Global Asset And Wealth Management Market

Market Size in USD Billion

CAGR :

%

USD

3.98 Billion

USD

5.62 Billion

2024

2032

USD

3.98 Billion

USD

5.62 Billion

2024

2032

| 2025 –2032 | |

| USD 3.98 Billion | |

| USD 5.62 Billion | |

|

|

|

|

Asset and Wealth Management Market Size

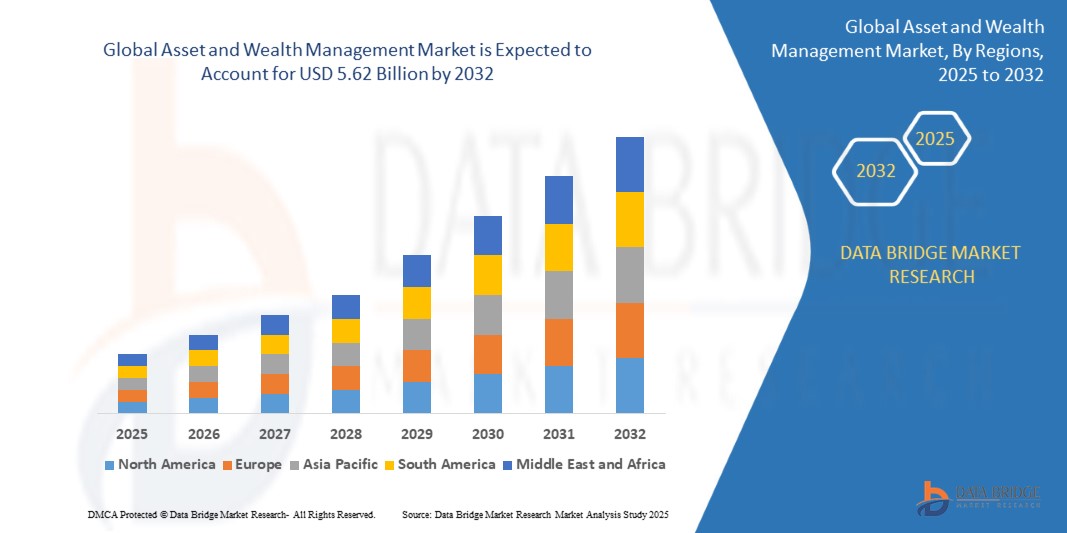

- The global asset and wealth management market was valued at USD 3.98 billion in 2024 and is expected to reach USD 5.62 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.40%, primarily driven by the increasing adoption of digital transformation

- This growth is driven by the rising demand for personalized financial services and the expansion of robo-advisory platforms

Asset and Wealth Management Market Analysis

- The asset and wealth management sector is witnessing rapid expansion globally, driven by the increasing adoption of digital investment platforms, rising demand for automated portfolio management, and growing interest in ESG-focused financial solutions. These advancements are transforming wealth management by enhancing client engagement, optimizing asset allocation, and improving financial decision-making

- The market growth is fueled by the rise of robo-advisory services, the integration of AI-driven financial analytics, and the shift toward cloud-based wealth management platforms. In addition, the demand for personalized investment strategies and alternative asset classes is further accelerating market adoption, making wealth management more accessible and efficient

- North America dominates the asset and wealth management market due to its strong financial ecosystem, early adoption of fintech innovations, and the presence of leading investment firms. The region is also benefiting from increasing investments in blockchain for secure transactions and advanced wealth intelligence tools

- For instance, in the U.S., companies such as BlackRock and Vanguard are leveraging AI-powered investment solutions and big data analytics to enhance portfolio management and client advisory services, contributing to sustained market growth

- Globally, asset and wealth management is evolving with trends such as tokenized assets, hybrid advisory models, and AI-driven risk assessment, shaping the future of financial services and wealth preservation

Report Scope and Asset and Wealth Management Market Segmentation

|

Attributes |

Asset and Wealth Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Asset and Wealth Management Market Trends

“Growing Integration of AI and Big Data in Wealth Advisory”

- A key trend in the asset and wealth management market is the increasing adoption of AI-driven analytics and big data solutions, enabling personalized investment strategies and real-time decision-making

- These technologies enhance portfolio optimization, automate risk assessment, and provide deeper insights into market trends, improving the efficiency and accuracy of financial planning

- For instance, companies such as BlackRock and Morgan Stanley are leveraging AI-powered wealth advisory platforms to deliver tailored financial recommendations and predictive investment models

- Market leaders are focusing on blockchain security, robo-advisory services, and API integrations to enhance customer engagement and ensure seamless transactions

- This trend is transforming the asset and wealth management industry by fostering data-driven decision-making, increasing automation in financial advisory, and expanding access to personalized wealth solutions

Asset and Wealth Management Market Dynamics

Driver

“Growing Demand for Digital Wealth Management Solutions”

- The increasing preference for digital financial services is driving the adoption of AI-driven wealth management platforms, enabling automated portfolio management and real-time investment insights

- The rising number of high-net-worth individuals (HNWIs) and mass affluent investors is fueling the need for personalized financial advisory and data-driven investment strategies

- Regulatory changes and compliance requirements are pushing financial institutions to integrate secure, cloud-based platforms for enhanced transparency and risk management

For Instance,

- In March 2024, J.P. Morgan Asset Management introduced an AI-powered wealth advisory tool to optimize client portfolios and enhance financial decision-making

- In January 2024, Goldman Sachs expanded its Robo-Advisory Services, offering automated investment solutions for retail and institutional investors

- In October 2023, BlackRock partnered with a Fintech startup to integrate big data analytics into its portfolio management solutions, enhancing real-time market forecasting

- The shift toward digitalization in asset management is expected to accelerate, with AI, big data, and cloud-based platforms playing a crucial role in shaping the future of the industry

Opportunity

“Expansion of WealthTech Solutions in Emerging Markets”

- The growing penetration of WealthTech platforms in emerging economies presents a significant market opportunity, driven by increased smartphone adoption and internet accessibility

- Rising financial literacy and the increasing number of retail investors are fueling demand for automated wealth management and AI-driven financial advisory services

For instance,

- In March 2024, RoboWealth, a Thai-based fintech company, expanded its AI-driven investment platform to target first-time investors in Southeast Asia

- In February 2024, India’s National Stock Exchange (NSE) introduced a digital wealth management program aimed at increasing retail participation in stock markets

- In November 2023, Brazil’s XP Inc. launched a mobile-based investment advisory service, offering personalized portfolio management for millennial investors

- The expansion of digital wealth management solutions in high-growth markets is expected to unlock new revenue streams, with AI, blockchain, and cloud-based advisory shaping the industry's next phase

Restraint/Challenge

“Regulatory Complexities and Compliance Burdens”

- The asset and wealth management industry faces increasing regulatory scrutiny, with financial authorities enforcing stricter compliance requirements across global markets

- Firms must navigate evolving regulations related to data privacy, anti-money laundering (AML) policies, and fiduciary responsibilities, increasing operational costs and legal complexities

- The challenge of ensuring transparency in fee structures, ESG compliance, and cross-border investment regulations further adds to the burden on asset managers and financial institutions

For instance,

- In March 2024, the U.S. Securities and Exchange Commission (SEC) implemented new cybersecurity disclosure rules, requiring wealth managers to enhance data protection measures

- In January 2024, the European Securities and Markets Authority (ESMA) introduced stricter ESG fund labeling regulations, affecting investment firms across the EU

- In October 2023, the Monetary Authority of Singapore (MAS) tightened anti-money laundering (AML) regulations, impacting digital wealth management firms

- As regulatory frameworks continue to evolve, compliance challenges may slow down innovation, forcing firms to allocate significant resources to legal and risk management functions

Asset and Wealth Management Market Scope

The market is segmented on the basis of asset class, advisory mode, component, institution, enterprise size, type of client, and service element.

|

Segmentation |

Sub-Segmentation |

|

By Asset Class |

|

|

By Advisory Mode |

|

|

By Component |

|

|

By Institution

|

|

|

By Enterprise Size |

|

|

By Type of Client |

|

|

By Service Element |

|

Asset and Wealth Management Market Regional Analysis

“North America is the Dominant Region in the Asset and Wealth Management Market”

- North America leads the asset and wealth management market, driven by a high concentration of high-net-worth individuals (HNWIs) and increasing demand for personalized financial services

- The rapid adoption of robo-advisory platforms and advancements in financial technology (FinTech) are reshaping investment strategies and portfolio management

- A well-established regulatory framework and the presence of major wealth management firms contribute to the region’s market strength

- This combination of factors positions North America as the leading hub for wealth management solutions, with continued expansion in digital advisory services

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the asset and wealth management market from 2025 to 2032

- Growth is driven by a rising number of high-net-worth individuals (HNWIs), increasing digital wealth platforms, and the rapid expansion of FinTech innovations

- The growing adoption of robo-advisory services, government initiatives to boost financial literacy, and the rise of self-directed investments are fueling market expansion

- This trend highlights the region’s potential for significant growth in wealth management solutions, with increasing reliance on data-driven investment strategies

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM (U.S.)

- Microsoft (U.S.)

- Siemens AG (Germany)

- ANSYS, Inc (U.S.)

- SAP (Germany)

- Oracle (U.S.)

- Robert Bosch GmbH (Germany)

- Nstream, Inc (U.S.)

- Atos SE (France)

- ABB (Switzerland)

- Kellton (India)

- AVEVA Group Limited (U.K.)

- DXC Technology Company (U.S.)

- Altair Engineering, Inc. (U.S.)

- Hexaware Technologies Limited (India)

- TATA Consultancy Services Limited (India)

- Infosys Limited (India)

- NTT DATA Group Corporation (Japan)

- Cloud Software Group, Inc. (U.S.)

Latest Developments in Global Asset and Wealth Management Market

- In April 2024, Rockwell Automation, Inc. announced its collaboration with Ericsson to showcase Plex Asset Performance Management (APM) at the Hannover Messe 2024 trade fair. This system, powered by industrial private 5G connectivity, enhances real-time decision-making and facilitates the management of emerging assets such as Autonomous Mobile Robots (AMRs). The adoption of private 5G technology enables manufacturers to improve flexibility, agility, and sustainability, while expanding device connectivity and intelligence within industrial networks

- In October 2023, HSBC Private Banking introduced a new suite of digital tools aimed at streamlining client onboarding processes. These tools leverage automation and artificial intelligence (AI) to reduce onboarding time, improve regulatory compliance, and enhance service quality for high-net-worth clients, aligning with the evolving expectations of affluent clientele

- In August 2023, UBS Group AG expanded its wealth management services with the acquisition of a sustainable investment solutions boutique. This move allows UBS to integrate stewardship and ESG-focused investment strategies into its offerings, reinforcing its leadership in the sustainable wealth management market

- In December 2023, Siemens AG completed the acquisition of BuntPlanet, a Spain-based technology company specializing in smart metering, asset management, and water quality monitoring. Since 2019, Siemens AG had a licensing agreement with BuntPlanet to market SIWA LeakPlus, a leakage detection software. This acquisition integrates BuntPlanet’s entire software suite into Siemens AG’s application portfolio, strengthening its offerings for water utilities with AI-driven solutions

- In November 2023, ABB introduced ABB Ability SmartMaster, an advanced Asset Performance Management (APM) platform designed for real-time verification and condition monitoring of instrumentation and field devices across industries such as water, wastewater, oil & gas, and chemicals. The system collects, analyzes, and validates diagnostic data remotely, ensuring seamless operations without disrupting ongoing measurement processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ASSET AND WEALTH MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ASSET AND WEALTH MANAGEMENT MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 TRENDS IMPACTING ASSET AND WEALTH MANAGEMENT

6 IMPACT OF COVID-19 PANDEMIC ON THE GLOBAL ASSET AND WEALTH MANAGEMENT MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.3 SOFTWARE

7.4 SERVICES

7.4.1 INTEGRATION

7.4.2 CONSULTING

7.4.3 OTHERS

8 GLOBAL WEALTH MANAGEMENT MARKET, BY SCOPE

8.1 OVERVIEW

8.2 CASH FLOWMANAGEMENT

8.3 INVESTMENT PLANNING

8.4 INSURANCE PLANNING

8.5 TAX PLANNING AND REPORTING

8.6 LEGAL ADVICE AND ESTATE PLANNING

8.7 RETIREMENT PLANNING

9 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ASSET TRACKING AND MANAGEMENT

9.3 CHECK IN/CHECK OUT

9.4 PROCUREMENT MANAGEMENT

9.5 COST CONTROL

9.6 IT SERVICE MANAGEMENT

9.7 AUDIT MANAGEMENT

9.8 COMPLIANCE MANAGEMENT

10 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, BY PRIMARY CHANNEL

10.1 OVERVIEW

10.2 MOBILE APPLICATION

10.3 WEBSITE ACCESS

10.4 DIGITAL ASSISTANT/CHATBOT

10.5 FACE TO FACE

10.6 OTHERS

11 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, BY INSTITUTION

11.1 OVERVIEW

11.2 BANKS

11.3 BROKER DEALERS

11.4 WEALTH ADVISORS

11.5 SPECIALTY FINANCE

12 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, BY REGION

12.1 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. FRANCE

12.1.2.3. U.K.

12.1.2.4. ITALY

12.1.2.5. SPAIN

12.1.2.6. RUSSIA

12.1.2.7. TURKEY

12.1.2.8. BELGIUM

12.1.2.9. NETHERLANDS

12.1.2.10. SWITZERLAND

12.1.2.11. REST OF EUROPE

12.1.3 ASIA PACIFIC

12.1.3.1. JAPAN

12.1.3.2. CHINA

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. AUSTRALIA

12.1.3.6. SINGAPORE

12.1.3.7. THAILAND

12.1.3.8. MALAYSIA

12.1.3.9. INDONESIA

12.1.3.10. PHILIPPINES

12.1.3.11. REST OF ASIA PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. SAUDI ARABIA

12.1.5.3. EGYPT

12.1.5.4. ISRAEL

12.1.5.5. REST OF MIDDLE EAST AND AFRICA

12.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, SWOT ANALYSIS

15 GLOBAL ASSET AND WEALTH MANAGEMENT MARKET, COMPANY PROFILE

15.1 TATA CONSULTANCY SERVICES LIMITED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 HEXAWARE TECHNOLOGIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 SAP SE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ORACLE CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 FIDELITY NATIONAL INFORMATION SERVICES, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 SAS INSTITUTE, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 IBM

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 CAPGEMINI SE

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 DELL EMC

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 COGNIZANT

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 HCL TECHNOLOGIES LIMITED

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 ABB

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 LAZARD ASSET MANAGEMENT LLC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 RFGEN SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 EMAINT

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 GAM

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 NORTHSTAR SYSTEM INTERNATIONAL

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 INVESTEDGE, INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.