Global Artificial Intelligence In Food Beverages Market

Market Size in USD Billion

CAGR :

%

USD

8.90 Billion

USD

87.71 Billion

2024

2032

USD

8.90 Billion

USD

87.71 Billion

2024

2032

| 2025 –2032 | |

| USD 8.90 Billion | |

| USD 87.71 Billion | |

|

|

|

|

Artificial Intelligence in F&B Market Size

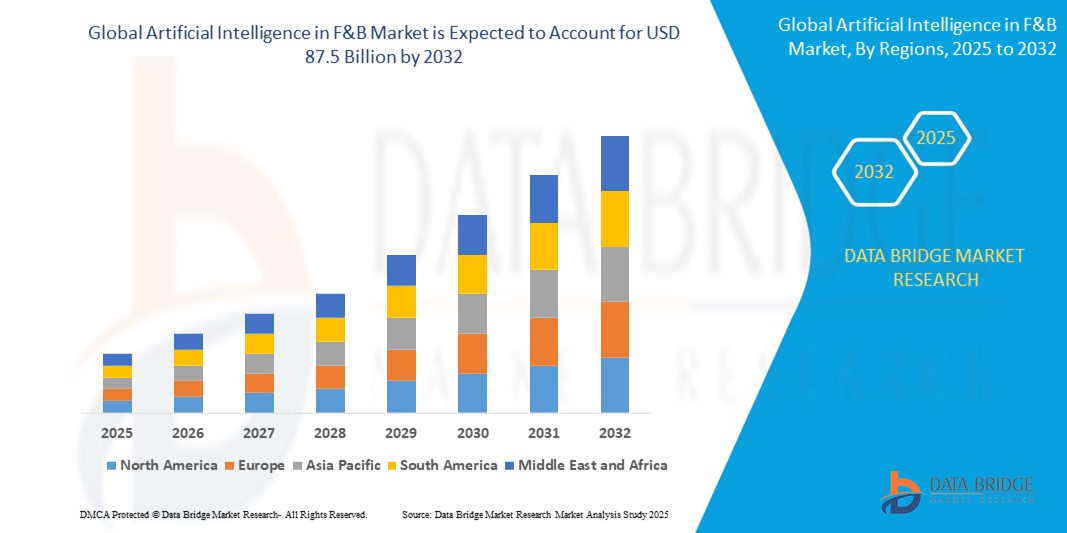

- The Global Artificial Intelligence in Food & Beverages Market size was valued at USD 8.9 billion in 2024 and is expected to reach USD 87.5 billion by 2032, at a CAGR of 38.6% during the forecast period.

- This growth is driven by Enhanced Food Safety & Quality Control.

Artificial Intelligence in F&B Market Analysis

- AI-driven automation and robotics streamline food production, packaging, and inventory processes, reducing waste and labour costs.

- Computer vision and machine learning are being used to detect contamination and monitor quality in real time.

- North America holds a significant market share due to its AI-driven automation and robotics streamline food production.

- North America is expected to register the fastest growth, fuelled by AI helps companies analyse consumer behaviour to personalize product offerings and marketing strategies.

- The Medium segment is projected to account for a significant market share of approximately 34.1% in 2025, driven by Personalized Consumer Experience.

Report Scope and Artificial Intelligence in F&B Market Segmentation

|

Attributes |

Artificial Intelligence in F&B Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

North America

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Artificial Intelligence in F&B Market Trends

“Smart Automation and Operational Intelligence”

- AI is increasingly embedded into food processing and quality assurance systems to enhance real-time monitoring, reduce human error, and ensure consistency across production lines. Vision-based AI inspection tools identify defects in food products at scale.

- Cloud-integrated AI platforms allow for scalable recipe optimization, production scheduling, and predictive maintenance in food manufacturing facilities. This helps reduce operational costs while improving yield.

- in 2024, Nestlé partnered with Microsoft Azure to deploy AI for production forecasting and factory performance optimization across European and Asian facilities.

- AI-driven robotics are being integrated into packaging and warehouse management. In 2023, Coca-Cola implemented AI-powered robotic arms for automated sorting and quality control in its North American bottling plants.

Artificial Intelligence in F&B Market Dynamics

Driver

“Regulatory Compliance and Safety Monitoring”

- Increasing food safety regulations and stricter international quality standards are pushing companies to adopt AI for end-to-end compliance monitoring and traceability.

- AI-enabled platforms support hazard detection, allergen tracking, and shelf-life prediction—critical for maintaining safety and building consumer trust.

- For instance, In April 2021, Tyson Foods adopted an AI-based traceability system using IBM Watson to track contaminants and ensure food safety compliance across its supply chain.

- AI helps digitize compliance workflows, automating documentation for HACCP, ISO 22000, and FSMA standards. This reduces manual reporting and error-prone recordkeeping.

Opportunity

“Integration with Predictive Analytics and Consumer Insights”

- Rapid digitalization and omnichannel retailing are providing vast data sets on consumer preferences. AI is being used to mine this data for trend forecasting and personalized product development.

- Machine learning algorithms identify emerging dietary patterns and optimize ingredient selection for new product formulations, shortening time-to-market.

- For instance, in 2025, PepsiCo launched an AI platform that analyzes global consumption data to co-create flavor profiles for regional markets, improving customer satisfaction and brand relevance.

- Restaurants and food delivery platforms are using AI to dynamically adjust menus, predict order volumes, and minimize food waste. In 2024, Domino’s integrated AI-based demand prediction into its inventory systems across Europe.

Restraint/Challenge

“High Implementation Costs and Data Sensitivity”

- AI deployment in food and beverage manufacturing requires significant capital investment in infrastructure, including high-performance computing, data warehousing, and skilled labor.

- Many SMEs face budget constraints and lack access to enterprise-grade AI tools, limiting adoption.

- For instance, a 2023 survey by the International Food and Beverage Technology Association found that 63% of small manufacturers cited cost as the primary barrier to implementing AI.

- Privacy and data security concerns are growing due to the sensitive nature of consumer health and preference data used in AI modelling. Ensuring GDPR and CCPA compliance adds further complexity and cost.

Artificial Intelligence in F&B Market Scope

The market is segmented based on Organization Size, End-User, Application.

|

Segmentation |

Sub-Segmentation |

|

By End-User |

|

|

By Application |

|

In 2025, Medium segment is projected to dominate the component segment

The Medium segment is expected to hold a market share of approximately 34.1% in 2025, driven by Demand Forecasting & Supply Chain Optimization.

The Food Processing segment is expected to account for the largest share during the forecast period in the application market

In 2025, the Food Processing segment is projected to account for a market share of 45.1%, driven by Enhanced Food Safety & Quality Control.

Artificial Intelligence in F&B Market Regional Analysis

“North America Holds the Largest Share in the Artificial Intelligence in F&B Market”

- North America dominates the market due to AI in Smart Agriculture & Crop Prediction.

- The U.S. holds a significant share, driven by Growth in E-commerce & Cloud Kitchens.

- The globe benefits from Waste Reduction & Sustainability Initiatives.

“Asia Pacific is Projected to Register the Highest CAGR in the Artificial Intelligence in F&B Market”

- Asia Pacific’s growth is driven by AI powers recommendation engines, smart inventory, and delivery optimization, fueling expansion in online food services.

- China is projected to exhibit the highest CAGR due to its Upstream integration of AI for ingredient sourcing and crop yield prediction enhances quality and sustainability.

- AI helps monitor shelf-life, forecast demand, and reduce food waste, aligning with global sustainability goals.

Artificial Intelligence in F&B Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GREEFA,

- TOMRA System ASA,

- Honeywell International Inc.,

- Martec of Whitell Ltd.

- Sesotec GmbH,

- Key Technology Inc.,

- Raytec Vision SpA,

- Rockwell Automation,

- ABB Ltd.,

- Foodable Network, LLC.

- Startup Creator,

- Compac Sorting Equipment,

- Agco Corporation,

- National Recovery Technologies, Llc,

- Max-Ai,

- Buhler AG |,

- QualySense AG,

- Bratney Companies,

- BoMill AB,

- Milltec Clarfai, Inc.,

- BBC technologies

- INTELLIGENTX Brewing Co.

Latest Developments in Global Artificial Intelligence in Food & Beverages Market

- In May 2025, Cargill has established an AI Centre of Excellence in Bengaluru, India, to enhance research and development and improve client experiences. This initiative aims to keep Cargill at the forefront of technological advancements in the food industry.

- In March 2025, Yum Brands, the parent company of Taco Bell, Pizza Hut, and KFC, partnered with Nvidia to implement AI-driven services in its restaurants. This includes AI-powered voice ordering at drive-throughs and on the phone, set to roll out at 500 locations in 2025.

- In January 2024, ITC Limited adopted AI technologies for improved quality control in dairy and beverage manufacturing. Utilizing visual inspection systems and real-time monitoring, the company aims to ensure high product quality.

- In July 2024, Mattson, a food and beverage innovation firm, appointed its first Chief Artificial Intelligence Officer and introduced AI-enhanced product innovation services. Their new ProtoThink AI platform enables rapid idea exploration with specialized AI models.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Artificial Intelligence In Food Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Artificial Intelligence In Food Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Artificial Intelligence In Food Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.