Global Albumin Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

1.70 Billion

2024

2031

USD

1.08 Billion

USD

1.70 Billion

2024

2031

| 2025 –2031 | |

| USD 1.08 Billion | |

| USD 1.70 Billion | |

|

|

|

|

Albumin Market Size

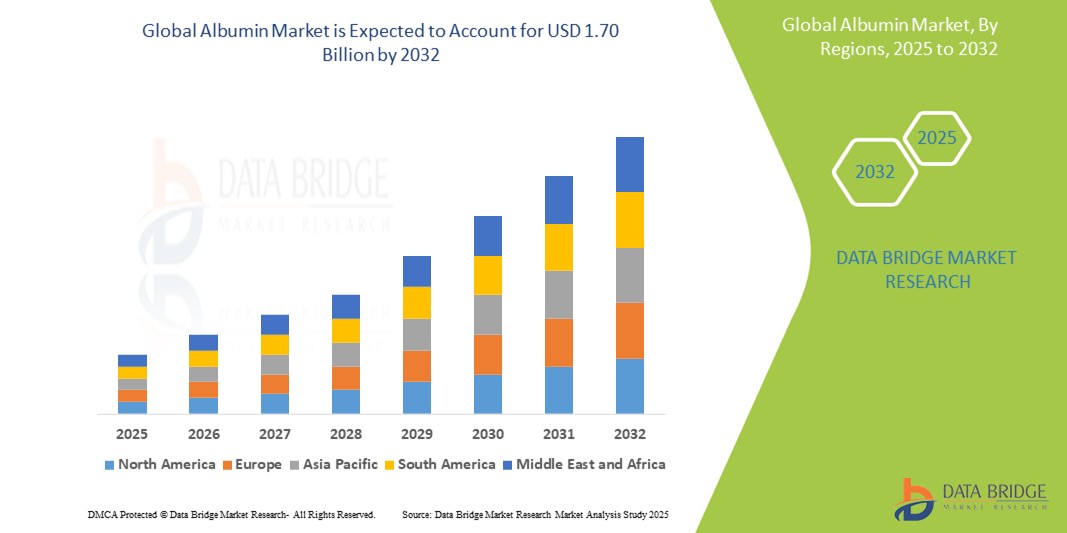

- The global albumin market size was valued at USD 1.07 billion in 2024 and is expected to reach USD 1.70 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases such as liver cirrhosis, kidney diseases, burns, and heart failure, which often require albumin supplementation for management

- Furthermore, the rising demand for albumin in therapeutic applications, drug formulation, and vaccine production, coupled with advancements in biotechnology for albumin production and increasing investments in healthcare infrastructure, are accelerating the uptake of albumin solutions, thereby significantly boosting the industry's growth

Albumin Market Analysis

- Albumin, the most abundant protein in blood plasma, is a crucial component in various medical and pharmaceutical applications, including maintaining osmotic pressure, transporting substances, and acting as a vital ingredient in drug formulations, vaccines, and cell culture media. Its versatility and critical physiological roles make it an indispensable part of modern healthcare

- The escalating demand for albumin is primarily fueled by the increasing prevalence of chronic diseases such as liver cirrhosis, kidney diseases, and burns, which often necessitate albumin supplementation. In addition, the growing adoption of albumin in non-therapeutic applications such as cosmetics and wound care, coupled with continuous advancements in biotechnology for albumin production and rising investments in healthcare infrastructure, are driving market expansion

- North America dominates the albumin market with the largest revenue share of 37.09% in 2024, characterized by its advanced healthcare infrastructure, a thriving pharmaceutical industry, a high prevalence of chronic diseases, and substantial research and development capabilities

- Asia-Pacific is expected to be the fastest growing region in the albumin market during the forecast period due to increasing urbanization, rising disposable incomes, improving healthcare infrastructure, and a growing focus on medical research and preventative treatment in countries

- Bovine serum albumin segment dominates the albumin market with a market share of 41.57% in 2024, driven by its cost-effectiveness, high purity, stability, and widespread use as a standard protein in various research, diagnostic, and biopharmaceutical applications

Report Scope and Albumin Market Segmentation

|

Attributes |

Albumin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Albumin Market Trends

“The Rise of Recombinant and Advanced Applications”

- A significant and accelerating trend in the global albumin market is the deepening adoption of recombinant albumin (rHA) as a safer, more consistent, and ethical alternative to plasma-derived albumin. This fusion of technologies is significantly enhancing the supply chain stability and reducing the risks associated with human plasma-derived products

- For instance, companies are increasingly investing in fermentation technologies to produce rHA, which offers a more controlled and scalable manufacturing process. Similarly, firms such as Albumedix and InVitria are at the forefront, addressing concerns about potential pathogen transmission and ethical considerations related to blood donations

- rHA integration in albumin production enables features such as large-scale, consistent manufacturing and providing a more reliable supply independent of human plasma availability. For instance, some manufacturers utilize yeast expression systems to improve production efficiency over time and can ensure a steady supply for therapeutic and research applications. Furthermore, the use of rHA offers users the ease of a standardized and highly pure product, allowing them to rely on its consistent quality

- The seamless integration of recombinant technologies with broader biopharmaceutical manufacturing platforms facilitates centralized control over various aspects of albumin production. Through a single interface, users can manage their raw material sourcing alongside purification processes and quality control, creating a unified and automated production experience

- This trend towards more intelligent, intuitive, and interconnected albumin production systems is fundamentally reshaping user expectations for biopharmaceuticals. Consequently, companies such as Novozymes are developing advanced rHA production methods with features such as automatic quality control and compatibility with existing biopharmaceutical workflows

- The demand for albumin that offers seamless recombinant technology integration is growing rapidly across both therapeutic and research sectors, as consumers increasingly prioritize safety, consistency, and comprehensive supply chain reliability

Albumin Market Dynamics

Driver

“Growing Need Due to Rising Chronic Disease Prevalence and Biopharmaceutical Applications”

- The increasing prevalence of chronic diseases such as liver cirrhosis, kidney diseases, and severe burns, coupled with the accelerating use of albumin in various biopharmaceutical applications, is a significant driver for the heightened demand for albumin

- For instance, in July 2023, Grifols announced the completion of enrollment for its phase-3 trial of Albutein (albumin-human injection) for the treatment of patients with decompensated cirrhosis. Such strategic initiatives by key companies are expected to drive the albumin industry growth in the forecast period

- As healthcare professionals become more aware of the critical role of albumin in maintaining oncotic pressure, transporting essential molecules, and supporting critical care, albumin offers advanced therapeutic benefits, providing a compelling solution for managing complex medical conditions

- Furthermore, the growing popularity of albumin as a excipient in drug formulations, vaccine stabilization, and cell culture media is making it an integral component of these systems, offering seamless integration with other biopharmaceutical processes

- The critical role of albumin in fluid resuscitation, its use as a carrier for targeted drug delivery, and its ability to stabilize various biological products are key factors propelling the adoption of albumin in both therapeutic and non-therapeutic sectors. The rising number of clinical trials and the increasing availability of advanced albumin-based products further contribute to market growth

Restraint/Challenge

“High Production Costs and Supply Chain Vulnerabilities”

- Concerns surrounding the high production costs of albumin, particularly plasma-derived albumin, and vulnerabilities in its supply chain, pose a significant challenge to broader market penetration. As albumin production involves complex, resource-intensive processes such as plasma collection, fractionation, and purification, these factors contribute to elevated expenses, raising anxieties among healthcare providers and patients about affordability and accessibility

- For instance, the intricate and costly process of extracting and purifying albumin from human plasma limits cost-effectiveness, and high-profile reports of plasma shortages or disruptions, as seen during the COVID-19 pandemic, have made some healthcare systems hesitant to rely solely on plasma-derived albumin, impacting supply stability

- Addressing these cost and supply chain concerns through robust investment in advanced manufacturing technologies, exploring alternative production methods such as recombinant albumin, and diversifying sourcing strategies is crucial for building market resilience. Companies such as Grifols and CSL Behring are investing in plasma collection centers and research into recombinant albumin to mitigate supply risks.

- In addition, the relatively high initial cost of albumin therapies compared to alternative treatments can be a barrier to adoption for price-sensitive healthcare systems, particularly in developing regions or for budget-conscious hospitals. While recombinant albumin offers a more consistent and safer alternative, its production still involves significant costs, limiting its widespread adoption

- While efforts are being made to optimize production processes and explore cost-effective alternatives, the perceived premium for high-quality albumin can still hinder widespread adoption, especially for those who face budget constraints or limited reimbursement policies

Albumin Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the albumin market is segmented into human serum albumin, bovine serum albumin, and recombinant albumin. Bovine serum albumin segment dominated the largest market revenue share of 41.57% in 2024, driven by its cost-effectiveness, high purity, and exceptional stability, making it an ideal and widely utilized protein standard in various research, diagnostic, and biopharmaceutical applications. Its readily available supply from bovine blood and its consistent performance in laboratory procedures, such as cell culture, immunoassays and as a blocking agent, contribute significantly to its market leadership

The recombinant albumin (rHA) segment is anticipated to witness the fastest growth rate during the forecast period, fueled by increasing concerns over potential pathogen transmission and supply limitations associated with plasma-derived products. rHA offers a safer, more consistent, and ethical alternative, with advancements in biotechnology enabling its large-scale production for diverse applications, including drug formulation and vaccine stabilization

- By Application

On the basis of application, the albumin market is segmented into therapeutics, vaccine ingredient, drug delivery, culture media, and others. The therapeutics segment held the largest market revenue share in 2024, driven by the widespread use of albumin in treating a variety of medical conditions, including liver diseases, hypovolemia, shock, and surgical complications. Its critical role in maintaining oncotic pressure and transporting essential substances makes it indispensable in critical care settings

The drug delivery segment is expected to witness significant growth during the forecast period, driven by albumin's excellent biocompatibility and its unique ability to bind and transport various molecules. Albumin is increasingly utilized as a carrier for drugs, enhancing their solubility, stability, and half-life in the bloodstream, leading to improved therapeutic outcomes and targeted drug delivery.

- By End User

On the basis of end user, the albumin market is segmented into hospitals, clinics, pharmaceutical and biotechnology, and research institutes. The hospitals & clinics segment held the largest market share in 2024, fueled by the increasing use of albumin products in critical care, surgeries, and the treatment of various diseases requiring fluid management and protein supplementation. Hospitals and clinics are the primary points of administration for therapeutic albumin

The pharmaceutical and biotechnology segment is expected to witness substantial growth, driven by the growing demand for albumin as an excipient in drug formulations, a stabilizer in vaccines, and a critical component in cell culture media for the production of biologics and other therapeutic proteins. The expanding biopharmaceutical industry and increased R&D activities contribute significantly to this segment's growth

Albumin Market Regional Analysis

- North America dominates the albumin market with the largest revenue share of 37.09% in 2024, driven by its advanced healthcare infrastructure, a thriving pharmaceutical industry, a high prevalence of chronic diseases, and substantial research and development capabilities

- Consumers and healthcare providers in the region highly value the established efficacy of albumin in therapeutic applications, along with increasing investments in advanced drug delivery systems and recombinant albumin production

- This widespread adoption is further supported by significant healthcare expenditure, a technologically inclined population, and the growing demand for plasma-derived therapies and biologics, establishing albumin as a crucial component in both clinical and research settings

U.S. Albumin Market Insight

The U.S. albumin market captured a significant revenue share within North America, fueled by the advanced healthcare infrastructure, high prevalence of chronic diseases such as liver and kidney conditions, and robust R&D in biopharmaceuticals. Healthcare providers are increasingly prioritizing the use of albumin in critical care and drug formulations. The growing preference for advanced therapeutic interventions, combined with strong demand for plasma-derived therapies and the push for innovative drug delivery systems, further propels the albumin industry. Moreover, the increasing investment in biotechnology and pharmaceutical companies is significantly contributing to the market's expansion.

Europe Albumin Market Insight

The Europe albumin market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing burden of chronic diseases and an aging population. The robust healthcare spending, coupled with significant research in rare diseases and oncology where albumin is crucial, is fostering the adoption of albumin. European healthcare systems are also drawn to the therapeutic benefits and versatility these products offer. The region is experiencing significant growth across hospital, clinic, and pharmaceutical applications, with albumin being incorporated into both established treatment protocols and new drug development.

U.K. Albumin Market Insight

The U.K. albumin market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing prevalence of liver and kidney diseases and a strong focus on advanced healthcare. In addition, the need for effective treatments for conditions such as sepsis and burns is encouraging healthcare professionals to prioritize albumin therapies. The UK's well-developed pharmaceutical industry, alongside its robust research and development infrastructure, is expected to continue to stimulate market growth.

Germany Albumin Market Insight

The Germany albumin market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced medical treatments and the demand for high-quality pharmaceutical products. Germany’s well-developed healthcare system, combined with its emphasis on pharmaceutical innovation and manufacturing, promotes the adoption of albumin, particularly in hospitals and biopharmaceutical companies. The integration of albumin into drug delivery systems and its crucial role in research and development are also becoming increasingly prevalent, with a strong preference for safe, highly pure solutions aligning with local healthcare expectations.

Asia-Pacific Albumin Market Insight

The Asia-Pacific albumin market is poised to grow at the fastest CAGR of 7.4% during the forecast period, driven by increasing healthcare expenditure, rising disposable incomes, and the growing prevalence of chronic diseases in countries such as China, Japan, and India. The region's growing focus on improving healthcare infrastructure, supported by government initiatives promoting access to essential medicines, is driving the adoption of albumin. Furthermore, as APAC emerges as a significant hub for pharmaceutical manufacturing and clinical research, the accessibility and demand for albumin are expanding to a wider patient base.

Japan Albumin Market Insight

The Japan albumin market is gaining momentum due to the country’s aging population, advanced medical research, and demand for high-quality therapeutic solutions. The Japanese market places a significant emphasis on patient safety and product purity, and the adoption of albumin is driven by the increasing number of patients with chronic diseases and the use of albumin in innovative drug formulations. The integration of albumin with other biopharmaceutical products and its role in regenerative medicine are fueling growth. Moreover, Japan's robust pharmaceutical sector is likely to spur demand for highly effective, safe treatment solutions in both clinical and research settings

India Albumin Market Insight

The India albumin market accounted for a significant market revenue share in Asia Pacific, attributed to the country's expanding middle class, rapid urbanization, and high rates of chronic disease prevalence. India stands as a growing market for biopharmaceuticals, and albumin is becoming increasingly popular in hospitals, clinics, and pharmaceutical manufacturing. The push towards improving healthcare access and the availability of advanced albumin products, alongside strong domestic and international pharmaceutical presence, are key factors propelling the market in India

Albumin Market Share

The albumin industry is primarily led by well-established companies, including:

- Octapharma AG (Switzerland)

- CSL (Australia)

- Baxter (U.S.)

- HiMedia Laboratories (India)

- MedxBio Pte Ltd (Singapore)

- Novozymes A/S (Denmark)

- Mitsubishi Tanabe Pharma Corporation (Japan)

- Merck KGaA (Germany)

- Akron Biotech (U.S.)

- Taibang Bio Group Co., Ltd. (China)

- Thermo Fisher Scientific Inc. (U.S.)

- Thrive Supplements (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Kedrion (Italy)

- Grifols, S.A. (Spain)

- InVitria (U.S.)

- Albumin Therapeutics, LLC (U.S.)

- RayBiotech, Inc. (U.S.)

- LGC Limited (U.K.)

Latest Developments in Global Albumin Market

- In April 2024, Takeda Pharmaceutical Company likely continued its strong performance in albumin products, as indicated by their Q4 2024 financial results, which reported growth in Plasma-Derived Therapies, including albumin products such as HUMAN ALBUMIN and FLEXBUMIN. This suggests ongoing market focus and potentially new initiatives related to these therapies

- In March 2024, BPL (Biotechnology Products Laboratories) launched an albumin-based drug delivery system aimed at enhancing the bioavailability of hydrophobic drugs. This advancement highlights the commitment to developing cutting-edge therapeutic technologies that safeguard patient health and ensure greater efficacy for pharmaceutical formulations

- In July 2024, CSL Behring launched a new albumin-based product for drug delivery in cancer treatment, highlighting its growing role in precision medicine. This initiative harnesses state-of-the-art solutions to create more effective and targeted therapies, underscoring CSL Behring's dedication to utilizing its expertise in innovative biopharmaceutical systems

- In December 2023, Albumedix, now part of Sartorius, completed its new state-of-the-art albumin manufacturing facility in the UK. This facility will enable the company to meet increased global demand for high-quality human serum albumin and support future therapeutic development

- In July 2023, Grifols announced the completion of enrollment in its phase-3 trial of Albutein (albumin-human injection) for the treatment of patients with decompensated cirrhosis. This innovative therapeutic effort highlights the company’s commitment to integrating advanced research into clinical solutions, offering healthcare providers enhanced options for managing complex liver conditions and ensuring robust patient care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.