Global Application Security Market, By Solution (Web Apps and Mobile apps), Service (Professional and Managed), Testing (Static Application Security Testing, Dynamic Application Security Testing, and Interactive Application Security Testing), Deployment (On-Cloud and On-Premise), Organization (Large Enterprises, and Small and Medium Enterprises), End-user (Government and Defense, Banking, Financial Services and Insurance, IT and Telecom, Healthcare, Retail, Education, and Other Verticals) – Industry Trends and Forecast to 2031.

Application Security Market Analysis and Size

In the application security market, adopting advanced technologies fuels progress, offering enhanced protection against cyber threats. Businesses benefit from robust security measures, safeguarding sensitive data and ensuring uninterrupted operations. Continual advancement in application security is essential to counter evolving threats, ensuring organizational resilience and readiness against emerging challenges in today's digital landscape.

Data Bridge Market Research analyses that the global application security market size was valued at USD 8.47 billion in 2023, is projected to reach USD 54.99 billion by 2031, with a CAGR of 26.35% during the forecast period 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Solution (Web Apps and Mobile apps), Service (Professional and Managed), Testing (Static Application Security Testing, Dynamic Application Security Testing, and Interactive Application Security Testing), Deployment (On-Cloud and On-Premise), Organization (Large Enterprises, and Small and Medium Enterprises), End-user (Government and Defense, Banking, Financial Services and Insurance, IT and Telecom, Healthcare, Retail, Education, and Other Verticals)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, and Rest of South America

|

|

Market Players Covered

|

VERACODE (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Synopsys, Inc (U.S.), IBM (U.S.), WhiteHat Security (U.S.), Qualys, Inc (U.S.), Checkmarx Ltd. (Israel), Acunetix (Malta), Rapid7 (U.S.), Trustwave Holdings, Inc. (U.S.), High-Tech Bridge SA (Switzerland), Contrast Security (U.S.), SiteLock (U.S.), Pradeo (France), Fasoo, Inc (South Korea), Oracle (U.S.), Micro Focus (U.K.), and Positive Technologies (Russia)

|

|

Market Opportunities

|

|

Market Definition

Application security protects software applications from various threats and vulnerabilities throughout their lifecycle. It encompasses strategies, techniques, and tools to ensure that applications are resilient to attacks, unauthorized access, data breaches, and other malicious activities. Effective application security measures protect sensitive data and ensure software systems' integrity and functionality by implementing robust security protocols and continuous monitoring.

Application Security Market Dynamics

Drivers

- Growing Adoption of DevOps Practices

The surge in DevOps adoption emphasizes integrating security into development workflows, fostering the rise of DevSecOps. This trend propels the demand for automated application security testing tools, including SAST (Static Application Security Testing) and DAST (Dynamic Application Security Testing). For instance, tools such as Veracode and Checkmarx enable seamless integration of security testing into CI/CD pipelines, ensuring continuous security validation throughout the software development lifecycle.

- Shift to Cloud-Native Applications

The shift to cloud-native applications presents fresh security hurdles for organizations. Application security providers are witnessing heightened demand for solutions tailored to cloud environments. Essential solutions for securing cloud-hosted applications and data include encryption, multi-factor authentication, regular audits, robust access controls, and continuous monitoring.

Opportunities

- Rising Focus on Secure Software Development

Organizations prioritize integrating security into software development, emphasizing secure coding practices and developer training. This proactive approach ensures robust application security from the initial stages, driving the adoption of application security solutions. Through ingraining security into the development process, businesses mitigate vulnerabilities and safeguard their digital assets effectively.

- Rising Cyber Threats

The rise in cyber threats such as malware, ransomware, and data breaches has heightened the urgency for organizations to prioritize application security. For instance, the WannaCry ransomware attack 2017 affected over 200,000 computers worldwide, exploiting vulnerabilities in unpatched systems. Such incidents underscore the critical need for robust application security measures to safeguard digital assets and prevent costly breaches, prompting organizations to invest in comprehensive security solutions.

Restraints/Challenges

- Complexity of Application Environments

Securing modern application environments, with their microservices, containers, and multi-cloud setups, is a daunting challenge due to their inherent complexity. Achieving comprehensive security mandates continuous monitoring and adaptation of measures to safeguard against evolving threats. Managing diverse and dynamic landscapes demands agility and robust strategies to effectively mitigate risks across the entire ecosystem.

- Lack of Skilled Security Professionals

The persistent shortage of proficient cybersecurity specialists poses a significant challenge in the application security sector. High demand for professionals skilled in implementing and overseeing security measures surpasses available expertise. This scarcity hampers organizations' ability to fully leverage security technologies offered by application security products and service providers and to adapt to evolving threats efficiently.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In November 2023, Require Security Inc. debuted Falcon, a Runtime Application Security Protection app. Geared towards companies reliant on open-source libraries, it provides top-tier security, shielding against potential threats and vulnerabilities, ensuring robust protection in the cybersecurity landscape

- In October 2023, Checkmarx Ltd. introduced the Checkmarx Technology Partner program, streamlining access to various technology partner features for businesses. This initiative empowers enterprises to enhance their AppSec platform efficiently, enabling seamless integration of diverse technology partner capabilities

- In July 2023, New Relic, Inc. unveiled Interactive Application Security Testing (IAST), offering advanced detection accuracy and guided remediation. It provides enhanced visibility and context to security findings, bolstering web tracking and analytics capabilities, and fortifying security measures

- In September 2020, Micro Focus launched Hybrid Cloud Management X to simplify multicloud service delivery. As a cloud-native, multi-tenant management platform, it can operate in both public cloud and on-premises environments, facilitating streamlined management of diverse cloud services

Application Security Market Scope

The market is segmented on the basis of solution, service, testing, deployment, organization, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Solution

- Web apps

- Mobile apps

Service

- Professional

- Managed

Testing

- Static Application Security Testing

- Dynamic Application Security Testing

- Interactive Application Security Testing

Deployment

- On-cloud

- On-Premise

Organization

- Large Enterprises

- Small and Medium Enterprises

End-user

- Government and Defense

- Banking

- Financial Services and Insurance

- IT and Telecom

- Healthcare

- Retail

- Education

- Other Verticals

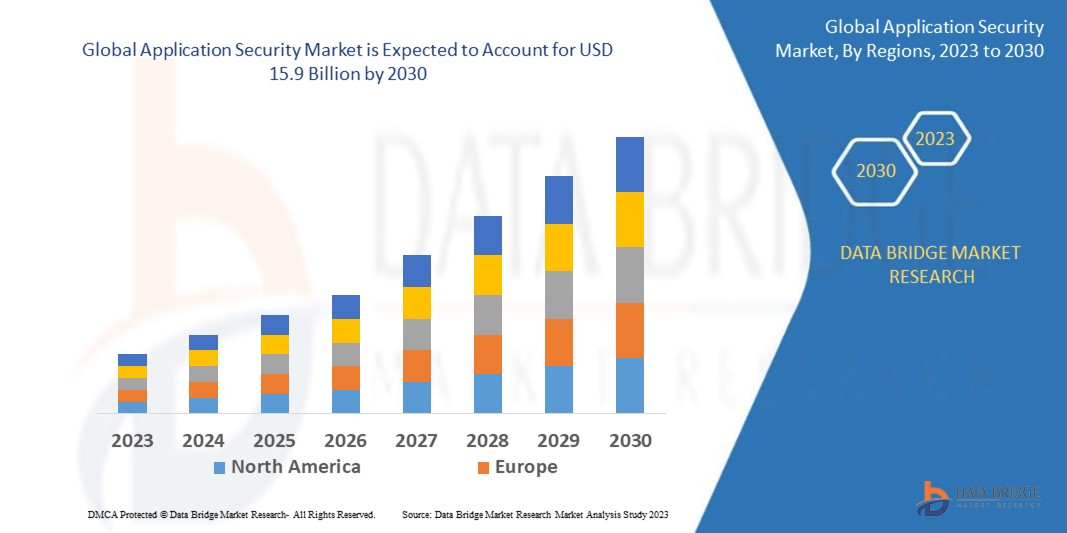

Application Security Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, solution, service, testing, deployment, organization and end-user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, and Rest of South America.

Asia Pacific is estimated to observe significant growth in the application security market. However, due to low finances, cybersecurity organizations heavily rely on open-source functions for safety testing, leading to potential infringement concerns, operational risks, and malpractices. The absence of cybercrime legislation and lack of safety awareness further exacerbate digital theft vulnerabilities, including ransomware attacks.

North America is expected to dominate the application security market due to its robust infrastructure, presence of global financial institutions, increasing adoption of IoT devices, and the development of threat intelligence solutions, fostering market growth in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Application Security Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- VERACODE (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Synopsys, Inc (U.S.)

- IBM (U.S.)

- WhiteHat Security (U.S.)

- Qualys, Inc (U.S.)

- Checkmarx Ltd. (Israel)

- Acunetix (Malta)

- Rapid7 (U.S.)

- Trustwave Holdings, Inc. (U.S.)

- High-Tech Bridge SA (Switzerland)

- Contrast Security (U.S.)

- SiteLock (U.S.)

- Pradeo (France)

- Fasoo, Inc (South Korea)

- Oracle (U.S.)

- Micro Focus (U.K.)

- Positive Technologies (Russia)

SKU-