Global Application Gateway Market

Market Size in USD Billion

CAGR :

%

USD

2.77 Billion

USD

6.43 Billion

2025

2033

USD

2.77 Billion

USD

6.43 Billion

2025

2033

| 2026 –2033 | |

| USD 2.77 Billion | |

| USD 6.43 Billion | |

|

|

|

|

Application Gateway Market Size

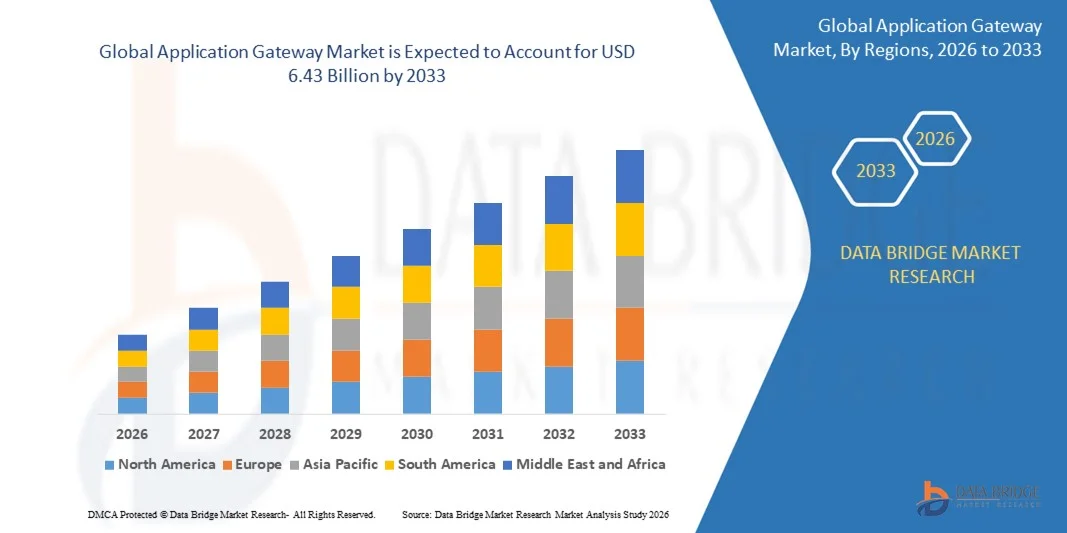

- The global application gateway market size was valued at USD 2.77 billion in 2025 and is expected to reach USD 6.43 billion by 2033, at a CAGR of 11.10% during the forecast period

- The market growth is largely fuelled by the increasing need for advanced network security solutions to protect web applications from sophisticated cyber threats

- Rising adoption of cloud‑based services and digital transformation initiatives across enterprises is driving demand for application gateways that offer secure, scalable, and high‑performance traffic management

Application Gateway Market Analysis

- Growing concerns over data breaches, DDoS attacks, and application layer vulnerabilities are prompting organizations to deploy application gateway solutions to strengthen their security posture

- The shift toward hybrid and multi‑cloud environments is encouraging enterprises to adopt application gateways that can provide secure access, traffic encryption, and centralized policy enforcement across distributed infrastructures

- North America dominated the application gateway market with the largest revenue share of 37.85% in 2025, driven by a growing demand for advanced cybersecurity solutions, cloud adoption, and digital transformation initiatives

- Asia-Pacific region is expected to witness the highest growth rate in the global application gateway market, driven by expanding IT infrastructure, rising adoption of cloud-based services, and government initiatives promoting digitalization and secure network environments

- The Solution segment held the largest market revenue share in 2025 driven by the increasing deployment of on-premises and cloud-based application gateways that provide security, traffic management, and API protection. Solutions are preferred by enterprises for their comprehensive features and ability to integrate with existing IT and network infrastructure

Report Scope and Application Gateway Market Segmentation

|

Attributes |

Application Gateway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Application Gateway Market Trends

Rising Demand for Advanced Network Security and Cloud-Based Solutions

- The growing focus on protecting web applications from cyber threats is significantly shaping the application gateway market, as enterprises increasingly require secure, reliable, and high-performance traffic management solutions. Application gateways are gaining traction due to their ability to monitor, filter, and control application-level traffic without compromising performance. This trend strengthens their adoption across IT, BFSI, healthcare, and retail industries, encouraging vendors to innovate with solutions that cater to evolving cybersecurity needs

- Increasing awareness around data protection, compliance requirements, and secure digital transformation has accelerated the demand for application gateways in enterprise networks, cloud services, and hybrid IT environments. Organizations are actively seeking solutions that ensure secure access, prevent DDoS attacks, and protect sensitive information, prompting vendors to prioritize advanced security features and seamless integration

- Security and compliance trends are influencing purchasing decisions, with companies emphasizing centralized traffic control, encryption, and policy enforcement. These factors help organizations differentiate their security posture in competitive markets and build trust with clients and partners, while also driving the adoption of advanced threat detection and API security measures

- For instance, in 2024, Cisco in the U.S. and F5 Networks in Germany expanded their application gateway offerings by introducing solutions with integrated firewall, load balancing, and API protection capabilities. These launches were introduced in response to rising enterprise demand for secure, high-performance, and compliant application delivery, with deployment across on-premises, cloud, and hybrid environments. The products were also marketed as critical cybersecurity tools, enhancing vendor credibility and enterprise adoption

- While demand for application gateways is growing, sustained market expansion depends on continuous innovation, cost-effective deployment, and maintaining performance and scalability under increasing traffic loads. Vendors are also focusing on improving integration capabilities, cloud compatibility, and developing intelligent solutions that balance security, efficiency, and ease of management for broader adoption

Application Gateway Market Dynamics

Driver

Growing Need for Secure, Scalable, and Compliant Application Delivery

- Rising enterprise demand for secure and reliable application delivery is a major driver for the application gateway market. Organizations are increasingly deploying application gateways to mitigate cyber threats, comply with data privacy regulations, and improve traffic management, supporting the adoption of advanced security architectures

- Expanding applications in cloud computing, hybrid IT environments, and digital transformation initiatives are influencing market growth. Application gateways help ensure secure access, centralized policy enforcement, and high availability while maintaining optimal performance, enabling organizations to meet operational and compliance requirements

- IT solution providers are actively promoting application gateway offerings through product innovation, managed services, and integration capabilities. These efforts are supported by growing enterprise emphasis on cybersecurity and regulatory compliance, encouraging partnerships between technology vendors and organizations to enhance protection and operational efficiency

- For instance, in 2023, Palo Alto Networks in the U.S. and A10 Networks in Singapore reported increased deployment of application gateways across financial services and healthcare networks. This expansion followed higher enterprise focus on secure cloud migration, API protection, and zero-trust security models, driving repeat investments and solution upgrades. Both companies also highlighted compliance and advanced analytics features to strengthen customer trust and vendor reputation

- Although rising security and cloud adoption trends support growth, wider adoption depends on cost optimization, integration complexity, and skill availability. Investment in cloud-ready solutions, scalable deployment models, and advanced threat detection will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

Complex Integration And Higher Deployment Costs Compared To Traditional Solutions

- The relatively higher deployment cost of application gateways compared to traditional network security solutions remains a key challenge, limiting adoption among small and mid-sized enterprises. Costs associated with licensing, hardware, and maintenance can be prohibitive, especially for organizations with constrained IT budgets

- Integration complexity with existing IT and network infrastructure can slow adoption, particularly in enterprises with legacy systems or hybrid cloud environments. Ensuring seamless interoperability with firewalls, load balancers, and identity management systems requires specialized expertise, which can be a barrier in certain regions

- Limited awareness and understanding of advanced application gateway functionalities among SMEs and developing markets also impact market growth. Lack of technical knowledge restricts adoption, leading to slower implementation of modern security frameworks and digital transformation initiatives

- For instance, in 2024, mid-sized enterprises in Southeast Asia and Latin America reported delayed adoption of application gateway solutions due to high initial investment, integration challenges, and insufficient in-house IT expertise. These factors also prompted some organizations to rely on traditional firewalls and proxy solutions, affecting overall market penetration

- Overcoming these challenges will require cost-effective deployment models, simplified integration tools, and targeted educational initiatives for IT teams and decision-makers. Collaboration with cloud providers, managed service operators, and cybersecurity training programs can help unlock the long-term growth potential of the global application gateway market. Furthermore, developing scalable, affordable, and easy-to-manage solutions will be essential for widespread adoption

Application Gateway Market Scope

The market is segmented on the basis of component, organization size, and end user.

- By Component

On the basis of component, the application gateway market is segmented into Solution and Services. The Solution segment held the largest market revenue share in 2025 driven by the increasing deployment of on-premises and cloud-based application gateways that provide security, traffic management, and API protection. Solutions are preferred by enterprises for their comprehensive features and ability to integrate with existing IT and network infrastructure.

The Services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for managed services, deployment support, and maintenance offerings. Service-based application gateways are particularly popular among organizations seeking scalable, flexible, and cost-effective solutions without requiring extensive in-house IT expertise.

- By Organization Size

On the basis of organization size, the market is segmented into Small and Medium-Sized Enterprises and Large Enterprises. The Large Enterprises segment held the largest market revenue share in 2025 due to higher investments in cybersecurity, cloud adoption, and regulatory compliance, prompting the deployment of advanced application gateway solutions across global operations.

The Small and Medium-Sized Enterprises segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing awareness of cybersecurity threats and growing availability of cost-effective, cloud-based, and managed application gateway services that cater to SMEs with limited IT resources.

- By End User

On the basis of end user, the market is segmented into Banking, Financial Services, and Insurance, Healthcare, Manufacturing, Government and Public Sector, IT and Telecommunication, Retail, and Others. The BFSI segment held the largest market revenue share in 2025 owing to the critical need for data protection, secure online transactions, and compliance with stringent financial regulations.

The Healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing digitalization of patient records, adoption of telemedicine, and the need for secure access and protection of sensitive health data across hospitals, clinics, and healthcare service providers.

Application Gateway Market Regional Analysis

- North America dominated the application gateway market with the largest revenue share of 37.85% in 2025, driven by a growing demand for advanced cybersecurity solutions, cloud adoption, and digital transformation initiatives

- Organizations in the region highly value the centralized traffic management, secure access, and threat protection offered by application gateways across enterprise networks and cloud environments

- This widespread adoption is further supported by robust IT infrastructure, high cybersecurity awareness, and stringent regulatory requirements, establishing application gateways as a preferred solution for large enterprises and government organizations

U.S. Application Gateway Market Insight

The U.S. application gateway market captured the largest revenue share in 2025 within North America, fueled by rapid digital transformation, cloud migration, and increasing cyber threats targeting enterprise applications. Organizations are increasingly prioritizing application security, API protection, and secure traffic management. The growing adoption of hybrid and multi-cloud architectures, combined with the demand for managed security services and integration with zero-trust frameworks, further propels the application gateway market. Moreover, increasing investments in next-generation firewall and secure access technologies are significantly contributing to market expansion.

Europe Application Gateway Market Insight

The Europe application gateway market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent data protection regulations such as GDPR and rising cybersecurity concerns. The increase in enterprise digitalization, cloud adoption, and need for secure application delivery is fostering the adoption of application gateways. European organizations are also drawn to centralized security management, scalability, and compliance assurance. The region is experiencing significant growth across BFSI, healthcare, and government sectors, with application gateways being deployed in both new IT infrastructures and upgrades of legacy systems.

U.K. Application Gateway Market Insight

The U.K. application gateway market is expected to witness the fastest growth rate from 2026 to 2033, driven by the growing need for secure enterprise applications, cloud migration, and cyber threat mitigation. Rising regulatory compliance requirements, increasing adoption of SaaS platforms, and integration with cloud-based security services are encouraging enterprises to implement application gateways. The U.K.’s strong IT services sector and digital initiatives are expected to continue supporting market growth.

Germany Application Gateway Market Insight

The Germany application gateway market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of cybersecurity risks, demand for advanced threat protection, and adoption of cloud-first IT strategies. Germany’s emphasis on technological innovation, data privacy, and compliance with local and EU regulations promotes the deployment of application gateways across enterprise and public sector networks. Integration with secure API management and cloud-native architectures is increasingly prevalent, meeting the expectations of security-conscious organizations.

Asia-Pacific Application Gateway Market Insight

The Asia-Pacific application gateway market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing digitalization, cloud adoption, and IT infrastructure modernization in countries such as China, Japan, and India. The region’s growing focus on cybersecurity, supported by government initiatives and regulatory frameworks, is driving adoption of application gateways. Furthermore, as APAC becomes a hub for IT services and cybersecurity solutions, affordability and accessibility of application gateway technologies are expanding to a wider enterprise base.

Japan Application Gateway Market Insight

The Japan application gateway market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high adoption of advanced IT infrastructure, cloud services, and secure application solutions. Japanese organizations place significant emphasis on application security, API protection, and integration with enterprise security management systems. Increasing implementation of IoT, cloud-based applications, and zero-trust architectures is fueling growth, while demand for simplified and secure IT operations among SMEs and large enterprises further supports market expansion.

China Application Gateway Market Insight

The China application gateway market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid digital transformation, cloud migration, and increasing cybersecurity investments by enterprises. China stands as one of the largest markets for IT and network security solutions, and application gateways are becoming increasingly critical for BFSI, healthcare, and government sectors. The push towards secure cloud-based services, API management, and the presence of strong domestic vendors are key factors propelling the market in China.

Application Gateway Market Share

The Application Gateway industry is primarily led by well-established companies, including:

- Microsoft (U.S.)

- SAP SE (Germany)

- Orange Business Services (France)

- F5, Inc. (U.S.)

- Palo Alto Networks, Inc. (U.S.)

- Forcepoint (U.S.)

- Zscaler Inc. (U.S.)

- Citrix Systems, Inc. (U.S.)

- Akamai Technologies (U.S.)

- Aculab (U.K.)

- Imperva (U.S.)

- Barracuda Networks, Inc. (U.S.)

- Kemp Technologies, Inc. (U.S.)

- Snapt, Inc. (South Africa)

- Avi Networks (U.S.)

- IBM (U.S.)

- Wipro Limited (India)

- Cognizant (U.S.)

- Google (U.S.)

- CyberArk Software Ltd. (Israel)

Latest Developments in Global Application Gateway Market

- In September 2025, Amazon Web Services (AWS) launched a new application gateway service focused on improving security and performance for enterprise applications. The service integrates advanced security features and optimized traffic management, attracting enterprise clients and strengthening AWS’s leadership in cloud-based application gateway solutions

- In August 2025, Microsoft introduced enhancements to its Azure Application Gateway, emphasizing AI-driven analytics and improved scalability. These updates enable better operational insights, enhanced user experience, and more efficient application traffic management, reinforcing Microsoft’s competitive positioning in the market

- In July 2025, Cloudflare expanded its global network infrastructure to support application gateway services. The development reduces latency, improves service reliability, and enhances accessibility across regions, enabling Cloudflare to attract a wider customer base and strengthen its market presence

- In July 2024, Microsoft launched Azure Application Gateway for Containers, a new SKU combining Application Gateway with the Application Gateway Ingress Controller (AGIC). The solution provides layer seven load balancing, traffic management for Kubernetes workloads, Gateway API support, and weighted traffic distribution for blue-green deployments. This enhances enterprise container networking, improves scalability, and strengthens Microsoft’s position in the application gateway market

- In December 2023, IBM completed the acquisition of StreamSets and webMethods from Software AG. StreamSets’ data ingestion capabilities and webMethods’ integration and API management tools enhance IBM’s watsonx platform, supporting hybrid multi-cloud environments. The development expands IBM’s enterprise integration offerings and reinforces its competitive edge in the application gateway and API management market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.