retailers and logistics providers to adopt automation technologies to streamline operations and reduce lead times

- Automated systems offer scalability, allowing businesses to expand their operations without a proportional increase in labor costs, making them ideal for handling fluctuating demand

- Automation helps in reducing labor costs and minimizing human errors, leading to overall cost savings in warehouse and distribution center operations

- The need for efficient logistics solutions is driving the adoption of automated material handling systems across various regions, further fueling market growth

Opportunity

“Expansion in Emerging Markets”

- Emerging economies, particularly in Asia-Pacific, are experiencing rapid industrialization, increasing the demand for automated material handling solutions to support manufacturing and logistics sectors

- Governments in countries such as China and India are promoting automation through incentives and policies, encouraging businesses to adopt advanced material handling technologies

- Investments in infrastructure, such as the development of smart cities and industrial parks, create opportunities for implementing automated systems in material handling processes

- Many emerging markets have yet to fully adopt automated material handling solutions, presenting significant growth opportunities for companies offering these technologies

- Industries such as automotive, food and beverage, and pharmaceuticals in emerging markets are increasingly adopting automated material handling systems to improve efficiency and meet growing demand.

Restraint/Challenge

“High Initial Investment and Integration Complexities”

- The high upfront costs associated with purchasing and installing automated material handling systems can be a barrier for small and medium-sized enterprises (SMEs)

- Integrating new automated systems with existing infrastructure and processes can be complex and time-consuming, requiring specialized expertise and potentially causing operational disruptions

- Tailoring automated solutions to meet specific operational requirements may involve additional costs and time, deterring some businesses from adopting these technologies

- The introduction of automation may lead to concerns about job displacement, necessitating retraining and upskilling of the existing workforce to manage and maintain new systems.

- Automated systems require regular maintenance to ensure optimal performance. Unexpected breakdowns or technical issues can lead to downtime, affecting productivity and potentially leading to financial losses

Automated Material Handling Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By System Type |

unit load material handling bulk load material handling |

|

By Industry |

|

In 2025, the unit load material handling is projected to dominate the market with a largest share in system type segment

The unit load material handling segment is expected to dominate the Automated Material Handling market with the largest share in 2025 due to its activity involves moving and storing a single entity, including pallets and containers. It carries a single load despite the individual items that make it up. Unit load equipment carriers are economical and quicker to transfer many items simultaneously compared to moving each item individually.

The robots is expected to account for the largest share during the forecast period in product type market

In 2025, the robots segment is expected to dominate the market with the largest market share of 22.5% due to its high prevalence and demand for precision. Integrating artificial intelligence (AI) and ML technologies in robotic systems is driving the growth of the robot segment in the market..

Automated Material Handling Market Regional Analysis

“North America Holds the Largest Share in the Automated Material Handling Market”

- North America held 33% in the automated material handling market, with U.S. being the dominating country due to large population and advanced technology

- The region boasts a well-developed infrastructure, facilitating the widespread adoption of automated solutions

- High investments in research and development have led to the introduction of innovative automated systems

- Major companies in the automated material handling industry are headquartered in North America, driving market growth

- Sectors such as automotive, e-commerce, and manufacturing have a high demand for automated material handling solutions

- Government initiatives promoting automation and technological advancements further bolster market expansion

“Asia-Pacific is Projected to Register the Highest CAGR in the Automated Material Handling Market”

- Countries such as China and India are experiencing rapid industrial growth, increasing the demand for efficient material handling solutions

- The surge in online shopping has led to the establishment of numerous distribution centers, requiring automated systems for efficient operations

- Policies aimed at boosting manufacturing and infrastructure development are encouraging the adoption of automation technologies

- Automated systems offer cost savings in labor and operational efficiency, appealing to businesses in the region

- The integration of AI and IoT in automated systems enhances their capabilities, driving market growth

Automated Material Handling Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GreyOrange (India)

- Geekplus Technology Co., Ltd. (China)

- Scallog (France)

- Eiratech Robotics (Ireland)

- Dematic (U.S.)

- Witron (Germany)

- TGW Logistics Group (Austria)

- Knapp AG (Austria)

- Advanced Automated Systems, Inc. (U.S.)

- Taylor Material Handling & Conveyor (U.S.)

- L3 Technologies, Inc. (U.S.)

- Arcadis (Netherlands)

- Mecalux, S.A. (Spain)

- Performance People (U.S.)

- Conveyco (U.S.)

- Daifuku Co., Ltd. (Japan)

- IAM Robotics (U.S.)

- Material Handling Systems (U.S.)

- Swisslog Holding Ltd. (Switzerland)

- Schaefer Systems International Pvt Ltd (India)

- Amber Group India (India)

Latest Developments in Global Automated Material Handling Market

- In March 2025, Bastian Solutions merged with Viastore North America into its operations to strengthen material handling equipment services as part of the Toyota Automated Logistics Group. This integration combines Bastian Solutions’ expertise in systems integration with Viastore’s specialization in automated pallet handling technologies, expanding capabilities in warehouse automation and storage solutions

- In January 2025, May River Capital merged its portfolio companies, Automated Handling Solutions (AHS) and Advanced Material Processing (AMP), to create a consolidated platform offering material processing and handling equipment along with aftermarket services. The newly formed entity serves various sectors, including food and beverage, nutraceutical, pharmaceutical, and chemical industries

- In March 2024, OTTO Motors by Rockwell Automation, specializing in AMRs, unveiled its involvement in autonomous production logistics, a pioneering sector in manufacturing innovation. With the acquisition of OTTO Motors into its portfolio, Rockwell Automation broadened its material handling capabilities, offering a comprehensive solution for streamlining operations throughout entire facilities

- In July 2023, Jungheinrich unveils cutting-edge mobile robot solution at LogiMAT 2023, setting new industry standards. The adaptable robot seamlessly integrates into warehouses, autonomously solves challenges, and enhances performance, reflecting a shift towards intelligent intralogistics

- In May 2023, Toyota Material Handling expands its portfolio with innovative electric forklifts: Side-Entry End Rider, Center Rider Stacker, and Industrial Tow Tractor. These additions enhance material handling solutions, emphasizing adaptability and superior on-site performance for customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.