Global Artificial Intelligence Ai In Drug Discovery Market

Market Size in USD Million

CAGR :

%

USD

981.64 Million

USD

1,483.82 Million

2024

2032

USD

981.64 Million

USD

1,483.82 Million

2024

2032

| 2025 –2032 | |

| USD 981.64 Million | |

| USD 1,483.82 Million | |

|

|

|

Artificial Intelligence (AI) in Drug Discovery Market Size

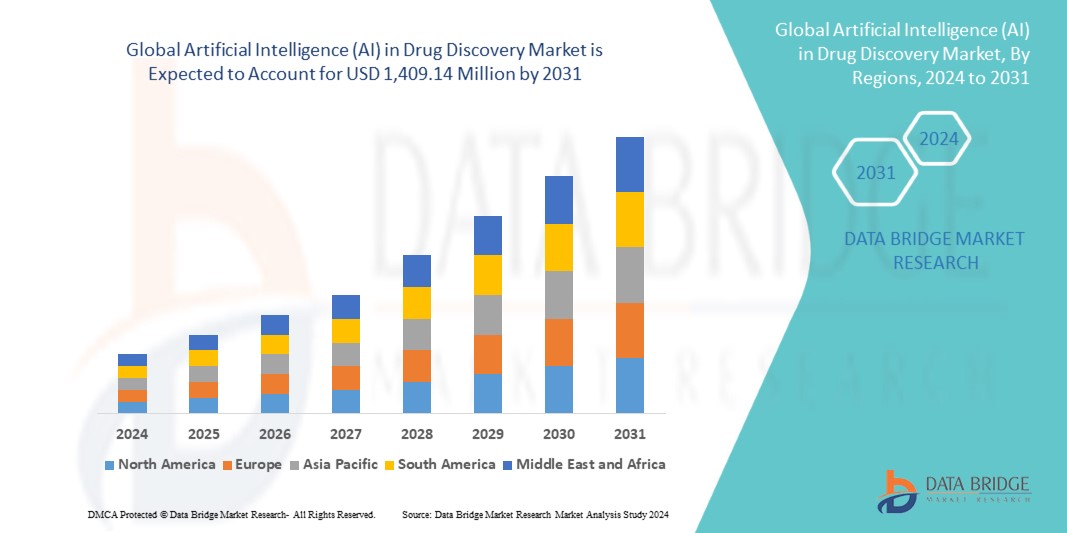

- The global artificial intelligence (AI) in drug discovery market was valued at USD 981.64 Million in 2024 and is expected to reach USD 1483.82 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.30%, primarily driven by the increasing availability of healthcare data

- This growth is driven by factors such as the rising prevalence of chronic diseases, and advancements in AI technologies that enhance drug discovery processes

Artificial Intelligence (AI) in Drug Discovery Market Analysis

- The market is experiencing rapid growth, driven by advancements in AI technologies like machine learning and deep learning, which are streamlining drug discovery processes and reducing costs.

- AI is being widely adopted for drug optimization, repurposing, preclinical testing, and clinical trial design, significantly accelerating the drug development timeline

- North America leads the market due to its strong pharmaceutical sector, while the Asia-Pacific region is expected to grow rapidly, fueled by increased investments in research and development

For instance, AI technologies such as machine learning and deep learning are being used to predict success rates in clinical trials, optimize drug candidates, and identify novel therapeutic targets, significantly reducing the time and cost of drug development.

- The adoption of AI in drug discovery is revolutionizing the pharmaceutical industry by addressing challenges such as high costs, lengthy timelines, and low success rates in traditional drug development processes.

Report Scope and Artificial Intelligence (AI) in Drug Discovery Market Segmentation

|

Attributes |

Artificial Intelligence (AI) in Drug Discovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Artificial Intelligence (AI) in Drug Discovery Market Trends

“AI-Driven Innovations Revolutionizing Drug Discovery”

- One prominent trend in the AI in drug discovery market is the increasing adoption of machine learning and deep learning technologies to streamline drug development processes.

- These advanced technologies enhance the efficiency and accuracy of drug discovery by analyzing vast datasets, predicting molecule binding properties, and identifying potential drug candidates.

- For instance, AI-powered platforms are being used to repurpose existing drugs for new therapeutic areas, significantly reducing the time and cost associated with traditional drug discovery methods.

- The integration of AI also enables better clinical trial design by predicting success rates and identifying patient populations, improving the overall success of drug development.

- This trend is transforming the pharmaceutical industry, accelerating the development of innovative therapies, and addressing unmet medical needs, thereby driving the demand for AI-driven solutions in the market.

Artificial Intelligence (AI) in Drug Discovery Market Dynamics

Driver

“Rising R&D Investments in Pharmaceutical Industry”

- Pharmaceutical companies are increasing their R&D budgets to develop new drugs and therapies, ensuring they stay competitive and meet evolving patient needs.

- AI tools are integrated into R&D processes to enhance drug discovery, enabling faster identification of drug candidates, improving success rates, and optimizing early-stage research.

- AI enables high-throughput screening, significantly speeding up the process of testing compounds and identifying promising candidates for further development.

- AI can process large datasets from genomics, clinical trials, and patient demographics to discover hidden patterns, accelerating the identification of new therapeutic targets.

- With AI algorithms optimizing patient recruitment and trial design, pharmaceutical companies can conduct more efficient clinical trials, reducing time and cost.

For instance,

- Sanofi partnered with Exscientia, using AI to design novel drug candidates, speeding up their path to clinical trials. In one of their collaborations, they identified a promising candidate for the treatment of autoimmune diseases in a fraction of the time it would have taken using traditional methods.

- GlaxoSmithKline (GSK) and 24M are working together to apply AI to optimize the R&D process, including the identification of new drug targets and accelerating the development of new therapies, such as for rare diseases.

- Rising investments in R&D, coupled with the power of AI, are significantly enhancing the pharmaceutical industry’s ability to discover new drugs faster, more cost-effectively, and with higher precision.

Opportunity

“Enhanced Predictive Modeling for Clinical Trials”

- AI can optimize clinical trial designs by identifying the most suitable trial parameters, such as sample size, endpoints, and treatment regimens, leading to more efficient and effective studies.

- By analyzing electronic health records and other data, AI can help identify the right patients for clinical trials based on specific inclusion/exclusion criteria, improving recruitment speed and accuracy.

- AI models can predict the likely success or failure of a clinical trial based on historical data and real-time insights, allowing for early adjustments to trial protocols and increasing the chances of success.

- By using predictive analytics, AI can identify patients at risk of dropping out and suggest interventions to keep them engaged, thereby reducing the number of incomplete trials.

- AI's ability to streamline the clinical trial process, from participant selection to outcome prediction, can significantly reduce the costs associated with traditional trial methods.

For instance,

- Pfizer used AI in partnership with IBM Watson Health to enhance clinical trial participant recruitment and optimize trial design for the development of a rare disease treatment. Their AI-driven approach helped accelerate recruitment and improve trial outcomes.

- Novartis employed AI to predict patient responses and optimize trial designs for their gene therapy treatments. This AI-powered approach led to better-targeted therapies and more efficient clinical trials.

- AI's ability to enhance predictive modeling in clinical trials offers significant advantages, including more efficient trial designs, faster patient recruitment, reduced costs, and improved trial outcomes, ultimately accelerating the development of new treatments.

Restraint/Challenge

“High Initial Investment Costs”

- AI-driven tools require expensive technology infrastructure, including powerful computing systems, data storage solutions, and specialized software, making the initial investment high.

- Recruiting skilled professionals such as data scientists, AI experts, and biopharma researchers with knowledge in both AI and drug discovery is costly, adding to the financial burden of implementing AI in R&D.

- Integrating AI tools into existing drug discovery workflows, especially in legacy systems, demands significant financial resources for adaptation, training, and optimization.

- AI technologies require continuous maintenance, software updates, and hardware upgrades to stay current with advances in machine learning and data analytics, contributing to long-term operational costs.

- AI systems in drug discovery depend on vast, high-quality datasets, and acquiring or licensing such datasets can be expensive for smaller companies or startups, further raising the cost of AI implementation.

For instance,

- BenevolentAI invested heavily in AI-driven drug discovery platforms and expertise to streamline the drug development process, focusing on oncology. Despite the initial high investment, their approach has enabled faster drug discovery with improved success rates.\

- Insilico Medicine, a startup leveraging AI for drug discovery, required significant upfront investment to build its AI-driven platform, which allowed them to accelerate drug development for diseases like fibrosis and cancer, but the costs were high and challenging for smaller competitors to match.

- The high initial investment costs in AI for drug discovery create a barrier for smaller companies and startups, limiting their ability to compete with larger organizations that can afford these technologies. Overcoming this challenge may require innovative funding models or partnerships to make AI more accessible to a broader range of players in the pharmaceutical industry.

Artificial Intelligence (AI) in Drug Discovery Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Technology |

|

|

By Drug Type |

|

|

By Offering |

|

|

By Indication |

|

|

By End Use

|

|

Artificial Intelligence (AI) in Drug Discovery Market Regional Analysis

“North America is the Dominant Region in the Artificial Intelligence (AI) in Drug Discovery Market”

- North America dominates the artificial intelligence (ai) in drug discovery market, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and strong presence of key market players

- The U.S. is home to some of the largest pharmaceutical companies, such as Pfizer, Johnson & Johnson, Merck, and Eli Lilly, which are at the forefront of adopting AI in drug discovery. These companies are investing heavily in AI to streamline the drug development process and improve outcomes.

- North America has a well-established technology ecosystem, with major AI players like IBM Watson Health and Google DeepMind driving innovation in drug discovery. These companies are leading in AI research and providing powerful AI tools for pharmaceutical R&D.

- North America consistently invests a significant portion of its GDP in research and development (R&D). This funding drives the adoption of advanced AI technologies in drug discovery, as companies seek ways to expedite the discovery of new drugs and treatments.

- North America has seen numerous partnerships between pharmaceutical companies and AI startups or tech firms. For example, collaborations like Novartis partnering with Microsoft to use AI in drug discovery highlight the region’s leadership in leveraging AI to innovate in drug development.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Artificial Intelligence (AI) in Drug Discovery, driven by rapid expansion in healthcare infrastructure, increasing awareness about eye health, and rising surgical volumes.

- Countries such as China, India, and Japan are investing heavily in AI and biotechnology, with the aim to enhance their pharmaceutical sectors and address the growing healthcare needs. These investments are accelerating the adoption of AI in drug discovery.

- Governments in the APAC region are actively promoting digital healthcare and AI integration through various initiatives. For instance, China has implemented national strategies to incorporate AI into healthcare, fostering the growth of AI in drug discovery.

- APAC countries have large populations and vast amounts of health data that can be leveraged for AI-powered drug discovery. The region’s robust digital infrastructure supports the integration of AI technologies for drug development.

- The Asia-Pacific (APAC) region is the fastest growing in the AI in drug discovery market, driven by increasing investments, supportive government policies, a large pool of data, and the expansion of biotech companies leveraging AI technology.

Artificial Intelligence (AI) in Drug Discovery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- NVIDIA Corporation (U.S.)

- IBM Corp. (U.S.)

- Atomwise Inc. (U.S.)

- Microsoft (U.S.)

- Benevolent AI (U.K.)

- Aria Pharmaceuticals, Inc. (U.S.)

- DEEP GENOMICS (Canada)

- Exscientia (U.K.)

- Insilico Medicine (Hong Kong)

- Cyclica (Canada)

- NuMedii, Inc. (U.S.)

- Envisagenics (U.S.)

- Owkin Inc. (U.S.)

- BERG LLC (U.S.)

- Schrödinger, Inc. (U.S.)

- XtalPi Inc. (China)

- BIOAGE Inc. (U.S.)

Latest Developments in Global Artificial Intelligence (AI) in Drug Discovery Market

- In May 2024, Google DeepMind unveiled the third version of its AlphaFold AI model, designed to enhance drug development and improve disease targeting. This advanced version enables researchers at DeepMind and Isomorphic Labs to analyze the behavior of all molecules, including human DNA

- In April 2024, Xaira Therapeutics, an innovative company specializing in AI-powered drug discovery and development, secured over USD 1 Million during a collaborative funding round with ARCH Venture Partners and Foresite Labs. Utilizing machine learning, data generation models, and therapeutic product development, the company focuses on addressing drug targets that have traditionally been difficult to tackle

- In December 2023, MilliporeSigma, the life science division of Merck, launched AIDDISON, a cutting-edge drug discovery software. This platform bridges the gap between virtual molecule design and real-world manufacturability by integrating the Synthia retrosynthesis software API. It combines generative AI, machine learning, and computer-aided drug design to streamline drug development processes

- In May 2023, Google launched two innovative AI-driven tools aimed at aiding biotech and pharmaceutical companies in accelerating drug discovery and refining precision medicine. These solutions are designed to reduce the time and expense involved in introducing new treatments to the U.S. market. Early adopters of these tools include Cerevel Therapeutics, Pfizer, and Colossal Biosciences.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING

16.1 OVERVIEW

16.2 SOFTWARE

16.2.1 INTEGRATED

16.2.2 STANDALONE

16.3 SERVICES

17 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 MACHINE LEARNING (ML)

17.2.1 SUPERVISED LEARNING

17.2.2 UNSUPERVISED LEARNING

17.2.3 REINFORCEMENT LEARNING

17.3 DEEP LEARNING

17.4 NATURAL LANGUAGE PROCESSING (NLP)

17.5 OTHERS

18 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE

18.1 OVERVIEW

18.2 SMALL MOLECULE

18.3 LARGE MOLECULE

19 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION

19.1 OVERVIEW

19.2 NOVEL DRUG CANDIDATES

19.2.1 IDENTIFY BIOLOGICS TARGET

19.2.2 PREDICT BIOACTIVITY OF SMALL MOLECULE

19.2.3 OTHERS

19.3 DRUG OPTIMISATION AND REPURPOSING PRECLINICAL TESTING AND APPROVAL

19.4 DRUG MONITORING

19.5 FINDING NEW DISEASES ASSOCIATED TARGETS AND PATHWAYS

19.6 UNDERSTANDING DISEASE MECHANISMS

19.7 AGGREGATING AND SYNTHESIZING INFORMATION

19.8 FORM ATION & QUALIFICATION OF HYPOTHESES

19.9 DE NOVO DRUG DESIGN

19.1 FINDING DRUG TARGETS OF AN OLD DRUG

19.11 OTHERS

20 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION

20.1 OVERVIEW

20.2 IMMUNO-ONCOLOGY

20.2.1 PROSTATE CANCER

20.2.2 BREAST CANCER

20.2.3 BRAIN CANCER

20.2.4 LUNG CANCER

20.2.5 PANCREATIC CANCER

20.2.6 COLORECTAL CANCER

20.2.7 LEUKEMIA

20.2.8 OTHERS

20.3 NEURODEGENERATIVE DISEASES

20.4 CARDIOVASCULAR DISEASES

20.5 METABOLIC DISEASES

20.6 OTHERS

21 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USER

21.1 OVERVIEW

21.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

21.3 CONTRACT RESEARCH ORGANIZATIONS

21.4 RESEARCH CENTRES AND ACADEMIC INSTITUTES

21.5 OTHERS

22 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2022-2031, (USD MILLION)

GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 OVERVIEW

22.2 NORTH AMERICA

22.2.1 U.S.

22.2.2 CANADA

22.2.3 MEXICO

22.3 EUROPE

22.3.1 GERMANY

22.3.2 U.K.

22.3.3 ITALY

22.3.4 FRANCE

22.3.5 SPAIN

22.3.6 SWITZERLAND

22.3.7 RUSSIA

22.3.8 TURKEY

22.3.9 BELGIUM

22.3.10 NETHERLANDS

22.3.11 REST OF EUROPE

22.4 ASIA-PACIFIC

22.4.1 JAPAN

22.4.2 CHINA

22.4.3 SOUTH KOREA

22.4.4 INDIA

22.4.5 AUSTRALIA & NEW ZEALAND

22.4.6 SINGAPORE

22.4.7 THAILAND

22.4.8 INDONESIA

22.4.9 MALAYSIA

22.4.10 PHILIPPINES

22.4.11 REST OF ASIA-PACIFIC

22.5 SOUTH AMERICA

22.5.1 BRAZIL

22.5.2 ARGENTINA

22.5.3 REST OF SOUTH AMERICA

22.6 MIDDLE EAST AND AFRICA

22.6.1 SOUTH AFRICA

22.6.2 EGYPT

22.6.3 SAUDI ARABIA

22.6.4 UNITED ARAB EMIRATES

22.6.5 ISRAEL

22.6.6 REST OF MIDDLE EAST AND AFRICA

23 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 NEW PRODUCT DEVELOPMENT & APPROVALS

23.7 EXPANSIONS

23.8 REGULATORY CHANGES

23.9 PARTNERSHIP AND OTHER STRATEGIC UPDATES

24 SWOT ANALYSIS AND DATA BRIDGE MARKET RESEARCH ANALYSIS

25 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, COMPANY PROFILE

25.1 MICROSOFT

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 PRODUCT PORTFOLIO

25.1.4 RECENT DEVELOPMENTS

25.2 SHANGHAI MEDICILON INC.

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 PRODUCT PORTFOLIO

25.2.4 RECENT DEVELOPMENTS

25.3 NVIDIA CORPORATION + ASTRAZENECA

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 PRODUCT PORTFOLIO

25.3.4 RECENT DEVELOPMENTS

25.4 ATOMWISE INC.

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 PRODUCT PORTFOLIO

25.4.4 RECENT DEVELOPMENTS

25.5 DEEP GENOMICS

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 PRODUCT PORTFOLIO

25.5.4 RECENT DEVELOPMENTS

25.6 CLOUD PHARMACEUTICALS INC.

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 PRODUCT PORTFOLIO

25.6.4 RECENT DEVELOPMENTS

25.7 INSILICO MEDICINE

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 PRODUCT PORTFOLIO

25.7.4 RECENT DEVELOPMENTS

25.8 BENEVOLENTAI

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 PRODUCT PORTFOLIO

25.8.4 RECENT DEVELOPMENTS

25.9 EXSCIENTIA

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 PRODUCT PORTFOLIO

25.9.4 RECENT DEVELOPMENTS

25.1 CYCLICA

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 PRODUCT PORTFOLIO

25.10.4 RECENT DEVELOPMENTS

25.11 OWKIN, INC

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 PRODUCT PORTFOLIO

25.11.4 RECENT DEVELOPMENTS

25.12 ENVISAGENICS

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 PRODUCT PORTFOLIO

25.12.4 RECENT DEVELOPMENTS

25.13 NUMEDII, INC.

25.13.1 COMPANY OVERVIEW

25.13.2 REVENUE ANALYSIS

25.13.3 PRODUCT PORTFOLIO

25.13.4 RECENT DEVELOPMENTS

25.14 BIOSYNTAGMA

25.14.1 COMPANY OVERVIEW

25.14.2 REVENUE ANALYSIS

25.14.3 PRODUCT PORTFOLIO

25.14.4 RECENT DEVELOPMENTS

25.15 COLLABORATIONS PHARMACEUTICALS, INC.

25.15.1 COMPANY OVERVIEW

25.15.2 REVENUE ANALYSIS

25.15.3 PRODUCT PORTFOLIO

25.15.4 RECENT DEVELOPMENTS

25.16 INVENIAI LLC

25.16.1 COMPANY OVERVIEW

25.16.2 REVENUE ANALYSIS

25.16.3 PRODUCT PORTFOLIO

25.16.4 RECENT DEVELOPMENTS

25.17 RECURSION PHARMACEUTICALS, INC. + NVIDIA CORPORATION

25.17.1 COMPANY OVERVIEW

25.17.2 REVENUE ANALYSIS

25.17.3 PRODUCT PORTFOLIO

25.17.4 RECENT DEVELOPMENTS

25.18 VALO HEALTH

25.18.1 COMPANY OVERVIEW

25.18.2 REVENUE ANALYSIS

25.18.3 PRODUCT PORTFOLIO

25.18.4 RECENT DEVELOPMENTS

25.19 AIFORIA

25.19.1 COMPANY OVERVIEW

25.19.2 REVENUE ANALYSIS

25.19.3 PRODUCT PORTFOLIO

25.19.4 RECENT DEVELOPMENTS

25.2 CHEMALIVE

25.20.1 COMPANY OVERVIEW

25.20.2 REVENUE ANALYSIS

25.20.3 PRODUCT PORTFOLIO

25.20.4 RECENT DEVELOPMENTS

25.21 DEEPMATTER GROUP LIMITED

25.21.1 COMPANY OVERVIEW

25.21.2 REVENUE ANALYSIS

25.21.3 PRODUCT PORTFOLIO

25.21.4 RECENT DEVELOPMENTS

25.22 MABSILICO.

25.22.1 COMPANY OVERVIEW

25.22.2 REVENUE ANALYSIS

25.22.3 PRODUCT PORTFOLIO

25.22.4 RECENT DEVELOPMENTS

25.23 OPTIBRIUM, LTD.

25.23.1 COMPANY OVERVIEW

25.23.2 REVENUE ANALYSIS

25.23.3 PRODUCT PORTFOLIO

25.23.4 RECENT DEVELOPMENTS

25.24 ABBVIE AND BIGHAT BIOSCIENCES

25.24.1 COMPANY OVERVIEW

25.24.2 REVENUE ANALYSIS

25.24.3 PRODUCT PORTFOLIO

25.24.4 RECENT DEVELOPMENTS

25.25 ADAGENE

25.25.1 COMPANY OVERVIEW

25.25.2 REVENUE ANALYSIS

25.25.3 PRODUCT PORTFOLIO

25.25.4 RECENT DEVELOPMENTS

25.26 PEPTICOM LTD.

25.26.1 COMPANY OVERVIEW

25.26.2 REVENUE ANALYSIS

25.26.3 PRODUCT PORTFOLIO

25.26.4 RECENT DEVELOPMENTS

25.27 DEARGEN INC.

25.27.1 COMPANY OVERVIEW

25.27.2 REVENUE ANALYSIS

25.27.3 PRODUCT PORTFOLIO

25.27.4 RECENT DEVELOPMENTS

25.28 GERO.AI

25.28.1 COMPANY OVERVIEW

25.28.2 REVENUE ANALYSIS

25.28.3 PRODUCT PORTFOLIO

25.28.4 RECENT DEVELOPMENTS

25.29 3BIGS CO. LTD.

25.29.1 COMPANY OVERVIEW

25.29.2 REVENUE ANALYSIS

25.29.3 PRODUCT PORTFOLIO

25.29.4 RECENT DEVELOPMENTS

25.3 BPGBIO INC.

25.30.1 COMPANY OVERVIEW

25.30.2 REVENUE ANALYSIS

25.30.3 PRODUCT PORTFOLIO

25.30.4 RECENT DEVELOPMENTS

25.31 SCHRÖDINGER, INC.

25.31.1 COMPANY OVERVIEW

25.31.2 REVENUE ANALYSIS

25.31.3 PRODUCT PORTFOLIO

25.31.4 RECENT DEVELOPMENTS

25.32 XTALPI INC.

25.32.1 COMPANY OVERVIEW

25.32.2 REVENUE ANALYSIS

25.32.3 PRODUCT PORTFOLIO

25.32.4 RECENT DEVELOPMENTS

25.33 BIOAGE INC.

25.33.1 COMPANY OVERVIEW

25.33.2 REVENUE ANALYSIS

25.33.3 PRODUCT PORTFOLIO

25.33.4 RECENT DEVELOPMENTS

26 RELATED REPORTS

27 QUESTIONNAIRE

28 CONCLUSION

29 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.