Global Aircraft Tube And Duct Assemblies Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

1.61 Billion

2021

2029

USD

1.14 Billion

USD

1.61 Billion

2021

2029

| 2022 –2029 | |

| USD 1.14 Billion | |

| USD 1.61 Billion | |

|

|

|

|

Aircraft Tube and Duct Assemblies Market Analysis and Size

The selection of superior aerospace materials is vital part in aerospace component and system design cycles. It affects several aspects of the aircraft performance from the design phase to disposal such as safety and reliability, lifecycle cost, recyclability, structural efficiency, flight performance, payload, energy consumption and disposability. For instance, Eaton Corporation, an American multinational power management company, has specifically designed and manufactured ducting and tubing components for aircrafts. This company specializes in the testing, design, analysis and manufacture of aircraft air duct systems which is s anticipated to drive the growth of the global aircraft tube and duct assemblies market during forecast period of 2022-2029.

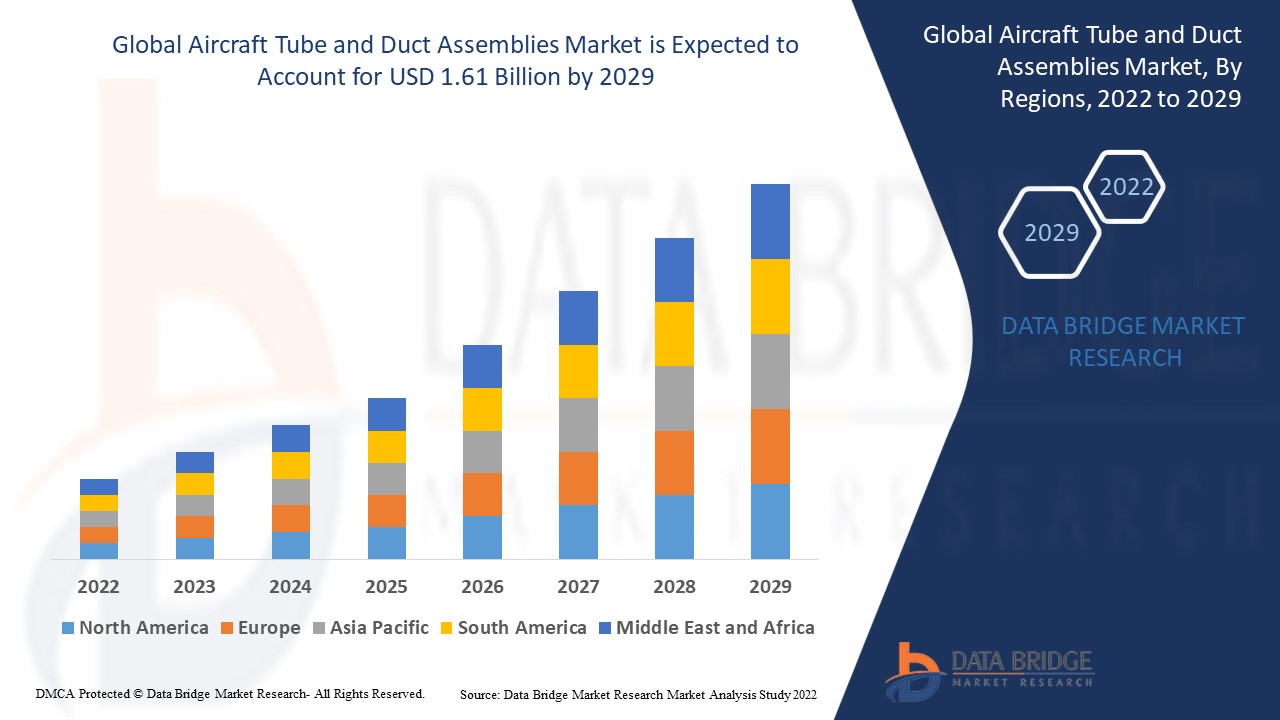

Data Bridge Market Research analyses that the aircraft tube and duct assemblies market was valued at USD 1.14 billion in 2021 and is expected to reach USD 1.61 billion by 2029, registering a CAGR of 4.45 % during the forecast period of 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Aircraft Tube and Duct Assemblies Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Aircraft Type (Commercial Aircraft, Military Aircraft), Material (Steel, Nickel, Titanium, Aluminum, Composite, Inconel), Duct Type (Rigid, Semi-Rigid, Flexible) Sales Channel (OEMs, Aftermarket), Application (Engine Bleeds, Thermal Anti-Ice, Pylon Ducting (HVAC) Enamel, Fuselages, Inlets/Exhausts, Environment Control Systems (ECS), Lavatories, Waste Systems) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Eaton (Ireland), Fiber Dynamics, Inc. (U.S.), AmCraft Manufacturing (U.S.), Woolf Aircraft Products Inc. (U.S.), PMF Industries, Inc. (U.S.), Flexaust, Inc. (U.S.), STEICO Industries Inc. (U.S.), RSA Engineered Products LLC (U.S.), Smiths Group plc (U.K.), Senior plc (U.K.), PFW Aerospace GmbH (Germany), Sigma Components Holdings Ltd (U.K.), Exotic Metals Forming (U.S.), Mundo-Tech, Inc. (U.S.), Flexco, Inc (U.S.), Hartzell Propeller (U.S.), Fiber Dynamics Inc, (U.S.) |

|

Market Opportunities |

|

Market Definition

Aircraft tube and duct assemblies are important part of the aircraft fluid lines. This is used for fluid passage solutions in aircraft systems. Tube and ducts are made from several materials such as steel, titanium, copper, aluminum alloy and other metals. Corrosion resistant steel, aluminium alloy, nickel alloy or titanium tubes have replaced copper tubing in modern aircrafts, and now they are extensively used in aviation fluid applications.

Drivers

- Rising demand for light weight aircraft tube and duct assemblies

Increasing importance for reducing the weight of the aircraft to achieve an optimum ratio between range and payload is anticipated to drive the sales of aircraft tube and duct assemblies. For instance, using carbon fiber in aircraft tubes and the ductile market can reduce an airliner’s weight by 20%. The Airbus A350 XWB’s sweeping wingtips, which are mainly made up of carbon fiber, offer roughly 5% in fuel savings.

- Growing government guidelines for reduction of harmful matter

The rules and regulations implemented by the government are anticipated to contribute considerably to the growth of the aircraft tube and duct assemblies. The government has imposed some guidelines on manufacturing materials used in aircraft interiors that cause emission of harmful particulate matter. These new guidelines will also contribute to the growth of the aircraft tube and duct assemblies market.

Furthermore, surging levels of investment in defence sector, growing consumer spending on air travel, growth of the aircraft, travel and tourism industry, increasing usages of lightweight material for production of aircraft tube and duct assemblies are some major factors which are expected to boost the growth of the aircraft tube and duct assemblies market during the forecast period of 2022-2029.

Opportunities

- Expansion of air tourism industry

The expansion of the air tourism industry is increasing the sales of commercial aircraft, which is anticipated to directly affect the sales of aircraft tube and duct assemblies. Several countries are investing more in the aviation sector to increase the air connectivity across all over the cities and other foreign countries, which is expected to fuel the growth of the aircraft tube and duct assemblies market.

- Technological advancement

The manufacturers are focusing on the advancements in technology so the companies are delivering modern and sophisticated tube and duct assemblies solutions. The company aims to help in decrease development costs and reduce development time with the reference design and software for smart and energy-efficient aircraft tube and duct assemblies due to all these major factors increase the demand of the aircraft tube and duct assemblies which are expected to create the beneficial opportunities for the market rate.

Moreover, emerging new markets and rise in strategic collaborations will also act as market drivers and further increase the valuable opportunities for the market’s growth rate.

Restraints/ Challenges

- Less demand and financial crisis

Less demand of aircraft tube and duct assemblies, and the financial crisis among consumers during the covid-19 pandemic are expected to act as major restraining factor for the growth of the aircraft tube and duct assemblies market during mentioned forecasted period.

Moreover, stringent rules and regulations of the government will also act as a market restraint for aircraft tube and duct assemblies and obstruct the market growth rate.

This aircraft tube and duct assemblies market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the aircraft tube and duct assemblies market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Aircraft Tube and Duct Assemblies Market

The aircraft tube and duct assemblies manufacturer mostly depends on the production activities shut down during this pandemic and disrupted the supply chain network. Majority of aircraft tube and duct assemblies manufacturers are under uncertainty about the normal plant activities to resume on a regular basis due to this COVID-19 pandemic, which is majorly hampering the demand and supply network of the targeted company. Due to this pandemic, many problems have been created, such as the closure of factories and the unavailability of workforce in the affected nations. This ultimately led to a main liquidity problem for the aircraft tube and duct assemblies manufacturer.

Global Aircraft tube and duct assemblies market Scope

The aircraft tube and duct assemblies market is segmented on the basis of aircraft type, material, duct type, sales channel and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Aircraft Type

- Commercial Aircraft

- Military Aircraft

Material

- Steel

- Nickel

- Titanium

- Aluminum

- Composite

- Inconel

Duct Type

- Rigid

- Semi-Rigid

- Flexible

Sales Channel

- OEMs

- Aftermarket

Application

- Engine Bleeds

- Thermal Anti-Ice

- Pylon Ducting (HVAC) Enamel

- Fuselages

- Inlets/Exhausts

- Environment Control Systems (ECS

- Lavatories

- Waste Systems

Aircraft Tube and Duct Assemblies Market Regional Analysis/Insights

The aircraft tube and duct assemblies market is analysed and market size insights and trends are provided by country, aircraft type, material, duct type, sales channel and application as referenced above.

The countries covered in the aircraft tube and duct assemblies market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Russia, Turkey, Belgium, Rest of Europe, Japan, China, South Korea, India, Australia & New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, South Africa, Israel, U.A.E., Saudi Arabia, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America and Europe dominate the aircraft tube and duct assemblies market in terms of market share. This is due to the prevalence of several aircraft production hubs in this region.

Asia-Pacific is expected to be the fastest developing regions during the forecast period due to the growing air traffic along with the growth of aftermarket and services in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Aircraft Tube and Duct Assemblies Market Share Analysis

The aircraft tube and duct assemblies’ market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to aircraft tube and duct assemblies market.

Some of the major players operating in the aircraft tube and duct assemblies market are:

- Eaton (Ireland)

- Fiber Dynamics, Inc. (U.S.)

- AmCraft Manufacturing (U.S.)

- Woolf Aircraft Products Inc. (U.S.)

- PMF Industries, Inc. (U.S.)

- Flexaust, Inc. (U.S.)

- STEICO Industries Inc. (U.S.)

- RSA Engineered Products LLC (U.S.)

- Smiths Group plc (U.K.)

- Senior plc (U.K.)

- PFW Aerospace GmbH (Germany)

- Sigma Components Holdings Ltd (U.K.)

- Exotic Metals Forming (U.S.)

- Mundo-Tech, Inc. (U.S.)

- Flexco, Inc (U.S.)

- Hartzell Propeller (U.S.)

- Fiber Dynamics Inc, (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.