Global Arthroscopy Instruments Market

Market Size in USD Billion

CAGR :

%

USD

6.11 Billion

USD

9.97 Billion

2024

2032

USD

6.11 Billion

USD

9.97 Billion

2024

2032

| 2025 –2032 | |

| USD 6.11 Billion | |

| USD 9.97 Billion | |

|

|

|

|

Arthroscopy Instruments Market Size

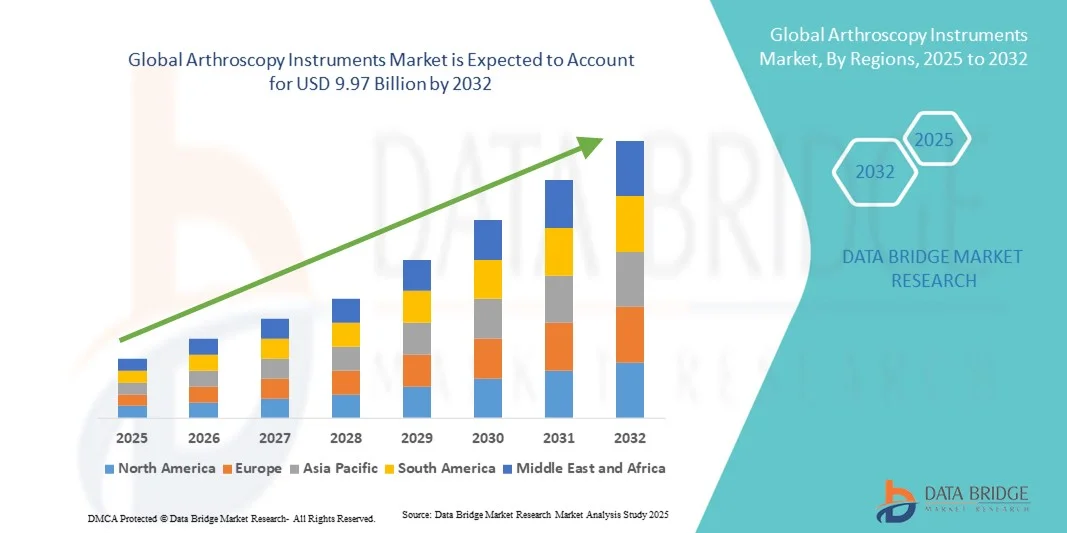

- The global arthroscopy instruments market size was valued at USD 6.11 billion in 2024 and is expected to reach USD 9.97 billion by 2032, at a CAGR of 6.3% during the forecast period

- The market growth is primarily driven by the rising prevalence of musculoskeletal disorders, increasing adoption of minimally invasive surgical procedures, and continuous technological advancements in arthroscopic equipment

- Moreover, growing demand for improved surgical outcomes, reduced recovery times, and enhanced patient safety is positioning arthroscopy instruments as essential tools in orthopedic surgeries, thereby accelerating the adoption of these solutions and fueling market expansion

Arthroscopy Instruments Market Analysis

- Arthroscopy instruments, including arthroscopes, power shaver systems, fluid management systems, and visualization tools, are becoming essential components of minimally invasive orthopedic surgeries in both hospitals and ambulatory surgical centers due to their precision, reduced recovery time, and improved patient outcomes

- The rising demand for arthroscopic procedures is primarily driven by the increasing prevalence of joint injuries, degenerative conditions such as osteoarthritis, and growing awareness of minimally invasive surgical benefits among patients and healthcare providers

- North America dominated the arthroscopy instruments market with the largest revenue share of 39.6% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative surgical technologies, and a strong presence of leading orthopedic device manufacturers, with the U.S. witnessing substantial growth in knee and shoulder arthroscopy procedures supported by continuous product innovations and training programs

- Asia-Pacific is expected to be the fastest-growing region in the arthroscopy instruments market during the forecast period due to rising healthcare expenditure, growing medical tourism, and increasing patient awareness of minimally invasive orthopedic solutions

- Knee arthroscopy segment dominated the arthroscopy instruments market with a market share of 43% in 2024, owing to the high incidence of knee injuries, growing demand for minimally invasive procedures, and advancements in arthroscopic implants and visualization systems facilitating precise joint repair

Report Scope and Arthroscopy Instruments Market Segmentation

|

Attributes |

Arthroscopy Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Arthroscopy Instruments Market Trends

Minimally Invasive Surgical Advancements and Smart Visualization

- A significant and accelerating trend in the global arthroscopy instruments market is the integration of high-definition imaging systems and smart visualization tools, enhancing precision and surgical outcomes in minimally invasive procedures

- For instance, arthroscopes equipped with 4K imaging and augmented reality overlays allow surgeons to clearly visualize joint structures, improving accuracy and reducing operation time

- Advanced instrument designs, including motorized shavers and fluid management systems, are enabling more efficient tissue removal and better joint access during surgery, reducing patient recovery periods

- The incorporation of smart sensors in arthroscopy tools facilitates real-time feedback on instrument positioning and tissue interaction, aiding surgeons in complex procedures with higher safety and efficiency

- This trend towards smarter, more intuitive, and connected surgical instruments is redefining expectations for arthroscopic procedures. Consequently, companies such as Stryker and Arthrex are developing AI-assisted arthroscopy tools that improve precision, workflow, and postoperative outcomes

- The demand for arthroscopy instruments with enhanced imaging, ergonomics, and integration with digital surgical platforms is growing rapidly across hospitals and ambulatory surgical centers, as surgeons increasingly prioritize procedure efficiency and patient safety

Arthroscopy Instruments Market Dynamics

Driver

Increasing Prevalence of Musculoskeletal Disorders and Minimally Invasive Surgery Adoption

- The rising incidence of joint injuries, osteoarthritis, and sports-related trauma, coupled with growing preference for minimally invasive surgeries, is a key driver for the heightened demand for arthroscopy instruments

- For instance, in March 2024, Arthrex announced an expansion of its joint repair portfolio, integrating advanced arthroscopic systems to improve surgical precision and patient recovery times

- As awareness of the benefits of arthroscopic procedures grows among patients and healthcare providers, instruments offering less invasive treatment options and faster rehabilitation are increasingly sought after

- Furthermore, increasing healthcare infrastructure investments and government support for advanced surgical procedures are making arthroscopy instruments more accessible and essential in orthopedic practices

- The convenience of reduced hospital stays, lower complication rates, and improved functional outcomes is propelling the adoption of advanced arthroscopy instruments in both developed and emerging markets

- Rising investments in research and development for next-generation arthroscopy technologies are encouraging innovation in ergonomic designs, sensor integration, and AI-assisted tools

- Expansion of medical tourism, particularly in Asia-Pacific, is driving demand for high-quality arthroscopic procedures, indirectly boosting the market for advanced instruments

Restraint/Challenge

High Cost and Technical Skill Requirement

- The high cost of advanced arthroscopy instruments, coupled with the need for specialized training, poses a significant challenge to widespread adoption, particularly in developing regions

- For instance, hospitals in lower-income regions may struggle to acquire 4K imaging arthroscopes or motorized shaver systems due to budget constraints, limiting patient access to minimally invasive procedures

- Addressing these challenges through training programs, affordable instrument variants, and leasing models is crucial for broader market penetration and surgeon proficiency

- In addition, complex instrument handling and maintenance requirements may hinder adoption among smaller clinics or less experienced surgeons, requiring continuous skill development initiatives

- While demand is rising, overcoming cost and technical barriers through strategic partnerships, modular instrument designs, and surgeon education will be vital for sustained market growth

- Regulatory hurdles and lengthy approval processes for new arthroscopy instruments can delay market entry, impacting adoption rates and innovation speed

- Limited awareness and hesitation among some healthcare providers regarding advanced arthroscopy techniques may restrict adoption, emphasizing the need for continuous professional education and awareness campaigns

Arthroscopy Instruments Market Scope

The market is segmented on the basis of product type, application, and end users.

- By Product Type

On the basis of product type, the arthroscopy instruments market is segmented into arthroscopes, arthroscopic implants, fluid management systems, radiofrequency systems, visualization systems, power shaver systems, and others. The arthroscopes segment dominated the market with the largest market revenue share of 35.8% in 2024, driven by their essential role in minimally invasive orthopedic procedures. Arthroscopes are fundamental tools for surgeons, providing high-definition visualization of joints and enabling precise diagnosis and treatment. Hospitals and ambulatory surgical centers prefer advanced arthroscopes due to their reliability, durability, and compatibility with other arthroscopic instruments. Their widespread adoption is also fueled by ongoing technological innovations such as 4K imaging, integrated lighting, and digital recording capabilities. Surgeons favor arthroscopes for their ergonomic designs and reduced operation time, improving patient outcomes. The increasing number of orthopedic surgeries globally, particularly knee and shoulder procedures, has further cemented the segment’s dominance.

The power shaver systems segment is expected to witness the fastest growth at a CAGR of 20.3% from 2025 to 2032, fueled by their ability to improve surgical efficiency and precision. These systems facilitate rapid tissue removal and joint debridement, reducing procedure time and enhancing patient recovery. Hospitals and high-volume surgical centers are increasingly adopting motorized shavers for complex procedures, and innovations such as variable speed control and ergonomic handpieces are driving demand. Power shaver systems are also being integrated with visualization tools and robotic-assisted platforms, further enhancing their appeal. The rise of sports injuries and arthroscopic surgeries in emerging regions is supporting rapid growth in this segment.

- By Application

On the basis of application, the arthroscopy instruments market is segmented into knee arthroscopy, hip arthroscopy, spine arthroscopy, foot and ankle arthroscopy, shoulder and elbow arthroscopy, and others. The knee arthroscopy segment dominated the market with a market share of 43% in 2024, driven by the high prevalence of knee injuries and degenerative joint disorders worldwide. Knee arthroscopy is a widely performed procedure for conditions such as meniscus tears, ligament reconstruction, and cartilage repair, making instruments for this application highly essential. Hospitals and orthopedic centers prioritize advanced arthroscopy tools for knee procedures due to improved outcomes, reduced recovery times, and minimized post-operative complications. The segment’s dominance is further supported by increasing sports-related injuries and rising geriatric population requiring knee repair procedures. Technological advancements in knee arthroscopy instruments, including enhanced visualization and ergonomic designs, are also boosting adoption.

The hip arthroscopy segment is expected to witness the fastest growth at a CAGR of 19.8% from 2025 to 2032, attributed to increasing awareness of minimally invasive hip surgeries and growing patient preference for faster recovery. Hip arthroscopy is gaining popularity for treating labral tears, femoroacetabular impingement, and early osteoarthritis. Surgeons are adopting advanced instruments designed for hip joint access, visualization, and precise tissue repair, driving market expansion. Rising sports injuries and obesity-related hip problems are also contributing to the rapid growth of this segment, especially in North America and Asia-Pacific.

- By End Users

On the basis of end users, the arthroscopy instruments market is segmented into hospitals, ambulatory surgery centers, clinics, and others. The hospitals segment dominated the market with a share of 52.4% in 2024, driven by the presence of advanced surgical infrastructure, high patient volumes, and skilled orthopedic surgeons. Hospitals are the primary adopters of comprehensive arthroscopy systems due to their capability to handle complex and high-volume procedures. They invest heavily in state-of-the-art instruments to improve surgical precision, minimize complications, and ensure faster patient recovery. In addition, hospitals often lead in adopting new technologies such as 4K imaging, AI-assisted visualization, and robotic integration. The segment benefits from strong government support and insurance coverage that encourages elective arthroscopic procedures.

The ambulatory surgery centers segment is expected to witness the fastest growth at a CAGR of 18.6% from 2025 to 2032, fueled by the rising preference for outpatient surgeries, lower costs, and shorter hospital stays. Ambulatory centers are increasingly equipped with advanced arthroscopy instruments to perform minimally invasive procedures efficiently. The growing trend of same-day discharge surgeries and patient demand for convenience is driving rapid adoption in this segment. Technological advancements that allow compact and portable instruments further support the expansion of ambulatory surgery centers as key end users.

Arthroscopy Instruments Market Regional Analysis

- North America dominated the arthroscopy instruments market with the largest revenue share of 39.6% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative surgical technologies, and a strong presence of leading orthopedic device manufacturers

- Hospitals and ambulatory surgical centers in the region prioritize arthroscopy instruments for their precision, reliability, and compatibility with advanced visualization systems, enabling improved surgical outcomes and faster patient recovery

- This widespread adoption is further supported by continuous technological innovations, skilled orthopedic surgeons, and high healthcare expenditure, establishing arthroscopy instruments as essential tools in both routine and complex orthopedic procedures

U.S. Arthroscopy Instruments Market Insight

The U.S. arthroscopy instruments market captured the largest revenue share of 79% in 2024 within North America, fueled by the high prevalence of musculoskeletal disorders and the widespread adoption of minimally invasive orthopedic procedures. Hospitals and ambulatory surgical centers increasingly prioritize advanced arthroscopy systems for knee, shoulder, and hip surgeries due to their precision and improved patient outcomes. The growing trend of outpatient procedures, combined with investments in state-of-the-art surgical facilities and robotic-assisted technologies, further propels market growth. Moreover, continuous innovations in imaging, power shaver systems, and smart visualization tools are significantly contributing to the expansion of the U.S. market.

Europe Arthroscopy Instruments Market Insight

The Europe arthroscopy instruments market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising incidence of joint injuries and the growing preference for minimally invasive surgeries. Increasing healthcare expenditure and government support for advanced surgical technologies are fostering adoption across hospitals and specialty orthopedic centers. European orthopedic surgeons are also increasingly leveraging advanced arthroscopy instruments for both primary and revision procedures. The region is witnessing notable growth across knee, hip, and shoulder arthroscopies, with instruments being incorporated into both new hospital setups and surgical center upgrades.

U.K. Arthroscopy Instruments Market Insight

The U.K. arthroscopy instruments market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for outpatient procedures, improved surgical outcomes, and reduced patient recovery times. In addition, rising sports injuries and orthopedic disorders are encouraging hospitals and clinics to adopt advanced arthroscopy systems. The U.K.’s well-established healthcare infrastructure, alongside its robust training programs for orthopedic surgeons, is expected to continue supporting market growth. Integration of high-definition imaging and ergonomic arthroscopy instruments is enhancing procedural efficiency and safety, further driving adoption.

Germany Arthroscopy Instruments Market Insight

The Germany arthroscopy instruments market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, high adoption of minimally invasive orthopedic procedures, and government initiatives promoting surgical innovation. Germany’s emphasis on precision healthcare and patient safety promotes the use of high-quality arthroscopy instruments, particularly in hospitals and specialty surgical centers. Integration of arthroscopy systems with digital visualization tools and robotic-assisted platforms is also becoming increasingly prevalent. Surgeons are increasingly adopting ergonomic, high-definition instruments for knee, hip, and shoulder procedures to improve clinical outcomes and reduce rehabilitation time.

Asia-Pacific Arthroscopy Instruments Market Insight

The Asia-Pacific arthroscopy instruments market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, driven by increasing healthcare expenditure, rising prevalence of sports injuries, and growing awareness of minimally invasive orthopedic procedures in countries such as China, Japan, and India. The region's expanding network of hospitals and ambulatory surgical centers, supported by government initiatives for healthcare modernization, is driving adoption. Furthermore, as APAC emerges as a hub for medical device manufacturing and cost-effective solutions, advanced arthroscopy instruments are becoming more accessible to a wider patient base.

Japan Arthroscopy Instruments Market Insight

The Japan arthroscopy instruments market is gaining momentum due to the country’s advanced healthcare system, aging population, and high patient awareness of minimally invasive surgical options. Japanese hospitals and surgical centers are increasingly adopting arthroscopy instruments integrated with high-definition visualization and AI-assisted systems. The demand is driven by both knee and shoulder procedures, with focus on reducing rehabilitation times and improving patient outcomes. Furthermore, Japan’s strong emphasis on precision surgery and technological innovation is fueling adoption in both residential and specialized orthopedic care facilities.

India Arthroscopy Instruments Market Insight

The India arthroscopy instruments market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s growing middle class, rising sports injuries, and increasing healthcare infrastructure. India is rapidly becoming a key market for minimally invasive orthopedic procedures, with hospitals and ambulatory surgical centers adopting advanced arthroscopy instruments for knee, hip, and shoulder surgeries. Government initiatives promoting medical tourism, along with the availability of affordable and locally manufactured arthroscopy tools, are key factors propelling market growth. The increasing awareness among orthopedic surgeons and patients regarding faster recovery and reduced post-operative complications further supports adoption.

Arthroscopy Instruments Market Share

The Arthroscopy Instruments industry is primarily led by well-established companies, including:

- Arthrex, Inc. (U.S.)

- Stryker (U.S.)

- Smith & Nephew (U.K.)

- CONMED Corporation (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Olympus Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- Richard Wolf GmbH (Germany)

- Biomet 3i, LLC (U.S.)

- Surgical Innovations Group plc (U.K.)

- XLO Surgical (India)

- Medi-Globe GmbH and ENDO-FLEX GmbH. (Germany)

- Auxein (India)

- MJS Surgical (India)

- Surgical Technologies Inc. (U.S.)

- Biovision (Germany)

- EndoClot Plus, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

What are the Recent Developments in Global Arthroscopy Instruments Market?

- In June 2025, Arthrex introduced the Synergy Power™ System, a comprehensive powered instrument system offering a selection of attachments and blades. This system is designed to facilitate various orthopedic procedures, including sports, arthroplasty, trauma, and distal extremities surgeries, aiming to improve surgical efficiency and versatility

- In January 2025, At Arab Health, Auxein Medical launched 'Asterius,' a revolutionary arthroscopy range featuring a 4K arthroscope and ultra HD camera. This advanced imaging system is designed to enhance surgical precision and visualization during arthroscopic procedures, contributing to improved patient outcomes

- In November 2024, At MEDICA 2024, Auxein Medical unveiled a range of innovative orthopedic and arthroscopy products, including AV-Wiselock Plates, Osteochondral Transfer System, and Bioabsorbable Interference Screws. These products are designed to enhance surgical outcomes in joint repair and reconstruction procedure

- In June 2024, ConMed Corporation launched the Hall Linvatec PowerPro Max Arthroscopic Shaver System. This system offers improved torque control and enhanced debris management, aimed at providing orthopedic surgeons with advanced tools for efficient tissue resection during arthroscopic procedures

- In January 2024, Arthrex introduced single-use, sterile-packed Nano arthroscopy instrumentation, featuring 2 mm-diameter instruments designed for atraumatic insertion through tight joint spaces. These instruments are engineered for diagnostic, resection, and extraction procedures, enhancing surgical precision in confined anatomical areas

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.