Global Alpha Olefins Market

Market Size in USD Billion

CAGR :

%

USD

11.18 Billion

USD

16.65 Billion

2024

2032

USD

11.18 Billion

USD

16.65 Billion

2024

2032

| 2025 –2032 | |

| USD 11.18 Billion | |

| USD 16.65 Billion | |

|

|

|

|

Alpha Olefins Market Analysis

The Alpha Olefins market has witnessed substantial growth, driven by the expanding demand for these chemical intermediates in various industries such as plastics, detergents, lubricants, and surfactants. Alpha olefins, including 1-butene, 1-hexene, and 1-decene, are produced through methods such as oligomerization of ethylene, and they are crucial in manufacturing high-performance polyethylene and other products. Recent technological advancements in the production process, such as improvements in catalyst systems and more efficient cracking technologies, have enhanced production capacities, making alpha olefins more affordable and accessible for industries worldwide.

Moreover, the demand for biodegradable lubricants, eco-friendly detergents, and other sustainable alternatives is propelling the use of alpha olefins as renewable feedstocks. The increasing emphasis on sustainability in chemical manufacturing has led to the development of greener production methods, such as those utilizing renewable resources. The surge in the automotive, packaging, and personal care industries further contributes to the growth of the alpha olefins market. In addition, with the growing need for high-quality packaging materials and the rise of smart plastics, alpha olefins are expected to play a pivotal role in the next wave of industry innovations.

Alpha Olefins Market Size

The global Alpha Olefins market size was valued at USD 11.18 billion in 2024 and is projected to reach USD 16.65 billion by 2032, with a CAGR of 5.10% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Alpha Olefins Market Trends

“Increasing Demand for Sustainable and Plant-Based Alternatives”

One significant trend driving the growth of the Alpha Olefins market is the increasing demand for sustainable and biodegradable materials, particularly in the packaging and automotive industries. Alpha olefins, such as 1-butene and 1-hexene, are essential in manufacturing high-performance polyethylene, which is widely used for eco-friendly packaging solutions. As global environmental concerns rise, industries are shifting toward bio-based and recyclable materials to reduce their carbon footprint. For instance, the automotive industry is embracing alpha olefins to create more durable and sustainable plastic components for vehicles, reducing the reliance on traditional plastics. In addition, advancements in green production technologies, such as the use of renewable feedstocks for alpha olefin production, are further supporting this trend. This growing focus on sustainability drives the demand for alpha olefins and encourages innovation in developing more eco-friendly alternatives, positioning the market for long-term growth in alignment with environmental goals.

Report Scope and Alpha Olefins Market Segmentation

|

Attributes |

Alpha Olefins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

INEOS (U.K.), Chevron Phillips Chemical Company LLC (U.S.), Exxon Mobil Corporation (U.S.), Mitsubishi Chemical Group Corporation (Japan), Qatar Chemical Company Ltd (Qatar), Sasol (South Africa), Evonik Industries AG (Germany), Dow (U.S.), Royal Dutch Shell (Netherlands), SABIC (Saudi Arabia), Idemitsu Kosan Co.Ltd. (Japan), Petro Rabigh (Saudi Arabia), National Petrochemical Company (Iran), Tappico (U.S.), and TPC Group (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alpha Olefins Market Definition

Alpha olefins are a group of hydrocarbons that are unsaturated and have a double bond located at the first carbon of their molecular chain, making them highly reactive and useful in various chemical processes. These compounds are typically produced through the cracking of larger hydrocarbons, such as in the petrochemical industry, and are commonly used as raw materials for producing a wide range of products.

Alpha Olefins Market Dynamics

Drivers

- Rising Demand for Polyethylene

Polyethylene, a widely used plastic, plays a crucial role in packaging, automotive, and construction industries due to its durability, versatility, and cost-effectiveness. The growing demand for polyethylene materials, especially for packaging solutions such as flexible films, bottles, and bags, is driving the need for alpha olefins such as 1-butene and 1-hexene. These olefins act as co-monomers in the production of linear low-density polyethylene (LLDPE), which is used in a wide range of applications, from food packaging to agricultural films. For instance, the increase in e-commerce and online shopping has resulted in a surge in demand for plastic packaging, which in turn has led to greater consumption of alpha olefins to meet production needs. This growth in the polyethylene sector is a significant market driver for alpha olefins as the demand for these co-monomers is directly tied to the production of high-quality polyethylene.

- Expansion in the Automotive and Oil & Gas Industries

Alpha olefins, especially 1-octene, are essential in the automotive and oil & gas industries for manufacturing lubricants, fuel additives, and detergents. With the increasing demand for high-performance lubricants in vehicles and machinery to enhance their efficiency and longevity, the need for 1-octene as a co-monomer for polyethylene and synthetic lubricants is growing. Moreover, 1-octene is used to produce specialty chemicals such as synthetic fuels and polymers, further driving market expansion. The booming oil and gas exploration activities, particularly in emerging markets, are also contributing to this growth. As more efficient and environmentally friendly lubricants and additives are required in the sector, the use of alpha olefins is expected to rise. For instance, the push toward sustainable energy solutions is driving the development of high-performance lubricants that reduce friction and energy consumption, increasing the demand for alpha olefins in the industry.

Opportunities

- Increasing Technological Advancements in Production

Technological advancements in alpha olefins production have led to the development of more efficient and cost-effective methods, particularly through the use of advanced catalysts in the polymerization process. These catalysts help to optimize reaction rates, improve selectivity, and reduce energy consumption during production, ultimately lowering the overall costs of manufacturing alpha olefins. This reduction in production costs, combined with the increased efficiency, makes alpha olefins more accessible to a wider range of industries, boosting the market’s growth. For instance, the introduction of single-site catalysts in the production of 1-hexene has significantly enhanced the commercial viability of the compound, allowing it to be used more extensively in applications such as linear low-density polyethylene (LLDPE) production and specialty chemicals. As the cost of production decreases and new technologies emerge, alpha olefins are expected to see expanded use, creating new market opportunities in various sectors, including packaging, automotive, and lubricants.

- Increasing Consumer Demand for Environmentally Friendly Products

The increasing consumer demand for environmentally friendly products has led to a rise in the use of alpha olefins in the production of biodegradable and sustainable products. Alpha olefins are key ingredients in the creation of eco-friendly detergents, surfactants, and other cleaning agents that are biodegradable and less harmful to the environment. For instance, alpha olefins are used to produce surfactants for detergents that break down quickly in nature, reducing the impact on aquatic ecosystems. As sustainability becomes a greater focus across industries, companies are looking for alternative raw materials that align with eco-conscious practices. The growing trend toward sustainable production and the development of green chemistry processes offers significant opportunities for market growth. For instance, companies such as SABIC are innovating to produce high-performance biodegradable products using renewable feedstocks, positioning alpha olefins as a valuable component in the green economy. This shift toward sustainability is a key driver, creating opportunities for alpha olefins in various consumer goods and industrial applications.

Restraints/Challenges

- High Production Costs

The production of alpha olefins, including popular compounds such as 1-butene, 1-hexene, and 1-octene, is associated with high production costs due to the complex processes involved in their manufacture. These chemicals are typically produced via cracking and polymerization processes, both of which require specialized equipment, high-pressure reactors, and catalysts that increase production expenses. The need for such advanced technology means that the costs for setting up and maintaining production facilities are substantial. For instance, to produce 1-hexene, a commonly used alpha olefin, large-scale petrochemical refineries must use high-energy processes such as oligomerization, which require significant capital investment and continuous energy input. As a result, the production of these chemicals becomes expensive, especially when compared to alternative materials such as plant-based oils or bio-based chemicals. Smaller companies, especially those with limited budgets, often find it challenging to compete with larger players who can leverage economies of scale. This high production cost is a barrier for market expansion and profitability, limiting the ability of new entrants or smaller players to gain a foothold in the alpha olefins market.

- Regulatory Challenges

The Alpha Olefins market is facing increasing regulatory scrutiny, particularly as concerns about the environmental impact of petrochemicals grow. The production processes involved in creating alpha olefins, such as polymerization and cracking, are energy-intensive and produce emissions, leading to stricter environmental regulations. In many regions, producers of alpha olefins must comply with local laws that dictate emission limits, waste management, and the safe handling of chemicals. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires manufacturers to assess and manage the risks posed by the chemicals they produce. In the U.S., the Environmental Protection Agency (EPA) enforces regulations on the chemical industry to minimize environmental harm. Compliance with these regulatory standards can be both time-consuming and costly, as manufacturers must invest in pollution control technologies, conduct environmental assessments, and possibly modify production processes to meet regulatory requirements. These regulatory challenges add a layer of complexity for companies, particularly smaller or regional producers, who may struggle to absorb the costs associated with compliance. Moreover, as regulations evolve and become more stringent, businesses must constantly adapt, which creates uncertainty and operational risks in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Alpha Olefins Market Scope

The market is segmented on the basis of product and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- 1-Butene

- 1-Hexene

- 1-Octene

- 1-Decene

- 1-Dodecene

- Others

Application

- Polyolefin Co-monomers

- Surfactant

- Plasticizer

- Lubricant

- Drilling Machinery Fuel

- Others

Alpha Olefins Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

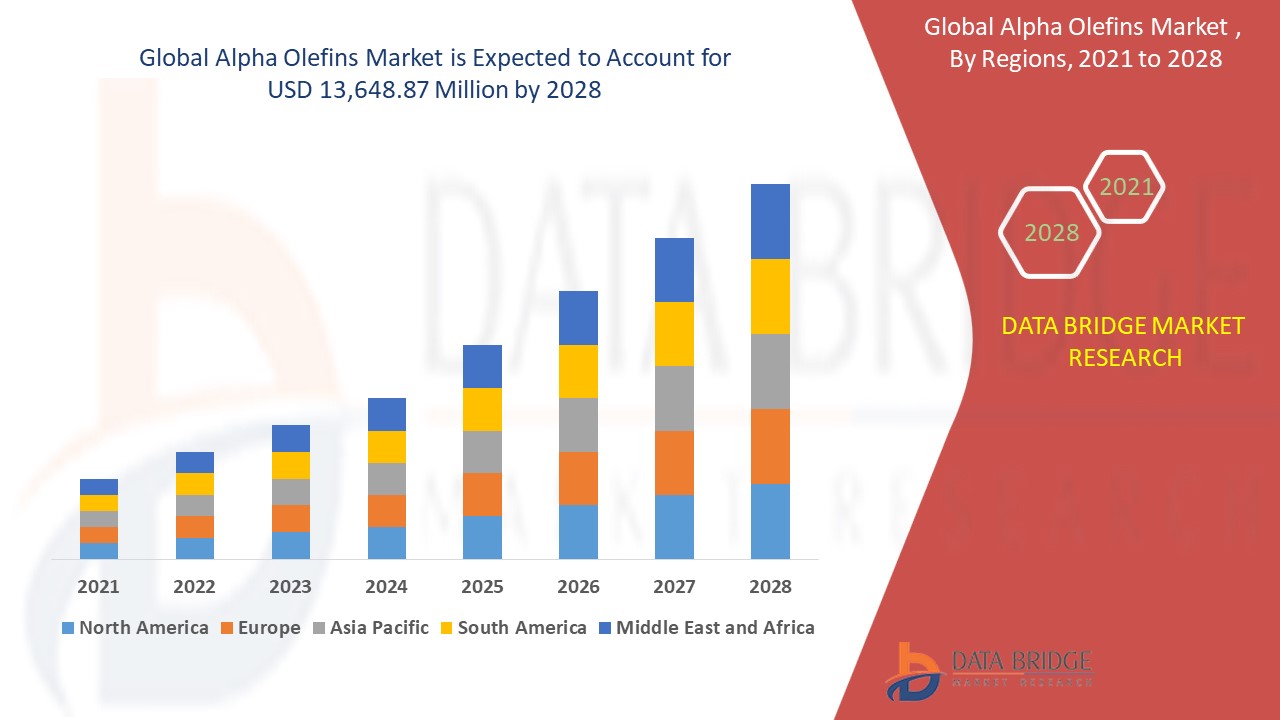

North America dominates the alpha olefins market and is expected to maintain its dominance throughout the forecast period, driven by the rapid growth in shale gas production and increasing investments in the oil and gas industry. The region's advanced infrastructure and technological developments in extracting and refining natural gas further contribute to this trend. In addition, the rising demand for alpha olefins in various industries, such as plastics and detergents, supports market expansion. With ongoing investments, North America's strategic position ensures continued growth in this sector.

Asia-Pacific is expected to experience the highest compound annual growth rate (CAGR) during the forecast period, driven by the increasing demand for alpha olefins across various industries in the region. Rapid industrialization, particularly in countries such as China and India, is boosting the need for these chemicals in the production of plastics, detergents, and lubricants. Moreover, the expanding oil and gas sector in the region, coupled with rising investments in petrochemical infrastructure, further fuels market growth. As manufacturing capabilities continue to scale, the demand for alpha olefins is set to rise sharply in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Alpha Olefins Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Alpha Olefins Market Leaders Operating in the Market Are:

- INEOS (U.K.)

- Chevron Phillips Chemical Company LLC (U.S.)

- Exxon Mobil Corporation (U.S.)

- Mitsubishi Chemical Group Corporation (Japan)

- Qatar Chemical Company Ltd (Qatar)

- Sasol (South Africa)

- Evonik Industries AG (Germany)

- Dow (U.S.)

- Royal Dutch Shell (Netherlands)

- SABIC (Saudi Arabia)

- Idemitsu Kosan Co.Ltd. (Japan)

- Petro Rabigh (Saudi Arabia)

- National Petrochemical Company (Iran)

- Tappico (U.S.)

- TPC Group (U.S.)

Latest Developments in Alpha Olefins Market

- In May 2023, SABIC partnered with Estiko Packaging Solutions and Coldwater Prawns of Norway to develop a highly sustainable packaging pouch for frozen prawns. The pouch is crafted from a multi-layer film produced by Estiko, utilizing a random circular certified polymer grade of SABIC PP QRYSTAL, containing approximately 60% ocean-bound plastic (OBP)

- In September 2023, ExxonMobil Corporation expanded its production capacity at the Baytown, Texas facility by adding two new chemical manufacturing plants. This expansion is designed to increase the production of high-value alpha olefin products derived from the company’s refining operations on the U.S. Gulf Coast

- In February 2023, Chevron Phillips Chemical (CPChem) and Charter Next Generation (CNG) announced that overwrap films made from CPChem's Marlex Anew Circular Polyethylene would be available on U.S. store shelves. These films, known for their versatility and efficiency, are used to preserve food, secure medical instruments, and provide durable, lightweight packaging. Alpha olefins play a key role in the production of polyethylene

- In April 2022, Shell Chemical received approval from the Louisiana Board of Commerce and Industry for a tax exemption under the Industrial Tax Exemption Program for their USD 1.4 billion project. This project involves building a "world-scale" linear alpha olefin plant at the Geismar facility, which will produce ingredients for detergents, waxes, plastics, and premium lubricants

- In November 2022, Chevron Phillips Chemical inaugurated a new alpha olefin chemical facility in Beringen, Belgium. The facility’s strategic location enables the company to better serve its European customers, benefiting from the feedstock availability in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alpha Olefins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alpha Olefins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alpha Olefins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.