Market Analysis and Insights

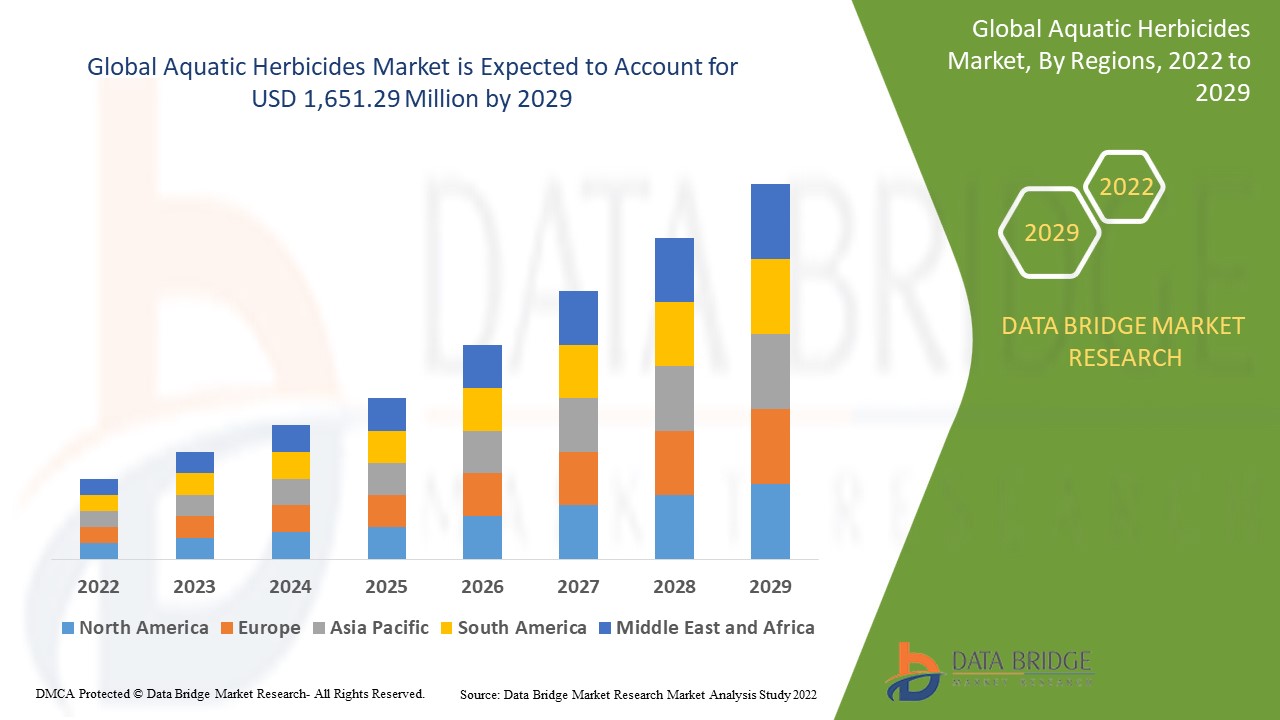

The global aquatic herbicides market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.1% in the forecast period of 2022 to 2029 and is expected to reach USD 1,651.29 million by 2029. The major factor driving the growth of the aquatic herbicides market is the advantages of using aquatic herbicides over other treatment methods, rising adoption of integrated weed management, and growth in fisheries and aquaculture farming.

Aquatic weeds reduce the effectiveness of water bodies for fish production. Aquatic weeds also cause a disturbance in irrigation channels and damage pumps and turbines in super thermal power stations. Aquatic herbicides are chemicals that are used in water to forestall aquatic weed growth as well as lake weeds, ponds, and pool weeds. Control of aquatic weeds with herbicides is usually easier, faster, and frequently cheaper than any other traditional/conventional methods. Most of the aquatic herbicides available in the market are low in mammalian toxicity and are economical. Herbicides used primarily to control algae may be called algaecides, even though they also kill other aquatic plants. For most aquatic weed problems, properly-used herbicides control vegetation without harming the fish. Aquatic herbicides are effective and commonly used means of controlling aquatic vegetation. The increasing adoption of weed control systems and solutions is expected to surge the demand for the aquatic herbicides market.

Aquatic herbicides are classified based on type into glyphosate, 2,4-D, imazapyr, diquat, Triclopyr, and others (fluoridone, flumioxazin, and copper & chelated copper). To reduce the intensity of the negative effects of weeds on the productivity of desired agricultural or forestry crops, fields may be sprayed with a herbicide that is toxic to the weeds, but not to the crop species. The commonly used herbicide 2, 4-D, for example, is toxic to many broad-leaved (that is, dicotyledonous) weeds, but not to wheat, maize or corn, barley, or rice, all of which are members of the grass family (Poaceae), and therefore monocotyledonous. Consequently, the pest plants are selectively eliminated, while maintaining the growth of the desired plant species

The global aquatic herbicides market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Glyphosate, 2,4-D, Imazapyr, Diquat, Triclopyr, Others), Mode of Action (Non-Selective, Selective), Application Method (Foliar, Submerged), Application (Agricultural Waters, Fisheries, Recreational Waters, Others (Retention Ponds, Development Waters, And Flood Control Canals)), Distribution Channel (Direct, Indirect) |

|

Countries Covered |

U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Rest of Europe, China, India, Indonesia, Thailand, Japan, Malaysia, Philippines, South Korea, Australia, New Zealand, Singapore, Hong Kong, Taiwan, Rest of Asia-Pacific, Brazil, Argentina, Costa Rica, Panama, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa |

|

Market Players Covered |

BASF SE, Nufarm, UPL, Helena Agri-Enterprises, LLC, BioSafe Systems, Bayer AG, FMC Corporation, Sanco Industries Inc., ALLIGARE America's VM Specialist, SePRO Corporation |

Market Definition

Herbicides used primarily to control algae may be called algaecides, even though they also kill other aquatic plants. For most aquatic weed problems, properly-used herbicides control vegetation without harming the fish. Aquatic herbicides are effective and commonly used means of controlling aquatic vegetation. The increasing adoption of weed control systems and solutions is expected to surge the demand for the aquatic herbicides market.

Global Aquatic Herbicides Market Dynamics

Drivers

- Advantages of using aquatic herbicides over other treatment methods

Many ponds and water bodies have severe waterweed infestations. Hand-pulling of the weeds or dredging the pond are possible methods of control. However, many times the infestation is so severe that these methods are impractical or uneconomical. With this, the application of aquatic herbicides requires only a short exposure time (approx. 6-24 hours), they are broad-spectrum, show very fast action (Usually less than 7 days), and are inexpensive. Therefore, here use of aquatic herbicides offers various advantages in controlling these infestations. Therefore, there is an increasing demand for aquatic herbicides in the global market owing to certain factors and advantages they offer.

- Rising adoption of integrated weed management

Integrated weed management (IWM) approaches are gaining popularity as they have various benefits such as herbicides must be balanced against the risks imposed upon society, the environment, and the long-term sustainability of agricultural economies. IWM approaches incorporate multiple factors of prevention, avoidance, monitoring, and suppression of weeds. The practice of an integrated weed management system is essential if farming is to remain sustainable into the future. Moreover, herbicide resistance is causing poor weed control, yield losses, and reduced profits on many farms, therefore, farmers are reticent to implement integrated weed management (IWM) in their farming systems by application of different types of herbicides to control the growth of weeds and make them less resistant to only one type of herbicide. This has shown that IWM and the various techniques used as part of an IWM strategy are successful, which in turn will boost the demand for aquatic herbicides in the global aquatic herbicides market.

- Growth in fisheries and aquaculture farming

In addition, the growth of aquatic weeds may have harmful effects on the aquatic population of fishes such as excessive population and dense growth of aquatic weeds such as over 25% of the surface area can cause depletion in the nighttime oxygen in the pond. This is because green plants produce oxygen in sunlight through the process of photosynthesis, but they consume oxygen at night due to translocation. Excessive population and dense growth of water weeds can provide too much cover in the water which may lead to the stunted small-sized fish population. Decaying water weeds can deplete the oxygen supply in the water to a very high extent that may suffocate fish to death. Some water weeds possess unpleasant taste that is capable of polluting the water certain species of algae give water bad tastes and odors that are offensive to the fish in the water. Moreover, densely populated water weeds increase the water turbidity and cause stress for fish as they spend more energy on locomotion. Therefore, the growing and fast-expanding fisheries and aquaculture farming business will boost the demand for aquatic herbicides, which in turn will help in the growth of the global aquatic herbicides market.

Opportunities

- Focus on improvement of herbicides that might be safe for aquatic animals and human

Herbicides are often phytotoxic to non-target aquatic organisms such as algae and macrophytes, and these adverse effects on primary producers can cascade up the food web altering community structure. In many regions, people rely on these valuable resources such as ponds, lakes, and others for drinking water, irrigation, and recreation purposes. Therefore, their proper maintenance, as well as reduced toxicity of herbicides, becomes an important part of the safety of animals and humans.

Organizations and manufacturers working in the market should focus on improving the quality and composition of herbicides, which might be safe for aquatic animals and humans. This will create a beneficial possibility and provide a lucrative opportunity for the market to grow with the existing as well as the introduction of new players in the market.

Restraints/Challenges

- Toxicity factors associated with herbicides

Aquatic herbicides also have sub-lethal effects including reproduction, stress, olfaction, and behavior-related effects. These effects have been observed in fish exposed to herbicides at large concentrations. These herbicides have indirect effects on the fish. These effects are due to herbicide-induced changes in food webs or the physical environment. Indirect effects occur if direct effects occur first and would be mediated by the killing of plants by herbicides. Although this indirect effect occurs when plants are controlled by direct treatment of surface waters, indirect effects appear to be unlikely to result from the use of herbicides in terrestrial systems as runoff concentrations in surface waters are very less than those that could directly affect plants.

- Prolonged approval process due to the stringent regulations

Permission in the form of a permit is legally required before herbicide application depending on the type of water body, ownership, aquatic species present there, proximity and hydrologic connection to other water bodies, amount of herbicides to be used, and many other variables. Therefore, the presence and imposition of various regulations for the enforcement of proper use of herbicides and their approval act as a challenge in increasing the demand for aquatic herbicides, which in turn slows down the growth of the global aquatic herbicides market.

COVID-19 had a Minimal Impact on Global Aquatic Herbicides Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, significant impact was noticed on aquatic herbicides market. The operations and supply chain of aquatic herbicides, with multiple manufacturing facilities were still operating in the region. The service providers continued offering aquatic herbicides following sanitation and safety measures in the post-COVID scenario.

Recent Development

In June 2021, BASF SE launched its herbicide Habitat Aqua herbicide, which was registered for use by Health Canada, to combat invasive weeds that threaten natural habitats across the Canadian region. This product has been approved for application in and around aquatic sites and provides effective control over tough-to-manage invasive species such as phragmites, cordgrasses, flowering rush, and knotweeds, which were problematic for the native ecosystem and caused significant damage to the surrounding area.

Global Aquatic Herbicides Market Scope

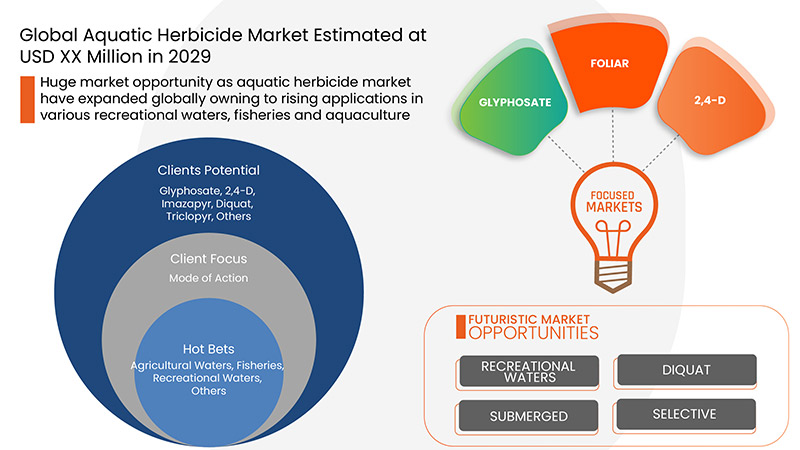

Global aquatic herbicides market is categorized based on type, mode of action, application method, application, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Glyphosate

- 2,4-D

- Diquat

- Triclopyr

- Imazapyr

- Others

Based on type, the global aquatic herbicides market is classified into six segments namely Glyphosate, 2,4-D, Imazapyr, Diquat, Triclopyr, and Others.

Mode of Action

- Selective

- Non-Selective

Based on mode of action, the global aquatic herbicide market is classified into two segments non-selective and selective.

Application Method

- Foliar

- Submerged

Based on application method, the global aquatic herbicides market is segmented into foliar and submerged

Application

- Agricultural waters

- Fisheries

- Recreational waters

- Others (Retention Ponds, Development Waters, And Flood Control Canals)

Based on application, the global aquatic herbicides market is segmented into agricultural waters, fisheries, recreational waters, and others.

Distribution Channel

- Direct

- Indirect

Based on distribution channel, the global aquatic herbicides market is segmented into direct and indirect.

Global Aquatic Herbicides Market Regional Analysis/Insights

The global aquatic herbicides market is segmented on the basis of type, mode of action, application method, application, and distribution channel.

The countries of global aquatic herbicides market in are U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Rest of Europe, China, India, Indonesia, Thailand, Japan, Malaysia, Philippines, South Korea, Australia, New Zealand, Singapore, Hong Kong, Taiwan, Rest of Asia-Pacific, Brazil, Argentina, Costa Rica, Panama, Rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa.

The U.S is dominating the North American aquatic herbicides market due to the increase the effectiveness of the herbicides on the weeds in the region. On the other hand, United Arab Emirates is dominating the Middle East and Africa aquatic herbicides market in due to increasing growth in fisheries and aquaculture farming in the region. China dominates the Asia-Pacific aquatic herbicides market due to the growing demand for aquatic herbicides for different applications in recent times.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Aquatic Herbicides Market Share Analysis

Global aquatic herbicides market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the global aquatic herbicides market.

Some of the prominent participants operating in the global aquatic herbicides market are BASF SE, Nufarm, UPL, Helena Agri-Enterprises, LLC, BioSafe Systems, Bayer AG, FMC Corporation, Sanco Industries Inc., and ALLIGARE America's VM Specialist, SePRO Corporation.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.