Global Asset Management Market

Market Size in USD Billion

CAGR :

%

USD

5.84 Billion

USD

15.53 Billion

2024

2032

USD

5.84 Billion

USD

15.53 Billion

2024

2032

| 2025 –2032 | |

| USD 5.84 Billion | |

| USD 15.53 Billion | |

|

|

|

|

Asset Management Market Size

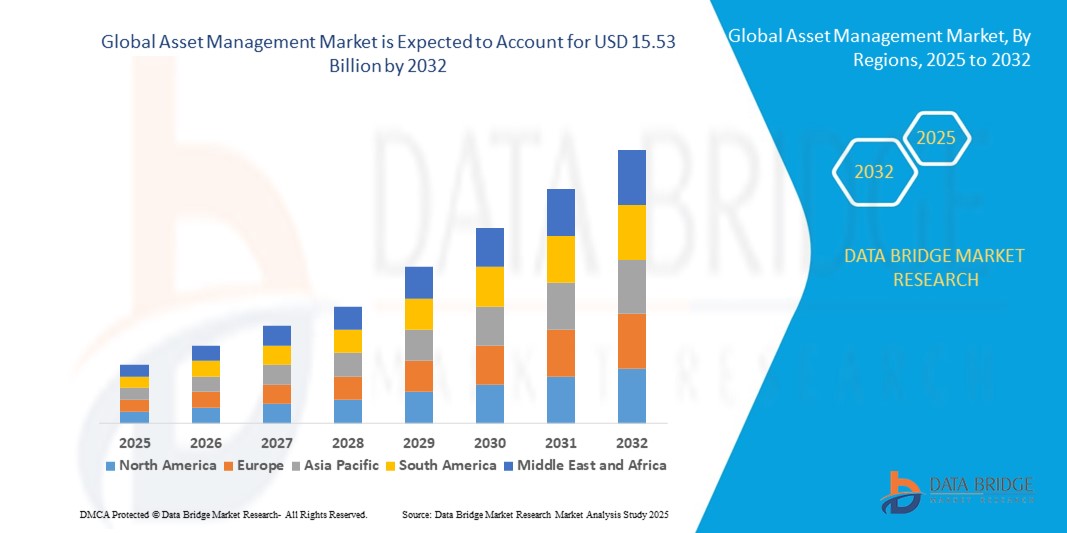

- The global asset management market size was valued at USD 5.84 billion in 2024 and is expected to reach USD 15.53 billion by 2032, at a CAGR of 13.0% during the forecast period

- The market growth is primarily driven by the increasing adoption of digital transformation in asset management, rising demand for real-time asset tracking, and the need for operational efficiency across industries

- Growing awareness of cost optimization, regulatory compliance, and sustainability initiatives is further propelling the demand for asset management solutions across various sectors

Asset Management Market Analysis

- The asset management market is experiencing robust growth as organizations prioritize operational efficiency, asset lifecycle management, and data-driven decision-making

- The demand for advanced technologies such as IoT, AI, and cloud-based solutions is encouraging providers to innovate with scalable and integrated asset management systems

- North America dominated the asset management market with the largest revenue share of 33.59% in 2024, driven by a mature financial services sector, widespread adoption of advanced technologies, and stringent regulatory requirements

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing adoption of digital solutions, and rising investments in infrastructure and manufacturing, particularly in countries such as China, India, and Japan

- The solutions segment dominated the largest market revenue share of 34.82% in 2024, driven by increasing demand for integrated platforms that enable organizations to monitor, analyze, and optimize asset performance across their lifecycle. Advanced asset management solutions provide real-time data insights, predictive maintenance capabilities, and centralized control, making them essential for enterprises seeking operational efficiency and cost reduction

Report Scope and Asset Management Market Segmentation

|

Attributes |

Asset Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Asset Management Market Trends

Increasing Adoption of AI, IoT, and Predictive Analytics in Asset Management

- The global asset management market is experiencing a strong trend towards the integration of Artificial Intelligence (AI), Internet of Things (IoT), and predictive analytics

- These technologies enable real-time monitoring, advanced data analysis, and predictive insights across various asset types, helping organizations optimize utilization and reduce operational costs

- AI-driven asset management platforms can anticipate equipment failures, schedule preventive maintenance, and improve decision-making by analyzing vast datasets from multiple sources

- For example, digital twin technology and AI-powered analytics are increasingly used in manufacturing and infrastructure asset management to simulate performance scenarios and enhance efficiency

- IoT-enabled sensors are widely deployed to track the location, condition, and usage of returnable transport assets, in-transit goods, and personnel in real time

- Predictive analytics supports better financial planning by forecasting asset lifecycle costs, enhancing investment strategies, and minimizing unplanned downtime

Asset Management Market Dynamics

Driver

Rising Demand for Real-Time Asset Tracking and Operational Efficiency

- Growing demand for solutions that provide real-time visibility into assets is a major driver for the global asset management market

- Organizations across sectors such as infrastructure, healthcare, aviation, and manufacturing are increasingly adopting asset management solutions to enhance operational efficiency and reduce losses

- The adoption of connected asset management systems helps track location, movement, and maintenance requirements, ensuring timely interventions and compliance with operational standards

- Advancements in IoT connectivity and the rollout of 5G technology are enabling faster, low-latency data transmission, making asset tracking more precise and reliable

- In North America, which dominated the market, the high rate of technology adoption and strong regulatory compliance requirements are accelerating growth

- In the Asia-Pacific region, the fastest-growing market, expanding industrialization and rising investment in smart infrastructure are driving rapid adoption

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- The significant upfront investment required for hardware, software, and integration of asset management systems can be a major barrier for small and medium-sized enterprises, particularly in cost-sensitive markets

- Retrofitting existing systems and processes to accommodate advanced asset management solutions can be complex and resource-intensive

- Data security and privacy concerns present another major challenge, as these systems collect and transmit sensitive operational and personal information

- Compliance with varying data protection regulations across different countries adds operational complexity for global service providers

- The risk of cyberattacks, unauthorized access, and data misuse can deter some organizations from fully deploying asset management technologies, especially in industries handling critical or confidential data

Asset Management market Scope

The market is segmented on the basis of component, asset type, application, and function.

- By Component

On the basis of component, the global asset management market is segmented into solutions and services. The solutions segment dominated the largest market revenue share of 34.82% in 2024, driven by increasing demand for integrated platforms that enable organizations to monitor, analyze, and optimize asset performance across their lifecycle. Advanced asset management solutions provide real-time data insights, predictive maintenance capabilities, and centralized control, making them essential for enterprises seeking operational efficiency and cost reduction. Adoption is further supported by the growing integration of AI, IoT, and digital twins, which enhance asset tracking, utilization, and risk management.

The services segment is expected to register the fastest growth rate from 2025 to 2032, fueled by rising outsourcing of asset management functions to specialized service providers. Businesses are increasingly leveraging consulting, implementation, training, and managed services to maximize return on investment in asset management technologies. The complexity of integrating multi-vendor systems and ensuring regulatory compliance is prompting organizations, especially in asset-intensive industries, to rely on professional services that deliver scalability, customization, and continuous optimization.

- By Asset Type

On the basis of asset type, the global asset management market is categorized into digital assets, returnable transport assets, in-transit assets, manufacturing assets, and personnel/staff. The digital assets segment accounted for the highest revenue share in 2024, supported by the proliferation of data-driven operations and the need to manage intellectual property, software, media content, and digital rights. As businesses digitize workflows, securing and optimizing digital assets has become critical for brand reputation and regulatory compliance.

The returnable transport assets segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the expansion of global supply chains and the need to track reusable containers, pallets, and crates. IoT-enabled tracking systems and RFID tagging are enhancing transparency, reducing loss, and improving turnaround efficiency for logistics providers. Meanwhile, the in-transit, manufacturing, and personnel/staff categories continue to see steady growth as industries increasingly adopt asset tracking to improve productivity, safety, and utilization rates.

- By Application

On the basis of application, the global asset management market is segmented into infrastructure asset management, enterprise asset management, healthcare asset management, aviation asset management, and others. The infrastructure asset management segment held the largest revenue share in 2024, attributed to the rising need to maintain and optimize public and private infrastructure such as roads, utilities, and facilities. Governments and enterprises are investing in asset management platforms to extend infrastructure lifespan, comply with safety regulations, and manage capital expenditures more effectively.

The healthcare asset management segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the increasing demand for real-time location systems (RTLS), RFID tagging, and IoT sensors in hospitals. The sector faces mounting pressure to optimize equipment usage, prevent loss of critical devices, and ensure compliance with stringent healthcare regulations. Growth is further driven by the adoption of connected solutions that improve patient safety, reduce downtime, and enhance operational efficiency.

- By Function

On the basis of function, the global asset management market is segmented into location & movement tracking, check in/check out, repair & maintenance, and others. The location & movement tracking segment dominated the market in 2024, as organizations seek to gain full visibility over asset location and usage in real time. The integration of GPS, RFID, and IoT sensors enables businesses to prevent theft, optimize logistics, and streamline operations across distributed sites.

The repair & maintenance segment is expected to witness the highest growth rate from 2025 to 2032, driven by the adoption of predictive and preventive maintenance models. Asset-intensive industries are increasingly deploying AI-driven analytics to forecast failures, minimize downtime, and extend asset lifespan. This shift from reactive to proactive maintenance is reducing operational costs and improving overall productivity.

Asset Management Market Regional Analysis

- North America dominated the asset management market with the largest revenue share of 33.59% in 2024, driven by a mature financial services sector, widespread adoption of advanced technologies, and stringent regulatory requirements

- Consumers and organizations prioritize asset management solutions for optimizing resource utilization, enhancing operational efficiency, and ensuring compliance with industry standards, particularly in asset-intensive industries

- Growth is supported by advancements in technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and cloud-based platforms, alongside increasing adoption in both enterprise and infrastructure applications

U.S. Asset Management Market Insight

The U.S. asset management market captured the largest revenue share of 83.9% in 2024 within North America, fueled by strong demand for digital and physical asset management solutions and growing awareness of cost optimization and regulatory compliance benefits. The trend towards integrating AI, IoT, and predictive analytics in asset management systems further boosts market expansion. The presence of major technology vendors and a mature financial sector complements both enterprise and infrastructure asset management applications, creating a diverse ecosystem.

Europe Asset Management Market Insight

The Europe asset management market is expected to witness significant growth, supported by a strong emphasis on regulatory compliance and sustainability. Organizations seek solutions that enhance asset visibility, streamline operations, and meet environmental standards. The growth is prominent in infrastructure and enterprise asset management, with countries such as Germany and France showing significant uptake due to increasing digitalization and urban infrastructure demands.

U.K. Asset Management Market Insight

The U.K. market for asset management is expected to witness rapid growth, driven by demand for efficient asset tracking and management in urban and industrial settings. Increased focus on operational efficiency and sustainability encourages adoption of cloud-based and AI-driven solutions. Evolving regulatory requirements for transparency and compliance influence organizational choices, balancing technological innovation with adherence to standards.

Germany Asset Management Market Insight

Germany is expected to witness rapid growth in the asset management market, attributed to its advanced industrial and manufacturing sectors and high organizational focus on operational efficiency and sustainability. German organizations prefer technologically advanced solutions, such as real-time location systems (RTLS) and IoT-enabled platforms, that optimize asset lifecycles and reduce operational costs. The integration of these solutions in enterprise and manufacturing asset management supports sustained market growth.

Asia-Pacific Asset Management Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, increasing adoption of digital solutions, and rising investments in infrastructure in countries such as China, India, and Japan. Growing awareness of asset optimization, cost reduction, and regulatory compliance boosts demand for asset management solutions. Government initiatives promoting digital transformation and smart infrastructure further encourage the adoption of advanced asset management technologies.

Japan Asset Management Market Insight

Japan’s asset management market is expected to witness rapid growth due to strong organizational preference for high-quality, technologically advanced solutions that enhance operational efficiency and compliance. The presence of major industrial and technology firms and the integration of asset management solutions in enterprise and infrastructure applications accelerate market penetration. Rising interest in digital transformation also contributes to growth.

China Asset Management Market Insight

China holds the largest share of the Asia-Pacific asset management market, propelled by rapid urbanization, increasing industrial output, and growing demand for digital and in-transit asset management solutions. The country’s expanding industrial base and focus on smart manufacturing support the adoption of advanced asset management systems. Strong domestic technological capabilities and competitive pricing enhance market accessibility.

Asset Management Market Share

The asset management industry is primarily led by well-established companies, including:

- ABB Inc. (Switzerland)

- Adobe Systems Inc. (U.S.)

- Brookfield Asset Management Inc. (Canada)

- Honeywell International Inc. (U.S.)

- IBM Corp. (U.S.)

- Oracle (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Siemens AG (Germany)

- WSP Global Inc. (Canada)

- Zebra Technologies Corp. (U.S.)

- Hitachi, Ltd. (Japan)

- General Electric Company (U.S.)

- Bentley Systems, Incorporated (U.S.)

- Hexagon AB (Sweden)

- AssetWorks, Inc. (U.S.)

- SAP SE (Germany)

What are the Recent Developments in Global Asset Management Market?

- In March 2023, BlackRock, one of the world’s leading asset managers, launched the Future of Work ETF (ticker: WKFL), designed to invest in companies shaping the evolving work landscape. This thematic ETF targets firms involved in remote work technologies, automation, cybersecurity, human capital management, and other innovations redefining how and where people work. WKFL reflects BlackRock’s strategic focus on long-term trends and aims to capture growth opportunities driven by digital transformation, flexible work models, and workforce optimization across industries

- In January 2023, Voya Investment Management launched AI-enabled virtual analysts as part of its Machine Intelligence (MI) strategy, marking a significant step in integrating artificial intelligence into the investment management process. These virtual analysts—machine learning models—analyze vast datasets to identify persistent patterns and generate stock recommendations, complementing human expertise. By transforming raw data into actionable insights, the system helps portfolio managers make informed decisions while maintaining robust risk controls. This hybrid approach enhances efficiency, reduces emotional bias, and reflects Voya’s commitment to innovation in active equity strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Asset Management Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Asset Management Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Asset Management Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.