Global Automated Liquid Handling Market

Market Size in USD Billion

CAGR :

%

USD

1.49 Billion

USD

2.83 Billion

2024

2032

USD

1.49 Billion

USD

2.83 Billion

2024

2032

| 2025 –2032 | |

| USD 1.49 Billion | |

| USD 2.83 Billion | |

|

|

|

|

Automated Liquid Handling Market Size

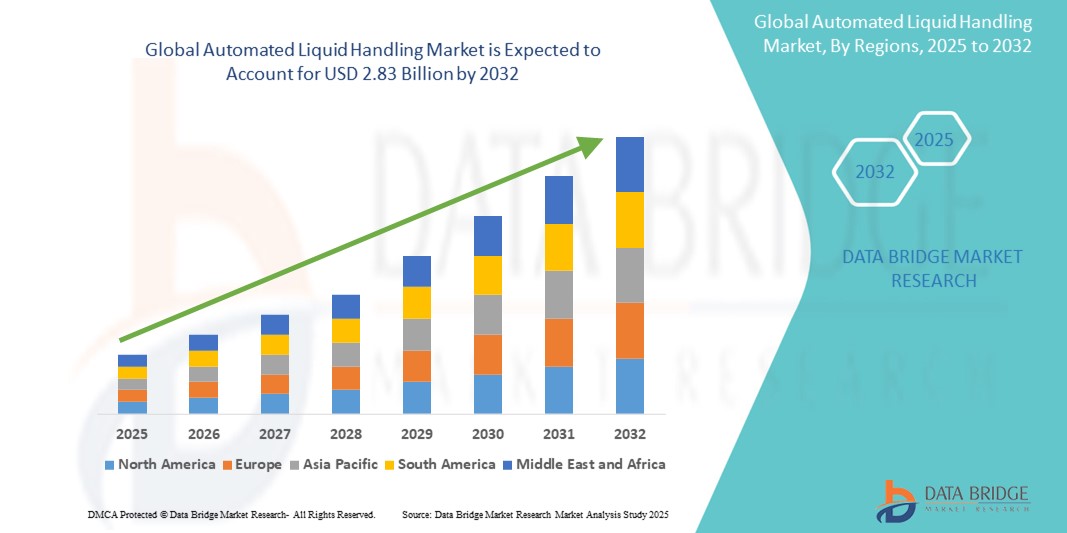

- The global automated liquid handling market size was valued at USD 1.49 billion in 2024 and is expected to reach USD 2.83 billion by 2032, at a CAGR of 8.30% during the forecast period

- The market growth is largely fueled by the increasing demand for high-throughput screening in drug discovery and development, a surge in R&D investments by pharmaceutical and biotechnology companies, and the growing adoption of automation in clinical and research settings

- Furthermore, rising needs for precision, accuracy, and reproducibility in laboratory workflows, coupled with technological advancements such as contactless dispensing, miniaturization, and AI integration, are establishing automated liquid handling systems as indispensable tools.

Automated Liquid Handling Market Analysis

- Automated liquid handling systems, comprising robotic platforms for precise and efficient dispensing, mixing, and transferring of liquids, are increasingly crucial for modern laboratory workflows in pharmaceutical, biotechnology, and academic research settings due to their enhanced accuracy, reproducibility, and high-throughput capabilities

- The escalating demand for automated liquid handling systems is primarily fueled by the growing need for high-throughput screening in drug discovery and development, increasing R&D investments by life science companies, and a rising preference for laboratory automation to minimize human error and increase efficiency

- North America dominates the automated liquid handling market with the largest revenue share of 40.5% in 2024, characterized by robust biotechnology and pharmaceutical industry, significant R&D expenditures, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest growing region in the automated liquid handling market during the forecast period due to increasing investments in life science research, a burgeoning pharmaceutical and biotechnology sector, and growing awareness and adoption of advanced laboratory automation technologies in countries

- Automated liquid handling workstations segment dominates the automated liquid handling market with a market share of 57.4% in 2024, driven by its versatility, ability to perform various liquid handling tasks, and critical role in enabling high-throughput and reproducible experiments across diverse applications such as drug discovery and genomic research

Report Scope and Automated Liquid Handling Market Segmentation

|

Attributes |

Automated Liquid Handling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automated Liquid Handling Market Trends

“AI and Machine Learning for Enhanced Precision and Workflow Optimization”

- A significant and accelerating trend in the global automated liquid handling market is the deepening integration of Artificial Intelligence (AI) and Machine Learning (ML). This fusion of technologies is significantly enhancing the precision, efficiency, and adaptability of liquid handling processes in laboratories

- For instance, companies such as Bio Molecular Systems, with their Myra Liquid Handling System, are integrating advanced algorithms and cameras for error-free pipetting and automated calibration, ensuring precise and reliable results. Similarly, Formulatrix has introduced advanced liquid handlers such as the FLO i8, which uses intelligent pipetting to optimize protocols without manual specification of liquid properties or labware geometries

- AI and ML integration in automated liquid handlers enables features such as real-time monitoring of dispensing to optimize conditions, predicting experimental outcomes, and flagging inconsistencies. This allows for smarter experimental design and dynamic, adaptive workflows. For example, machine learning algorithms can analyze historical data to predict how compounds will perform in drug discovery, accelerating the identification and testing of promising candidates

- The seamless integration of automated liquid handlers with AI and ML platforms facilitates centralized control and data analysis across various laboratory instruments. Through a single interface, users can manage complex experimental designs, analyze data, and potentially integrate with Laboratory Information Management Systems (LIMS) for a unified and automated research experience

- This trend towards more intelligent, intuitive, and interconnected liquid handling systems is fundamentally reshaping laboratory operations. Consequently, companies such as Thermo Fisher Scientific, Hamilton Company, Tecan Group, and Agilent Technologies are actively developing and incorporating AI and ML into their automated liquid handling solutions.

- The demand for automated liquid handling systems that offer seamless AI and ML integration is growing rapidly across pharmaceutical, biotechnology, and academic research sectors, as laboratories increasingly prioritize enhanced precision, reproducibility, high-throughput capabilities, and overall workflow optimization

Automated Liquid Handling Market Dynamics

Driver

“Increasing Demand Due to Rising R&D Investments and Need for High-Throughput Screening”

- The increasing R&D investments by pharmaceutical and biotechnology companies, coupled with the growing demand for high-throughput screening (HTS) in drug discovery and development, is a significant driver for the heightened demand for automated liquid handling systems

- For instance, the continuous pursuit of novel drugs and therapies for various diseases, including chronic and infectious conditions, necessitates efficient and accurate handling of large volumes of liquid samples. Automated liquid handling systems are crucial for accelerating the drug discovery process by enabling rapid and parallel processing of samples, which is essential for screening millions of compounds to identify potential drug candidates

- Furthermore, the growing emphasis on laboratory automation to minimize human error, enhance reproducibility, and improve overall workflow efficiency is making automated liquid handlers an indispensable component of modern research and diagnostic laboratories. These systems reduce manual labor, optimize reagent usage, and provide consistent results, which are critical in sensitive applications such as genomics, proteomics, and cell-based assays.

- The rising adoption of advanced techniques such as next-generation sequencing (NGS), PCR, and personalized medicine further fuels the demand for automated liquid handling systems. These techniques often involve complex and precise liquid transfers at low volumes, making automation a necessity

- The trend towards miniaturization of assays and the need for higher throughput in clinical diagnostics also contribute to the accelerating adoption of automated liquid handling solutions, thereby significantly boosting the industry's growth

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- The high initial investment costs associated with automated liquid handling systems, coupled with the complexity of integrating these advanced systems into existing laboratory workflows, pose a significant challenge to broader market penetration, particularly for smaller laboratories and research facilities with limited budgets

- For instance, prices for new automated liquid handling systems can range from tens of thousands to well over USD 100,000, and even up to millions for highly sophisticated robotic platforms from leading manufacturers such as Hamilton. This significant upfront cost can be prohibitive for many academic institutions, smaller biotech startups, or clinical diagnostic labs that operate on tighter budgets

- Furthermore, the integration of automated liquid handling systems into existing laboratory infrastructure can be complex. Laboratories often have established workflows, diverse instrumentation, and existing data management systems (such as LIMS, ELN). Seamlessly connecting and ensuring interoperability between the new automated liquid handler and these pre-existing systems requires significant technical expertise, time, and resources. Challenges can arise in terms of software compatibility, data transfer protocols, and physical layout adjustments within the lab. This complexity can slow down the adoption rate, as laboratories may face a steep learning curve and require specialized training for personnel to operate and troubleshoot these advanced systems effectively.

- While the long-term benefits of automation, such as increased efficiency, precision, and reproducibility, are clear, the immediate financial burden and the complexities of integration can be a significant barrier to widespread adoption

Automated Liquid Handling Market Scope

The market is segmented on the basis of product, type, procedure, modality, application, end user, and distribution channel.

- By Product

On the basis of product, the automated liquid handling market is segmented into automated liquid handling workstations, reagents & consumables, and others. The automated liquid handling workstations segment dominated the market, holding a significant share of 57.4% in 2024. This is driven by their crucial role in automating complex and high-volume liquid handling tasks, making them indispensable for high-throughput applications in modern laboratories.

The reagents & consumables segment is expected to be the fastest growing product segment from 2025 to 2032, fueled by the continuous demand for specialized reagents, pipette tips, plates, and other consumables that are essential for the operation of automated liquid handling systems, with increasing adoption of these systems directly correlating to higher consumable usage.

- By Type

On the basis of type, the automated liquid handling market is segmented into automated liquid handling systems and semi-automated liquid handling. The automated liquid handling systems segment dominated the market in 2024, due to the increasing shift towards full automation in laboratories to reduce manual errors, enhance precision, and significantly increase throughput in various research and diagnostic workflows

The automated liquid handling systems segment is also anticipated to witness fast growth during forecast period of 2025 to 2032, as laboratories continue to invest in fully integrated and sophisticated robotic platforms to meet the escalating demands of high-throughput applications and complex assays.

- By Procedure

On the basis of procedure, the automated liquid handling market is categorized into serial dilution, plate reformatting, plate replication, PCR setup, high throughput screening, cell culture, whole genome amplification, array printing, and others. The PCR setup segment dominated the market in 2024. This is driven by the widespread use of PCR in molecular diagnostics, research, and genomics, requiring precise and efficient automated liquid handling for reaction setup.

The serial dilution segment is expected to grow at the fastest CAGR during 2025 to 2032. This growth is linked to the increasing use of automated serial dilution for precise concentration gradients in various assays, including antibody screening and drug efficacy testing, where automation ensures accuracy and reproducibility.

- By Modality

On the basis of modality, the automated liquid handling market is bifurcated into disposable tips and fixed tips. The disposable tips segment dominates the market, holding a significant revenue share in 2024, This is driven by their critical role in preventing cross-contamination, ensuring sterility, and maintaining sample integrity across diverse laboratory applications, especially in sensitive genomic and clinical diagnostic procedures.

The Fixed Tips segment is expected to expand at the fastest CAGR during 2025 to 2032. This growth is attributed to the increasing adoption of fixed-tip systems for applications involving purified samples and for applications where cost-effectiveness and reduced waste are prioritized, as fixed tips can be cleaned and reused.

- By Application

On the basis of application, the automated liquid handling market is segmented into drug discovery, genomic, clinical diagnostic, proteomics, and others. The drug discovery segment dominates the market, holding the largest revenue share in 2024. This is fueled by the critical need for automated, high-throughput liquid handling in the various stages of drug development, from compound screening to lead optimization.

The genomic segment is estimated to grow at the fastest rate during 2025 to 2032 period. This acceleration is driven by the rapid advancements in genomic technologies, the increasing adoption of personalized medicine, and the growing demand for automated solutions to handle complex and large-scale genomic assays

- By End User

On the basis of end user, the automated liquid handling market is segmented into biotechnology and pharmaceutical industries, research institutes, hospitals and diagnostic laboratories, academic institutes, and other end users. The biotechnology and pharmaceutical industries segment dominated the market with the largest market share in 2024. This is attributed to the substantial investments in R&D, the increasing number of drug discovery projects, and the stringent requirements for precision and throughput in these industries

The hospitals and diagnostic laboratories segment is expected to witness fastest growth. During forecast period of 2025 to 2032. This is due to the rising demand for efficient and automated solutions for high-volume clinical diagnostics, infectious disease testing, and sample preparation in healthcare settings

- By Distribution Channel

On the basis of distribution channel, the automated liquid handling market is segmented into direct tender, retail sales, and third-party distributors. The direct tender segment is identified as the largest segment in 2024. This indicates that large institutions, government bodies, and major research organizations often prefer direct procurement through tender processes for high-value and specialized equipment

The direct tender segment is also expected to be the fastest-growing during 2025 to 2032. This growth is likely driven by the continued expansion of large-scale research projects, government funding for scientific infrastructure, and the preference for direct, customized procurement channels for sophisticated automated liquid handling systems.

Automated Liquid Handling Market Regional Analysis

- North America dominates the automated liquid handling market with the largest revenue share of 40.5% in 2024, driven by robust biotechnology and pharmaceutical industry, significant R&D expenditures, and a strong presence of key industry players

- Consumers and research institutions in North America highly value the precision, throughput, and efficiency offered by automated liquid handling systems, particularly for applications in drug discovery, genomics, and clinical diagnostics

- This widespread adoption is further supported by substantial investments in life science research, a high demand for personalized medicine, and increasing awareness of the benefits of laboratory automation in minimizing errors and accelerating scientific breakthroughs, establishing automated liquid handling as a favored solution across various research and industrial settings

U.S. Automated Liquid Handling Market Insight

The U.S. automated liquid handling market captured a significant revenue share in 2024, within North America, fueled by its robust biotechnology and pharmaceutical industries and substantial R&D expenditures. Consumers and research institutions are increasingly prioritizing automation for high-throughput screening, drug discovery, and genomic research to enhance precision and efficiency. The growing focus on personalized medicine and the strong presence of key market players developing advanced robotic systems further propel the automated liquid handling industry. Moreover, the increasing integration of laboratory automation with data analytics and AI is significantly contributing to the market's expansion

Europe Automated Liquid Handling Market Insight

The Europe automated liquid handling market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing funding for life science research, a well-developed healthcare sector, and stringent quality control regulations in pharmaceutical production. The rising prevalence of chronic diseases, coupled with the demand for advanced diagnostic solutions, is fostering the adoption of automated liquid handlers. European laboratories are also drawn to the efficiency and reproducibility these devices offer. The region is experiencing significant growth across academic research, clinical diagnostics, and biopharmaceutical applications, with automated systems being incorporated into new laboratory setups and modernization projects.

U.K. Automated Liquid Handling Market Insight

The U.K. automated liquid handling market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing government and private funding for life sciences research, a strong presence of academic institutions, and a growing biotech startup ecosystem. In addition, the focus on developing advanced therapies and diagnostics is encouraging both research organizations and pharmaceutical companies to choose automated liquid handling solutions. The UK's embrace of laboratory automation, alongside its robust research infrastructure, is expected to continue to stimulate market growth.

Germany Automated Liquid Handling Market Insight

The Germany automated liquid handling market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investments in biotechnology and pharmaceutical R&D, and a strong emphasis on precision and quality in laboratory practices. Germany’s well-developed research infrastructure, combined with its focus on innovation and efficiency, promotes the adoption of automated liquid handlers, particularly in drug discovery and clinical research. The integration of automated systems with advanced laboratory information management systems (LIMS) is also becoming increasingly prevalent, with a strong preference for reliable and high-throughput solutions aligning with local scientific expectations.

Asia-Pacific Automated Liquid Handling Market Insight

The Asia-Pacific automated liquid handling market is poised to grow at the fastest CAGR during the forecast period, driven by increasing R&D investments, rising healthcare expenditure, and rapid expansion of biotechnology and pharmaceutical sectors in countries such as China, Japan, and India. The region's growing emphasis on drug discovery and diagnostics, supported by government initiatives promoting scientific innovation, is driving the adoption of automated liquid handlers. Furthermore, as APAC emerges as a significant hub for manufacturing and research, the accessibility and affordability of these advanced laboratory solutions are expanding to a wider research and industrial base

Japan Automated Liquid Handling Market Insight

The Japan automated liquid handling market is gaining momentum due to the country’s strong focus on advanced scientific research, aging population-driven healthcare needs, and demand for high-precision laboratory solutions. The Japanese market places a significant emphasis on quality and technological sophistication, and the adoption of automated liquid handlers is driven by the increasing number of biopharmaceutical companies and research institutes. The integration of automated systems with other laboratory robotics and analytical instruments is fueling growth. Moreover, Japan's commitment to cutting-edge research and development is likely to spur demand for highly efficient and reliable automated liquid handling solutions in both academic and industrial sectors.

India Automated Liquid Handling Market Insight

The India automated liquid handling market is experiencing significant growth in 2024, attributed to the country's expanding biotechnology and pharmaceutical industries, increasing investments in R&D, and a rising prevalence of chronic diseases demanding advanced diagnostics. India is emerging as a significant hub for pharmaceutical manufacturing and clinical research, and automated liquid handlers are becoming increasingly popular in contract research organizations (CROs), academic institutions, and diagnostic laboratories. The push towards modernizing laboratory infrastructure and the availability of advanced yet increasingly accessible automated solutions, alongside growing domestic research capabilities, are key factors propelling the market in India

Automated Liquid Handling Market Share

The automated liquid handling industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Aurora Biomed Inc. (Canada)

- Beckman Coulter, Inc. (U.S.)

- Analytik Jena GmbH+Co. KG (Germany)

- SPT Labtech Ltd. (U.K.)

- Eppendorf SE (Germany)

- Illumina, Inc. (U.S.)

- FORMULATRIX (U.S.)

- Gilson Incorporated (U.S.)

- Hamilton Company (U.S.)

- ACTIVE MOTIF (U.S.)

- LONZA (U.S.)

- PerkinElmer (U.S.)

- Diagenode Diagnostics (Belgium)

- Hudson Lab Automation (U.S.)

- DISPENDIX GmbH (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Tecan Trading AG (Switzerland)

- METTLER TOLEDO (U.S.)

- QIAGEN (Germany)

Latest Developments in Global Automated Liquid Handling Market

- In April 2024, Cole-Parmer, an Antylia Scientific company, re-launched an all-new range of industry-leading fluid handling solutions, initially comprising tubing, fittings, parts, and accessories. This initiative aims to suit a diverse array of research and production needs, with plans to expand the product line to include peristaltic pumps and complex assemblies.

- In October 2023, Piramal Pharma Solutions (PPS) launched its in-vitro biology capabilities at its Ahmedabad Discovery Services site. This enhancement includes primary and secondary screening capabilities for compound manufacturers, significantly boosting its ability to support drug discovery processes through advanced high-throughput screening

- In May 2025, Eppendorf expanded its epMotion family of automated liquid handling systems with the introduction of three new 4-channel dispensing tools. These tools are designed to significantly shorten throughput times and increase productivity for processes such as (q)PCR and nucleic acid purification by enabling 4-channel dispensing where typically 1-channel was used

- In July 2023, Revvity announced the launch of the Fontus Automated Liquid Handling Workstation. This next-generation liquid handler combines features from various existing platforms to deliver simpler and faster workflows, especially optimized for applications such as Next-Generation Sequencing (NGS) library preparation

- In June 2023, Agilent Technologies Inc. released the Agilent BioTek 406 FX Washer Dispenser. This compact instrument combines fast, full-plate washing with up to six reagent dispensers, offering laboratories a versatile tool for various liquid handling tasks including cell-based assays and biomagnetic bead protocols

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.