Global Aseptic Paper Packaging Market

Market Size in USD Billion

CAGR :

%

USD

15.32 Billion

USD

28.46 Billion

2024

2032

USD

15.32 Billion

USD

28.46 Billion

2024

2032

| 2025 –2032 | |

| USD 15.32 Billion | |

| USD 28.46 Billion | |

|

|

|

|

Aseptic Paper Packaging Market Size

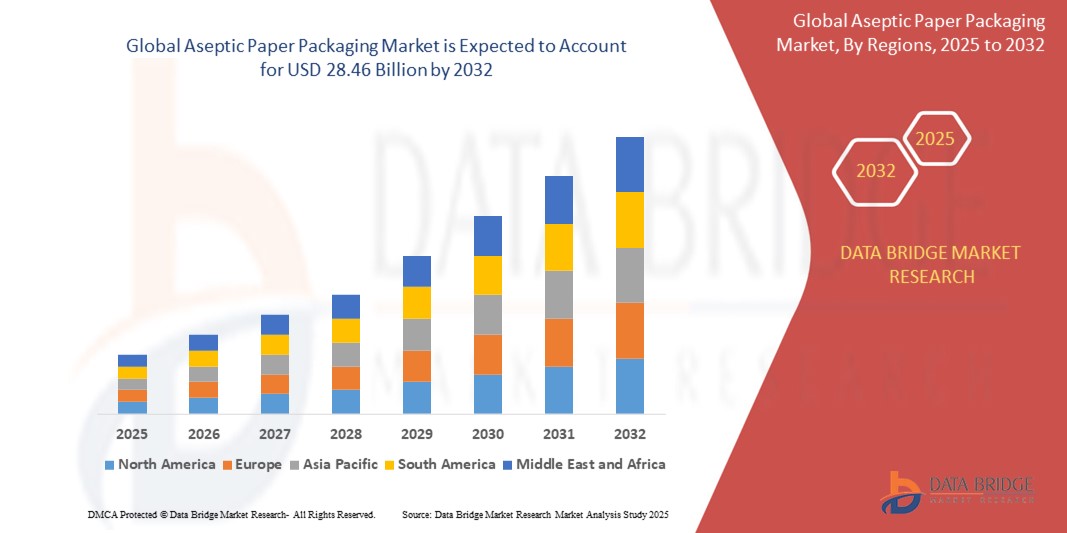

- The global aseptic paper packaging market size was valued at USD 15.32 billion in 2024 and is expected to reach USD 28.46 billion by 2032, at a CAGR of 8.05% during the forecast period

- The market growth is largely fueled by increasing demand for sustainable, eco-friendly packaging solutions that extend the shelf life of dairy, beverage, and pharmaceutical products without refrigeration

- Furthermore, rising consumer awareness about food safety, convenience, and environmental impact, combined with technological advancements in aseptic filling and multilayer paperboard production, is accelerating the adoption of aseptic paper packaging across various end-use industries. These factors together are driving strong market expansion globally

Aseptic Paper Packaging Market Analysis

- Aseptic paper packaging, providing sustainable and hygienic packaging solutions for shelf-stable dairy, beverage, and pharmaceutical products, is becoming increasingly essential across food and beverage industries due to its ability to preserve product freshness without refrigeration while reducing environmental impact

- The rising demand for aseptic paper packaging is primarily driven by growing consumer awareness of sustainability, increasing preference for convenient and preservative-free products, and advancements in packaging technologies that enhance barrier properties and recyclability

- Asia-Pacific dominated the aseptic paper packaging market with a share of 41.6% in 2024 due to rapid urbanization, growing population, and rising demand for shelf-stable dairy and beverage products across emerging economies

- North America is expected to be the fastest growing region in the aseptic paper packaging market with a share of during the forecast period due to rising demand for sustainable, eco-friendly packaging in dairy alternatives, functional beverages, and ready-to-drink products.

- Bleached segment dominated the market due to its widespread use in premium beverage and dairy packaging due to its clean appearance and compatibility with advanced printing. Its strong barrier properties and ability to maintain product freshness make it a preferred choice for food-grade applications

Report Scope and Aseptic Paper Packaging Market Segmentation

|

Attributes |

Aseptic Paper Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aseptic Paper Packaging Market Trends

“Rising Sustainability-Driven Innovation in Packaging Materials”

- A major trend in the aseptic paper packaging market is the rising emphasis on sustainable and recyclable materials as both consumers and regulatory bodies push for environmentally responsible packaging solutions

- Manufacturers are increasingly innovating by developing paperboard structures with reduced plastic content and enhanced recyclability such as plant-based barriers replacing aluminum or polymer layers

- For instance companies such as SIG and Tetra Pak have introduced packaging made from FSC-certified paperboard with bio-based caps and coatings to meet sustainability targets

- In addition, the demand for carbon-neutral and compostable packaging is spurring investments in new material technologies and circular packaging initiatives

- These innovations not only help reduce environmental impact but also align with the growing demand for corporate sustainability among global food and beverage brands

- As ESG (Environmental Social and Governance) standards become central to packaging decisions sustainability-led material development is reshaping the competitive landscape and product offerings in the aseptic paper packaging market

Aseptic Paper Packaging Market Dynamics

Driver

“Rising Demand for Shelf-Stable Preservative-Free Food and Beverage Products”

- A key driver for the aseptic paper packaging market is the growing consumer preference for ready-to-consume shelf-stable products that do not require refrigeration or preservatives

- This is particularly evident in dairy plant-based beverages and fruit juices where aseptic packaging ensures longer shelf life while maintaining nutritional value and taste without added chemicals

- For instance, brands such as Amul and Danone have expanded their aseptic product lines to meet demand in urban and semi-urban areas lacking consistent cold chain infrastructure

- The increasing pace of urbanization coupled with the expansion of modern retail formats and e-commerce has made ambient packaged goods more accessible further boosting demand

- This convenience combined with the hygiene and safety offered by aseptic technology is making it a preferred choice among both consumers and food manufacturers globally

Restraint/Challenge

“High Initial Investment in Aseptic Filling Infrastructure”

- A significant challenge in the aseptic paper packaging market is the high initial capital investment required for aseptic filling equipment and processing lines which can be a barrier for small- and medium-sized enterprises (SMEs)

- These systems require stringent sterile environments specialized technology and trained personnel leading to high setup and maintenance costs

- For instance, the installation of aseptic UHT (ultra-high temperature) processing lines can cost significantly more than conventional packaging setups deterring smaller players from entering the market

- Furthermore, regional disparities in technical expertise and infrastructure development can slow adoption in emerging economies despite growing demand

- Overcoming this challenge requires strategic partnerships co-packing models and government incentives to make advanced aseptic technologies more accessible to a broader range of manufacturers

Aseptic Paper Packaging Market Scope

The market is segmented on the basis of paper type, thickness, packaging structure, packaging type, and end-use.

• By Paper Type

On the basis of paper type, the aseptic paper market is segmented into bleached and coated unbleached kraft paperboard. The bleached segment accounted for the largest market revenue share in 2024, attributed to its widespread use in premium beverage and dairy packaging due to its clean appearance and compatibility with advanced printing. Its strong barrier properties and ability to maintain product freshness make it a preferred choice for food-grade applications.

The coated unbleached kraft paperboard segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for sustainable and cost-effective packaging alternatives. Its natural look and reduced chemical processing appeal to environmentally conscious brands, particularly in emerging economies transitioning to greener materials.

• By Thickness

On the basis of thickness, the market is segmented into less than 240um, 240-260um, 260-280um, and more than 280um. The 240-260um segment held the largest market share in 2024, supported by its balance of flexibility and strength, which suits a variety of liquid food packaging needs such as milk and juices. Manufacturers prefer this range for its processability and suitability in high-speed filling machines.

The more than 280um segment is projected to record the fastest CAGR from 2025 to 2032, driven by increasing demand for high-durability cartons for transportation and long-shelf-life products. This thickness range offers enhanced mechanical strength, ideal for larger packaging volumes and export-oriented products.

• By Packaging Structure

On the basis of packaging structure, the aseptic paper market is segmented into 3 layer, 4 layer, 6 layer, and others. The 6 layer segment dominated the market in 2024 due to its superior barrier properties, ensuring maximum product safety, shelf life, and hygiene. It is the standard for high-acid products such as fruit juices and flavored milk, protecting against light, oxygen, and microbial contamination.

The 4 layer segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by cost-efficiency and sufficient protection for low-acid or short-life liquid foods. This structure offers a balance of material use and performance, appealing to mid-tier product categories and small-scale producers.

• By Packaging Type

On the basis of packaging type, the market is segmented into flat top, gable top, and others. The flat top segment accounted for the largest market share in 2024, attributed to its space-efficient design and convenience in stacking and storage, especially in retail and logistics environments. Its compatibility with modern filling technologies further enhances its appeal.

The gable top segment is anticipated to witness the highest CAGR from 2025 to 2032, driven by its consumer-friendly design, reclosability, and strong branding appeal. It is gaining popularity in premium dairy and beverage segments where packaging aesthetics influence consumer preference.

• By End-Use

On the basis of end-use, the aseptic paper market is segmented into dairy products, beverages, pharmaceuticals, and others. The dairy products segment held the largest market share in 2024, driven by the widespread consumption of UHT milk and yogurt drinks, especially in regions with limited cold chain infrastructure. The demand for lightweight, long-lasting packaging further supports segment growth.

The pharmaceutical segment is expected to grow at the fastest pace from 2025 to 2032, fueled by rising requirements for sterile, tamper-proof packaging in liquid medications and health drinks. Aseptic paper offers a safe, cost-efficient alternative to plastic and glass in select pharma use-cases.

Aseptic Paper Packaging Market Regional Analysis

- Asia-Pacific dominated the aseptic paper packaging market with the largest revenue share of 41.6% in 2024, driven by rapid urbanization, growing population, and rising demand for shelf-stable dairy and beverage products across emerging economies

- The region’s increasing health awareness, expanding middle class, and preference for convenient, portable packaging are major contributors to market growth

- In addition, supportive government policies on food safety and sustainability, along with local production capabilities and advancements in filling technology, are accelerating adoption of aseptic paper packaging in both domestic and export-oriented sectors

Japan Aseptic Paper Packaging Market Insight

The Japan market is expanding due to growing demand for portion-controlled, convenient beverage packaging amid a fast-paced lifestyle and aging population. Japanese consumers value compact, hygienic packaging, and aseptic cartons meet these needs effectively. Local manufacturers are investing in high-tech filling machines and recyclable multilayer paperboard to cater to the demand for eco-friendly and practical packaging.

China Aseptic Paper Packaging Market Insight

The China aseptic paper packaging market held the largest share in Asia-Pacific in 2024, supported by its status as a global production hub and vast domestic consumption of milk, soy drinks, and flavored beverages. Government policies supporting food safety, combined with the shift towards packaged health drinks and kids’ beverages, are driving demand. Chinese players are increasingly investing in sustainable paper-based packaging technologies to meet local and export market needs.

Europe Aseptic Paper Packaging Market Insight

The Europe aseptic paper packaging market is projected to grow at a significant CAGR over the forecast period, fueled by strong regulatory support for sustainable packaging and rising consumer awareness about carbon footprint. The region leads in recycling infrastructure and circular economy initiatives, promoting adoption among beverage and dairy producers. A surge in demand for organic and natural drinks in aseptic cartons is further boosting market penetration across Western and Northern Europe.

U.K. Aseptic Paper Packaging Market Insight

The U.K. market is anticipated to grow steadily during the forecast period, driven by evolving consumer preferences for recyclable, lightweight packaging and increasing availability of premium dairy and juice products. Government-led plastic reduction initiatives and food packaging mandates are encouraging brands to adopt fiber-based aseptic solutions. In addition, the rapid expansion of organic beverage lines in supermarkets is positively influencing market growth.

Germany Aseptic Paper Packaging Market Insight

The Germany aseptic paper packaging market is expected to witness considerable expansion, underpinned by a strong environmental ethos and innovation in packaging technologies. Germany’s commitment to recycling, along with consumer demand for minimal processing and clean packaging labels, is driving the switch from plastic bottles to paper-based cartons. Advanced filling technologies and high dairy consumption levels also support the sector’s robust outlook.

North America Aseptic Paper Packaging Market Insight

North America market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for sustainable, eco-friendly packaging in dairy alternatives, functional beverages, and ready-to-drink products. Increasing health awareness and preference for minimally processed, preservative-free items are boosting aseptic packaging adoption. Advances in filling technology, strong regulatory support for recyclable materials, and efforts to reduce plastic use, along with a robust retail infrastructure, are further accelerating market growth.

U.S. Aseptic Paper Packaging Market Insight

U.S. aseptic paper packaging market captured the largest revenue share in 2024 within North America, supported by the high consumption of UHT milk, plant-based drinks, and functional beverages. The foodservice and retail sectors are increasingly adopting aseptic cartons for product differentiation and sustainability goals. In addition, the growing popularity of clean-label and preservative-free products is accelerating the use of aseptic packaging technologies that maintain freshness without refrigeration.

Aseptic Paper Packaging Market Share

The aseptic paper packaging industry is primarily led by well-established companies, including:

- Tetra Pak International S.A. (Switzerland)

- Elopak SA (Norway)

- Nippon Paper Industries Co., Ltd. (Japan)

- Nampak Ltd. (South Africa)

- SIG Combibloc Obeikan Ltd. (Saudi Arabia)

- Mondi Plc (Austria)

- Evergreen Packaging Inc. (U.S.)

- Polyoak Packaging Group (Pty) Ltd. (South Africa)

- Amcor Plc (Australia)

- IPI s.r.l. (Italy)

- Uflex Ltd. (India)

- Ducart Group (Israel)

Latest Developments in Global Aseptic Paper Packaging Market

- In November 2023, Tetra Pak and Lactogal introduced an aseptic beverage carton with a paper-based barrier. This initiative is part of a large-scale technology validation involving approximately 25 million packages, currently underway in Portugal. The carton is composed of about 80% paperboard, raising the renewable content to 90%. It also reduces its carbon footprint by one third (33%) and has been certified as Carbon Neutral by the Carbon Trust

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aseptic Paper Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aseptic Paper Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aseptic Paper Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.