Global Artificial Intelligence Ai Chipset Market

Market Size in USD Billion

CAGR :

%

USD

73.24 Billion

USD

558.18 Billion

2024

2032

USD

73.24 Billion

USD

558.18 Billion

2024

2032

| 2025 –2032 | |

| USD 73.24 Billion | |

| USD 558.18 Billion | |

|

|

|

|

Artificial Intelligence (AI) Chipset Market Size

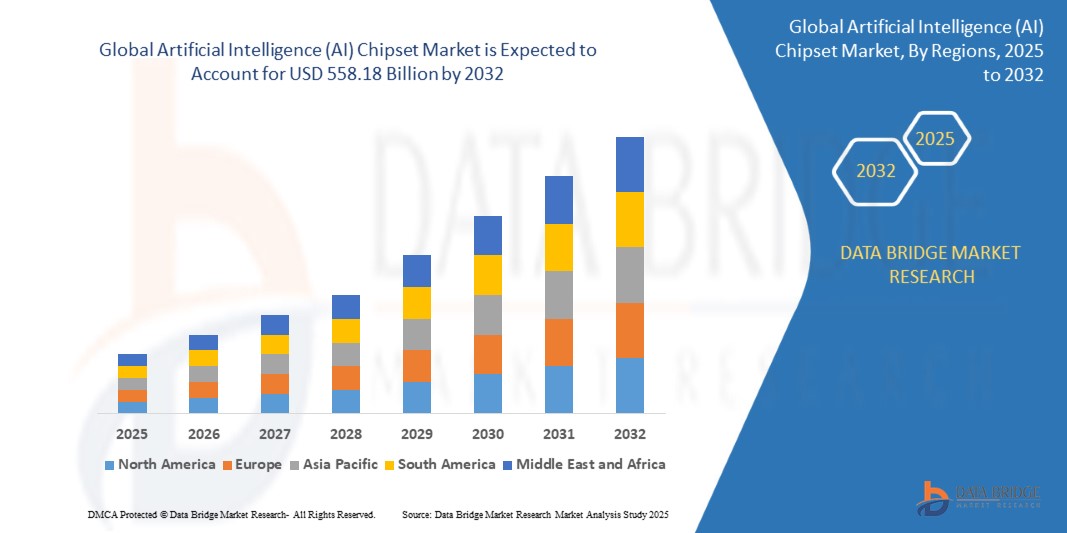

- The global artificial intelligence (AI) chipset market size was valued at USD 73.24 billion in 2024 and is expected to reach USD 558.18 billion by 2032, at a CAGR of 28.9% during the forecast period

- The market growth is largely fuelled by the rising demand for high-speed processors in AI applications, growing adoption of AI across sectors such as healthcare, automotive, finance, and manufacturing, and the increasing investments in AI research and development by both public and private sectors

- Advancements in chip architectures, including the integration of neuromorphic and quantum computing elements, are expected to unlock new performance benchmarks and accelerate AI adoption in complex and real-time scenarios

Artificial Intelligence (AI) Chipset Market Analysis

- The AI chipset market is witnessing robust expansion driven by the proliferation of data-centric technologies and the rising implementation of machine learning and deep learning models across industries

- Edge computing is gaining significant traction, increasing the demand for energy-efficient AI chips capable of real-time data processing

- North America dominated the artificial intelligence (AI) chipset market with the largest revenue share of 44.3% in 2024, driven by strong investments in AI development, well-established data center infrastructure, and widespread deployment of AI-powered solutions across industries

- Asia-Pacific region is expected to witness the highest growth rate in the global artificial intelligence (AI) chipset market, driven by increasing adoption of AI-powered technologies in emerging economies, growing investments in smart city and industrial automation projects, and the presence of low-cost semiconductor manufacturing hubs in countries such as China, Taiwan, and South Korea

- The processor segment dominated the market with the largest revenue share of 61.5% in 2024, driven by the growing need for high-performance computing across AI workloads such as deep learning and neural network training. Graphics processing units (GPUs) and application-specific integrated circuits (ASICs) are particularly in demand due to their parallel processing capabilities and optimized design for AI tasks. This segment continues to benefit from technological advancements and increasing deployment in both cloud and edge environments

Report Scope and Artificial Intelligence (AI) Chipset Market Segmentation

|

Attributes |

Artificial Intelligence (AI) Chipset Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Artificial Intelligence (AI) Chipset Market Trends

“Growing Integration of AI Chipsets in Edge Devices”

- The growing need for real-time processing and low-latency decision-making is driving the adoption of AI chipsets in edge devices. These chipsets reduce reliance on cloud infrastructure by enabling localized processing. This shift is especially important in applications such as autonomous driving, industrial automation, and video surveillance

- AI chipsets embedded in consumer electronics are enhancing device intelligence and personalization. Smartphones, smart speakers, and wearables now include neural processing units that handle complex AI tasks on-device. This development significantly improves response time, battery life, and user experience

- Edge AI chipsets are being designed with smaller footprints and improved power efficiency to suit compact devices. These chips allow for continuous AI functionality without draining energy resources. Their deployment is expanding across drones, medical devices, and IoT sensors

- For instance, Google’s Edge TPU chip powers its Coral devices used in manufacturing and retail for on-device image classification and analytics. These chips process data locally, reducing bandwidth usage and ensuring real-time decision-making. The success of Coral demonstrates how edge AI is scaling across industries

- The shift toward edge-based AI processing is transforming both consumer and industrial applications. AI chipsets tailored for localized, efficient computation are setting new benchmarks in performance and innovation. This trend is expected to accelerate as demand for intelligent, responsive systems continues to rise

Artificial Intelligence (AI) Chipset Market Dynamics

Driver

“Surge in AI Applications Across Industries”

- The increasing adoption of AI across sectors such as healthcare, finance, automotive, and manufacturing is driving the demand for high-performance chipsets. These sectors rely on AI for diagnostics, fraud detection, predictive maintenance, and smart automation. The versatility of AI chipsets positions them as essential tools in modern infrastructure

- Companies are investing heavily in AI development, boosting the need for specialized hardware to support complex machine learning and deep learning models. AI chipsets deliver the computational power required to train and deploy such models effectively. As organizations scale their AI capabilities, demand for powerful processors continues to rise

- AI chipsets are enabling advanced functionalities in next-generation applications such as autonomous vehicles and precision medicine. These systems depend on fast, reliable, and energy-efficient processing. AI chips help translate real-time data into actionable insights, improving outcomes across various domains

- For instance, Tesla’s custom-built Full Self-Driving (FSD) chip processes data from multiple sensors to enable autonomous vehicle operations without external connectivity. The chip’s performance and speed have allowed Tesla to advance its driver assistance features significantly. This example highlights the importance of chipset innovation in AI deployment

- Cross-industry adoption of AI technologies is propelling long-term growth in the AI chipset market. These processors are critical to enabling smarter systems and more efficient decision-making. As AI becomes more embedded in everyday operations, demand for advanced chipsets will continue to surge

Restraint/Challenge

“High Development Costs and Technical Complexity”

- Designing AI chipsets involves complex architectures, advanced manufacturing, and specialized skill sets, leading to high development costs. Unlike traditional processors, AI chips must support parallel computing and adaptive learning models. This complexity creates barriers for new entrants and extends product development timelines

- Rapid advancements in AI software require constant hardware upgrades to maintain compatibility and performance. Chip manufacturers face pressure to innovate quickly, which increases research and operational expenses. This dynamic creates sustainability challenges for companies operating in highly competitive environments

- Smaller firms and startups often lack the financial and technical resources needed to compete in the AI hardware space. The dominance of large players limits diversity and slows the democratization of AI chipset availability. Without collaborative efforts, these gaps may hinder broader market participation

- For instance, Intel faced production setbacks with its AI-focused Nervana and Habana Labs chips, impacting its competitiveness against rivals such as NVIDIA. Delays in product rollout and integration challenges limited its market share in key segments. This illustrates how even established firms face difficulties in AI chip innovation

- The cost and complexity of AI chipset development remain key challenges to market expansion. Overcoming these barriers will require modular design strategies, ecosystem collaboration, and scalable production techniques. Addressing these issues is crucial to unlocking widespread adoption and market maturity

Artificial Intelligence (AI) Chipset Market Scope

The market is segmented on the basis of hardware, technology, function, and end user.

• By Hardware

On the basis of hardware, the artificial intelligence (AI) chipset market is segmented into processor, memory, and network. The processor segment dominated the market with the largest revenue share of 61.5% in 2024, driven by the growing need for high-performance computing across AI workloads such as deep learning and neural network training. Graphics processing units (GPUs) and application-specific integrated circuits (ASICs) are particularly in demand due to their parallel processing capabilities and optimized design for AI tasks. This segment continues to benefit from technological advancements and increasing deployment in both cloud and edge environments.

The network segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for efficient data transfer between AI components in complex systems. High-speed interconnects and AI-optimized networking solutions are essential in data centers and edge deployments, where latency reduction and bandwidth optimization are critical for real-time processing and AI model inference.

• By Technology

On the basis of technology, the artificial intelligence (AI) chipset market is segmented into machine learning, natural language processing, context-aware computing, computer vision, and predictive analysis. The machine learning segment held the largest market revenue share in 2024 due to its wide-scale adoption across applications such as fraud detection, recommendation engines, and customer behavior analytics. As businesses across sectors prioritize data-driven decision-making, machine learning-based AI chipsets are seeing increased integration in consumer electronics, cloud platforms, and enterprise systems.

The computer vision segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the expanding use of AI in image and video analysis. Applications such as facial recognition, autonomous vehicles, and smart surveillance systems rely heavily on computer vision technology, which requires powerful, vision-specific chipsets capable of processing high-resolution visual data in real-time.

• By Function

On the basis of function, the artificial intelligence (AI) chipset market is segmented into training and inference. The training segment dominated the market with the largest revenue share in 2024, driven by the increasing need for powerful processing units capable of handling vast datasets and complex neural network models. Training AI models typically requires advanced GPUs and ASICs designed to manage high workloads, especially in cloud-based infrastructure supporting large-scale learning applications.

The inference segment is expected to witness the fastest growth rate from 2025 to 2032, due to the rising demand for real-time decision-making at the edge. Inference-focused AI chipsets are optimized for power efficiency and rapid processing, making them ideal for applications in mobile devices, industrial automation, and autonomous systems where immediate responses are crucial.

• By End User

On the basis of end user, the artificial intelligence (AI) chipset market is segmented into consumer electronics, healthcare, manufacturing, automotive, agriculture, retail, cybersecurity, human resources, marketing, law, fintech, and government. The consumer electronics segment accounted for the largest market revenue share in 2024, supported by the widespread incorporation of AI functionalities in smartphones, smart TVs, and wearables. Chipsets embedded with AI capabilities enhance user experience by enabling voice assistants, facial recognition, and personalized content recommendations.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of AI in medical diagnostics, drug discovery, and robotic surgeries. AI chipsets play a critical role in enabling real-time data analysis and predictive modeling in healthcare systems, improving diagnostic accuracy and operational efficiency.

Artificial Intelligence (AI) Chipset Market Regional Analysis

- North America dominated the artificial intelligence (AI) chipset market with the largest revenue share of 44.3% in 2024, driven by strong investments in AI development, well-established data center infrastructure, and widespread deployment of AI-powered solutions across industries

- The region benefits from a highly developed technological ecosystem, leading semiconductor manufacturers, and high AI adoption rates in sectors such as healthcare, automotive, and finance

- The combination of favorable government initiatives, increasing enterprise adoption of machine learning and deep learning tools, and growing demand for AI in both consumer and industrial applications continues to support market expansion in the region

U.S. Artificial Intelligence (AI) Chipset Market Insight

The U.S. AI chipset market captured the largest revenue share within North America in 2024, owing to strong R&D capabilities, early adoption of cutting-edge AI applications, and the dominance of key players such as NVIDIA, Intel, and AMD. The U.S. is a global leader in AI research and innovation, with chipsets being used extensively in cloud platforms, autonomous systems, and healthcare diagnostics. Increasing deployment of AI-enabled consumer electronics, alongside support for advanced manufacturing and cybersecurity, further propels demand across the country.

Europe Artificial Intelligence (AI) Chipset Market Insight

The Europe AI chipset market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising interest in AI adoption across smart mobility, manufacturing, and public sector applications. Countries in the region are investing in digital transformation, particularly in areas such as Industry 4.0 and smart cities. Emphasis on data privacy, ethical AI development, and sustainability is encouraging the deployment of energy-efficient AI chipsets. The presence of regional tech hubs and growing cross-border collaborations are also contributing to market expansion.

Germany Artificial Intelligence (AI) Chipset Market Insight

The Germany AI chipset market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's leadership in automotive innovation and industrial automation. AI chipsets are being increasingly adopted for predictive maintenance, robotics, and autonomous driving applications. Germany’s strong emphasis on data security and precision engineering supports the use of custom AI hardware, particularly in smart factories and research facilities. The ongoing push toward digital sovereignty and support for semiconductor innovation further bolsters growth.

U.K. Artificial Intelligence (AI) Chipset Market Insight

The U.K. AI chipset market is expected to witness the fastest growth rate from 2025 to 2032, supported by government initiatives such as the AI Sector Deal and increasing AI deployment in healthcare, finance, and legal services. The country is actively investing in AI start-ups and university-led research, strengthening its position in Europe’s AI ecosystem. Growing interest in AI for cybersecurity, drug discovery, and financial modeling is fueling demand for specialized chipsets that deliver high computational efficiency and scalability.

Asia-Pacific Artificial Intelligence (AI) Chipset Market Insight

The Asia-Pacific AI chipset market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid digitalization, strong government support, and increasing investments in AI innovation across countries such as China, Japan, South Korea, and India. The region benefits from large-scale manufacturing capabilities, growing AI start-up ecosystems, and expanding use of AI in sectors such as e-commerce, transportation, and agriculture. Local production of AI chipsets and rising demand for cost-effective solutions are expanding access across emerging economies.

China Artificial Intelligence (AI) Chipset Market Insight

The China AI chipset market accounted for the largest revenue share in Asia-Pacific in 2024, supported by government-led initiatives such as the “Next Generation Artificial Intelligence Development Plan” and robust investments in smart infrastructure. China is home to leading semiconductor and AI technology firms, and demand for AI chipsets is soaring across facial recognition, surveillance, and consumer electronics. The country's focus on becoming self-reliant in chip manufacturing and the rapid deployment of AI in urban and industrial environments are major growth drivers.

Japan Artificial Intelligence (AI) Chipset Market Insight

The Japan AI chipset market is expected to witness the fastest growth rate from 2025 to 2032, driven by the integration of AI in robotics, elderly care, and advanced transportation systems. Japan’s technological leadership and well-established electronics sector are enabling widespread adoption of AI hardware across both consumer and industrial applications. As the country tackles labor shortages and aims to enhance operational efficiency, the use of inference-optimized chipsets in smart cities, healthcare, and autonomous mobility is expected to accelerate.

Artificial Intelligence (AI) Chipset Market Share

The Artificial Intelligence (AI) Chipset industry is primarily led by well-established companies, including:

- NVIDIA Corporation (U.S.)

- Intel Corporation (U.S.)

- Xilinx, Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Micron Technology, Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- IBM Corp. (U.S.)

- Google Inc. (U.S.)

- Microsoft (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Advanced Micro Devices, Inc (U.S.)

- General Vision Inc. (U.S.)

- Mythic (U.S.)

- Baidu, Inc. (China)

Latest Developments in Global Artificial Intelligence (AI) Chipset Market

- In January 2023, NXP Semiconductors launched the i.MX 95 family as part of its i.MX 9 series. This high-performance processor integrates Arm Mali-powered 3D graphics, an in-house machine learning accelerator, and advanced data processing capabilities. It enables enhanced functionality across automotive, industrial, and HMI applications, strengthening NXP’s position in edge computing and AI-driven markets

- In September 2022, Kinara entered a collaboration with NXP Semiconductors to offer the Ara-1 Edge AI processor alongside NXP’s AI-enabled portfolio. This partnership aims to scale AI acceleration and improve deep learning inferencing at the edge, expanding both companies' capabilities in delivering integrated AI solutions for diverse applications

- In September 2022, Intel released its 4th Gen Intel Xeon AI chip, Sapphire Rapids scalable processors, and Data Center GPUs. It also unveiled its 13th Gen Intel Core processors optimized for AI. These developments aim to boost performance for gaming, content creation, and enterprise AI workloads, enhancing Intel’s AI ecosystem

- In August 2022, Intel partnered with Aible to optimize AI performance for enterprise customers through cloud-based solutions. This collaboration focuses on rapid deployment and measurable impact using advanced benchmarking and engineering optimization, enabling businesses to adopt AI more efficiently across operational domains

- In November 2021, NXP Semiconductors introduced the i.MX 93 family of application processors, designed for automotive, smart home, and industrial automation. Featuring edge machine learning capabilities, the processors anticipate and adapt to user needs, supporting the growing demand for intelligent, responsive devices in connected environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.