Global Asthma Spacers Market

Market Size in USD Billion

CAGR :

%

USD

1.86 Billion

USD

2.62 Billion

2024

2032

USD

1.86 Billion

USD

2.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.86 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Asthma Spacers Market Size

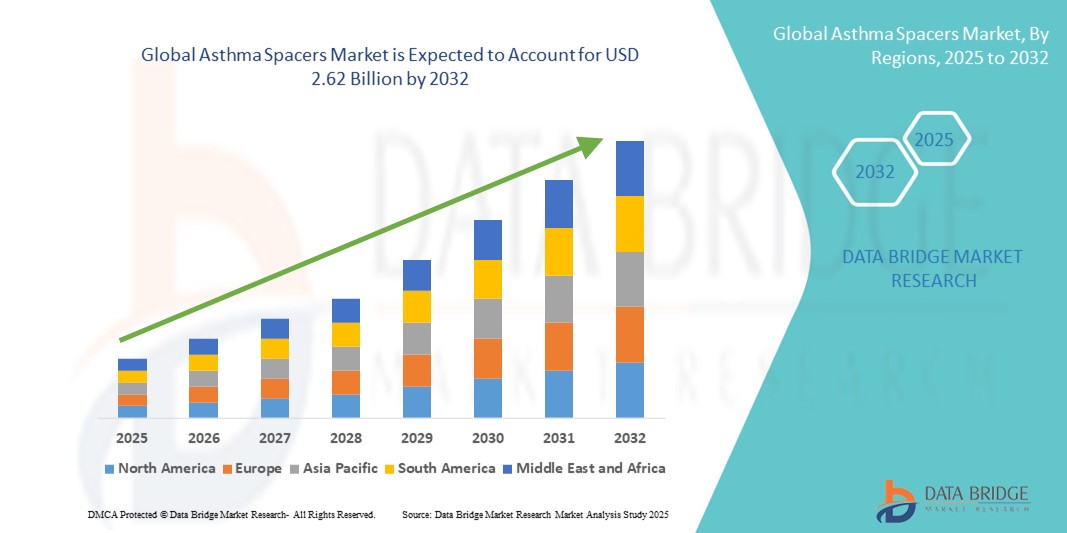

- The global asthma spacers market size was valued at USD 1.86 billion in 2024 and is expected to reach USD 2.62 billion by 2032, at a CAGR of 4.32% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within inhalation therapy devices and respiratory care, leading to increased digitalization and product innovation in both home-based and clinical asthma management

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for managing asthma in children, elderly patients, and those with coordination issues is establishing asthma spacers as the delivery enhancement tool of choice. These converging factors are accelerating the uptake of Asthma Spacers solutions, thereby significantly boosting the industry's growth

Asthma Spacers Market Analysis

- Asthma spacers, also known as inhalation chambers, are essential add-on devices used with metered-dose inhalers (MDIs) to optimize medication delivery directly to the lungs. They are widely adopted in both clinical and homecare settings due to their ability to reduce inhalation errors, improve drug efficacy, and enhance patient compliance—particularly among children and elderly patients

- The rising global prevalence of asthma, currently affecting over 339 million people worldwide (as per WHO), along with increasing clinical emphasis on proper inhaler technique, is significantly boosting the demand for asthma spacers. Moreover, guidelines from health organizations such as GOLD and GINA strongly recommend the use of spacers to improve treatment outcomes

- North America dominated the asthma spacers market with the largest revenue share of 38.4% in 2024, driven by high awareness levels, favorable reimbursement policies, and a strong presence of leading manufacturers such as Trudell Medical International, Philips Healthcare, and PARI Respiratory Equipment, Inc. The U.S. market is witnessing a steady increase in spacer adoption across pediatric care units, primary healthcare centers, and retail pharmacies

- Asia-Pacific is projected to be the fastest-growing region in the asthma spacers market during the forecast period, registering a CAGR of 8.9% from 2025 to 2032. This growth is attributed to rapidly increasing asthma diagnoses, rising urban pollution, and improved access to respiratory care products in emerging markets such as India, China, and Indonesia. Local production and affordability are also contributing to broader market penetration

- The Inhaled segment dominated the asthma spacers market with a share of 81.3% in 2024, as inhaled therapy remains the gold standard in asthma treatment, offering targeted drug delivery with fewer systemic side effects

Report Scope and Asthma Spacers Market Segmentation

|

Attributes |

Asthma Spacers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asthma Spacers Market Trends

Enhanced Convenience Through Digital Health Integration and Smart Inhaler Compatibility

- A significant and accelerating trend in the global asthma spacers market is the integration of digital health technologies with inhaler systems, improving treatment adherence, medication tracking, and overall asthma management. This evolution is transforming conventional spacer devices into smarter, more patient-centric tools

- For instance, Teva Pharmaceuticals launched ProAir Digihaler, an FDA-approved digital inhaler that pairs with a mobile app to record usage data and send reminders. When used in conjunction with compatible spacers, this integration allows patients and caregivers to monitor treatment frequency and inhalation technique in real-time

- Several digital spacer-compatible solutions are now incorporating Bluetooth-enabled sensors that track inhalation events and sync data with smartphone applications. These tools support remote patient monitoring by healthcare providers and enable proactive intervention in cases of poor adherence or declining control

- Artificial intelligence (AI) is also being explored to analyze inhaler usage patterns via connected devices and deliver personalized insights—such as identifying triggers, flagging abnormal usage trends, or predicting asthma exacerbations. This is particularly beneficial in managing chronic cases in children and elderly populations who may need caregiver supervision

- Moreover, voice-assisted reminders and mobile app integrations with platforms such as Apple Health, Google Fit, and other health ecosystems are helping patients stay on track with their prescribed asthma management plans. These features are gaining popularity among tech-savvy patients seeking convenience and control over their respiratory health

- This trend toward smart, data-integrated, and user-friendly asthma spacer systems is reshaping patient expectations and driving manufacturers to innovate. Companies such as Trudell Medical International, Philips Respironics, and emerging digital health startups are at the forefront of this transformation—offering devices that blend clinical precision with digital engagement tools to support better outcomes

- The demand for asthma spacers that offer seamless compatibility with smart inhalers, mobile health apps, and digital monitoring platforms is expected to grow rapidly as healthcare systems shift toward personalized, remote, and preventive respiratory care models

Asthma Spacers Market Dynamics

Driver

Growing Need Due to Rising Asthma Prevalence and Focus on Inhaler Efficiency

- The increasing global burden of asthma, coupled with a rising emphasis on proper inhaler technique, is a significant driver for the growing demand for asthma spacers. These devices are essential for enhancing medication delivery and ensuring effective asthma management, especially in pediatric and geriatric populations

- For instance, in October 2023, Trudell Medical International launched an updated version of its popular AeroChamber Plus Flow-Vu spacer with improved anti-static materials and optimized chamber design to enhance drug deposition. The device also includes a visual flow indicator to help patients and caregivers confirm proper inhalation timing—addressing one of the most common issues in asthma therapy

- Guidelines from organizations such as NICE (UK) and GINA increasingly recommend the use of valved holding chambers (VHCs) in both clinical and home settings to reduce coordination errors and improve treatment outcomes. The demand is particularly high in schools, pediatric clinics, and among caregivers seeking safer alternatives to direct inhaler use

- Moreover, the growing awareness campaigns around asthma care—especially during global respiratory health observances—are helping to educate patients on the importance of spacer use. This is fueling adoption in both high-income countries and emerging markets where previously, spacers were underutilized

- In addition, the convenience of portable, anti-static, and reusable spacer options, along with growing availability through online and retail pharmacies, is making these devices more accessible than ever—supporting widespread market growth

Restraint/Challenge

Lack of Awareness and Limited Reimbursement in Some Regions

- Despite their clinical importance, asthma spacers remain underutilized in many regions due to low awareness among patients and even healthcare providers about the benefits of using spacers with metered-dose inhalers (MDIs). Many individuals mistakenly believe that MDIs alone are sufficient, overlooking the role of spacers in improving lung deposition and reducing side effects

- According to a 2023 survey published in the European Respiratory Journal, fewer than 50% of asthma patients in some parts of Europe regularly use a spacer with their inhaler, even when prescribed. This gap is largely attributed to inadequate patient education and limited in-clinic demonstration of proper spacer usage

- Another key challenge is the lack of insurance reimbursement for spacers in certain healthcare systems, especially in developing economies. While the U.K.’s NHS and systems in Canada and Australia often cover spacers, patients in other regions may need to purchase them out of pocket, reducing access in low-income communities

- In addition, disposable or low-quality spacer alternatives sold online—without proper medical guidance—can compromise treatment effectiveness, further undermining consumer trust in the category

- Overcoming these barriers will require a coordinated effort involving healthcare providers, policymakers, and manufacturers. Strategies include expanding patient education, improving product labeling, promoting clinician training, and advocating for broader insurance coverage for medically recommended spacers

Asthma Spacers Market Scope

The market is segmented on the basis of drug class, product type, route of administration, and distribution channel.

- By Drug Class

On the basis of drug class, the asthma spacers market is segmented into anti-inflammatory, bronchodilators, and combination therapy. The combination therapy segment dominated the largest market revenue share of 44.8% in 2024 due to its efficacy in managing moderate to severe asthma cases by combining anti-inflammatory and bronchodilator actions.

The bronchodilators segment is expected to witness the fastest CAGR of 8.2% from 2025 to 2032, driven by rising emergency asthma cases and the increasing use of rescue medications among pediatric and elderly populations.

- By Product Type

On the basis of product type, the market is segmented into inhalers and nebulizers. The inhalers segment accounted for the largest revenue share of 57.6% in 2024, primarily due to ease of use, portability, and growing adoption of metered-dose inhalers (MDIs) and dry powder inhalers (DPIs) with spacers.

The nebulizers segment is anticipated to grow at the fastest CAGR of 7.9% during the forecast period, propelled by their increasing use in hospitals and for patients with severe or chronic respiratory conditions.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, inhaled, and others. The inhaled segment captured the largest share of 81.3% in 2024, as inhaled therapy remains the gold standard in asthma treatment, offering targeted drug delivery with fewer systemic side effects.

The oral segment is projected to grow at a CAGR of 6.1% from 2025 to 2032, particularly in mild cases and among pediatric patients who face challenges using inhalation devices.

- By Distribution Channel

On the basis of distribution channel, the Asthma Spacers market is segmented into retail pharmacy, hospital pharmacy, and E-Commerce. The Retail Pharmacy segment held the largest revenue share of 46.7% in 2024, driven by wide accessibility, growing over-the-counter (OTC) availability, and consumer trust.

The E-Commerce segment is expected to record the highest CAGR of 9.5% during the forecast period due to increasing internet penetration, convenience, and expanding telemedicine and digital health platforms.

Asthma Spacers Market Regional Analysis

- North America dominated the asthma spacers market with the largest revenue share of 38.4% in 2024

- Driven by high asthma prevalence, widespread use of metered-dose inhalers (MDIs), and strong clinical emphasis on proper inhalation techniques

- The region benefits from well-established healthcare infrastructure, high public health awareness, and a robust presence of key manufacturers such as Trudell Medical International and Philips Respironics.

U.S. Asthma Spacers Market Insight

The U.S. asthma spacers market captured the largest revenue share of 79.05% within North America in 2024, supported by high rates of asthma diagnosis (affecting over 25 million Americans), favorable reimbursement policies, and wide adoption of asthma management guidelines by the CDC and NIH. Increased availability of anti-static spacers and valved holding chambers in both clinical and homecare settings is boosting market penetration. The market is also benefiting from telehealth-driven prescription refills and digital education programs promoting correct inhaler usage.

Europe Asthma Spacers Market Insight

The Europe asthma spacers market is projected to expand at a substantial CAGR during the forecast period, primarily due to rising awareness of asthma control protocols and clinical recommendations across countries. National health services in regions such as the U.K., Germany, and France are promoting the use of spacers for pediatric and elderly populations. School-based asthma care initiatives and government-backed public health campaigns are further encouraging proper spacer usage.

U.K. Asthma Spacers Market Insight

The U.K. asthma spacers market is expected to grow at a noteworthy CAGR from 2025 to 2032, driven by the National Health Service (NHS) guidelines that recommend spacer use with MDIs, particularly in children. The market is further supported by the British Thoracic Society’s recommendations for widespread use of valved holding chambers in both primary care and emergency asthma management. Increased asthma education in schools and rising adoption of anti-static spacers are further propelling the market.

Germany Asthma Spacers Market Insight

The Germany asthma spacers market is anticipated to grow steadily, fueled by a combination of public health insurance coverage for asthma devices, strong pharmaceutical distribution networks, and a proactive approach toward preventive care. Increased awareness of spacer usage in managing chronic respiratory conditions among aging populations is driving demand. Innovations in eco-friendly, reusable spacers are also gaining traction due to Germany's emphasis on sustainable healthcare.

Asia-Pacific Asthma Spacers Market Insight

The Asia-Pacific asthma spacers market is poised to grow at the fastest CAGR of 8.9% during the forecast period (2025–2032), owing to a sharp rise in asthma prevalence linked to urban pollution, rising smoking rates, and industrial exposure. Countries such as India, China, and Indonesia are witnessing increased healthcare access and government efforts to improve respiratory care. The availability of cost-effective spacers and international NGO-backed distribution programs are helping improve access in lower-income regions.

Japan Asthma Spacers Market Insight

The Japan asthma spacers market is experiencing steady growth, driven by the country’s aging population, which is more prone to chronic respiratory illnesses. Japanese healthcare providers emphasize patient education and precision medicine, making valved spacers a preferred choice. Domestic manufacturers and pharmaceutical companies are also introducing compact, anti-static devices tailored for elderly and pediatric users, supporting market expansion.

China Asthma Spacers Market Insight

The China asthma spacers market held the largest revenue share in Asia-Pacific in 2024, supported by a growing middle class, urban air pollution issues, and government initiatives promoting chronic disease management. The increased production of low-cost spacers by local manufacturers and nationwide asthma education campaigns are accelerating product adoption. E-pharmacy platforms and hospital partnerships are making spacers more accessible across both urban and semi-urban regions.

Asthma Spacers Market Share

The asthma spacers industry is primarily led by well-established companies, including:

- Teva Pharmaceutical Industries Ltd (Israel)

- GSK plc (U.K.)

- Merck & Co., Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- AstraZeneca (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Sanofi (France)

- Koninklijke Philips N.V. (Netherlands)

- BD (U.S.)

Latest Developments in Global Asthma Spacers Market

- In January 2022, Monaghan Medical Corporation (MMC) was honored with the 2021 Zenith Award by the American Association for Respiratory Care (AARC), marking the seventh consecutive year that MMC has received this prestigious recognition. MMC is a leader in the development, manufacture, and marketing of respiratory devices, including the AeroChamber Plus, Flow-Vu VHC, AeroEclipse II Nebulizer, and Aerobika Oscillatory Pep Device

- In October 2024, Monaghan Medical Corp., known for devices such as AeroChamber Plus and Flow‑Vu VHC, was honored with the 2024 Zenith Award by the American Association for Respiratory Care (AARC). This marks their continued leadership in respiratory care innovation and customer support excellence

- In June 2025, Senator Maggie Hassan launched an inquiry into GSK’s discontinuation of the pediatric asthma inhaler Flovent HFA in January 2024. The move has been linked to increased hospitalizations and reduced treatment access for low‑income families. The probe also raises concerns over GSK avoiding USD 367 million in Medicaid rebates

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.