Amino acids and Proteins for Animal Nutrition Market Analysis and Size

As most livestock cannot synthesise amino acids, animal feed amino acids have grown in popularity in recent years. Research and development activities have revealed that the first and second limiting amino acids, lysine (Lys) and methionine (Met), are increasingly used in lactating dairy cows to improve production efficiency and reduce metabolic disorders.

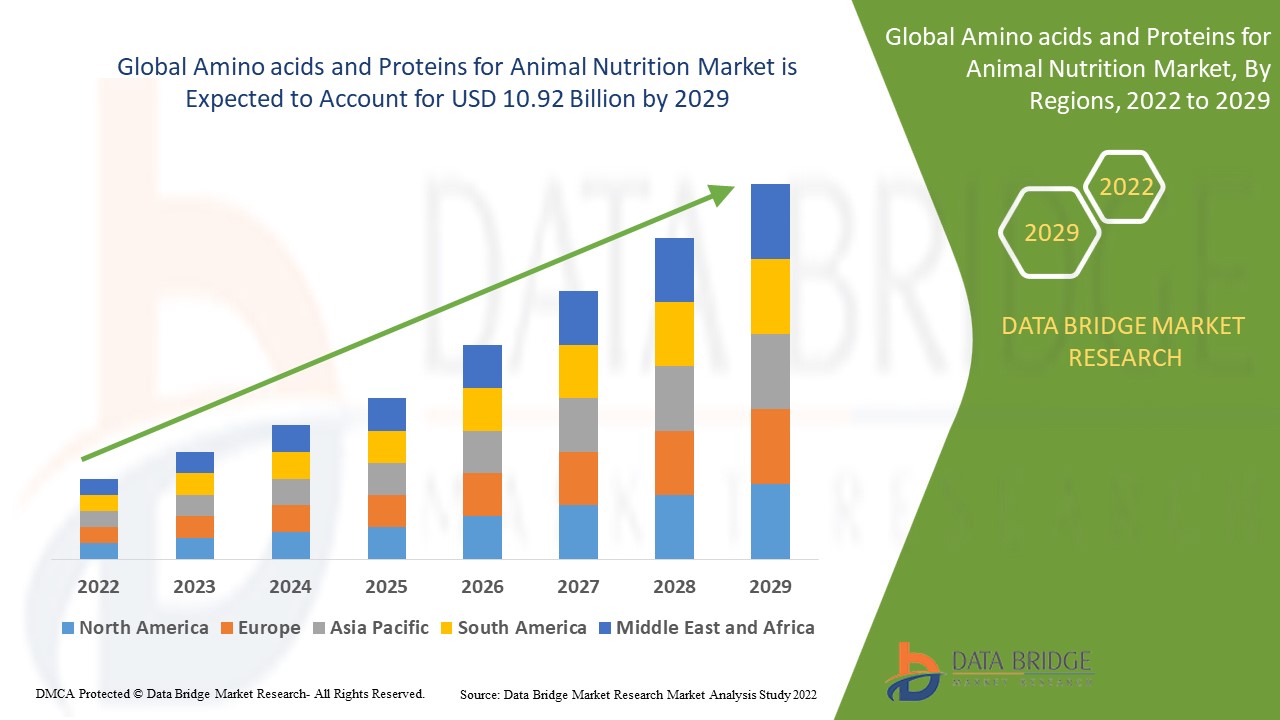

Data Bridge Market Research analyses that the amino acids and proteins for animal nutrition market which was growing at a value of 6.7 billion in 2021 and is expected to reach the value of USD 10.92 billion by 2029, at a CAGR of 6.30% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, technological advancements and patent analysis.

Amino acids and Proteins for Animal Nutrition Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Classification (Nutritionally Essential, Nonessential), Application (Ruminant Feed, Aquatic Feed, Equine Feed, Poultry Feed, Swine Feed), |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Dow (U.S.), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (U.S.), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (USA), Alltech (Nicholasville), Associated British Foods plc (U.K.), Charoen Pokphand Foods PCL (Thailand), Cargill, Incorporated (U.S.), Nutreco (Netherlands), ForFarmers. (Netherlands), De Heus Animal Nutrition (Netherlands), Land O'Lakes (U.S.), Kent Nutrition Group (U.S.), J. D. HEISKELL & CO. (U.S.), Perdue Farms (U.S.), SunOpta (Canada), Scratch and Peck Feeds (U.S.), De Heus Animal Nutrition (Netherlands), MEGAMIX (Russia), Agrofeed (Hungary) |

|

Opportunities |

|

Market Definition

Amino acids are important in health nutrition, particularly parenteral nutrition. Amino acids are frequently used in animal feed as dietary supplements. Amino acids are used as animal feed to increase metabolic rate and provide nutrition to animals such as cattle, broilers, and pigs. Furthermore, feed amino acids aid in animal health, reproduction, and lactation.

Amino acids and Proteins for Animal Nutrition Market Dynamics

Drivers

- Growing emphasis on animal health

Increased emphasis on animal health will also drive market growth. Increased cattle farming is likely to result in increased demand for amino acids and proteins for animal nutrition. Humans' increasing demand for animal-based products will drive up market demand. Proponents of natural growth are expected to be active in the market as their momentum grows. Rising consumer awareness of the benefits of using feed additives to reduce disease has fuelled the market's demand.

- Increase in the demand for organic meat

Food safety concerns have increased the demand for amino acids and proteins for animal nutrition to ensure meat safety. Another factor driving the growth of amino acids and proteins for animal nutrition is the growing awareness among farm owners of the importance of maintaining a healthy diet. As a result, they are transitioning from standard feed additives to functional and premium variants that help improve the animals' immunity against enzootic diseases while also lowering the risk of metabolic disorders, acidosis, injuries, and infections.

Furthermore, an increase in demand for organic meat from developed-country consumers, as well as the implementation of new animal rearing practises and the maintenance of high farming standards, has created a positive outlook for the industry.

Opportunity

The rising demand for nutritional supplements, combined with an increase in aquaculture development for the maintenance of aquatic animal health and nutrition, will create lucrative opportunities, resulting in the growth of the amino acids and proteins for animal nutrition market during the forecast period.

Restraints

The high cost of animal nutrition, as well as the availability of low-quality products, will most likely act as market restraints for the growth of amino acids and proteins for animal nutrition during the forecast period.

This amino acids and proteins for animal nutrition market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the amino acids and proteins for animal nutrition market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Amino acids and Proteins for Animal Nutrition Market

Agriculture and food production have been identified as critical sectors Global during the COVID-19 situation. As a result, farmers have continued to ensure that farm animals receive high-quality nutrition in order to feed an increasing number of Global consumers. However, the disruption of the supply chain has become the most significant factor affecting the amino acids and proteins for animal nutrition market. China is a major producer and exporter of amino acids premix for feed, and it stockpiled significant amounts of product during the emergence of the COVID-19 situation while businesses were closed for the Lunar New Year, which was enough for 2-3 months’ supply. Furthermore, logistics issues have hampered the supply of containers and vessels, as well as the transport of certain micro-ingredients.

Recent Development

- Cargill and BASF partnered in the animal nutrition business in October 2021, adding research and development capabilities and new markets to the partners' existing feed enzymes distribution agreements. This collaboration aided in the development, production, marketing, and sale of customer-focused enzyme products and solutions for animals, including swine.

- De Heus acquired Coppens Diervoeding, a feed manufacturing company based in the Netherlands that specialises in the pig farming sector, in July 2021. This acquisition enabled the company to double its production capacity and strengthen its regional presence by 400k.

- ADM opened a new livestock feed plant in Ha Nam province, Vietnam, in November 2019. The new facility adds to ADM's growing list of investments in Vietnam, becoming the company's fifth plant dedicated to animal nutrition in the country. The plant is

Global amino acids and Proteins for Animal Nutrition Market Scope

The amino acids and proteins for animal nutrition market is segmented on the basis of classification and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Classification

- Nutritionally essential

- Phenylalanine

- Valine

- Threonine

- Tryptophan

- Isoleucine

- Methionine

- Histidine

- Arginine

- Leucine and lysine

- Non-essential

- Alanine

- Aspartic acid

- Cysteine

- Cystine

- Glutamic acid

- Glycine

- Hydroxyproline

- Proline

- Serine and tyrosine

Application

- Ruminant Feed

- Aquatic Feed

- Equine Feed

- Poultry Feed

- Swine Feed

Amino acids and Proteins for Animal Nutrition Market Regional Analysis/Insights

The amino acids and Proteins for Animal Nutrition market is analysed and market size insights and trends are provided by country, classification and application as referenced above.

The countries covered in the amino acids and proteins for animal nutrition market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the amino acids and proteins for animal nutrition market due to rising consumption of milk, meat, and meat products, as well as a growing population in the region.

North America and Europe are expected to grow during the forecast period due to the presence of various manufacturing companies in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Amino acids and Proteins for Animal Nutrition Market Share Analysis

The amino acids and proteins for animal nutrition market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to amino acids and proteins for animal nutrition market.

Some of the major players operating in the amino acids and proteins for animal nutrition market are:

- Cargill, Incorporated (U.S)

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (Nicholasville)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch Peck Feeds (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.