Global Anticoagulation Therapy Market

Market Size in USD Billion

CAGR :

%

USD

32.48 Billion

USD

61.88 Billion

2024

2032

USD

32.48 Billion

USD

61.88 Billion

2024

2032

| 2025 –2032 | |

| USD 32.48 Billion | |

| USD 61.88 Billion | |

|

|

|

|

Anticoagulation Therapy Market Size

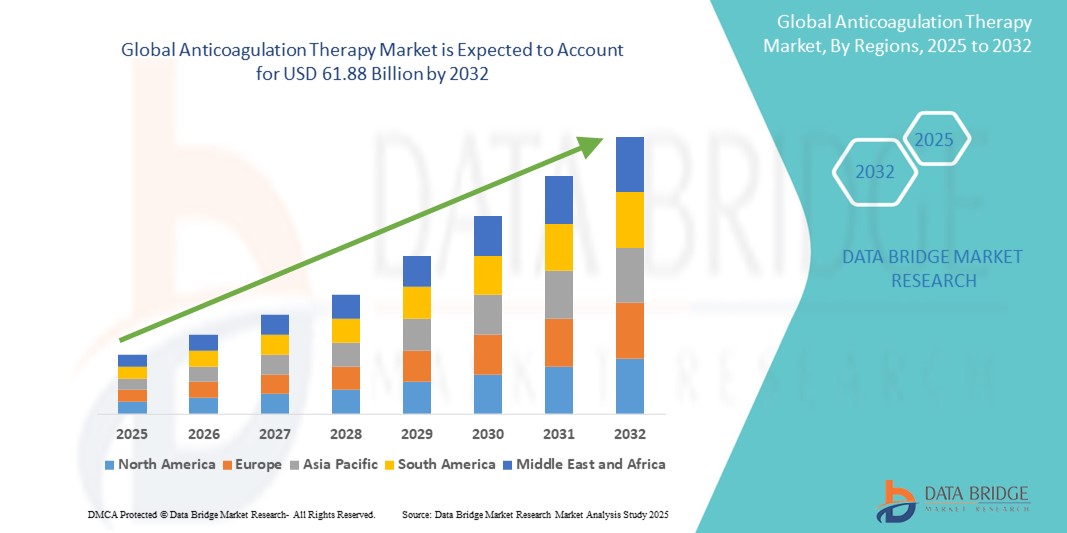

- The global anticoagulation therapy market size was valued at USD 32.48 billion in 2024 and is expected to reach USD 61.88 billion by 2032, at a CAGR of 8.39% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular diseases, an expanding aging population, and significant technological advancements in drug development, particularly in novel oral anticoagulants (NOACs).

- Furthermore, increasing awareness of cardiovascular health and the growing demand for more effective and safer treatment options are establishing anticoagulants as a crucial therapy. These converging factors are accelerating the uptake of anticoagulation solutions, thereby significantly boosting the industry's growth

Anticoagulation Therapy Market Analysis

- Anticoagulation therapy, involving the use of drugs to prevent or reduce blood clot formation, is a critical component in managing various cardiovascular and thrombotic disorders, including atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and stroke

- The escalating demand for anticoagulation therapy is primarily fueled by the increasing global prevalence of cardiovascular diseases, an aging population more susceptible to these conditions, and significant advancements in drug development, particularly the introduction and growing adoption of novel oral anticoagulants (NOACs)

- North America dominates the anticoagulation therapy market with the largest revenue share of 51.7% in 2024, characterized by its advanced healthcare infrastructure, high healthcare expenditure, established presence of major pharmaceutical companies, and a high burden of cardiovascular diseases

- Asia-Pacific is expected to be the fastest growing region in the anticoagulation therapy market with a CAGR of 6.6%, during the forecast period due to increasing urbanization, rising disposable incomes, improving healthcare access, growing awareness of cardiovascular health, and a rising patient population

- Novel Oral Anticoagulants (NOAC), segment dominates the Anticoagulation Therapy market with a market share of 57.7% in 2024, driven by its superior convenience improved safety profiles, and predictable pharmacokinetics, leading to increased patient compliance and broader adoption

Report Scope and Anticoagulation Therapy Market Segmentation

|

Attributes |

Anticoagulation Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anticoagulation Therapy Market Trends

“Advancements in Novel Oral Anticoagulants (NOACs) and Personalized Medicine”

- A significant and accelerating trend in the global anticoagulation therapy market is the continuous evolution and increasing adoption of Novel Oral Anticoagulants (NOACs), also known as Direct Oral Anticoagulants (DOACs). This shift is driven by their more predictable pharmacokinetics, fewer drug and food interactions, and the reduced need for routine monitoring compared to traditional Vitamin K Antagonists (VKAs) such as warfarin

- For instance, NOACs such as dabigatran, rivaroxaban, apixaban, and edoxaban have become preferred choices for various indications such as stroke prevention in atrial fibrillation and treatment of venous thromboembolism (VTE) due to their improved safety profiles, particularly a lower risk of intracranial bleeding

- Furthermore, the market is witnessing a growing emphasis on personalized medicine approaches. This includes utilizing genetic testing (pharmacogenomics) to optimize anticoagulant dosing and identify patients at higher risk of bleeding or thrombosis, thereby enhancing treatment efficacy and safety. For instance, genetic variants in enzymes involved in drug metabolism can influence individual responses to anticoagulants, guiding tailored therapy

- The exploration of novel targets, such as Factor XIa inhibitors, represents a promising future avenue. These inhibitors aim to provide more targeted thrombosis prevention with potentially lower bleeding risks, addressing a key challenge in anticoagulation therapy

- This trend towards more targeted, convenient, and personalized anticoagulation solutions is fundamentally reshaping patient management for thrombotic disorders. Consequently, pharmaceutical companies are investing heavily in R&D to bring next-generation anticoagulants to market, offering improved safety and efficacy

- The demand for anticoagulation therapies that offer enhanced safety, convenience, and personalized approaches is growing rapidly, as healthcare providers and patients increasingly prioritize improved outcomes and reduced complications in the management of cardiovascular and thrombotic diseases

Anticoagulation Therapy Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Cardiovascular Diseases and Aging Population”

- The increasing global prevalence of cardiovascular diseases (CVDs), including atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and stroke, coupled with the rapidly expanding aging population, is a significant driver for the heightened demand for anticoagulation therapy

- For instance, according to the Centers for Disease Control and Prevention (CDC), around 900,000 people in the United States are at risk of developing DVT each year, with 60,000 to 100,000 fatalities annually from venous thromboembolism (VTE). Such high incidence rates underscore the critical need for effective anticoagulants

- As individuals age, the risk of developing conditions requiring anticoagulation therapy significantly increases. Older adults are more susceptible to atrial fibrillation, a leading cause of stroke, and VTE, making anticoagulants essential for preventive and therapeutic care. This demographic shift directly fuels market growth

- Furthermore, increasing awareness among healthcare professionals and patients regarding the importance of timely diagnosis and management of thrombotic disorders is driving the adoption of anticoagulation therapy. The focus on preventive care and improved patient outcomes reinforces the demand for these medications

- The convenience and improved safety profiles of newer oral anticoagulants (NOACs), which offer reduced bleeding risk and do not require frequent monitoring, further contribute to their growing adoption and overall market expansion in both hospital and outpatient settings

Restraint/Challenge

“Risk of Bleeding and High Cost of Novel Oral Anticoagulants (NOACs)”

- A significant challenge to the broader adoption of anticoagulation therapy, particularly with newer agents, is the inherent risk of bleeding complications. All anticoagulants, while effective in preventing clots, increase the likelihood of bleeding, ranging from minor bruising to life-threatening hemorrhages such as intracranial bleeding

- For instance, while NOACs generally show a lower risk of intracranial hemorrhage compared to warfarin, they still carry a risk of major bleeding events, including gastrointestinal bleeding. Managing this delicate balance between preventing thrombosis and avoiding excessive bleeding remains a primary concern for clinicians and a source of anxiety for patients

- Furthermore, the relatively high initial cost of Novel Oral Anticoagulants (NOACs) compared to traditional, inexpensive Vitamin K Antagonists (VKAs) such as warfarin, poses a significant barrier to widespread adoption, especially in price-sensitive markets or regions with limited healthcare budgets. Although NOACs offer benefits such as less frequent monitoring and fewer drug-food interactions, their higher price can limit access for many patients

- Patient adherence to long-term anticoagulation therapy also presents a challenge, influenced by factors such as medication cost, fear of bleeding, and the perceived lack of symptoms in conditions such as atrial fibrillation. Poor adherence can lead to suboptimal treatment outcomes and increased risk of thrombotic events

Anticoagulation Therapy Market Scope

The market is segmented on the basis of treatment, therapeutic class, drug type, route of administration, therapeutic area, procedure, type, end user, and distribution channel

- By Treatment

On the basis of treatment, the anticoagulation therapy market is segmented into deep vein thrombosis (DVT), pulmonary embolism (PE), arterial thromboembolism (AT), stroke, and others. The stroke segment accounts for the largest market revenue share in 2024, driven by the high global incidence of stroke, particularly ischemic stroke, and the critical role of anticoagulants in stroke prevention, especially in patients with atrial fibrillation. The growing aging population and rising prevalence of risk factors such as hypertension and diabetes further contribute to this segment's dominance.

The deep vein thrombosis (DVT) segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of VTE (Venous Thromboembolism) and improved diagnostic capabilities. A rising number of surgical procedures, prolonged hospitalization, and certain medical conditions that increase the risk of DVT are also driving the adoption of anticoagulants for both prophylaxis and treatment.

- By Therapeutic Class

On the basis of therapeutic class, the anticoagulation therapy market is segmented into novel oral anticoagulants (NOAC), heparin, vitamin K antagonists, and others. The novel oral anticoagulants (NOAC) segment held the largest market revenue share in 2024 of 57.7% in 2024, driven by their superior convenience improved safety profiles, and predictable pharmacokinetics that eliminate the need for frequent monitoring.

The NOAC segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their increasing adoption as first-line therapy for various indications, ongoing clinical research expanding their approved uses, and the growing demand for safer and more patient-friendly anticoagulant options

- By Drug Type

On the basis of drug type, the anticoagulation therapy market is segmented into bivalirudin, dabigatran, edoxaban, betrixaban, rivaroxaban, apixaban, enoxaparin, dalteparin, and others. The apixaban segment held the largest market revenue share in 2024, driven by its favorable safety profile, particularly in terms of bleeding risk, and its broad indications, including stroke prevention in atrial fibrillation and treatment of VTE. Its once or twice-daily dosing regimen also contributes to its high adherence rates.

The rivaroxaban segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its once-daily dosing for many indications and its established efficacy across a range of thrombotic conditions. Its strong market presence and continuous expansion of indications also contribute to its rapid growth.

- By Route Of Administration

On the basis of route of administration, the anticoagulation therapy market is segmented into oral and parenteral. The oral segment held the largest market revenue share in 2024, driven by the widespread adoption of NOACs, which are orally administered. The convenience of oral dosing significantly enhances patient compliance for long-term therapy, reducing the burden of injections or hospital visits

The oral segment is expected to witness the fastest CAGR from 2025 to 2032, as the shift from traditional parenteral anticoagulants to more convenient oral options continue to gain momentum, especially for chronic conditions requiring prolonged anticoagulation.

- By Therapeutic Area

On the basis of therapeutic area, the anticoagulation therapy market is segmented into Cardiovascular, Respiratory, Oncology, Nephrology, CNS, and Others. The cardiovascular segment accounted for the largest market revenue share in 2024, driven by the high and rising global prevalence of cardiovascular diseases such as atrial fibrillation, coronary artery disease, and heart failure, all of which often necessitate anticoagulation to prevent thromboembolic events

The Oncology segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing recognition of cancer-associated thrombosis (CAT) as a significant complication in cancer patients. Anticoagulants are increasingly used for both prophylaxis and treatment of VTE in this patient population, driven by advancements in cancer treatment and extended patient survival

- By Procedure

On the basis of procedure, the anticoagulation therapy market is segmented into pre-surgical procedures, post-surgical procedures, kidney dialysis, and heart valve replacement. The post-surgical procedures segment accounted for the largest market revenue share in 2024, driven by the routine use of anticoagulants to prevent deep vein thrombosis and pulmonary embolism following a wide range of surgeries, particularly orthopedic and major abdominal surgeries.

The kidney dialysis segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising global incidence of end-stage renal disease (ESRD) requiring dialysis, where anticoagulants are essential to prevent clotting in the dialysis circuit and access sites.

- By Type

On the basis of type, the anticoagulation therapy market is segmented into generics and branded. The branded segment accounted for the largest market revenue share in 2024, primarily due to the dominance of patented novel oral anticoagulants (NOACs) which command premium pricing. These innovative drugs offer significant clinical advantages, driving their high market value

The generics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the impending patent expirations of several key NOACs, which will introduce more affordable generic alternatives. This increased affordability is expected to expand access to anticoagulation therapy, particularly in developing regions, and drive higher market penetration.

- By End User

On the basis of end user, the anticoagulation therapy market is segmented into hospitals, clinics, homecare, ambulatory surgical centres, and others. The hospitals segment accounted for the largest market revenue share in 2024, driven by the fact that most acute thrombotic events are managed in hospital settings, alongside surgical procedures requiring anticoagulation. Hospitals serve as major points of diagnosis, initiation, and monitoring of anticoagulation therapy

The homecare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing shift towards outpatient management of chronic conditions, the convenience offered by oral anticoagulants, and the growing emphasis on reducing hospital stays. Telemedicine and remote monitoring further support the expansion of homecare for anticoagulation management

- By Distribution Channel

On the basis of distribution channel, the anticoagulation therapy market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest market revenue share in 2024, primarily due to their role in dispensing anticoagulants for in-hospital use, managing acute prescriptions, and providing initial patient education upon discharge.

The online pharmacies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing digitalization, the convenience of home delivery, competitive pricing, and the growing trend of e-prescribing. This channel is increasingly favored for long-term medication management, including anticoagulants.

Anticoagulation Therapy Market Regional Analysis

- North America dominates the anticoagulation therapy market with the largest revenue share of 51.7% in 2024, driven by its advanced healthcare infrastructure, high healthcare expenditure, established presence of major pharmaceutical companies, and a high burden of cardiovascular diseases

- Healthcare providers and patients in the region highly value the efficacy, safety, and convenience offered by novel oral anticoagulants (NOACs), leading to their widespread adoption for stroke prevention in atrial fibrillation and treatment of venous thromboembolism

- ·This widespread adoption is further supported by high healthcare expenditure, a strong presence of key pharmaceutical players, and robust reimbursement policies, establishing anticoagulants as a critical component of patient care in both hospital and outpatient settings

U.S. Anticoagulation Therapy Market Insight

The U.S. anticoagulation therapy market largest revenue share of 79.1% in 2024 within North America, propelled by the high incidence of cardiovascular diseases, an aging population, and advanced healthcare infrastructure. Consumers and healthcare providers are increasingly prioritizing effective and safer blood clot prevention and treatment through innovative anticoagulant drugs, particularly Novel Oral Anticoagulants (NOACs). The growing emphasis on preventative care and the continuous introduction of new, more targeted therapies further bolster the market.

Europe Anticoagulation Therapy Market Insight

The Europe anticoagulation therapy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of chronic diseases, notably cardiovascular conditions, and a growing geriatric population. The increasing awareness of thrombotic disorders and the widespread adoption of NOACs, offering improved efficacy and convenience, are fostering market growth. European healthcare systems are also focusing on preventative strategies and long-term management of conditions requiring anticoagulation, leading to increased demand across various patient demographics.

U.K. Anticoagulation Therapy Market Insight

The U.K. anticoagulation therapy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating burden of cardiovascular diseases and a strong emphasis on improving patient outcomes in thrombosis management. Concerns regarding stroke prevention in atrial fibrillation and the treatment of venous thromboembolism are encouraging the adoption of advanced anticoagulant solutions. The U.K.'s robust healthcare system, particularly the NHS, and its focus on evidence-based guidelines recommending NOACs, are expected to continue to stimulate market growth.

Germany Anticoagulation Therapy Market Insight

The Germany anticoagulation therapy market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of thrombotic risks and the demand for highly effective and safe treatment options. Germany’s well-developed healthcare infrastructure, combined with a strong emphasis on high-quality patient care and early adoption of innovative therapies such as NOACs, promotes the widespread use of anticoagulants. The integration of advanced diagnostics for cardiovascular diseases and a preference for well-tolerated treatment solutions further align with local consumer and healthcare professional expectations

Asia-Pacific Anticoagulation Therapy Market Insight

The Asia-Pacific anticoagulation therapy market is poised to grow at the fastest CAGR of 6.6% during the forecast period, driven by increasing urbanization, rising disposable incomes, and significant improvements in healthcare infrastructure in countries such as China, Japan, and India. The region's growing burden of cardiovascular diseases and an expanding aging population are creating a substantial patient pool requiring anticoagulation. Furthermore, government initiatives aimed at increasing access to essential medications and a burgeoning pharmaceutical manufacturing sector are expanding the affordability and accessibility of anticoagulation therapies to a wider consumer base

Japan Anticoagulation Therapy Market Insight

The Japan anticoagulation therapy market is gaining momentum due to the country’s rapidly aging population, high prevalence of cardiovascular diseases, and a strong emphasis on advanced medical care. The Japanese market places significant importance on patient safety and efficacy, and the adoption of NOACs is driven by the increasing incidence of atrial fibrillation and other thrombotic conditions. The integration of advanced diagnostic tools and a preference for personalized treatment approaches are fueling growth. Moreover, Japan's commitment to high-tech healthcare solutions is expected to spur demand for even more effective and user-friendly anticoagulation management

India Anticoagulation Therapy Market Insight

The India anticoagulation therapy market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and a high burden of cardiovascular diseases. India is witnessing a significant increase in conditions such as atrial fibrillation and venous thromboembolism, making anticoagulants increasingly crucial in patient management. The push towards improving healthcare access, along with the availability of both affordable generic options and growing adoption of branded NOACs, alongside strong domestic pharmaceutical manufacturers, are key factors propelling the market in India

Anticoagulation Therapy Market Share

The anticoagulation therapy industry is primarily led by well-established companies, including:

- Hikma Pharmaceuticals PLC (U.K.)

- Viatris Inc (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Novartis AG (Switzerland)

- Eisai Co., Ltd. (Japan)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Fresenius Kabi AG (Germany)

- Aspen Holdings (South Africa)

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (China)

- Cipla Inc. (India)

- Johnson & Johnson Services, Inc. (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Eagle Pharmaceuticals, Inc. (U.S.)

- Endo International plc (Ireland)

- Mitsubishi Tanabe Pharma Corporation (Japan)

- Portola Pharmaceuticals, Inc. (U.S.)

- Taro Pharmaceutical Industries Ltd. (Israel)

Latest Developments in Global Anticoagulation Therapy Market

- In December 2024, Novo Nordisk announced that its Alhemo (concizumab-mtci) injection received approval from the U.S. Food and Drug Administration (FDA). This approval is for a once-daily subcutaneous prophylaxis to prevent or reduce the frequency of bleeding episodes in adult and pediatric patients 12 years of age and older with hemophilia A or B with inhibitors. This strengthens Novo Nordisk's portfolio and further its commitment to offering solutions for rare bleeding disorders, highlighting innovation beyond traditional anticoagulants

- In October 2024, Pfizer Inc. announced that it had received U.S. FDA approval for its HYMPAVZI (marstacimab-hncq). This is a once-weekly subcutaneous prophylactic treatment developed for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in adult and pediatric patients 12 years of age and older with hemophilia A or B without inhibitors, showcasing advancements in long-acting and patient-friendly treatments for bleeding disorders often related to anticoagulation

- In February 2024, Roche (F. Hoffmann-La Roche Ltd) launched three new coagulation tests for the oral Factor Xa inhibitors apixaban, edoxaban, and rivaroxaban in countries recognizing the CE mark. These tests are designed to facilitate clinical decision-making for prescribing direct oral anticoagulants (DOACs), primarily for stroke prevention, indicating an ongoing focus on improving the precision and safety of anticoagulant therapy

- In November 2023, Pharmascience Canada announced the launch of the generic drug (Pr) pms-RIVAROXABAN. This medicine, a direct Factor Xa inhibitor, belongs to the anticoagulant (blood thinner) group and helps prevent blood clots. The introduction of generic versions of NOACs contributes to increased accessibility and affordability of these crucial medications in Canada

- In July 2023, Endo International plc. launched bivalirudin injection in ready-to-use (RTU) vials in the U.S., in collaboration with Gland Pharma Limited, India, and MAIA Pharmaceuticals, Inc. The new RTU vials of bivalirudin are expected to offer more convenience and efficiency for healthcare professionals in acute care settings, enhancing the ease of administration for specific anticoagulant drugs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.