Global Audio Power Amplifier Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

2.76 Billion

2024

2032

USD

1.60 Billion

USD

2.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 2.76 Billion | |

|

|

|

|

Audio Power Amplifier Market Size

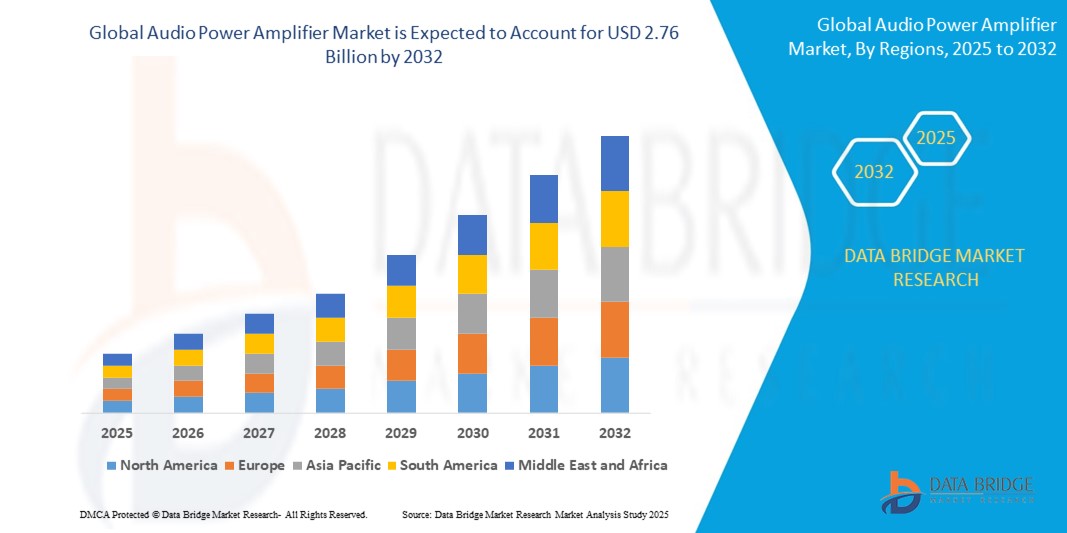

- The global audio power amplifier market size was valued at USD 1.60 billion in 2024 and is expected to reach USD 2.76 billion by 2032, at a CAGR of 7.01% during the forecast period

- The market growth is primarily driven by the increasing demand for high-quality audio systems in consumer electronics, advancements in automotive infotainment systems, and the growing adoption of audio amplifiers in telecommunications infrastructure

- Rising consumer preference for immersive audio experiences, coupled with technological advancements in amplifier efficiency and compact designs, is propelling the market forward, making audio power amplifiers a critical component in modern audio solutions

Audio Power Amplifier Market Analysis

- Audio power amplifiers, essential for enhancing audio signals in various devices, are integral to consumer electronics, automotive systems, and telecommunications, offering improved sound quality, efficiency, and integration with smart technologies

- The surge in demand is fueled by the proliferation of smart devices, the rise of in-car entertainment systems, and the need for robust audio solutions in telecommunication networks, driven by increasing consumer expectations for high-fidelity audio and seamless connectivity

- Asia-Pacific dominated the audio power amplifier market with the largest revenue share of 42.5% in 2024, driven by its strong manufacturing base, high consumer electronics adoption, and presence of key industry players in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, propelled by rapid technological innovation, increasing demand for premium audio systems, and growing investments in automotive and smart home technologies

- The 2-channel segment dominated the largest market revenue share of 38% in 2024, driven by its widespread use in home audio systems, particularly for stereo sound setups, due to consumer preference for high-quality audio experiences

Report Scope and Audio Power Amplifier Market Segmentation

|

Attributes |

Audio Power Amplifier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Audio Power Amplifier Market Trends

“Increasing Integration of AI and Advanced Signal Processing”

- The global audio power amplifier market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and advanced signal processing technologies

- These technologies enable enhanced audio quality, adaptive sound optimization, and efficient power management, providing superior performance in consumer electronics, automotive, and telecommunications applications

- AI-driven amplifiers can dynamically adjust audio output based on environmental factors, user preferences, or device requirements, improving user experience and energy efficiency

- For instances, companies are developing AI-powered audio platforms that optimize sound for specific environments, such as in-car audio systems that adapt to road noise or consumer devices that personalize sound profiles

- This trend enhances the value of audio power amplifiers, making them more appealing to manufacturers and end-users across various applications

- AI algorithms can analyze audio signals to reduce distortion, enhance clarity, and optimize power consumption, particularly in Class-D amplifiers, which are increasingly popular for their efficiency

Audio Power Amplifier Market Dynamics

Driver

“Rising Demand for High-Quality Audio and Smart Devices”

- The growing consumer demand for high-fidelity audio experiences in devices such as smartphones, home theater systems, and automotive infotainment systems is a key driver for the global audio power amplifier market

- Audio power amplifiers enhance sound quality by providing robust amplification for speakers, enabling features such as immersive surround sound, voice recognition, and noise cancellation

- Government initiatives promoting smart cities and IoT adoption, particularly in the Asia-Pacific region, which dominates the market, are driving demand for advanced audio solutions in telecommunications and consumer electronics

- The rollout of 5G technology is further enabling faster data transmission, supporting high-quality audio streaming and real-time audio processing in connected devices

- Manufacturers are increasingly integrating advanced amplifiers, such as Class-D and Class-G&H, as standard features in consumer electronics and automotive systems to meet rising consumer expectations for premium audio experiences

Restraint/Challenge

“High Development Costs and Concerns over Power Efficiency”

- The high costs associated with designing and manufacturing advanced audio power amplifiers, particularly those incorporating AI and high-efficiency Class-D or Class-G&H technologies, pose a significant barrier to market growth, especially in price-sensitive markets

- Integrating these amplifiers into compact devices or existing systems can be complex and costly, requiring specialized engineering and testing

- In addition, concerns over power efficiency and thermal management remain a challenge, as high-performance amplifiers often generate significant heat, impacting device longevity and user safety

- Regulatory variations across regions, particularly in North America, the fastest-growing market, regarding energy efficiency standards and electromagnetic compatibility, create challenges for manufacturers operating globally

- These factors can deter adoption in cost-sensitive regions or applications, limiting market expansion where budget constraints or regulatory compliance are significant concerns

Audio Power Amplifier market Scope

The market is segmented on the basis of channel, application, and type.

- By Channel

On the basis of channel, the audio power amplifier market is segmented into 2-channel and 4-channel. The 2-channel segment dominated the largest market revenue share of 38% in 2024, driven by its widespread use in home audio systems, particularly for stereo sound setups, due to consumer preference for high-quality audio experiences. Its affordability and compatibility with portable speakers and soundbars further bolster its dominance.

The 4-channel segment is expected to witness the fastest growth rate of 7.8% from 2025 to 2032, propelled by increasing demand for multi-channel audio systems in automotive infotainment and home theater systems. Advancements in surround sound technologies and rising consumer interest in immersive audio experiences are key drivers of this segment's growth.

- By Application

On the basis of application, the audio power amplifier market is segmented into consumer electronics, automotive, and telecommunications. The consumer electronics segment dominated the market with a revenue share of 43% in 2024, driven by the proliferation of smart devices, such as smartphones, soundbars, and home audio systems, which require compact and energy-efficient amplifiers to deliver superior sound quality. The rise of streaming services and smart home integration further accelerates demand.

The automotive segment is anticipated to experience the fastest growth rate of 8.5% from 2025 to 2032. This growth is fueled by the increasing integration of advanced audio systems in vehicles, particularly in electric and premium models, where amplifiers enhance in-car entertainment with features such as Bluetooth connectivity and surround sound. The adoption of Class D amplifiers for their efficiency in automotive applications is a significant contributor.

- By Type

On the basis of type, the audio power amplifier market is segmented into Class-A, Class-B, Class-A/B, Class-G&H, and Class-D. The Class-D segment held the largest market revenue share of 40% in 2024, owing to its high energy efficiency, compact size, and low heat generation, making it ideal for portable devices, automotive audio systems, and smart home applications. Its adoption in consumer electronics, such as wireless speakers and soundbars, drives its dominance.

The Class-A/B segment is expected to witness significant growth from 2025 to 2032, with a projected CAGR of 7.2%. This growth is driven by its balance of sound quality and efficiency, making it suitable for high-fidelity audio systems in both consumer and professional applications. Advancements in hybrid amplifier designs and increasing demand for premium audio equipment in home entertainment systems are key factors supporting this segment's growth.

Audio Power Amplifier Market Regional Analysis

- Asia-Pacific dominated the audio power amplifier market with the largest revenue share of 42.5% in 2024, driven by its strong manufacturing base, high consumer electronics adoption, and presence of key industry players in countries such as China, Japan, and South Korea

- Consumers prioritize audio power amplifiers for enhanced sound quality, energy efficiency, and compact designs, particularly in regions with high adoption of smart devices and advanced automotive systems

- Growth is supported by advancements in amplifier technology, including Class-D and Class-G&H amplifiers, alongside rising integration in both OEM and aftermarket applications

Japan Audio Power Amplifier Market Insight

Japan’s audio power amplifier market is expected to witness significant growth due to strong consumer preference for high-quality, technologically advanced amplifiers that enhance audio performance in consumer electronics and automotive systems. The presence of major electronics and automotive manufacturers accelerates market penetration. Rising interest in aftermarket audio customization also contributes to growth.

China Audio Power Amplifier Market Insight

China holds the largest share of the Asia-Pacific audio power amplifier market, propelled by rapid urbanization, rising consumer electronics ownership, and increasing demand for advanced audio solutions. The country’s growing middle class and focus on smart technology support the adoption of high-efficiency amplifiers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Audio Power Amplifier Market Insight

The U.S. audio power amplifier market is expected to witness significant growth, fueled by strong demand in consumer electronics and automotive sectors. Growing consumer awareness of superior audio performance and energy-efficient amplifiers drives market expansion. The trend toward smart home systems and vehicle infotainment systems further boosts demand, with both OEM and aftermarket segments contributing to a dynamic product ecosystem.

Europe Audio Power Amplifier Market Insight

The Europe audio power amplifier market is expected to witness significant growth, supported by increasing demand for high-fidelity audio in consumer electronics and automotive applications. Consumers seek amplifiers that offer superior sound clarity and power efficiency. Growth is notable in both new device integrations and retrofit projects, with countries such as Germany and France showing strong adoption due to advancements in automotive audio systems and smart home technologies.

U.K. Audio Power Amplifier Market Insight

The U.K. market for audio power amplifiers is expected to experience rapid growth, driven by demand for enhanced audio experiences in consumer electronics and urban mobility solutions. Increased interest in home entertainment systems and vehicle audio customization encourages adoption. Evolving regulations promoting energy-efficient electronics also influence consumer preferences, balancing performance with compliance.

Germany Audio Power Amplifier Market Insight

Germany is expected to witness rapid growth in the audio power amplifier market, attributed to its advanced electronics and automotive manufacturing sectors. German consumers prioritize high-performance amplifiers that enhance audio quality and contribute to energy efficiency. The integration of advanced amplifiers in premium vehicles and consumer electronics, along with strong aftermarket demand, supports sustained market growth.

Audio Power Amplifier Market Share

The audio power amplifier industry is primarily led by well-established companies, including:

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated (U.S.)

- Peavey Electronics Corporation (U.S.)

- QSC, LLC (U.S.)

- Broadcom (U.S.)

- Skyworks Solutions, Inc. (U.S.)

- STMicroelectronics (Switzerland)

- Analog Devices, Inc. (U.S.)

- Bose Corporation (U.S.)

- Renesas Electronics (Japan)

- Diodes Incorporated (U.S.)

- ESS Technology (U.S.)

- ROHM Semiconductor (Japan)

- Monolithic Power Systems (U.S.)

- Nuvoton Technology (Taiwan)

What are the Recent Developments in Global Audio Power Amplifier Market?

- In August 2023, Apex Microtechnology announced the release of the PA198, the newest addition to its family of precision power operational amplifiers. Designed for high-voltage applications, the PA198 features voltage supply rails up to ±215V with a dual supply (or +440V single supply) and delivers output currents up to 200 mA. It boasts a remarkable slew rate of 2000 V/µs and a power bandwidth of 2 MHz, making it ideal for applications such as piezo drive, electrostatic deflection, and high-voltage instrumentation. This launch underscores Apex’s commitment to advancing precision analog power solutions

- In July 2023, Musical Fidelity unveiled the Nu-Vista 800.2, its new flagship integrated amplifier, marking a major evolution in high-end audio technology. Building on the legacy of the original Nu-Vista 800, the 800.2 features upgraded power supply circuits, rewound transformers for reduced noise, and a redesigned front panel with a modern display. It delivers over 300 watts per channel and incorporates Nuvistor tube technology for smooth, immersive sound. Enhanced connectivity options and remote standby functionality make it ideal for analog audio enthusiasts seeking premium performance and refined aesthetics

- In June 2023, Infineon Technologies AG introduced the XENSIV™ MEMS microphone IM68A130A, expanding its portfolio of high-performance audio components. Designed for automotive applications, this analog MEMS microphone features a flat frequency response down to 10Hz, a high signal-to-noise ratio of 68 dB(A), and an acoustic overload point of 130 dBSPL. It supports active noise cancellation (ANC), beamforming, and voice control, making it ideal for integration into advanced audio systems. While primarily a microphone, its deployment often complements high-quality audio amplification, reflecting a broader industry trend toward integrated, high-performance audio solutions

- In May 2023, Filtronic announced the launch of two cutting-edge E-band products: the Taurus high-power amplifier and the Hades X2 active diplexer. Unveiled at the International Microwave Symposium (IMS) in San Diego, these innovations push the boundaries of high-frequency, high-power amplification. Taurus delivers market-leading linear mmWave power with a typical PSAT of 38 dBm, while Hades X2 integrates dual GaAs MMICs for enhanced performance and linearity. These products are designed for long-range communications and are ideal for advanced wireless infrastructure, defense, and aerospace applications—highlighting Filtronic’s commitment to RF and mmWave innovation

- In May 2023, Qualcomm Technologies, Inc. announced its acquisition of Autotalks, an Israeli semiconductor company specializing in vehicle-to-everything (V2X) communication solutions. The strategic move aims to integrate Autotalks’ dual-mode safety chipsets into Qualcomm’s Snapdragon Digital Chassis platform, enhancing automotive safety and connectivity. While not directly related to audio power amplification, the Snapdragon platform often includes advanced infotainment systems, suggesting future synergies in high-performance automotive audio. This acquisition reflects Qualcomm’s broader commitment to smart transportation and the evolution of software-defined vehicles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Audio Power Amplifier Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Audio Power Amplifier Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Audio Power Amplifier Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.