Global Anatomic Pathology Market

Market Size in USD Billion

CAGR :

%

USD

22.76 Billion

USD

38.67 Billion

2024

2032

USD

22.76 Billion

USD

38.67 Billion

2024

2032

| 2025 –2032 | |

| USD 22.76 Billion | |

| USD 38.67 Billion | |

|

|

|

|

Anatomic Pathology Market Size

- The global anatomic pathology market size was valued at USD 22.76 billion in 2024 and is expected to reach USD 38.67 billion by 2032, at a CAGR of 6.85% during the forecast period

- This growth is driven by factors such as expansion of the pharmaceutical industry, rising demand for generic drugs and technological advancements in drug delivery systems

Anatomic Pathology Market Analysis

- Anatomic pathology is a critical branch of pathology that focuses on the examination of tissues, organs, and whole bodies to diagnose diseases, including cancer, inflammatory disorders, and infections. It plays a vital role in personalized medicine and targeted therapies by providing precise diagnostic information

- The demand for anatomic pathology is significantly driven by the rising prevalence of cancer, increasing geriatric population, and advancements in molecular pathology and digital imaging technologies. These innovations improve diagnostic accuracy and enhance patient outcomes

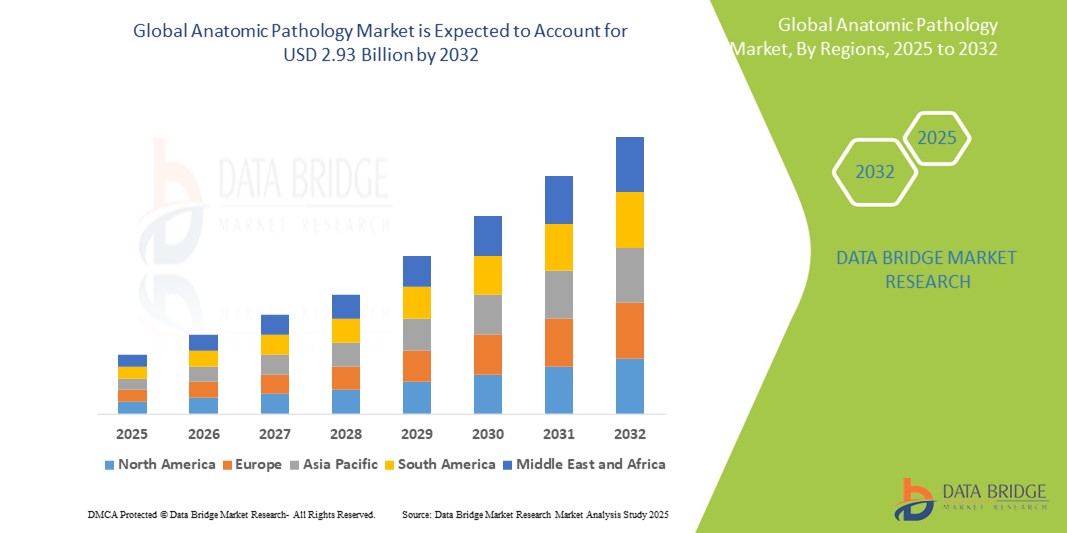

- North America is expected to dominate the anatomic pathology market with market share of 47.5%, due to its advanced healthcare infrastructure, high prevalence of chronic diseases, and significant investments in research and development

- Asia-Pacific is expected to be the fastest growing region in the anatomic pathology market with a market share of 21.1%, during the forecast period, driven by rapid healthcare infrastructure development, increasing awareness about early disease detection, and rising cancer incidence

- Consumables segment is expected to dominate the market with a market share of 69.3%, driven by their essential role in diagnostic processes

Report Scope and Anatomic Pathology Market Segmentation

|

Attributes |

Anatomic Pathology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anatomic Pathology Market Trends

“Technological Integration & Automation in Anatomic Pathology Workflows”

- One prominent trend in the anatomic pathology market is the increasing integration of digital pathology platforms and automated slide scanners to streamline diagnostics and enhance workflow efficiency

- These innovations support pathologists by enabling high-resolution digital imaging, AI-assisted analysis, and remote diagnostic capabilities, reducing turnaround times and improving diagnostic accuracy

- For instance, whole-slide imaging (WSI) systems paired with AI-powered image analysis tools allow for the rapid identification of cancerous tissues and cellular anomalies, which is especially valuable in high-throughput laboratories and oncology diagnostics

- These advancements are reshaping pathology services by promoting faster, more precise diagnoses and fostering a transition toward fully digital, interconnected lab ecosystems, which are critical for managing rising caseloads and ensuring quality in patient care

Anatomic Pathology Market Dynamics

Driver

“Rising Cancer Incidence and Increasing Demand for Accurate Diagnostics”

- The rising global cancer burden is a major driver of the anatomic pathology market, as accurate tissue diagnosis is essential for effective cancer treatment

- As cancer rates continue to increase, the demand for precise pathological analysis grows, supporting early detection, personalized therapies, and better patient outcomes

- The need for detailed tissue analysis to differentiate between benign and malignant tumors, assess disease progression, and guide targeted therapies further drives market growth

For instance,

- In December 2023, according to the World Health Organization (WHO), cancer remains a leading cause of death worldwide, with approximately 10 million deaths annually, highlighting the critical role of accurate diagnostic techniques in early detection and treatment

- As a result, the demand for advanced anatomic pathology solutions, including tissue staining, immunohistochemistry (IHC), and digital pathology, continues to rise

Opportunity

“Integration of Artificial Intelligence and Digital Pathology”

- AI-powered pathology systems can enhance diagnostic accuracy, automate routine tasks, and streamline laboratory workflows, reducing turnaround times and operational costs

- These technologies enable pathologists to identify complex patterns, assess tissue samples more accurately, and provide faster, more precise diagnoses

- In addition, AI-driven systems can assist in image analysis, enabling pathologists to identify rare cell types and assess disease progression more efficiently

For instance,

- In January 2025, according to a study published in the Journal of Pathology Informatics, AI-based image analysis systems demonstrated over 95% accuracy in detecting breast cancer cells, significantly reducing diagnostic errors and improving patient outcomes

- The integration of AI in anatomic pathology can lead to more personalized treatment plans, reduced diagnostic variability, and improved patient outcomes, making it a significant growth opportunity

Restraint/Challenge

“High Equipment Costs and Skilled Workforce Shortage”

- The high cost of advanced anatomic pathology equipment, including automated tissue processors, digital scanners, and AI-powered diagnostic tools, poses a significant barrier to market growth, particularly for small and mid-sized laboratories

- These technologies often require significant upfront investments, ongoing maintenance, and specialized training for pathologists and technicians

- This financial barrier can limit the adoption of advanced diagnostic tools, especially in developing regions where healthcare budgets are constrained

For instance,

- In November 2024, according to a report by the Pathology Devices Association, the high cost of digital pathology systems can exceed USD 200,000 per unit, significantly impacting the ability of smaller labs to adopt these technologies, thereby limiting market penetration

- Consequently, these cost challenges can create disparities in diagnostic quality and access to advanced pathology services, affecting overall patient outcomes

Anatomic Pathology Market Scope

The market is segmented on the basis of product and service, end user and application.

|

Segmentation |

Sub-Segmentation |

|

By Product and Service |

|

|

By End User |

|

|

By Application |

|

In 2025, the consumables is projected to dominate the market with a largest share in product and service segment

The consumables segment is expected to dominate the anatomic pathology market with the largest share of 69.3% in 2025 due to its critical role in diagnostic processes. As essential components in tissue analysis, including reagents, antibodies, and kits, consumables support accurate disease diagnosis and efficient laboratory workflows, driving market growth. The increasing demand for precise diagnostics in cancer and other chronic diseases further reinforces this segment's market dominance.

The disease diagnosis is expected to account for the largest share during the forecast period in application market

In 2025, the disease diagnosis segment is expected to dominate the anatomic pathology market with the largest share of 59.1% due to its critical role in diagnosing various diseases, particularly cancers. The growing need for accurate diagnostic tools to detect and monitor complex diseases drives market growth, reinforcing this segment's market leadership.

Anatomic Pathology Market Regional Analysis

“North America Holds the Largest Share in the Anatomic Pathology Market”

- North America dominates the anatomic pathology market, accounting for approximately 47.5% of the total market share, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key market players

- U.S. holds a significant share within this region, contributing around 39.1% to the global market, supported by its well-established pharmaceutical industry, extensive research and development activities, and increasing demand for precise disease diagnostics

- The substantial share held by North America is further reinforced by favourable reimbursement policies, continuous advancements in diagnostic technologies, and the presence of major market players investing heavily in R&D

- In addition, the high volume of pathology tests and strong focus on early disease detection in the U.S. continue to drive market growth in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Anatomic Pathology Market”

- Asia-Pacific accounted for approximately 21.1% of the global anatomic pathology market in 2024, with the highest projected growth rate among all regions, driven by rapid healthcare infrastructure development, increasing awareness about early disease detection, and rising cancer incidence

- Countries such as China, India, and Japan are emerging as key markets, driven by rapid expansion in healthcare infrastructure, increasing awareness about disease diagnosis, and rising surgical volumes

- Japan, with its advanced medical technology and increasing number of pathologists, remains a crucial market for premium diagnostic equipment, supporting accurate disease diagnosis

- India is projected to register the highest CAGR of 14.6% within the region, fueled by the rapid growth of its healthcare sector, increasing healthcare expenditure, and rising demand for efficient diagnostic tools, making it a key player in the global market

Anatomic Pathology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc. (U.K.)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Lilly (U.S.)

- Merck & Co., Inc. (U.S.)

- AbbVie Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Cipla Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Abbott (U.S.)

Latest Developments in Global Anatomic Pathology Market

- In April 2024, Clarapath, a medical robotics company, announced a strategic collaboration with Mayo Clinic to propel a new era of laboratory automation. This partnership aims to enhance the efficiency and accuracy of anatomic pathology workflows through advanced automation technologies

- In May 2024, Indica Labs received FDA clearance for its HALO AP Dx digital pathology platform. This approval marks a significant milestone in the adoption of digital pathology solutions, enabling pathologists to analyze digital slides with improved precision and efficiency

- In September 2023, Lab Genomics USA, a subsidiary of Lab Genomics Co., Ltd., announced the acquisition of QDx Pathology, a leader in molecular and diagnostic pathology. This acquisition is anticipated to significantly impact the firm's capabilities and the broader industry's future by expanding molecular diagnostic services

- In March 2023, PathAI introduced the Aim-PDL1 algorithm and digital pathology platform for non-small cell lung cancer (NSCLC) in collaboration with 13 top academic medical facilities, health systems, independent pathology institutions, and reference laboratories nationwide. This initiative aims to enhance diagnostic accuracy and streamline pathology workflows through AI integration

- In February 2022, GlobalMedia Group, LLC achieved the CE mark for its ClinicalAccess Station Lite, the eNcounter telehealth software suite, and other diagnostic examination cameras. This regulatory approval allows the company to expand its telepathology services within the European Union, improving access to pathology diagnostics in remote areas

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.