Global Anti Money Laundering Software Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

9.84 Billion

2024

2032

USD

2.92 Billion

USD

9.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 9.84 Billion | |

|

|

|

|

Anti-Money Laundering Software Market Size

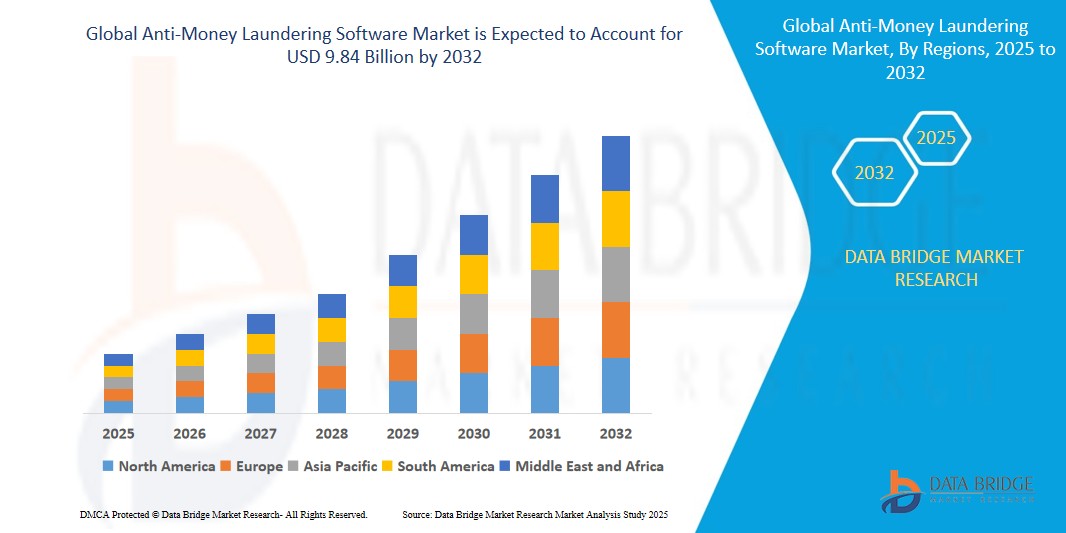

- The global Anti-Money Laundering Software market size was valued at USD 2.92 billion in 2024 and is expected to reach USD 9.84 billion by 2032, at a CAGR of 16.40% during the forecast period

- The market’s significant expansion is primarily attributed to the widespread adoption of AML software across diverse industries, coupled with rapid advancements in artificial intelligence (AI), machine learning (ML), and blockchain technologies that enhance the precision and efficiency of detecting and preventing financial crimes such as money laundering and terrorist financing.

- Furthermore, the increasing demand for real-time transaction monitoring, stringent global regulatory compliance requirements, and the growing prevalence of digital transactions in sectors such as banking, e-commerce, and cryptocurrencies are establishing AML software as a critical tool for ensuring financial integrity and adherence to regulatory standards.

Anti-Money Laundering Software Market Analysis

- Anti-money laundering software encompasses a suite of advanced technological solutions designed to detect, monitor, and prevent illicit financial activities, including money laundering, terrorist financing, and fraud, within financial institutions and other regulated sectors. These solutions leverage AI, ML, big data analytics, and blockchain to analyze vast volumes of transactional data, identify suspicious patterns, and ensure compliance with global regulatory frameworks such as the Financial Action Task Force (FATF) recommendations.

- The escalating demand for AML software is primarily fueled by its ability to provide real-time transaction monitoring, robust customer due diligence, and automated compliance reporting, coupled with increasing global regulatory pressures and the rising incidence of financial crimes. According to the United Nations, an estimated 2–5% of global GDP, equivalent to USD 800 billion to USD 2 trillion, is laundered annually, underscoring the urgent need for effective AML solutions.

- North America dominated the global AML software market with a revenue share of 33.92% in 2024, driven by a well-established financial infrastructure, stringent regulatory frameworks such as the USA PATRIOT Act, and high adoption rates in banking and financial services. The United States, in particular, has emerged as a leader due to the presence of major AML solution providers and proactive regulatory bodies like the Financial Industry Regulatory Authority (FINRA).

- The Asia-Pacific region is anticipated to experience the fastest growth rate during the forecast period, propelled by rapid digitalization, increasing cross-border transactions, and government-led initiatives to combat financial crime in countries such as China, India, and Singapore.

- Among product types, the transaction monitoring software segment held the largest market share of over 52.44% in 2024, attributed to its pivotal role in real-time analysis of financial transactions and detection of suspicious activities, which is critical for compliance with anti-money laundering regulations.

Report Scope and Anti-Money Laundering Software Market Segmentation

|

Attributes |

Anti-Money Laundering Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Money Laundering Software Market Trends

“Advancements in Artificial Intelligence and Blockchain Technologies”

- A prominent and transformative trend in the global anti-money laundering software market is the deepening integration of artificial intelligence (AI), machine learning (ML), and blockchain technologies, which significantly enhance the precision, automation, and transparency of AML solutions in combating financial crime.

- For instance, in April 2023, NICE Actimize launched SAM-10, an AI-based transaction monitoring solution featuring multilayered analytics to improve the detection of suspicious activities while minimizing false positives, thereby streamlining compliance processes for financial institutions.

- AI-powered AML software enables real-time analysis of vast transactional datasets, identifies complex patterns of illicit activity, and automates alert management, making it highly effective for applications in banking, insurance, and cryptocurrency exchanges. For example, WorkFusion’s AI solution, Isaac, launched in October 2023, automates first-level alert reviews, escalating high-risk cases and closing non-suspicious alerts with comprehensive supporting documentation.

- Blockchain technology, valued at USD 1.43 billion in 2023, is increasingly adopted for its ability to provide immutable, transparent records of financial transactions, reducing the risk of undetected money laundering activities and enhancing traceability across global financial networks.

- This trend towards more intelligent, automated, and transparent AML systems is fundamentally reshaping the financial technology landscape, with companies like LexisNexis Risk Solutions developing advanced analytical capabilities to streamline Know Your Customer (KYC) processes and bolster regulatory compliance.

Anti-Money Laundering Software Market Dynamics

Driver

“Increasing Regulatory Compliance and Escalating Financial Crimes”

- The increasing need for stringent regulatory compliance, driven by global regulations such as the Financial Action Task Force (FATF) recommendations, the USA PATRIOT Act, and the EU’s Fifth Anti-Money Laundering Directive, is a significant driver propelling the growth of the AML software market. These regulations mandate robust monitoring, reporting, and customer due diligence systems to combat money laundering and terrorist financing effectively.

- For example, in January 2024, FICO launched an enhanced AML solution with advanced machine-learning algorithms designed to improve anomaly detection, addressing the growing complexity of financial crimes in an increasingly digital financial landscape.

- AML software provides cost-effective, scalable, and automated solutions for real-time transaction monitoring, customer identity verification, and compliance reporting, significantly reducing the risk of regulatory penalties, which reached USD 7.7 billion globally from January to April 2022, according to industry reports.

- The surge in digital payments, online banking, and cryptocurrency transactions has exponentially increased the volume and complexity of financial transactions, necessitating sophisticated AML solutions to monitor cross-border activities, detect suspicious patterns, and ensure compliance with international standards.

Restraint/Challenge

“High Implementation Costs and Shortage of Skilled Professionals”

- The high implementation and maintenance costs associated with advanced AML software, particularly those incorporating AI, machine learning, and blockchain technologies, pose significant challenges to adoption, especially for small and medium-sized enterprises (SMEs) operating with constrained budgets. For instance, some AML software licenses start at EUR 259 monthly, with additional costs for system upgrades, integration with legacy systems, and ongoing maintenance.

- The shortage of qualified AML specialists capable of effectively utilizing advanced software insights and navigating complex regulatory landscapes is a major barrier, particularly in regions with underdeveloped financial technology ecosystems. This lack of skilled professionals limits organizations’ ability to fully leverage the capabilities of AML solutions.

- Regulatory complexities, such as varying compliance requirements across different jurisdictions, can hinder market growth by increasing the time and cost of deploying standardized AML solutions, particularly for multinational organizations operating in multiple regions.

- Addressing these challenges through the development of cost-effective cloud-based AML solutions, standardized global regulatory frameworks, and investments in workforce training programs is critical to fostering consumer trust and ensuring sustained market growth.

Anti-Money Laundering Software Market Scope

The global anti-money laundering software market is segmented on the basis of product type, component, application, deployment model, and end-user.

- By Product Type

On the basis of product type, the AML software market is segmented into transaction monitoring software, customer identity management software, compliance management software, currency transaction reporting software, sanctions screening software, fraud detection software, and others. The transaction monitoring software segment dominated the market with a commanding revenue share of over 52.44% in 2024, driven by its essential role in real-time analysis of financial transactions and detection of suspicious activities, such as sudden large deposits or frequent small transactions designed to evade regulatory scrutiny.

The sanctions screening software segment is anticipated to witness the fastest CAGR of 18.1% from 2025 to 2032, fueled by increasing global sanctions regimes and the need for financial institutions to screen transactions and customers against international sanction lists to ensure compliance and avoid penalties.

- By Component

On the basis of component, the AML software market is segmented into software, services, and managed services. The software segment held the largest market revenue share of 63.41% in 2024, driven by the widespread adoption of AI-driven and cloud-based AML software for real-time transaction monitoring, KYC compliance, and automated reporting.

The managed services segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing demand for outsourced AML solutions that provide expert monitoring, compliance support, and system maintenance, particularly for organizations lacking in-house expertise.

- By Application

On the basis of application, the AML software market is segmented into banking and financial services, insurance, gaming and gambling, government, healthcare, cryptocurrency exchanges, retail and e-commerce, and others. The banking and financial services segment accounted for the largest market revenue share of over 46.71% in 2024, driven by the sector’s high exposure to financial crimes and stringent regulatory requirements for transaction monitoring and customer due diligence.

The cryptocurrency exchanges segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rapid growth of digital currencies, increasing regulatory scrutiny of crypto transactions, and the need to prevent money laundering in decentralized financial systems.

- By Deployment Model

On the basis of deployment model, the AML software market is segmented into on-premises, cloud-based, and hybrid. The cloud-based segment held the largest market revenue share in 2024, driven by its scalability, cost-effectiveness, and ease of integration with existing financial systems, making it a preferred choice for institutions undergoing digital transformation.

The hybrid segment is expected to witness the fastest CAGR from 2025 to 2032, as organizations seek to balance the security of on-premises systems with the flexibility of cloud-based solutions, particularly in highly regulated sectors like banking and government.

- By End-User

On the basis of end-user, the AML software market is segmented into large enterprises and small and medium enterprises (SMEs). The large enterprises segment dominated the market with a significant share in 2024, driven by their complex operational needs, high transaction volumes, and substantial budgets for advanced AML solutions.

The SMEs segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by increasing regulatory pressures on smaller organizations and the availability of affordable, cloud-based AML solutions tailored to their needs.

Anti-Money Laundering Software Market Regional Analysis

North America

North America dominated the global AML software market with a revenue share of 33.04% in 2024, driven by the region’s advanced financial infrastructure, stringent regulatory frameworks such as the USA PATRIOT Act and Bank Secrecy Act, and widespread adoption in banking, financial services, and insurance sectors. Financial institutions in North America highly value the efficiency, scalability, and real-time monitoring capabilities offered by AML software, which integrate seamlessly with advanced technologies like AI, ML, and blockchain to ensure compliance and combat financial crime. The widespread adoption is further supported by substantial regulatory enforcement, high financial crime rates, and the presence of leading AML solution providers like LexisNexis Risk Solutions and NICE Actimizet.

U.S. Anti-Money Laundering Software Market Insight

The U.S. AML software market captured the largest revenue share of 82.51% within North America in 2024, fueled by the rapid adoption of advanced financial technologies and an increasing focus on combating financial crimes in a highly digitized financial ecosystem. Financial institutions are prioritizing real-time transaction monitoring, enhanced KYC processes, and sanctions screening to meet stringent regulatory requirements from bodies such as the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). The growing preference for AI-driven and cloud-based AML solutions, combined with robust demand for integration with digital banking and cryptocurrency platforms, further propels the market. Supportive regulations and the presence of leading companies like SAS Institute and Fiserv are significantly contributing to the market’s expansion.

Europe Anti-Money Laundering Software Market Insight

The Europe AML software market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards, such as the EU’s Fifth and Sixth Anti-Money Laundering Directives, and the escalating need for robust compliance solutions in banking, insurance, and emerging sectors like cryptocurrency exchanges. The increase in cross-border transactions, coupled with the demand for advanced analytics to detect sophisticated financial crimes, is fostering the adoption of AML software across financial and non-financial sectors. European financial institutions are also drawn to the efficiency and transparency benefits offered by AI and blockchain-based solutions, with significant growth observed in key financial hubs like the United Kingdom, Germany, and Switzerland.

U.K. Anti-Money Laundering Software Market Insight

The U.K. AML software market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of digital banking, the rapid growth of fintech startups, and the need for enhanced compliance to address financial crimes. Concerns regarding regulatory penalties, which can amount to millions of pounds, and reputational risks are encouraging financial institutions and regulated entities to adopt advanced AML solutions for transaction monitoring, KYC compliance, and sanctions screening. The U.K.’s robust financial services sector, alongside its strong regulatory framework under the Financial Conduct Authority (FCA), is expected to continue stimulating market growth.

Germany Anti-Money Laundering Software Market Insight

The Germany AML software market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of financial crime risks, the demand for technologically advanced compliance solutions, and Germany’s position as a leading financial hub in Europe. Germany’s well-developed financial sector, combined with its emphasis on regulatory compliance and data security under the Federal Financial Supervisory Authority (BaFin), promotes the adoption of AML software, particularly in banking, insurance, and cryptocurrency exchanges. The integration of AML solutions with AI-driven analytics and cloud-based platforms is becoming increasingly prevalent, aligning with local priorities for efficient, secure, and compliant financial operations.

Asia-Pacific Anti-Money Laundering Software Market Insight

The Asia-Pacific AML software market is poised to grow at the fastest CAGR of 18.2% during the forecast period of 2025 to 2032, driven by rapid digitalization, increasing cross-border transactions, and proactive government initiatives to combat financial crime in countries such as China, India, and Singapore. The region’s growing adoption of digital payment platforms, supported by government initiatives like India’s Digital India program and Singapore’s Smart Nation initiative, is driving the demand for AML software to monitor high-risk transactions and ensure regulatory compliance. Furthermore, as Asia-Pacific emerges as a hub for financial technology innovation and cryptocurrency adoption, the affordability and scalability of cloud-based AML solutions are expanding to a wider range of institutions, including SMEs and fintech startups.

Japan Anti-Money Laundering Software Market Insight

The Japan AML software market is gaining momentum due to the country’s advanced financial technology sector, rapid growth in digital payments, and increasing demand for robust compliance solutions to address financial crime risks. The Japanese market places a significant emphasis on precision, reliability, and regulatory adherence, and the adoption of AML software is driven by the rising volume of digital banking, e-commerce, and cryptocurrency transactions. The integration of AML solutions with AI, machine learning, and blockchain technologies is fueling growth, enabling financial institutions to detect sophisticated money laundering schemes. Moreover, Japan’s stringent regulatory environment under the Financial Services Agency (FSA) and the Act on Prevention of Transfer of Criminal Proceeds is likely to spur demand for advanced AML systems in banking, financial services, and emerging sectors like cryptocurrency exchanges.

China Anti-Money Laundering Software Market Insight

The China AML software market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding digital economy, significant growth in online banking and e-commerce, and high rates of regulatory enforcement under the China Banking and Insurance Regulatory Commission (CBIRC) and the People’s Bank of China (PBoC). China stands as one of the largest markets for AML software, with widespread use in banking, fintech, and cryptocurrency exchanges to monitor high-risk transactions and ensure compliance with anti-money laundering regulations. The push towards digital financial systems, the increasing adoption of cryptocurrencies, and the availability of scalable AML solutions, alongside strong domestic providers, are key factors propelling the market in China.

Anti-Money Laundering Software Market Share

- The Anti-Money Laundering Software industry is primarily led by well-established companies, including:

- LexisNexis Risk Solutions (United States)

- NICE Actimize (United States)

- SAS Institute Inc. (United States)

- Fiserv Inc. (United States)

- Oracle Corporation (United States)

- BAE Systems PLC (United Kingdom)

- Thomson Reuters Corporation (Canada)

- Accenture PLC (Ireland)

- FICO (Fair Isaac Corporation) (United States)

- ComplyAdvantage Ltd. (United Kingdom)

- Refinitiv (United Kingdom)

- ACI Worldwide Inc. (United States)

- TransUnion Holding Company Inc. (United States)

- Feedzai Inc. (Portugal)

- CaseWare RCM Inc. (Canada)

- Temenos AG (Switzerland)

- WorkFusion (United States)

- Eastnets Holding Ltd. (United Arab Emirates)

- Dow Jones Risk & Compliance (United States)

- Quantexa Ltd. (United Kingdom)

- Alessa by Tier1 Financial Solutions (Canada)

- Verafin Inc. (Canada)

Latest Developments in Global Anti-Money Laundering Software Market

- In April 2023, NICE Actimize launched SAM-10, an AI-based transaction monitoring solution featuring multilayered analytics to enhance the detection of suspicious activities and reduce false positives, improving compliance efficiency for financial institutions worldwide.

- In January 2024, FICO introduced an enhanced AML solution with advanced machine-learning algorithms designed to improve anomaly detection, addressing the growing complexity of financial crimes in digital banking and cryptocurrency transactions.

- In February 2023, NICE Actimize announced a strategic partnership with Microsoft to integrate its AML solutions with Microsoft Azure, providing financial institutions with a robust cloud-based environment for enhanced compliance, scalability, and risk management.

- In October 2023, WorkFusion launched Isaac, an AI-driven solution designed to automate first-level alert reviews for AML transaction monitoring, escalating high-risk cases and closing non-suspicious alerts with comprehensive supporting documentation, reducing manual workloads.

- In May 2025, Azentio Software unveiled Amlock, a next-generation AML platform with advanced AI capabilities to combat financial crime in the banking, financial services, and insurance (BFSI) sector, enhancing real-time monitoring, KYC processes, and sanctions screening.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.