Global Aluminum Rolled Products Market

Market Size in USD Billion

CAGR :

%

USD

57.16 Billion

USD

94.60 Billion

2024

2032

USD

57.16 Billion

USD

94.60 Billion

2024

2032

| 2025 –2032 | |

| USD 57.16 Billion | |

| USD 94.60 Billion | |

|

|

|

|

Aluminum Rolled Products Market Analysis

The global aluminum rolled products market is experiencing significant growth, driven by increasing demand across various industries such as automotive, aerospace, packaging, and construction. Aluminum rolled products, including sheets, foils, and coils, are prized for their lightweight, corrosion-resistant properties, making them ideal for applications that require strength without adding weight. The market is poised to benefit from advancements in manufacturing technologies, including precision rolling and surface treatment techniques that enhance the properties of aluminum products.

One of the key trends in the industry is the growing demand for high-performance aluminum rolled products, particularly in automotive and aerospace sectors, where the focus on lightweight materials is intensifying to improve fuel efficiency and reduce emissions. In addition, innovations in aluminum recycling and green production methods are pushing the market toward more sustainable practices. Regions such as North America and Europe are major contributors to the market, with companies investing in state-of-the-art facilities to meet the rising demand. Technological advancements such as the use of advanced alloys and coatings are enabling manufacturers to cater to niche requirements across industries, further driving the market's growth. Overall, the Aluminum Rolled Products market is set to expand with increasing applications, sustainability trends, and technological advancements.

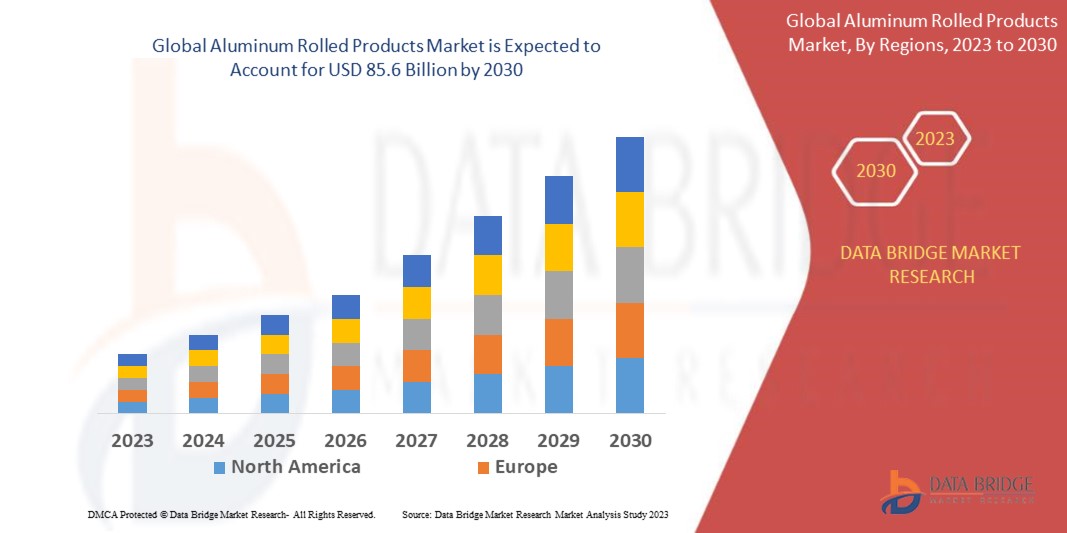

Aluminum Rolled Products Market Size

The global aluminum rolled products market size was valued at USD 57.16 billion in 2024 and is projected to reach USD 94.60 billion by 2032, with a CAGR of 6.50% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Aluminum Rolled Products Market Trends

“Increasing Adoption of Lightweight Aluminum Solutions”

One prominent trend driving the aluminum rolled products market is the increasing adoption of lightweight aluminum solutions in the automotive industry. As the automotive sector focuses on improving fuel efficiency and reducing emissions, manufacturers are increasingly turning to aluminum rolled products, such as aluminum sheets and coils, for vehicle production. These products offer a combination of strength, lightness, and corrosion resistance, making them ideal for use in automotive body panels, engine components, and structural parts. For instance, the use of aluminum in electric vehicles (EVs) is growing rapidly, as automakers aim to reduce vehicle weight to extend battery range. Companies such as Tesla and BMW have incorporated high percentages of aluminum in their vehicle designs, with aluminum rolled products playing a crucial role in meeting industry standards for durability and performance. This trend toward lightweighting is expected to continue driving the demand for aluminum rolled products, particularly in sectors focused on sustainability and energy efficiency.

Report Scope and Aluminum Rolled Products Market Segmentation

|

Attributes |

Aluminum Rolled Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Alcoa Corporation (U.S.), Novelis (U.S.), Arconic (U.S.), Constellium (France), UACJ Corporation (Japan), Norsk Hydro ASA (Norway), Gränges (Sweden), Aluminium Corp (China), China Hongqiao Group Limited (China), Xinfal (China), KOBE STEEL, LTD. (Japan), Hulamin (South Africa), Kaiser Aluminum (U.S.), AMAG Austria Metall AG (Austria), Viohalco (Belgium), and TOYO ALUMINIUM K.K. (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aluminum Rolled Products Market Definition

Aluminum rolled products refer to aluminum sheets, coils, and plates that are produced by rolling aluminum ingots or billets through a process that involves compressing the material at elevated temperatures or cold temperatures to achieve the desired thickness.

Aluminum Rolled Products Market Dynamics

Drivers

- Rising Demand for Lightweight Materials

The growing need for lightweight materials, especially in industries such as automotive and aerospace, is one of the primary drivers of the aluminum rolled products market. Manufacturers are increasingly turning to aluminum for vehicle body panels, as it reduces overall weight, which directly enhances fuel efficiency and reduces emissions. This is particularly relevant in the automotive industry, where regulatory standards on fuel efficiency and carbon emissions are becoming more stringent. For instance, in the production of electric vehicles, aluminum’s lightweight nature contributes to higher energy efficiency and longer battery life. Moreover, the aerospace sector also benefits from aluminum rolled products, as they contribute to the construction of lightweight aircraft, reducing fuel consumption and improving overall performance. As environmental concerns rise and regulations tighten, aluminum’s lightweight properties make it an attractive material, driving further market growth.

- Growth in Construction and Infrastructure

The booming construction and infrastructure sectors worldwide are also propelling the demand for aluminum rolled products. Aluminum is widely used in the construction of building facades, windows, and roofing materials due to its durability, corrosion resistance, and aesthetic flexibility. For instance, architects and builders often prefer aluminum for window frames and curtain walls because of its sleek, modern look, and ability to withstand harsh weather conditions. In addition, aluminum's resistance to corrosion ensures longevity, reducing maintenance costs for building owners. The growing trend towards green and sustainable buildings further boosts the demand for aluminum, as the material can be easily recycled and is considered eco-friendly. As the construction sector expands in both emerging and developed markets, the demand for aluminum rolled products continues to rise, making it a significant market driver.

Opportunities

- Increasing Focus on Sustainability and Environmental Regulations

The increasing focus on sustainability and environmental regulations is presenting a significant opportunity for the aluminum rolled products market. Aluminum’s high recyclability makes it an attractive material for industries striving to reduce their environmental footprint. As governments and regulatory bodies enforce stricter standards to lower carbon emissions, industries such as automotive, construction, and packaging are turning to aluminum to meet these requirements. For instance, the automotive sector is adopting aluminum in vehicle production to reduce weight and improve fuel efficiency, aligning with global initiatives aimed at cutting CO2 emissions. Furthermore, aluminum’s ability to be recycled repeatedly without loss of quality ensures a closed-loop system that minimizes waste, which aligns with circular economy principles. This growing emphasis on eco-friendly materials offers a market opportunity for aluminum manufacturers to cater to industries focused on reducing their environmental impact, further driving the demand for aluminum rolled products.

- Increasing Technological Advancements in Aluminum Processing and Rolling

Technological innovations in aluminum processing and rolling are opening new market opportunities by enhancing the quality, efficiency, and cost-effectiveness of aluminum rolled products. Advancements in automation, such as the use of robotic systems for precision rolling, enable manufacturers to produce high-quality products with greater consistency and at lower costs. For instance, improved rolling techniques such as twin-roll casting allow for the production of thinner, stronger aluminum sheets, ideal for applications in automotive, aerospace, and packaging industries. These innovations also make it easier to meet the increasing demand for custom-sized and tailored aluminum products, further expanding their use across diverse sectors. In addition, advancements in energy-efficient processing methods are reducing production costs and minimizing the carbon footprint of aluminum manufacturing. As these technologies continue to evolve, they present a substantial opportunity for aluminum rolled products to become even more accessible and attractive for various industries, driving growth in the market.

Restraints/Challenges

- High Production Costs

The production of aluminum rolled products involves significant costs related to raw materials, energy consumption, and manufacturing processes. Aluminum, as a base metal, requires extensive energy to extract from bauxite and process into rolled products. In addition, maintaining specialized equipment for rolling, cutting, and finishing requires ongoing investments. For instance, aluminum production facilities often require energy-intensive processes such as electrolysis to produce aluminum from bauxite ore, driving up the cost of production. These high production costs can make aluminum products less competitive compared to alternative materials, especially in price-sensitive sectors such as packaging and automotive. The ongoing volatility of energy prices and raw material costs exacerbates this issue.

- Competition from Alternative Materials

Aluminum rolled products face competition from alternative materials, such as plastics, steel, and composites, which are often cheaper and easier to process. For instance, in the automotive and aerospace industries, high-strength steel and carbon fiber composites are increasingly being used in place of aluminum due to their lighter weight, strength, and cost-effectiveness. In packaging, plastic and glass containers can serve as alternatives to aluminum, offering different performance characteristics at a lower cost. The competition from these substitutes, especially in cost-sensitive markets, poses a challenge for the aluminum rolled products sector to maintain its market share.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Aluminum Rolled Products Market Scope

The market is segmented on the basis of grade and end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Grade

- 1xxx Series

- 1050

- Others

- 3xxx Series

- 3003

- Others

- 5xxx Series

- 5005

- Others

- 6xxx Series

End Use

- Transportation

- Automotive

- Aerospace

- Train

- Shipbuilding

- Building and Infrastructure

- Building Facades

- Doors and Windows

- Packaging

- Consumer Durables

- Others

Aluminum Rolled Products Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, grade, and end use as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is anticipated to dominate the aluminum rolled products market during the forecast period, driven by rising consumer spending, shifting lifestyles, and the rapid growth of the building and construction sector. This region's increased demand for aluminum in infrastructure projects, along with a surge in urbanization and industrialization, is further contributing to market growth. In addition, growing investments in residential and commercial real estate are expected to boost aluminum's demand. The expanding construction industry, coupled with evolving consumer needs, is positioning Asia-Pacific as a key driver in the market.

North America is projected to experience fastest growth in the aluminum rolled products market from 2025 to 2032, driven by the rising demand for aluminum in the automotive sector. The region's focus on reducing carbon emissions through stringent environmental regulations is pushing manufacturers toward lightweight materials, with aluminum being a key solution. In addition, the automotive industry's increasing need for energy-efficient and fuel-saving vehicles is boosting aluminum consumption. These factors, combined with the growing trend of using sustainable materials in manufacturing, position North America for robust market growth during the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aluminum Rolled Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Aluminum Rolled Products Market Leaders Operating in the Market Are:

- Alcoa Corporation (U.S.)

- Novelis (U.S.)

- Arconic (U.S.)

- Constellium (France)

- UACJ Corporation (Japan)

- Norsk Hydro ASA (Norway)

- Gränges (Sweden)

- Aluminium Corp (China)

- China Hongqiao Group Limited (China)

- Xinfal (China)

- KOBE STEEL, LTD. (Japan)

- Hulamin (South Africa)

- Kaiser Aluminum (U.S.)

- AMAG Austria Metall AG (Austria)

- Viohalco (Belgium)

- TOYO ALUMINIUM K.K. (Japan)

Latest Developments in Aluminum Rolled Products Market

- In May 2024, Shyam Metalics & Energy announced a major greenfield expansion project focused on aluminum flat-rolled products. The company plans to invest Rs 450 crore in the initiative, which will create 1,000 direct and indirect jobs. This expansion aims to boost manufacturing capacity and address the demand-supply gap, making the group self-sufficient in producing raw materials for the aluminum foil business. The new plant will be located in Odisha

- In July 2022, Hydro extended the subscription period for its proposed acquisition of Alumetal S.A., a move that reflects the company's continued growth strategy in the aluminum sector

- In July 2022, Hydro’s Rackwitz aluminum recycling plant was set to supply more post-consumer aluminum to automotive clients, highlighting the company’s efforts to cater to growing demand from the automotive industry for sustainable materials

- In April 2020, Novelis Inc. completed its acquisition of Aleris Corporation, enhancing its position as a global leader in aluminum rolling and recycling. The acquisition expands Novelis’ product portfolio and strengthens its commitment to sustainability and safety, better positioning the company to meet increasing customer demand for aluminum

- In November 2020, Alcoa Corporation announced the sale of its rolling mill operations to Kaiser Aluminum Corporation for approximately USD 670 million. The deal involved the Alcoa Warrick LLC's mill operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aluminum Rolled Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aluminum Rolled Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aluminum Rolled Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.