Global Anomaly Detection For Professional Market

Market Size in USD Billion

CAGR :

%

USD

8.96 Billion

USD

42.01 Billion

2025

2033

USD

8.96 Billion

USD

42.01 Billion

2025

2033

| 2026 –2033 | |

| USD 8.96 Billion | |

| USD 42.01 Billion | |

|

|

|

|

Anomaly Detection for Professional Market Size

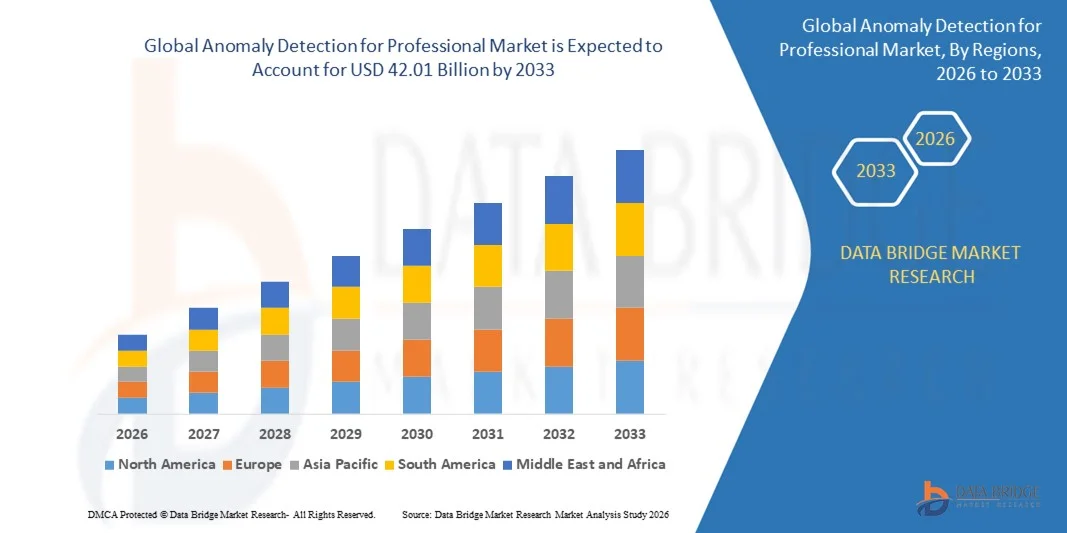

- The global anomaly detection for professional market size was valued at USD 8.96 billion in 2025 and is expected to reach USD 42.01 billion by 2033, at a CAGR of 21.30% during the forecast period

- The market growth is largely fueled by the increasing frequency and sophistication of cyber threats, driving organizations to adopt advanced anomaly detection solutions for real-time monitoring and risk mitigation across networks and user activities

- Furthermore, rising enterprise demand for AI- and machine learning-based tools that can proactively identify deviations in system behavior is establishing anomaly detection as a critical component of modern cybersecurity and operational analytics strategies. These converging factors are accelerating the adoption of anomaly detection solutions, thereby significantly boosting the market’s growth

Anomaly Detection for Professional Market Analysis

- Anomaly detection solutions are software and service platforms that identify unusual patterns or deviations in network traffic, user behavior, or system operations. These systems leverage technologies such as machine learning, AI, big data analytics, and business intelligence to provide actionable insights, enhance security, and support operational efficiency across enterprises

- The escalating demand for anomaly detection is primarily fueled by growing digitalization across industries, increased regulatory compliance requirements, and the need for proactive threat detection. Organizations are increasingly prioritizing solutions that provide real-time alerts, prevent fraud, and reduce operational risk, contributing to robust market expansion

- North America dominated the anomaly detection for professional market with a share of 46.1% in 2025, due to the increasing frequency of cyberattacks and growing investments in enterprise cybersecurity solutions

- Asia-Pacific is expected to be the fastest growing region in the anomaly detection for professional market during the forecast period due to rapid digital transformation, urbanization, and technological adoption in countries such as China, Japan, and India

- Network behavior anomaly detection segment dominated the market with a market share of 47% in 2025, due to the increasing sophistication of cyber threats and the need for continuous monitoring of network traffic patterns. Organizations prioritize network-focused anomaly detection for its ability to identify unusual data flows, unauthorized access attempts, and potential breaches in real time. The market also sees strong demand for this segment due to its compatibility with existing security information and event management (SIEM) systems and the availability of advanced analytics features enhancing threat visibility and mitigation

Report Scope and Anomaly Detection for Professional Market Segmentation

|

Attributes |

Anomaly Detection for Professional Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Anomaly Detection for Professional Market Trends

Growing Adoption of AI-Driven Anomaly Detection

- A significant trend in the anomaly detection for professional market is the rising adoption of AI- and machine learning-based platforms to monitor network behavior, user activity, and system operations. This trend is driven by the increasing sophistication of cyber threats and the need for real-time detection of subtle deviations that could indicate security breaches or operational risks

- For instance, Darktrace leverages AI to autonomously detect anomalous patterns in enterprise networks, enabling proactive threat mitigation and strengthening cybersecurity infrastructure. Such AI-driven solutions are redefining traditional security monitoring and helping enterprises reduce reliance on manual analysis

- Organizations are increasingly integrating anomaly detection with cloud, on-premises, and hybrid systems to support scalable monitoring across distributed networks. This is positioning anomaly detection as a foundational technology for modern enterprise cybersecurity strategies

- The financial sector is accelerating adoption as AI-based anomaly detection identifies unusual transaction patterns, prevents fraud, and ensures compliance with regulations such as PSD2 and GDPR. This trend is reinforcing the value of predictive analytics in operational risk management

- Enterprises in IT, telecom, and healthcare are expanding their use of anomaly detection to safeguard critical data, prevent service disruptions, and optimize operational performance. AI-enabled anomaly detection platforms provide faster, more accurate insights compared with traditional rule-based approaches

- The growing integration of anomaly detection into Security Information and Event Management (SIEM) and extended detection and response (XDR) platforms is enhancing automated threat response. This adoption is establishing anomaly detection as a key component of comprehensive cybersecurity frameworks

Anomaly Detection for Professional Market Dynamics

Driver

Rising Cybersecurity Threats and Regulatory Compliance

- The growing frequency and complexity of cyberattacks, coupled with strict regulatory requirements, are driving enterprises to invest heavily in anomaly detection solutions. These platforms help identify malicious activities, prevent data breaches, and ensure compliance across industries with sensitive information

- For instance, Anodot provides AI-powered anomaly detection services for finance and telecom sectors, enabling organizations to detect revenue leaks, transaction anomalies, and operational irregularities in real time. Such solutions enhance business resilience and strengthen governance frameworks

- The proliferation of IoT devices, cloud services, and interconnected enterprise systems is increasing the attack surface, necessitating continuous monitoring and proactive threat detection. Anomaly detection platforms allow organizations to manage these risks efficiently and maintain secure digital operations

- Enterprises are prioritizing real-time analytics to address insider threats, unauthorized access, and operational anomalies. Solutions that leverage machine learning and AI provide adaptive capabilities that evolve with changing threat landscapes

- The rising cost of data breaches and operational downtime is encouraging companies to adopt anomaly detection as a preventive measure. Investments in these technologies are now viewed as essential for protecting brand reputation, ensuring business continuity, and meeting compliance mandates

Restraint/Challenge

Complexity of Integrating Anomaly Detection Across Legacy Systems

- The anomaly detection market faces challenges due to the difficulty of implementing advanced AI- and ML-based monitoring solutions across existing legacy IT and OT infrastructures. Integration often requires significant customization, system upgrades, and alignment with pre-existing security protocols

- For instance, organizations attempting to deploy Splunk or Securonix anomaly detection platforms across heterogeneous IT environments often encounter compatibility issues with older systems, resulting in prolonged deployment timelines and higher operational costs

- Ensuring seamless data flow, system interoperability, and consistent anomaly detection across multiple platforms requires specialized skills and ongoing maintenance. This complexity can limit adoption among enterprises with constrained IT resources

- The reliance on high-quality, structured data for effective anomaly detection introduces additional hurdles. Legacy systems may lack the necessary data architecture, requiring data cleansing and transformation efforts before AI or ML models can function effectively

- Scaling anomaly detection solutions while maintaining accuracy, minimal false positives, and real-time responsiveness continues to challenge enterprises. These factors collectively place pressure on solution providers to offer flexible, integrable platforms that balance performance with enterprise requirements

Anomaly Detection for Professional Market Scope

The market is segmented on the basis of solution type, technology, deployment model, and end-user.

- By Solutions

On the basis of solutions, the anomaly detection for professional market is segmented into network behavior anomaly detection and user behavior anomaly detection. The network behavior anomaly detection segment dominated the largest market revenue share of 47% in 2025, driven by the increasing sophistication of cyber threats and the need for continuous monitoring of network traffic patterns. Organizations prioritize network-focused anomaly detection for its ability to identify unusual data flows, unauthorized access attempts, and potential breaches in real time. The market also sees strong demand for this segment due to its compatibility with existing security information and event management (SIEM) systems and the availability of advanced analytics features enhancing threat visibility and mitigation.

The user behavior anomaly detection segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the growing emphasis on insider threat detection and identity access management. For instance, companies such as Splunk and Securonix are increasingly offering solutions that analyze user activities to detect unusual behavior indicative of compromised credentials or policy violations. Organizations adopt user behavior anomaly detection for its ability to provide granular insights into individual actions, support compliance requirements, and reduce the risk of data breaches in sectors handling sensitive information.

- By Technology

On the basis of technology, the anomaly detection market is segmented into big data analytics, data mining and business intelligence, machine learning, and artificial intelligence. The machine learning segment dominated the largest market revenue share in 2025, driven by its ability to learn from historical data and identify subtle anomalies that traditional rule-based systems may miss. Enterprises increasingly leverage machine learning algorithms for predictive threat detection and proactive security management, enabling continuous improvement in anomaly detection accuracy. The segment benefits from the integration of machine learning with cloud and on-premises platforms, offering scalable and adaptive solutions to a wide range of industries.

The artificial intelligence segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by its advanced pattern recognition, automated threat response, and capability to handle massive, complex datasets. For instance, Darktrace utilizes AI-driven anomaly detection to autonomously identify and mitigate cyber threats across enterprise environments. AI-based solutions are particularly popular for their efficiency in real-time threat detection, reduction of manual monitoring workloads, and enhancement of overall organizational security posture.

- By Deployment Model

On the basis of deployment model, the anomaly detection for professional market is segmented into hybrid, on-premises, and cloud. The on-premises segment dominated the largest market revenue share in 2025, driven by organizations’ preference for maintaining control over sensitive data and critical security infrastructure. Enterprises adopt on-premises solutions for compliance with data privacy regulations, customizable security configurations, and seamless integration with existing IT environments. The market also sees strong demand for on-premises deployment due to the perceived reliability, low latency, and high level of security it provides for critical applications.

The cloud segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing adoption of cloud-based IT infrastructure and the scalability of cloud-native anomaly detection solutions. For instance, Microsoft Azure and AWS offer cloud-based anomaly detection services that enable real-time monitoring, cross-location analysis, and integration with cloud-native security tools. Organizations prefer cloud deployment for its cost-effectiveness, rapid deployment, and ability to leverage advanced analytics and AI capabilities without heavy upfront investments.

- By End User

On the basis of end user, the anomaly detection for professional market is segmented into banking, financial services, and insurance (BFSI), defense and government, healthcare, IT and telecom, retail, manufacturing, and others. The BFSI segment dominated the largest market revenue share in 2025, driven by the high stakes of financial fraud, regulatory compliance requirements, and the need to protect sensitive customer data. Financial institutions prioritize anomaly detection solutions to identify transaction anomalies, prevent identity theft, and ensure continuous monitoring of critical systems. The market also sees strong demand from BFSI due to the integration of anomaly detection with broader risk management and fraud prevention strategies.

The IT and telecom segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing reliance on complex networks and cloud infrastructure that require proactive threat detection. For instance, companies such as Cisco and Palo Alto Networks provide anomaly detection platforms for telecom operators to monitor traffic, prevent service disruptions, and enhance cybersecurity measures. Organizations in this sector adopt these solutions for their ability to detect emerging threats, reduce downtime, and improve overall operational resilience.

Anomaly Detection for Professional Market Regional Analysis

- North America dominated the anomaly detection for professional market with the largest revenue share of 46.1% in 2025, driven by the increasing frequency of cyberattacks and growing investments in enterprise cybersecurity solutions

- Organizations in the region are highly focused on strengthening threat detection frameworks and minimizing operational risks through advanced anomaly detection systems

- This widespread adoption is further supported by high digital maturity, substantial IT budgets, and regulatory compliance requirements such as GDPR and CCPA, positioning anomaly detection as a critical component of security infrastructure

U.S. Anomaly Detection Market Insight

The U.S. anomaly detection market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of cloud computing, IoT, and connected enterprise systems. Companies are prioritizing anomaly detection to identify unusual network and user behaviors, prevent fraud, and maintain data integrity. The rising integration of AI and machine learning in security solutions, coupled with increased demand for real-time monitoring, further propels market growth. In addition, the U.S.’s focus on cybersecurity frameworks and proactive threat mitigation strategies is significantly contributing to the expansion of the market.

Europe Anomaly Detection Market Insight

The Europe anomaly detection market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent data protection regulations and the need for enhanced cyber resilience across enterprises. The region is experiencing growing adoption of advanced analytics and AI-based anomaly detection solutions across BFSI, healthcare, and IT sectors. European organizations are increasingly leveraging anomaly detection to mitigate insider threats, prevent financial fraud, and comply with regulatory mandates such as PSD2. The demand for integrated solutions offering network and user behavior monitoring is fostering significant growth across both large enterprises and SMEs.

U.K. Anomaly Detection Market Insight

The U.K. anomaly detection market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by increasing concerns over cybersecurity breaches and digital fraud. Businesses are adopting anomaly detection solutions to enhance threat visibility and secure sensitive data, while the government’s focus on cyber resilience in critical infrastructure supports market expansion. The U.K.’s robust IT services sector, strong adoption of cloud solutions, and the rise in connected enterprise systems are expected to continue driving the uptake of anomaly detection technologies.

Germany Anomaly Detection Market Insight

The Germany anomaly detection market is expected to expand at a considerable CAGR during the forecast period, fueled by heightened awareness of cyber threats and the adoption of AI-enabled security solutions. Enterprises are focusing on proactive threat identification, fraud detection, and monitoring of user and network behavior to safeguard operations. Germany’s technologically advanced industrial and financial sectors, combined with strong data privacy regulations, are encouraging the deployment of both on-premises and cloud-based anomaly detection systems.

Asia-Pacific Anomaly Detection Market Insight

The Asia-Pacific anomaly detection market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid digital transformation, urbanization, and technological adoption in countries such as China, Japan, and India. Organizations in the region are increasingly implementing AI and machine learning-based anomaly detection to secure networks, prevent financial fraud, and enhance operational efficiency. Furthermore, government initiatives promoting cybersecurity and smart infrastructure development, alongside the rising number of SMEs investing in digital security, are contributing to widespread market growth.

Japan Anomaly Detection Market Insight

The Japan anomaly detection market is gaining momentum due to the country’s highly digitized economy, growing cyber risk awareness, and demand for operational security in enterprises. The adoption of anomaly detection solutions is being driven by the need to secure critical IT and industrial systems, prevent insider threats, and support compliance requirements. The integration of AI-driven anomaly detection with IoT and cloud-based platforms is fueling growth, with enterprises focusing on predictive threat detection and real-time monitoring.

China Anomaly Detection Market Insight

The China anomaly detection market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid digitalization, expanding enterprise networks, and high adoption of cloud and AI technologies. Chinese organizations across BFSI, IT, and manufacturing sectors are leveraging anomaly detection to prevent fraud, secure data, and enhance operational efficiency. The push towards smart cities, coupled with strong domestic cybersecurity solution providers, is further propelling the adoption of anomaly detection systems across commercial and government sectors.

Anomaly Detection for Professional Market Share

The anomaly detection for professional industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- Dell Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Anodot, Ltd. (Israel)

- Happiest Minds (India)

- GURUCUL (U.S.)

- Flowmon Networks a.s. (Czech Republic)

- Wipro Limited (India)

- SAS Institute Inc. (U.S.)

- Broadcom (U.S.)

- IBM (U.S.)

- Trustwave Holdings, Inc. (U.S.)

- LogRhythm, Inc. (U.S.)

- Splunk Inc. (U.S.)

- Trend Micro Incorporated (Japan)

- GREYCORTEX s.r.o. (Czech Republic)

- Securonix, Inc. (U.S.)

- Infosys Limited (India)

- Tracxn Technologies (India)

- PATTERNEX, INC. (U.S.)

Latest Developments in Global Anomaly Detection for Professional Market

- In 2024, SAS introduced a new anomaly detection module within its fraud prevention suite, targeting financial institutions and insurance providers. This development strengthens the adoption of advanced real-time analytics in the BFSI sector, enabling organizations to detect suspicious activities quickly and reduce financial losses. The module reinforces SAS’s position in the professional anomaly detection market by offering specialized solutions for fraud detection, enhancing enterprise trust and operational security

- In 2024, Elastic entered a strategic partnership with Microsoft to integrate its anomaly detection capabilities directly into Microsoft Azure. This collaboration expands the reach of anomaly detection to cloud-native environments, allowing enterprises to leverage advanced threat detection tools without additional infrastructure investments. The partnership is expected to drive adoption across organizations utilizing Azure, accelerating cloud-based anomaly detection deployment and strengthening Elastic’s presence in the professional market

- In 2024, Splunk appointed a new Chief Technology Officer to spearhead its strategy in anomaly detection and machine learning. This leadership change is aimed at driving innovation in enterprise security and operational analytics, enhancing the company’s capabilities in detecting and mitigating network and user anomalies. The move signals Splunk’s commitment to maintaining a competitive edge in the anomaly detection market and addressing evolving cybersecurity challenges for large organizations

- In 2024, Anodot secured $35 million in Series C funding to accelerate the development and global rollout of its AI-driven anomaly detection solutions for professional markets, including finance and telecom. This funding infusion enables Anodot to scale operations, enhance AI capabilities, and broaden market penetration. The investment highlights the growing demand for automated anomaly detection solutions and positions Anodot to capitalize on the expanding enterprise cybersecurity and monitoring market

- In 2024, Darktrace launched its next-generation anomaly detection platform designed to enhance real-time threat detection for large enterprises. Leveraging advanced AI to identify subtle deviations in network behavior, this platform strengthens proactive threat management and operational resilience. The launch reinforces Darktrace’s leadership in the enterprise anomaly detection market and encourages wider adoption of AI-powered cybersecurity solutions across industries with critical infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.