Global Augmented Analytics Market Segmentation, By Component (Software and Services), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), Deployment Type (Cloud and On-Premise), Vertical (Banking, Financial Services, and Insurance, Telecom and IT, Retail and Consumer Goods, Healthcare and Life Sciences, Manufacturing, Government and Defense, Energy and Utilities, Transportation and Logistics, Media and Entertainment, and Others) – Industry Trends and Forecast to 2031

Augmented Analytics Market Analysis

The augmented analytics market is experiencing significant growth, driven by advancements in machine learning, natural language processing, and data visualization technologies. These innovations empower users to analyze vast data sets more intuitively, reducing reliance on data scientists. One notable method is automated data preparation, which streamlines the data cleansing and integration processes, enabling organizations to generate insights faster.

In addition, advanced visualization tools facilitate the creation of interactive dashboards, allowing users to explore data dynamically. The adoption of cloud-based solutions is also increasing, as they offer scalability and flexibility, making augmented analytics accessible to businesses of all sizes.

Industries such as healthcare, finance, and retail are leveraging these technologies to enhance decision-making. For instance, healthcare providers utilize augmented analytics to identify patient trends and improve care quality, while retailers analyze consumer behavior for personalized marketing strategies.

Overall, the growth of augmented analytics is fostering a data-driven culture, enabling organizations to harness the full potential of their data assets and make informed decisions quickly. This trend is expected to continue as more businesses recognize the value of data in driving strategic initiatives.

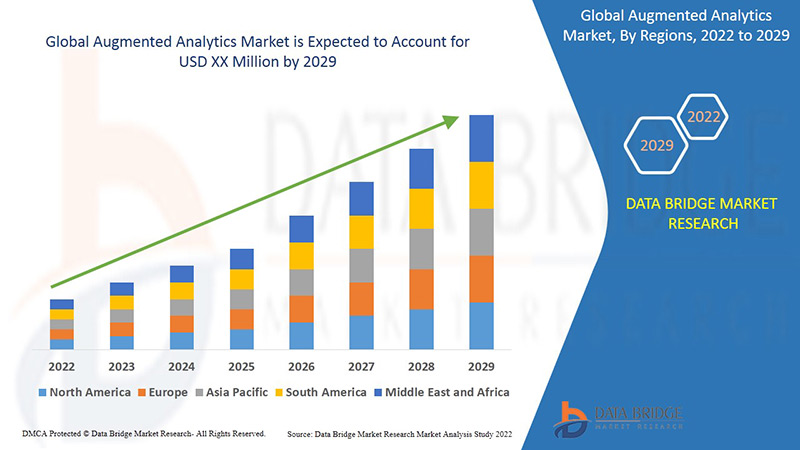

Augmented Analytics Market Size

The global augmented analytics market size was valued at USD 17.95 billion in 2023 and is projected to reach USD 148.27 billion by 2031, with a CAGR of 30.20% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Augmented Analytics Market Trends

“Proliferation of Self-Service Analytics”

One specific trend driving growth in the augmented analytics market is the proliferation of self-service analytics tools. Organizations are increasingly adopting these solutions to empower non-technical users to generate insights without relying on IT departments. For instance, In September 2023, Hadean, a British scale-up, partnered with BAE Systems to develop advanced digital technologies for military training. The collaboration utilizes a new enterprise license allowing BAE to integrate state-of-the-art AI and Large Language Models into the Hadean Platform for Defence. This partnership aims to provide military personnel with immersive, scalable, and interoperable collective training solutions, enhancing their readiness and effectiveness across various services and domains.

Report Scope and Augmented Analytics Market Segmentation

|

Attributes

|

Augmented Analytics Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Salesforce (U.S.), SAP SE (Germany), IBM Corporation (U.S.), Microsoft (U.S.), Oracle (U.S.), Tableau Software (U.S.), MicroStrategy Incorporated (U.S.), SAS Institute Inc. (U.S.), QlikTech (Qlik) (Sweden), TIBCO Software Inc. (U.S.), Sisense Inc. (U.S.), Yellowfin International (Australia), ThoughtSpot Inc. (U.S.), and Domo, Inc. (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Augmented Analytics Market Definition

Augmented analytics is an advanced data analysis technique that leverages machine learning, artificial intelligence, and natural language processing to enhance data preparation, analysis, and visualization. It automates complex processes, enabling users to uncover insights more quickly and intuitively, even without extensive data expertise. By simplifying data interactions, augmented analytics empowers business users to ask questions, receive answers in real-time, and make data-driven decisions efficiently. This approach is transforming how organizations handle data, fostering a culture of self-service analytics and democratizing access to insights across various levels of the enterprise.

Augmented Analytics Market Dynamics

Drivers

- Demand for Self-Service Analytics

The demand for self-service analytics is a significant driver of the augmented analytics market. Businesses are increasingly adopting tools that empower non-technical users to derive insights without heavy reliance on IT departments. Augmented analytics platforms, such as Tableau and Microsoft Power BI, offer intuitive interfaces and drag-and-drop functionalities, making data exploration accessible to all employees. For instance, in May 2024, Oracle and Accenture joined forces to accelerate the adoption of generative AI, focusing on innovative solutions that empower Chief Financial Officers (CFOs) with AI-driven financial planning and analysis tools. This collaboration aims to optimize operations, drive efficiency, and fuel growth within organizations. By integrating AI capabilities into financial strategies, Oracle and Accenture are enabling businesses to make more informed decisions based on real-time data insights.

- Growth of Cloud-Based Solutions

The rise of cloud computing significantly drives the augmented analytics market by allowing organizations to adopt solutions with minimal upfront investments. Cloud-based platforms, such as Microsoft Azure and Google Cloud, provide scalable and flexible analytics tools that can be customized to meet varying business needs. For instance, in May 2024, IBM unveiled significant updates to its Watson X platform, enhancing its offerings with the release of a family of Granite models as open source. The launch also included InstructLab and new generative AI-powered data products, expanding the platform's capabilities. These updates aim to streamline AI development, allowing businesses to leverage advanced data analytics and artificial intelligence for improved decision-making and operational efficiency across various industries.

Opportunities

- Integration of AI and Machine Learning

The integration of AI and machine learning in augmented analytics presents significant market opportunities. These technologies automate data preparation, visualization, and insights generation, making analytics more efficient and accessible. For instance, in July 2024, Qlik announced the general availability of Qlik Talend Cloud, a robust solution that integrates advanced artificial intelligence with reliable data foundations. This comprehensive offering aims to facilitate seamless and secure adoption of AI technologies across organizations at scale. By combining data integration and AI capabilities, Qlik Talend Cloud empowers businesses to leverage data-driven insights, enhancing decision-making processes and operational efficiency.

- Integration with Existing Business Intelligence Tools

The integration of augmented analytics with existing business intelligence (BI) tools creates significant market opportunities. Many organizations utilize BI platforms such as Tableau, Power BI, or Qlik, and augmented analytics enhances these tools' capabilities by automating data preparation and analysis. For instance, in January 2023, Seerist Inc., a leader in augmented analytics for threat and security professionals, announced enhancements to its solution designed to elevate user experience. These new capabilities allow users to gain significant contextual intelligence, effectively filtering through data "noise" to extract meaningful insights. Furthermore, the updates enable organizations to customize the solution, targeting critical operational areas and enhancing their ability to respond to emerging threats and security challenges.

Restraints/Challenges

- High Implementation Costs

High implementation costs significantly restrain the augmented analytics market, particularly for small to medium enterprises (SMEs). These organizations often face budget constraints that make it difficult to invest in advanced analytics tools and technologies. The initial costs associated with purchasing software, integrating systems, and training personnel can be prohibitive, leading to reluctance in adopting these solutions. In addition, ongoing maintenance and subscription fees can further strain limited budgets, deterring SMEs from investing in augmented analytics. As a result, the high financial barriers restrict market growth, limiting the widespread adoption of augmented analytics and preventing potential competitive advantages that such tools could provide.

- Data Quality Issues

Data quality issues significantly hinder the augmented analytics market. The effectiveness of these tools relies heavily on the accuracy, completeness, and consistency of the underlying data. Poor data quality can lead to inaccurate insights, which may result in misguided business decisions and wasted resources. Consequently, organizations may become reluctant to adopt augmented analytics solutions, fearing that the potential risks outweigh the benefits. In addition, ongoing data maintenance and cleansing require substantial effort and resources, further complicating the implementation process. As businesses grapple with these challenges, the overall growth and adoption of the augmented analytics market may be severely impacted, limiting its potential benefits.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Augmented Analytics Market Scope

The market is segmented on the basis of components, organization size, deployment type and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Software

- Services

- Training and Consulting Services

- Deployment and Integration

- Support and Maintenance

Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

Deployment Type

- Cloud

- On-Premise

Vertical

- Banking, Financial Services, and Insurance

- Telecom and IT

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Manufacturing

- Government and Defense

- Energy and Utilities

- Transportation and Logistics

- Media and Entertainment

- Others

Augmented Analytics Market Regional Analysis

The market is analyzed and market size insights and trends are provided by components, organization size, deployment type and vertical as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the augmented analytics market due to the initial adoption and innovative initiatives for advanced analytics solutions and practices such as natural language processing (NLP), machine learning (ML), and smart data preparation and discovery. Furthermore, the growing augmented analytics market application in business intelligence will further boost the growth of the augmented analytics market in the region during the forecast period.

Asia-Pacific is projected to observe significant amount of growth in the augmented analytics market due to the application of data discovery. Moreover, the growing adoption of business intelligence tools is further anticipated to propel the growth of the augmented analytics market in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Augmented Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Augmented Analytics Market Leaders Operating in the Market Are:

- Salesforce (U.S.)

- SAP SE (Germany)

- IBM Corporation (U.S.)

- Microsoft (U.S.)

- Oracle (U.S.)

- Tableau Software (U.S.)

- MicroStrategy Incorporated (U.S.)

- SAS Institute Inc. (U.S.)

- QlikTech (Qlik) (Sweden)

- TIBCO Software Inc. (U.S.)

- Sisense Inc. (U.S.)

- Yellowfin International (Australia)

- ThoughtSpot Inc. (U.S.)

- Domo, Inc. (U.S.)

Latest Developments in Augmented Analytics Market

- In April 2024, Cloud Software Group, Inc. and Microsoft entered into an eight-year strategic partnership, solidifying their collaboration with a commitment of USD 1.65 billion. This alliance is designed to enhance Microsoft's cloud and AI offerings, aiming to deliver innovative joint solutions that will positively impact over 100 million users. By focusing on generative AI, the partnership seeks to transform how organizations utilize cloud technology and data analytics

- In May 2024, Oracle and Accenture joined forces to accelerate the adoption of generative AI, focusing on innovative solutions that empower Chief Financial Officers (CFOs) with AI-driven financial planning and analysis tools. This collaboration aims to optimize operations, drive efficiency, and fuel growth within organizations. By integrating AI capabilities into financial strategies, Oracle and Accenture are enabling businesses to make more informed decisions based on real-time data insights

- In May 2024, IBM unveiled significant updates to its Watson X platform, enhancing its offerings with the release of a family of Granite models as open source. The launch also included InstructLab and new generative AI-powered data products, expanding the platform's capabilities. These updates aim to streamline AI development, allowing businesses to leverage advanced data analytics and artificial intelligence for improved decision-making and operational efficiency across various industries

- In March 2024, SAP and NVIDIA announced an expansion of their partnership to accelerate the integration of generative AI into SAP’s cloud solutions. This collaboration leverages NVIDIA’s expertise in delivering AI capabilities at scale, helping enterprise customers adopt transformative technologies. By enhancing SAP's cloud offerings with advanced AI functionalities, the partnership aims to drive innovation and improve business processes, enabling companies to harness the full potential of their data

- In August 2023, Qlik was recognized on two Constellation ShortLists for its innovative solutions: Qlik AutoML for Artificial Intelligence and Machine Learning and Qlik Sense for Augmented BI and Analytics. These accolades highlight Qlik’s commitment to enabling early adopters and fast-followers in their digital transformation journeys. By providing cutting-edge technology and services, Qlik empowers organizations to make data-driven decisions and enhance their analytics capabilities effectively

- In September 2023, Hadean, a British scale-up, partnered with BAE Systems to develop advanced digital technologies for military training. The collaboration utilizes a new enterprise license allowing BAE to integrate state-of-the-art AI and Large Language Models into the Hadean Platform for Defence. This partnership aims to provide military personnel with immersive, scalable, and interoperable collective training solutions, enhancing their readiness and effectiveness across various services and domains

- In May 2023, TrinityLife Sciences and WhizAI announced a strategic partnership aimed at revolutionizing AI-driven insights for life sciences companies. This collaboration enables organizations to generate and share augmented analytics quickly and efficiently. WhizAI’s technology can seamlessly integrate with Trinity’s enterprise reporting platforms, providing stakeholders with actionable insights. This partnership ultimately seeks to enhance decision-making processes and improve operational effectiveness within the life sciences and healthcare sectors

SKU-