Global Argon Gas Market Segmentation, By Gas Phase (Liquid, Gas), Grade (Food Grade, Industrial Grade, Scientific Grade, Others), Storage (Cylinders and Packaged Gas, Merchant Liquid/Bulk, Tonnage), Mixture (Argon-Carbon Dioxide, Argon-Oxygen, Argon-Helium, Argon-Hydrogen, Other Mixtures), Function (Insulation, Illumination, Cooling), End-Use Industry (Metal Manufacturing and Fabrication, Food and Beverages, Healthcare, Energy, Chemicals, Electronics, Others) – Industry Trends and Forecast to 2032

Argon Gas Market Analysis

The argon gas market has witnessed immense popularity owing to its ability to connect several ferrous and nonferrous alloys. These factors also make argon gas very useful in the aerospace, aviation, and automobile industries, where it is used to weld parts and frames. Due to its superior thermal insulation capabilities over air, argon gas is one of the most often utilized gases to fill scuba divers' dry suits.

Global Argon Gas Market Size

Global argon gas market size was valued at USD 8.14 billion in 2024 and is projected to reach USD 25.96 billion by 2032, with a CAGR of 15.60% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes

|

Argon Gas Key Market Insights

|

|

Segmentation

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Air Products Inc., (U.S.), Linde Plc (Germany), Air Liquide (France), Ellenbarrie Industrial Gases (India), Praxair Technology, Inc., (U.S.), TAIYO NIPPON SANSO CORPORATION, (Japan), AIMS INDUSTRIES PRIVATE LIMITED (India), scicalgas (U.S.), SOL Group (Italy), Atlas Copco AB (Sweden), Zaburitz Pearl Energy Co., Ltd., (Myanmar), Rotarex (Luxembourg), Messer Group GmbH (Germany), Amico Group, (UAE) and GCE Group (Sweden)

|

|

Market Opportunities

|

|

Argon Gas Market Definition

The third noble gas in period 8, with an atomic number of 18, is argon gas. This gas has no flavour or color and is inert. It is separated from liquid air through a process called fractional distillation, and it exists in the form of natural isotopes like 40Ar, 36Ar, and 38Ar. It accounts for around 1% of the Earth's atmosphere.

Argon Gas Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Burgeoning Usage of across Metal Manufacturing and Fabrication

Argon is utilized to create an inert barrier between molten metals and slags and atmospheric oxygen, nitrogen, or carbon dioxide. In addition, argon's resistance to heat cracking and other properties, such as its high thermal conductivity, which allows for quick travel rates throughout the welding process, make it vital when welding stainless steel. The welding industry uses argon gas because it helps shield workpieces from contamination. This characteristic of argon gas makes it a well-liked element for usage in manufacturing and metalworking processes. It is the most desired gas for the metal industry because of its inert reactivity; it is utilized as an inert gas to protect metals from oxidation during welding as well as being used to join many nonferrous and ferrous alloys. It is also the most frequently utilized gas for filling the dry suits used for scuba diving because of its outstanding thermal insulation qualities.

- Increased Usage across Food and Beverages Industry

In the food and beverages industry, argon gas is frequently employed for packaging. Argons can be utilized as a preservative for meat products because they are odorless and inert. Additionally, by inhibiting oxidation and other chemical reactions of oxygen-sensitive components contained in packaged foods like fruits and vegetables, argon aids in maintaining product quality. By regulating temperature and maintaining storage pressure, argon gas is used in the beverage industry for wine preservation, beer foam stability, and carbonation management.

Furthermore, its wide range of uses across the industries such as the manufacturing, food, beverage, electronics, chemical, image and lighting, and metal fabrication industries will further propel the growth rate of argon gas market. Additionally, the surge in infrastructural activities along with the increasing industrialization across the globe will also drive market value growth. The qualities and benefits of argon gas, including its inertness, low cost, non-toxic nature, non-flammability, colorlessness, and non-reactive nature, even under extreme temperature, have helped it replace many other gases in the industry, increasing its demand in a variety of market sectors.

Opportunities

- Acquisitions And Expansion Strategies

Furthermore, the increased investments in various acquisitions and expansion strategies further enhance product applications and extend profitable opportunities to the market players in the forecast period of 2025 to 2032. For instance, The Oxygen and Argon Works were bought by Air Products & Chemicals, a US company, in December 2020 for NIS 575 million ($176.84 million). The business expansion and prospects for quick growth of Air Products & Chemicals are aided by this acquisition. Israel's top producer of industrial gases such helium, oxygen, hydrogen, and argon is Oxygen & Argon Works.

- Adoption of the Internet of Things (IoT)

Additionally, the growing adoption of the internet of things (IoT) technologies to link machinery and smart devices in order to get real-time insights and find manufacturing process gaps will further expand the future growth of the argon gas market. For instance, smart systems provide data on the operation and performance of chemical reactors with embedded analytics capabilities to alert plant managers and operators of potential machine failures. Praxair-Linde and Air Products are two significant producers of industrial gases that have embraced IoT technology.

Restraints/Challenges

- High Costs

Rising prices largely hamper the argon gas market's expansion. This increase in production expenses as a result of the rising cost of raw materials reduced the funds available for new product development and research. Additionally, the rising freight prices for trucks, railroads, dry bulk, and air freight and the demand on businesses to safeguard margins while preserving the quality of their products increased as a result of the rise in operational costs.

- Presence of Substitutes

The argon is also difficult to separate from oxygen due to its diffusive and adsorptive qualities. The sales of argon gas are being restricted by the development of nitrogen microwave inductively coupled atmospheric pressure plasma (MICAP), which is more affordable in comparison. In addition, manufacturers are switching from argon to krypton since it is denser and gives greater thermal efficiency. Therefore, the presence of these substitutes which offer better features will challenge the argon gas market growth rate.

This argon gas market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the argon gas market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Argon Gas Market Scope

The argon gas market is segmented on the basis of gas phase, grade, storage, mixture, function and end-use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Gas Phase

- Liquid

- Gas

Grade

- Food Grade

- Industrial Grade

- Scientific Grade

- High Purity Grade

- Ultra-High Purity Grade

- Others

- Others

Storage

- Cylinders and Packaged Gas

- Merchant Liquid/Bulk

- Tonnage

Mixture

- Argon-Carbon Dioxide

- Argon-Oxygen

- Argon-Helium

- Argon-Hydrogen

- Other Mixtures

Function

- Insulation

- Illumination

- Cooling

End-Use Industry

- Metal Manufacturing and Fabrication

- Food and Beverages

- Healthcare

- Energy

- Chemicals

- Electronics

- Others

- Scuba Diving

- Automotive and Transportation Equipment

Argon Gas Market Regional Analysis

The argon gas market is analyzed and market size insights and trends are provided by country, gas phase, grade, storage, mixture, function and end-use industry as referenced above.

The countries covered in the argon gas market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

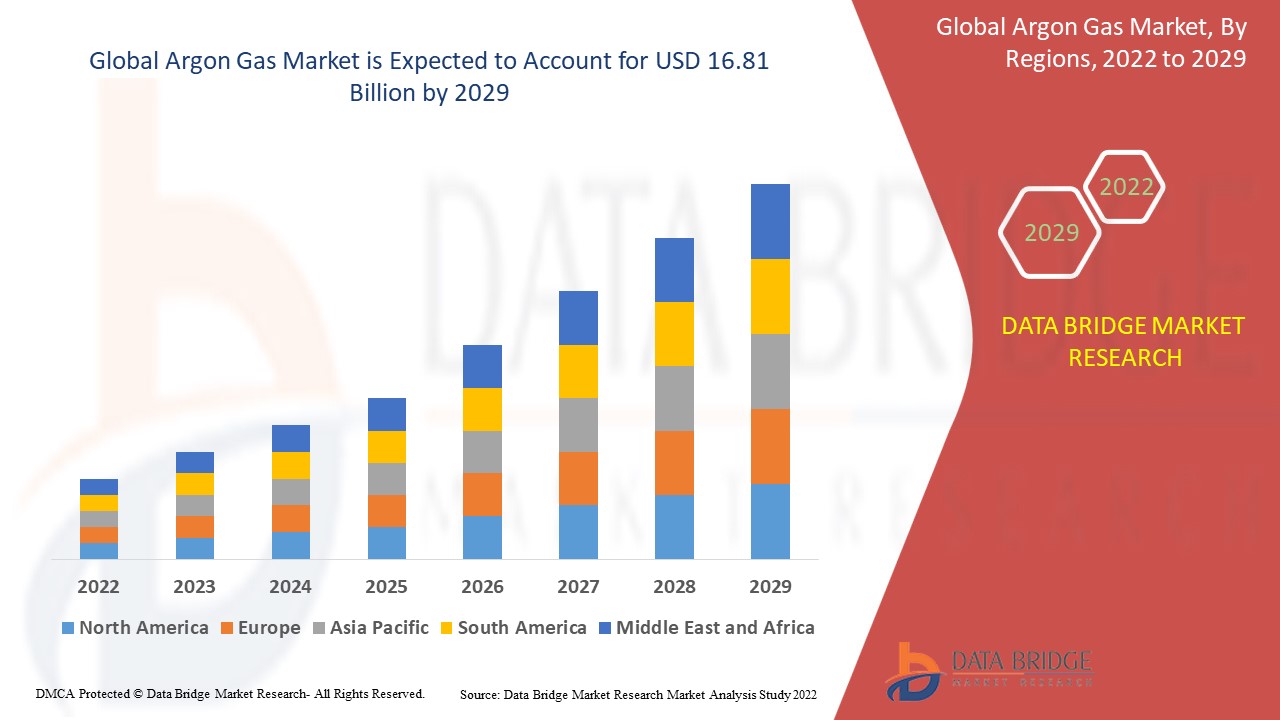

North America dominates the market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2025-2032. The market growth over this region is attributed to the rising demand from various industries such as food and beverages, pharmaceuticals, and others.

Asia-Pacific on the other hand, is estimated to show lucrative growth over the forecast period of 2025-2032, due to the rising number of developmental activities in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Argon Gas Market Share

The argon gas market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to argon gas market.

Argon Gas Market Leaders Operating in the Market Are:

- Air Products Inc., (U.S.)

- Linde Plc (Germany)

- Air Liquide (France)

- Ellenbarrie Industrial Gases (India)

- Praxair Technology, Inc., (U.S.)

- TAIYO NIPPON SANSO CORPORATION, (Japan)

- AIMS INDUSTRIES PRIVATE LIMITED (India)

- scicalgas (U.S.)

- SOL Group (Italy)

- Atlas Copco AB (Sweden)

- Zaburitz Pearl Energy Co., Ltd., (Myanmar)

- Rotarex (Luxembourg)

- Messer Group GmbH (Germany)

- Amico Group, (UAE)

- GCE Group (Sweden)

Latest Developments in Argon Gas Market

- In December 2020, a US company named Air Products & Chemicals acquired the oxygen and argon facilities for NIS 575 million ($176.84 million). This acquisition supports the potential for quick growth and commercial expansion of Air Products & Chemicals. The top manufacturer of industrial gases in Israel, including helium, oxygen, hydrogen, and argon, is called Oxygen & Argon Works.

SKU-