Global Aromatic Solvents Market

Market Size in USD Billion

CAGR :

%

USD

8.60 Billion

USD

11.26 Billion

2024

2032

USD

8.60 Billion

USD

11.26 Billion

2024

2032

| 2025 –2032 | |

| USD 8.60 Billion | |

| USD 11.26 Billion | |

|

|

|

|

What is the Global Aromatic Solvents Market Size and Growth Rate?

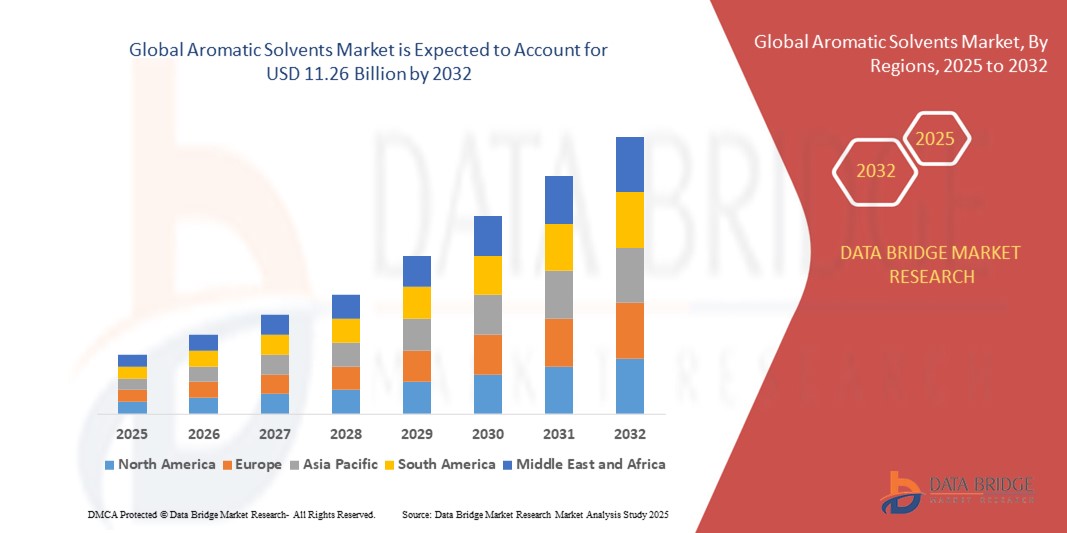

- The global aromatic solvents market size was valued at USD 8.60 billion in 2024 and is expected to reach USD 11.26 billion by 2032, at a CAGR of 3.42% during the forecast period

- The increase in demand for these solvents from the paint and coating industries due to their high solvency property, as well as their growing popularity, are the primary drivers driving the aromatic solvents market. These solvents dissolve or disperse a wide range of components to produce high-quality pigments, extenders, additives, and binders, increasing their demand

- The introduction of severe regulatory rules promoting the investigation of substitutes owing to concerns about the emission of volatile organic compounds (VOCs) and the trend towards non-aromatic solvents, on the other hand, are factors projected to hinder the aromatic solvents market

What are the Major Takeaways of Aromatic Solvents Market?

- The chemical industry relies heavily on various solvents, including aromatic solvents, for a wide range of applications, including synthesis, formulation, extraction, and as reaction media. The global chemical industry is experiencing steady growth, driven by factors such as population expansion, urbanization, and industrialization

- As chemical production rises, the demand for solvents, including aromatic solvents, also increases. Many chemical products are solvent-based, and aromatic solvents play a crucial role in their formulation. These products include printing inks, varnishes, and specialty chemicals used in diverse applications

- The growth in the chemical industry is a key driver for the aromatic solvents market due to the versatile and essential role these solvents play in various chemical processes. As chemical production expands to meet the demands of multiple sectors, the demand for aromatic solvents continues to rise, making them a fundamental component of the global chemical industry supply chain

- Asia-Pacific dominated the Aromatic Solvents market with the largest revenue share of 43.87% in 2024, driven by rapid industrialization, expanding chemical manufacturing, and increased adoption of solvents across end-use industries such as paints, coatings, and pharmaceuticals

- North America Aromatic Solvents market is poised to grow at the fastest CAGR of 10.26% during the forecast period of 2025 to 2032, fueled by rising demand for high-performance solvents in industrial manufacturing, paints and coatings, and pharmaceuticals

- The toluene segment dominated the market with a revenue share of 38.5% in 2024, driven by its widespread use as a solvent in paints, coatings, adhesives, and chemical intermediates

Report Scope and Aromatic Solvents Market Segmentation

|

Attributes |

Aromatic Solvents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aromatic Solvents Market?

Rising Demand for Eco-Friendly and Sustainable Solvents

- A significant trend in the global aromatic solvents market is the increasing shift towards eco-friendly and sustainable solvent formulations. Manufacturers are focusing on reducing VOC emissions, using bio-based feedstocks, and developing greener production processes, meeting both regulatory requirements and consumer demand for environmentally responsible products

- For instance, companies such as Shell and ExxonMobil have introduced low-VOC aromatic solvents suitable for industrial coatings and paints, minimizing environmental impact while maintaining performance standards

- The adoption of sustainable solvents is further driven by regulatory initiatives such as REACH in Europe and EPA guidelines in the U.S., which encourage the replacement of traditional aromatic hydrocarbons with safer alternatives

- This trend is reshaping the market, compelling manufacturers to innovate and offer products that align with sustainability goals without compromising performance, durability, or cost-efficiency

- As industries including coatings, paints, adhesives, and printing increasingly prioritize green chemistry, demand for eco-friendly aromatic solvents is expected to rise steadily across regions

- Companies such as BASF and PPG Industries are expanding their portfolios with bio-based and low-toxicity solvents, reflecting the market’s transition toward sustainability and regulatory compliance

What are the Key Drivers of Aromatic Solvents Market?

- The rising demand for high-performance solvents across industries such as coatings, adhesives, automotive, and pharmaceuticals is a primary driver for the Aromatic Solvents market

- For instance, in March 2024, BASF launched a new line of specialty aromatic solvents designed for high-performance coatings, addressing both environmental regulations and industrial efficiency. Such product launches are expected to boost market growth

- Regulatory pressures limiting VOC emissions, coupled with growing consumer and industrial awareness about environmental sustainability, are encouraging the adoption of bio-based and low-toxicity aromatic solvents

- Increasing industrialization in emerging economies, particularly in Asia-Pacific, is driving demand for aromatic solvents in paints, adhesives, and automotive applications.

- The versatility of aromatic solvents, including their ability to dissolve a wide range of materials and improve product stability and performance, further supports market expansion

- Growing trends toward energy-efficient and eco-conscious formulations are propelling R&D investments and new product developments in the aromatic solvents industry globally

Which Factor is Challenging the Growth of the Aromatic Solvents Market?

- The stringent environmental regulations governing VOC emissions, solvent disposal, and workplace safety pose challenges for market expansion, especially in North America and Europe

- For instance, non-compliance with REACH, EPA, or OSHA standards can lead to fines, product recalls, or production halts, increasing operational costs for solvent manufacturers

- The fluctuating prices of crude oil and raw materials also create cost pressure, impacting profitability and making it difficult for smaller players to compete with established multinational companies

- In addition, growing demand for water-based and non-aromatic solvent alternatives may reduce the market share of traditional aromatic solvents over time.

- While manufacturers are developing greener alternatives, transitioning production and reformulating products require substantial capital and time, slowing adoption

- Overcoming these challenges will depend on continued innovation, regulatory alignment, and consumer education on the benefits of aromatic solvents in industrial and specialty applications

How is the Aromatic Solvents Market Segmented?

The market is segmented on the basis of product, application, and end-users.

- By Product

On the basis of product, the aromatic solvents market is segmented into benzene, toluene, xylene, and solvent naphtha. The toluene segment dominated the market with a revenue share of 38.5% in 2024, driven by its widespread use as a solvent in paints, coatings, adhesives, and chemical intermediates. Toluene’s efficiency in dissolving various resins and its ability to enhance product performance makes it a preferred choice across multiple industries.

The xylene segment is expected to witness the fastest CAGR of 19.2% from 2025 to 2032, fueled by growing demand in the printing inks, automotive coatings, and electronics sectors. Xylene’s high solvency, low toxicity compared to other aromatics, and effectiveness in industrial applications are key factors contributing to its accelerating adoption globally. Increasing industrialization in emerging economies is expected to further support this segment’s growth.

- By Application

On the basis of application, the aromatic solvents market is segmented into paints and coatings, adhesives, printing inks, cleaning and degreasing, and others. The paints and coatings segment held the largest market revenue share of 42.1% in 2024, driven by the increasing construction activities, automotive refinishing, and demand for high-performance industrial coatings. Aromatic solvents in this segment improve drying times, adhesion, and finish quality, making them indispensable in both industrial and decorative coatings.

The printing inks segment is anticipated to witness the fastest CAGR of 18.5% from 2025 to 2032, fueled by growth in packaging, commercial printing, and flexible media. Rising demand for high-quality, fast-drying, and environmentally compliant inks is encouraging manufacturers to adopt aromatic solvents with low VOC content and high solvency efficiency, ensuring superior print quality and regulatory compliance.

- By End-Users

On the basis of end-users, the aromatic solvents market is segmented into pharmaceuticals, oilfield chemicals, automotive, paints and coatings, pesticides, textiles, cleaners, chemical intermediates, electronics, adhesives and sealants, perfumes, and cosmetics. The paints and coatings end-user segment dominated the market with a 36.7% revenue share in 2024, driven by high industrial and construction sector consumption and the need for durable, high-performance coatings.

The automotive segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, fueled by rising vehicle production and the demand for specialty coatings, adhesives, and cleaning solutions in automotive manufacturing. Growth in emerging markets, combined with the adoption of eco-friendly solvents in automotive applications, is expected to further propel the use of aromatic solvents across this end-user segment globally.

Which Region Holds the Largest Share of the Aromatic Solvents Market?

- Asia-Pacific dominated the aromatic solvents market with the largest revenue share of 43.87% in 2024, driven by rapid industrialization, expanding chemical manufacturing, and increased adoption of solvents across end-use industries such as paints, coatings, and pharmaceuticals

- Countries in the region, including China, Japan, and India, are witnessing growing demand due to urbanization, rising disposable incomes, and technological advancements in chemical processing and manufacturing

- This widespread adoption is further supported by a robust manufacturing ecosystem, availability of raw materials, and cost-effective production, establishing Aromatic Solvents as a preferred choice for industrial, commercial, and consumer applications

China Aromatic Solvents Market Insight

The China aromatic solvents market captured the largest revenue share of 42% in 2024 within APAC, fueled by strong domestic chemical production, the expanding middle class, and high industrial consumption. Growth is driven by rising applications in paints, coatings, adhesives, and electronics manufacturing. Government initiatives supporting chemical manufacturing and export-oriented industries further boost market adoption. China’s extensive industrial base ensures steady demand for cost-effective and high-performance aromatic solvents across multiple sectors, making it a dominant contributor to the APAC Aromatic Solvents market.

Japan Aromatic Solvents Market Insight

The Japan aromatic solvents market is gaining momentum due to advanced manufacturing technologies, a strong industrial base, and high-quality standards in chemical processing. Adoption is driven by the demand for specialty solvents in electronics, automotive, and pharmaceutical sectors. Japanese manufacturers prioritize environmentally friendly solvents with low VOC content, enhancing market acceptance. In addition, integration of aromatic solvents in high-tech coatings and precision chemical applications is fueling growth. Japan’s focus on innovation and stringent quality requirements makes it a critical market within the APAC region.

India Aromatic Solvents Market Insight

The India aromatic solvents market is experiencing robust growth due to rapid urbanization, increased industrial activity, and expanding end-use industries such as paints, adhesives, and pharmaceuticals. Rising export opportunities and government incentives for chemical manufacturing further stimulate demand. The country’s large workforce and cost-effective production capacity position India as a key contributor to the APAC Aromatic Solvents market. In addition, growing domestic consumption in construction, automotive, and consumer goods sectors is driving adoption across industrial and commercial applications.

Which Region is the Fastest Growing Region in the Aromatic Solvents Market?

North America aromatic solvents market is poised to grow at the fastest CAGR of 10.26% during the forecast period of 2025 to 2032, fueled by rising demand for high-performance solvents in industrial manufacturing, paints and coatings, and pharmaceuticals. Increasing awareness regarding quality standards, sustainability, and solvent efficiency is driving adoption. The presence of advanced chemical manufacturers and ongoing innovations in environmentally compliant solvents further support growth. North America’s expanding industrial base, coupled with the demand for specialty applications, ensures rapid market expansion.

U.S. Aromatic Solvents Market Insight

The U.S. aromatic solvents market captured the largest revenue share of 81% in North America in 2024, driven by growth in automotive coatings, printing inks, and industrial chemical sectors. Adoption is supported by increasing demand for high-purity solvents, regulatory compliance, and technological innovations in solvent formulations. The country’s focus on environmentally friendly and low-VOC solvents enhances market potential. Rising industrial automation, smart manufacturing processes, and the presence of major chemical manufacturers contribute to the steady expansion of the Aromatic Solvents market in the U.S., positioning it as a key growth engine for the North American region.

Which are the Top Companies in Aromatic Solvents Market?

The aromatic solvents industry is primarily led by well-established companies, including:

- China Petrochemical Corporation (China)

- Exxon Mobil Corporation (U.S.)

- SK Global Chemical Co., Ltd. (South Korea)

- Shell (Netherlands)

- BASF SE (Germany)

- LyondellBasell (U.S.)

- China National Petroleum Corporation (China)

- Reliance Industries Limited (India)

- TotalEnergies (France)

- CPC Corporation (Taiwan)

- Bharat Petroleum Corporation Limited (India)

- Chevron Phillips Chemical Company LLC (U.S.)

- Formosa Plastics Group (Taiwan)

- HCS Group (Germany)

- Indian Oil Corporation Ltd (India)

- Pon Pure Chemicals Group (India)

- Recochem Corporation (Canada)

- TOP SOLVENT CO., LTD (Japan)

- WM Barr & Co., Inc. (U.S.)

What are the Recent Developments in Global Aromatic Solvents Market?

- In January 2023, Clariter and TotalEnergies Fluids, a division of TotalEnergies, launched the world’s first sustainable ultra-pure solvent, produced from recycled plastic waste for use in pharmaceuticals, cosmetics, and other high-demand applications. The solvent meets stringent pharmacopoeia-standard purity criteria, being safe, colorless, odorless, and tasteless. By utilizing plastic waste as feedstock, the environmental impact is significantly reduced, while contributing to the mitigation of end-of-life plastic pollution, marking a major advancement in sustainable solvent production

- In April 2022, Solvay developed Rhodiasolv IRIS, a next-generation solvent with strong eco-friendly properties, previously manufactured in China but now produced at Solvay’s Melle, France site starting in 2023. This development ensures localized, environmentally conscious production while maintaining high-quality standards, supporting the company’s sustainability and innovation goals in solvent manufacturing

- In February 2021, Hengyi Industries, in collaboration with Honeywell International Inc., advanced aromatics production at the petrochemical complex in Pulau Muara Besar, Brunei, utilizing Honeywell UOP technology. The facility can process approximately 200,000 barrels per day, addressing the rising demand for paraxylene in Asia and driving significant investment in innovative petrochemical technologies, boosting regional production capabilities and efficiency

- In January 2021, Ineos Group Ltd. acquired BP plc’s global aromatics & acetyls division for USD 5 billion, strengthening Ineos’s global position and expanding its international reach in the petrochemical sector. This acquisition enhances the company’s capabilities, broadens its product portfolio, and reinforces its competitive advantage in global aromatics and acetyls markets, marking a significant strategic milestone

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aromatic Solvents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aromatic Solvents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aromatic Solvents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.