Global Articulated Robot Market

Market Size in USD Billion

CAGR :

%

USD

3.35 Billion

USD

21.31 Billion

2024

2032

USD

3.35 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 3.35 Billion | |

| USD 21.31 Billion | |

|

|

|

|

Articulated Robot Market Size

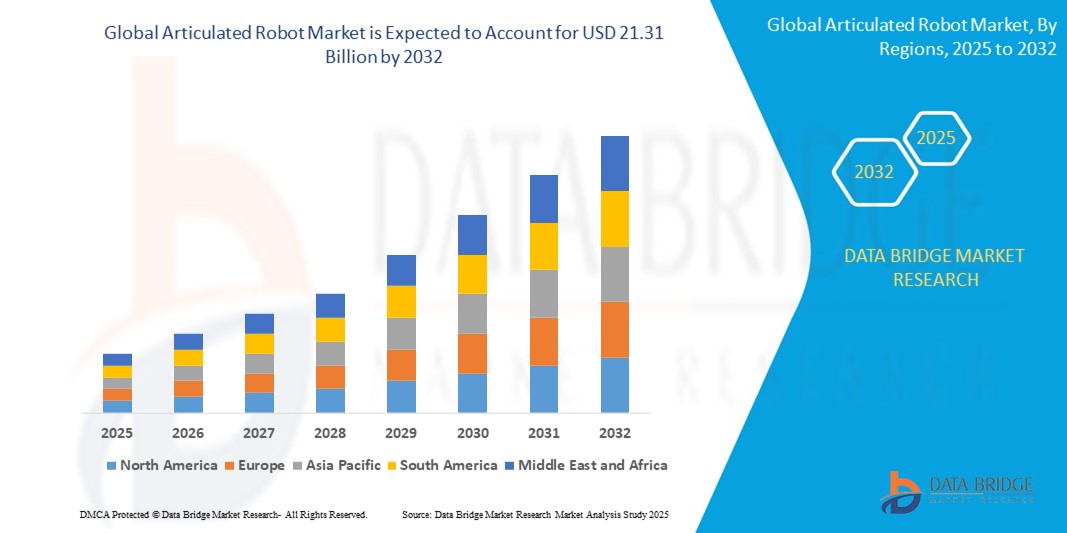

- The global articulated robot market size was valued at USD 3.35 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely fueled by increasing automation across various industries such as automotive, electronics, and manufacturing, driving demand for flexible and precise robotic solutions

- Furthermore, advancements in artificial intelligence and machine learning integrated into articulated robots are enhancing their capabilities, efficiency, and adaptability, thereby expanding their application scope. These converging factors are accelerating the adoption of articulated robots, significantly propelling the market growth globally

Articulated Robot Market Analysis

- Articulated robots, featuring rotary joints allowing a wide range of motion, are increasingly vital components in modern automation systems across automotive, electronics, and manufacturing industries due to their precision, flexibility, and ability to perform complex tasks

- The escalating demand for articulated robots is primarily fueled by growing industrial automation initiatives, labor cost reduction efforts, and the rising need for improved productivity and safety in manufacturing processes

- North America dominates the articulated robot market with the largest revenue share of approximately 35% in 2025, driven by early adoption of advanced manufacturing technologies, significant investment in Industry 4.0, and a strong presence of key robotics companies, particularly in the U.S. automotive and electronics sectors

- Asia-Pacific is expected to be the fastest-growing region in the articulated robot market during the forecast period due to rapid industrialization, expansion of automotive and electronics manufacturing hubs, and increasing government support for automation and robotics adoption

- The automotive segment is expected to dominate the articulated robot market with a market share of around 40% in 2025, driven by its extensive use in assembly lines, welding, painting, and material handling, as manufacturers seek higher precision and efficiency in production

Report Scope and Articulated Robot Market Segmentation

|

Attributes |

Articulated Robot Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

Articulated Robot Market Trends

“Enhanced Precision and Flexibility through AI and Collaborative Robotics”

- A significant and accelerating trend in the global articulated robot market is the integration of artificial intelligence (AI) and collaborative robot (cobot) technologies, enabling robots to perform complex, adaptive tasks alongside human workers safely and efficiently

- For instance, companies such as FANUC and Universal Robots are developing articulated robots equipped with AI-powered vision systems and advanced sensors, allowing them to recognize objects, adapt to changing environments, and optimize workflows in real time

- AI integration enables articulated robots to learn from operational data to improve task accuracy, predictive maintenance, and dynamic path planning. For example, some ABB articulated robots use AI algorithms to optimize welding patterns and detect defects during production, significantly reducing errors and downtime

- Collaborative robots enhance operational flexibility by safely working side-by-side with humans without the need for extensive safety barriers, enabling easier deployment in small and medium-sized enterprises and facilitating human-robot interaction in assembly, packaging, and inspection tasks

- This trend towards more intelligent, adaptable, and user-friendly articulated robots is reshaping manufacturing and industrial automation, with companies such as KUKA and Yaskawa offering AI-enabled robot models that include features such as voice command operation and seamless integration with factory IoT systems

- The demand for articulated robots with AI and collaborative capabilities is growing rapidly across automotive, electronics, and general manufacturing sectors, as industries increasingly prioritize operational efficiency, customization, and workforce safety

Articulated Robot Market Dynamics

Driver

“Rising Demand Driven by Industrial Automation and Labor Cost Reduction”

- The increasing adoption of industrial automation across manufacturing sectors, particularly in automotive, electronics, and consumer goods, is a major driver boosting the demand for articulated robots

- For instance, in early 2024, FANUC launched an AI-powered articulated robot line aimed at enhancing automation in automotive assembly plants, demonstrating the market’s shift towards smarter, more efficient robotic solutions. Such innovations by key industry players are expected to accelerate articulated robot market growth during the forecast period

- As companies strive to reduce labor costs and improve productivity, articulated robots offer precise, repeatable, and high-speed operations that enhance manufacturing efficiency while minimizing human error and workplace injuries

- Furthermore, increasing demand for customization and flexible manufacturing processes is driving the adoption of articulated robots capable of handling diverse tasks with ease.

- The integration of articulated robots into Industry 4.0 frameworks, allowing seamless communication with other smart factory devices and systems, also contributes to the rising market demand globally

Restraint/Challenge

“High Initial Investment and Complex Integration Requirements”

- The relatively high capital investment required for purchasing and deploying articulated robots, along with the costs of training personnel and maintaining robotic systems, remains a significant barrier for small and medium-sized enterprises (SMEs) looking to adopt automation technologies

- For instance, while large manufacturers benefit from economies of scale, SMEs often face challenges in justifying the upfront expenditure and navigating the complexities of robot integration into existing workflows

- In addition, integrating articulated robots into legacy manufacturing systems can be complex and time-consuming, requiring expert knowledge and specialized infrastructure, which may deter rapid adoption in certain sectors or regions.

- Concerns regarding workforce displacement and the need for reskilling employees also present social challenges that companies and policymakers must address to ensure sustainable growth.

- Overcoming these hurdles through innovations that reduce costs, improve user-friendly programming interfaces, and provide flexible leasing or robotic-as-a-service (RaaS) models will be critical to expanding articulated robot adoption worldwide

Articulated Robot Market Scope

The market is segmented on the basis of type, payload capacity, application, and end user.

• By Type

On the basis of type, the articulated robot market is segmented into 2-axis articulated robots, 3-axis articulated robots, 4-axis articulated robots, and multi-axis articulated robots. The multi-axis articulated robots segment dominates the largest market revenue share in 2025, driven by their enhanced flexibility, precision, and ability to perform complex tasks across various industrial applications. Manufacturers and end users often prioritize multi-axis robots for their adaptability and efficiency in automating sophisticated processes. The market also sees strong demand for multi-axis articulated robots due to their compatibility with advanced automation systems and their capacity to integrate with AI and vision technologies.

The 3-axis articulated robots segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in industries requiring moderately complex automation, such as electronics and food and beverage. Their relatively simpler design and lower cost compared to multi-axis robots make them attractive for small to medium enterprises seeking automation solutions

• By Payload Capacity

On the basis of payload capacity, the articulated robot market is segmented into low (<16 kg), medium (16–60 kg), and high (>60 kg). The medium payload capacity segment held the largest market revenue share in 2025, driven by its suitability for a wide range of applications, including material handling and assembly, where moderate lifting capacity is required without compromising speed and precision. Medium payload robots offer an optimal balance of performance and cost-efficiency, making them the preferred choice in manufacturing industries

The high payload capacity segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand in heavy industries such as automotive and aerospace, where handling large and heavy components is critical. High payload articulated robots are favored for their robustness and reliability in demanding production environments

• By Application

On the basis of application, the articulated robot market is segmented into material handling, palletizing and depalletizing, welding and soldering, assembly, packaging, and others. The material handling segment accounted for the largest market revenue share in 2024, driven by the growing need for efficient and safe movement of goods within manufacturing and logistics operations. Automation of material handling tasks helps reduce labor costs and improve throughput in warehouses and production lines

The welding and soldering segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the expanding use of robotic welding in automotive and metal fabrication industries, where precision and consistency are crucial for product quality and operational efficiency

• By End User

On the basis of end user, the articulated robot market is segmented into automotive, electronics, food and beverage, aerospace, pharmaceuticals, logistics and warehousing, and others. The automotive segment accounted for the largest market revenue share in 2024, driven by extensive deployment of articulated robots for assembly, welding, and painting in vehicle manufacturing plants worldwide. The industry’s emphasis on automation to boost productivity and maintain stringent quality standards propels demand

The electronics segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing automation in the production of consumer electronics, semiconductors, and other high-tech devices requiring delicate and precise handling

Articulated Robot Market Regional Analysis

- North America dominates the articulated robot market with the largest revenue share of approximately 35% in 2025, driven by rapid adoption of advanced manufacturing technologies and strong investment in automation across key industries such as automotive and electronics

- Manufacturers in the region highly value the precision, flexibility, and productivity improvements offered by articulated robots, alongside their seamless integration with Industry 4.0 technologies and smart factory systems

- This widespread adoption is further supported by high industrial automation spending, skilled workforce availability, and government initiatives promoting robotics innovation, establishing articulated robots as a preferred automation solution for both large enterprises and SMEs in North America

U.S. Articulated Robot Market Insight

The U.S. articulated robot market captured the largest revenue share of approximately 38% within North America in 2025, fueled by widespread adoption of automation technologies in automotive, electronics, and aerospace industries. Manufacturers are increasingly prioritizing robotic solutions that enhance production efficiency, precision, and flexibility. The growing trend of smart factories and Industry 4.0 integration, combined with strong R&D investments and supportive government policies, further propels the articulated robot market. Moreover, increasing demand for robots capable of complex tasks such as welding, assembly, and material handling is significantly contributing to the market's expansion

Europe Articulated Robot Market Insight

The European articulated robot market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing industrial automation initiatives and stringent manufacturing quality standards. Growing urbanization and the demand for automation across automotive, pharmaceutical, and food and beverage sectors are fostering articulated robot adoption. European manufacturers are focusing on energy-efficient and flexible robotic systems, boosting demand across both new production setups and upgrades of existing facilities.

U.K. Articulated Robot Market Insight

The U.K. articulated robot market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising automation investments in manufacturing and logistics sectors. Increasing concerns about labor shortages and the need for enhanced operational efficiency are encouraging businesses to adopt articulated robots. The U.K.’s strong technology infrastructure and growing interest in smart manufacturing are expected to continue fueling market growth

Germany Articulated Robot Market Insight

The German articulated robot market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s robust automotive and machinery manufacturing industries. Germany’s emphasis on Industry 4.0, innovation, and sustainability promotes the adoption of advanced robotic solutions that improve productivity while minimizing environmental impact. Integration of articulated robots with AI and machine vision systems is becoming increasingly prevalent to meet rising demand for high precision and flexible manufacturing

Asia-Pacific Articulated Robot Market Insight

The Asia-Pacific articulated robot market is poised to grow at the fastest CAGR of over 22% in 2025, driven by rapid industrialization, increasing automation adoption, and government initiatives in countries such as China, Japan, South Korea, and India. The region's growing manufacturing base, coupled with rising labor costs and technological advancements, is accelerating articulated robot deployment. Furthermore, Asia-Pacific is emerging as a major manufacturing hub for robotics components, which is improving affordability and accessibility for end users

Japan Articulated Robot Market Insight

The Japan articulated robot market is gaining momentum due to the country’s strong robotics heritage, advanced manufacturing sector, and demand for high-precision automation. Japan places significant emphasis on developing and deploying articulated robots in automotive assembly, electronics manufacturing, and healthcare. Integration of robots with IoT and AI technologies is fueling growth, alongside the need to address labor shortages in an aging population

China Articulated Robot Market Insight

The China articulated robot market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding manufacturing industry, rapid urbanization, and government support for smart factory initiatives. China is one of the largest consumers and producers of industrial robots globally, with articulated robots being increasingly adopted in automotive, electronics, and consumer goods sectors. The drive toward automation, cost-effective robotic solutions, and domestic robotics manufacturing capabilities are key factors propelling the market in China

Articulated Robot Market Share

The articulated robot industry is primarily led by well-established companies, including:

- KUKA AG (Germany)

- ABB Ltd. (Switzerland)

- Yaskawa Electric Corporation (Japan)

- FANUC Corporation (Japan)

- Siemens AG (Germany)

- Parker Hannifin Corporation (U.S.)

- Thomson Industries, Inc. (U.S.)

- Schneider Electric SE (France)

- Zollern GmbH & Co. KG (Germany)

- IAI Industrial Robots (Japan)

- Festo AG & Co. KG (Germany)

- Bosch Rexroth AG (Germany)

- Bürobotec GmbH (Germany)

Latest Developments in Global Articulated Robot Market

- In August 2024, Mitsubishi Electric Corporation launched its RV-35/50/80FR robot series, designed to handle heavier payloads and offer an extended reach compared to previous models. With a maximum reach of 2100mm and a payload capacity of up to 80kg, these robots enhance automation capabilities for industries requiring palletizing and machine tending. The series integrates seamlessly with Mitsubishi Electric’s factory automation systems and features advanced safety functions, including position and speed monitoring

- In May 2024, Fanuc Corporation introduced the CRX-10iA/L Paint, the world’s first global explosion-proof collaborative paint robot. Designed for industrial painting, coating, and powder applications, this cobot meets stringent explosion-proof safety standards across multiple regions, including ATEX and IECEx compliance for hazardous zones. With a payload capacity of 10 kg and an extended reach of 1,418 mm, it enables precise painting of large workpieces while maintaining operator safety. The CRX-10iA/L Paint features intuitive programming, allowing users to easily teach motion paths for efficient automation

- In May 2024, Fanuc Corporation introduced the CRX-10iA/L Paint, the world’s first global explosion-proof collaborative paint robot. Designed for industrial painting, coating, and powder applications, this cobot meets stringent explosion-proof safety standards across multiple regions, including ATEX and IECEx compliance for hazardous zones. With a payload capacity of 10 kg and an extended reach of 1,418 mm, it enables precise painting of large workpieces while maintaining operator safety. The CRX-10iA/L Paint features intuitive programming, allowing users to easily teach motion paths for efficient automation

- In March 2024, ABB introduced its latest articulated robot series, designed to enhance energy efficiency and lower operational costs in automotive production lines. These robots integrate advanced automation and precision control, optimizing manufacturing processes while reducing waste and energy consumption. ABB’s innovations aim to support sustainable production and improve assembly speed in automotive manufacturing

- In January 2024, KUKA AG introduced the KR FORTEC industrial robot, designed for flexible manufacturing systems with AI-driven optimization. This robot features high dynamic performance, enabling efficient material handling and spot welding while maintaining low energy consumption. With an extended arm reaching up to 3700mm and a payload capacity of 240kg, the KR FORTEC enhances automation in diverse industrial applications. Its modular design ensures cost-effective maintenance and adaptability to harsh environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Articulated Robot Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Articulated Robot Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Articulated Robot Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.