Global Aircraft Seat Actuation Systems Market

Market Size in USD Million

CAGR :

%

USD

495.83 Million

USD

1,424.36 Million

2025

2033

USD

495.83 Million

USD

1,424.36 Million

2025

2033

| 2026 –2033 | |

| USD 495.83 Million | |

| USD 1,424.36 Million | |

|

|

|

|

Aircraft Seat Actuation Systems Market Size

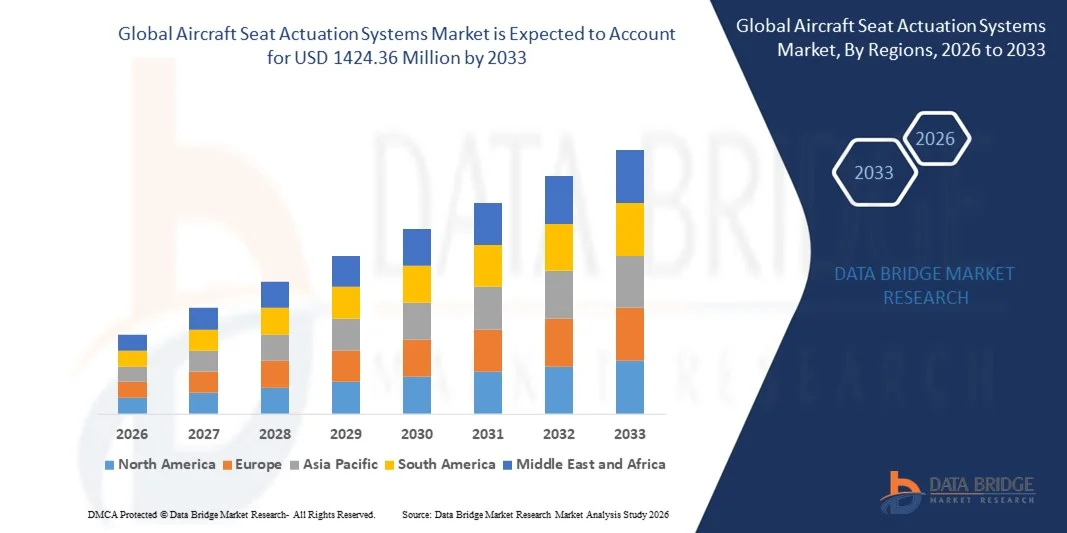

- The global aircraft seat actuation systems market size was valued at USD 495.83 million in 2025 and is expected to reach USD 1424.36 million by 2033, at a CAGR of 14.10% during the forecast period

- The market growth is largely driven by increasing demand for enhanced passenger comfort and personalization in commercial aircraft, encouraging airlines to adopt advanced seat actuation systems across premium and mid-range cabin classes

- Furthermore, rising aircraft production rates, frequent fleet modernization programs, and growing investments in cabin interior upgrades are accelerating the adoption of electrically and mechanically actuated seating solutions, thereby supporting sustained market expansion

Aircraft Seat Actuation Systems Market Analysis

- Aircraft seat actuation systems are electromechanical, pneumatic, or hydraulic mechanisms that enable controlled seat movements such as recline, leg rest adjustment, and lumbar support, improving comfort and ergonomics for passengers across different seat classes

- The growing demand for these systems is primarily fueled by rising air passenger traffic, increasing focus on in-flight experience differentiation by airlines, and the expansion of premium economy and business class seating configurations

- North America dominated the aircraft seat actuation systems market with a share of in 2025, due to strong aircraft manufacturing activity, high air passenger traffic, and continuous investment in cabin comfort upgrades

- Asia-Pacific is expected to be the fastest growing region in the aircraft seat actuation systems market during the forecast period due to rapid growth in air passenger traffic and aggressive aircraft fleet expansion

- Electromechanical segment dominated the market with a market share of 48.5% in 2025, due to its high precision, lower maintenance requirements, and better integration with modern aircraft electrical architectures. Airlines increasingly prefer electromechanical actuators due to their reduced weight compared to hydraulic systems, supporting overall fuel efficiency goals. These systems also enable smoother and more accurate seat movements, enhancing passenger comfort in premium cabins

Report Scope and Aircraft Seat Actuation Systems Market Segmentation

|

Attributes |

Aircraft Seat Actuation Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Seat Actuation Systems Market Trends

Increasing Adoption of Electromechanical and Lightweight Seat Actuation Systems

- A major trend in the aircraft seat actuation systems market is the growing adoption of electromechanical and lightweight actuation technologies, driven by airline efforts to reduce aircraft weight while improving passenger comfort and operational efficiency. These systems replace traditional hydraulic mechanisms with compact electric actuators that offer precise control and lower maintenance requirements

- For instance, Safran Seating Systems integrates electromechanical seat actuation technologies across its business and premium economy seating platforms supplied to major aircraft manufacturers. These systems enable smoother seat movement, improved reliability, and better integration with modern aircraft electrical architectures

- Aircraft OEMs and seat manufacturers are increasingly prioritizing lightweight seat actuation designs to support fuel efficiency targets and emission reduction goals. Reduced system weight directly contributes to lower operating costs for airlines, especially on long-haul and high-frequency routes

- The demand for advanced seat customization is accelerating the use of multi-axis electromechanical actuators that support features such as lie-flat beds, adjustable leg rests, and lumbar support. This trend is particularly strong in wide-body aircraft where passenger comfort is a key competitive differentiator

- Airlines are also adopting modular actuation systems that simplify installation and maintenance while allowing easier upgrades during cabin retrofits. This flexibility supports long-term fleet modernization strategies and aligns with evolving passenger expectations

- Overall, the shift toward electromechanical and lightweight seat actuation systems is reinforcing technological advancement in aircraft interiors and strengthening the market’s role in next-generation cabin design

Aircraft Seat Actuation Systems Market Dynamics

Driver

Rising Focus on Passenger Comfort and Premium Cabin Differentiation

- The increasing focus on enhancing passenger comfort and cabin experience is a primary driver for the aircraft seat actuation systems market, as airlines seek to differentiate their services in a highly competitive aviation landscape. Advanced seat actuation systems enable personalized seating positions that improve comfort on medium- and long-haul flights

- For instance, Collins Aerospace supplies powered seating solutions with advanced actuation mechanisms for business and premium economy cabins used by several global airlines. These systems allow airlines to offer improved recline angles, leg support, and ergonomic positioning

- The expansion of premium economy seating across international fleets is further increasing demand for powered seat actuation systems that bridge the gap between economy and business class. Airlines rely on these systems to justify higher ticket pricing through enhanced comfort

- Passenger expectations for comfort, privacy, and control are influencing airline investment decisions, especially on long-distance routes where seating quality directly impacts customer satisfaction. This driver is reinforcing steady demand for advanced actuation technologies

- As airlines continue to compete on in-flight experience rather than pricing alone, the role of sophisticated seat actuation systems is becoming increasingly critical in supporting brand differentiation and long-term passenger loyalty

Restraint/Challenge

High System Costs and Complex Certification Requirements

- The aircraft seat actuation systems market faces challenges related to high system costs and stringent certification requirements imposed by aviation regulatory authorities. Developing and certifying actuation systems involves extensive testing to meet safety, durability, and reliability standards

- For instance, companies such as Moog Inc. and BAE Systems must comply with rigorous certification processes defined by organizations including the Federal Aviation Administration and the European Union Aviation Safety Agency. These requirements significantly extend development timelines and increase compliance costs

- Advanced electromechanical actuation systems require precision engineering, high-quality materials, and redundancy features to ensure safe operation under all flight conditions. These factors elevate manufacturing and validation expenses

- The complexity of integrating seat actuation systems with aircraft electrical and cabin management systems further increases design and testing requirements. This creates barriers for cost optimization and slows the introduction of new technologies

- As a result, balancing innovation with regulatory compliance and cost efficiency remains a key challenge, influencing pricing strategies and limiting rapid adoption across cost-sensitive aircraft segments

Aircraft Seat Actuation Systems Market Scope

The market is segmented on the basis of type, component, aircraft type, seat class, and end user.

- By Type

On the basis of type, the aircraft seat actuation systems market is segmented into electromechanical, pneumatic, and hydraulic systems. The electromechanical segment dominated the largest market revenue share of 48.5% in 2025, driven by its high precision, lower maintenance requirements, and better integration with modern aircraft electrical architectures. Airlines increasingly prefer electromechanical actuators due to their reduced weight compared to hydraulic systems, supporting overall fuel efficiency goals. These systems also enable smoother and more accurate seat movements, enhancing passenger comfort in premium cabins.

The pneumatic segment is anticipated to witness the fastest growth from 2026 to 2033, supported by its cost-effectiveness and simpler system design. Pneumatic actuation is gaining traction in narrow-body and regional aircraft where basic seat adjustment functions are sufficient. The growing demand for lightweight and reliable actuation solutions in short-haul aircraft further accelerates the adoption of pneumatic systems.

- By Component

On the basis of component, the market is segmented into actuator, motor, in-seat power supply, passenger control unit, electronic control unit, and others. The actuator segment accounted for the largest market revenue share in 2025, as actuators form the core mechanical element enabling seat recline, leg rest, and lumbar movements. High demand for multi-axis seat adjustments in business and first-class cabins has significantly increased actuator installations per seat. Continuous advancements in compact and high-load actuators further strengthen this segment’s dominance.

The passenger control unit segment is expected to register the fastest growth during the forecast period, driven by rising passenger expectations for personalized seat control. Touchscreen interfaces and smart control panels integrated into armrests are becoming standard in premium seating. Airlines focus on intuitive user interfaces to enhance in-flight experience, directly supporting the rapid growth of passenger control units.

- By Aircraft Type

On the basis of aircraft type, the aircraft seat actuation systems market is segmented into fixed wing and rotary wing aircraft. The fixed wing segment dominated the market in 2025, supported by the large global fleet of commercial airplanes and continuous aircraft deliveries. High passenger traffic and long-haul operations require advanced seating systems with multiple actuation points, increasing overall system demand. Wide-body aircraft, in particular, drive higher installation volumes due to complex seat configurations.

The rotary wing segment is projected to grow at the fastest rate from 2026 to 2033, owing to increasing use of helicopters for VIP transport, offshore operations, and medical services. Demand for enhanced seating comfort and adjustability in specialized rotary wing applications is rising. Lightweight and compact actuation systems tailored for limited cabin space support this accelerated growth.

- By Seat Class

On the basis of seat class, the market is segmented into business class, first class, premium economy class, and economy class. The business class segment held the largest revenue share in 2025, driven by high installation of fully automated seats with multiple actuation functions. Airlines prioritize business class seating to differentiate service offerings on long-haul routes. Advanced recline, lie-flat mechanisms, and privacy features significantly increase actuation system content per seat.

The premium economy class segment is expected to witness the fastest growth over the forecast period, supported by airlines expanding this cabin to capture mid-range travelers. Premium economy seats increasingly incorporate powered recline and leg rest features previously limited to business class. This shift drives higher adoption of actuation systems within this rapidly expanding seat category.

- By End User

On the basis of end user, the aircraft seat actuation systems market is segmented into OEM and aftermarket. The OEM segment dominated the market in 2025, driven by rising aircraft production rates and line-fit installation of advanced seating systems. Aircraft manufacturers and seat suppliers increasingly collaborate to integrate optimized actuation systems during initial aircraft assembly. Growing orders for new-generation aircraft directly support OEM segment dominance.

The aftermarket segment is anticipated to grow at the fastest rate from 2026 to 2033, fueled by frequent cabin retrofits and seat upgrades by airlines. Operators invest in seat refurbishment to enhance passenger experience without purchasing new aircraft. Increasing focus on cabin modernization and compliance with evolving comfort standards accelerates demand for aftermarket actuation systems.

Aircraft Seat Actuation Systems Market Regional Analysis

- North America dominated the aircraft seat actuation systems market with the largest revenue share of 44.27% in 2025, driven by strong aircraft manufacturing activity, high air passenger traffic, and continuous investment in cabin comfort upgrades

- The region places strong emphasis on premium passenger experience, particularly across long-haul and wide-body aircraft, which increases demand for advanced seat actuation systems with multiple adjustment functions

- This dominance is further supported by the presence of major aircraft OEMs, leading seat manufacturers, and frequent fleet modernization programs, establishing North America as a key revenue-generating region

U.S. Aircraft Seat Actuation Systems Market Insight

The U.S. aircraft seat actuation systems market captured the largest revenue share in 2025 within North America, driven by high commercial aircraft deliveries and large-scale fleet expansion by domestic airlines. U.S. carriers strongly prioritize business and premium economy seating upgrades to remain competitive on international routes. The country’s leadership in aircraft production, coupled with strong adoption of electrically actuated seating systems, continues to propel market growth. Moreover, increasing investments in cabin retrofitting and passenger comfort technologies significantly support market expansion.

Europe Aircraft Seat Actuation Systems Market Insight

The Europe aircraft seat actuation systems market is projected to grow at a steady CAGR during the forecast period, supported by strong regulatory focus on passenger comfort and safety standards. Rising demand for premium seating solutions across both legacy and low-cost carriers is driving adoption of advanced actuation systems. Europe also benefits from the presence of major aircraft and seat system manufacturers, which supports consistent technological innovation and system upgrades across commercial fleets.

U.K. Aircraft Seat Actuation Systems Market Insight

The U.K. aircraft seat actuation systems market is expected to grow at a notable CAGR during the forecast period, driven by increasing international air travel and ongoing investments in fleet modernization. Airlines operating from the U.K. are focusing on improving in-flight comfort to enhance passenger satisfaction on long-haul routes. The growing demand for premium economy and business class seating configurations is supporting higher installation of powered seat actuation systems.

Germany Aircraft Seat Actuation Systems Market Insight

The Germany aircraft seat actuation systems market is anticipated to expand at a considerable CAGR, fueled by the country’s strong aerospace manufacturing base and emphasis on engineering excellence. Germany plays a critical role in aircraft component production, including seating and cabin interior systems. The focus on lightweight, energy-efficient actuation technologies aligns with airline objectives to reduce operational costs while enhancing passenger comfort.

Asia-Pacific Aircraft Seat Actuation Systems Market Insight

The Asia-Pacific aircraft seat actuation systems market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid growth in air passenger traffic and aggressive aircraft fleet expansion. Rising middle-class income levels and increasing demand for air travel are prompting airlines to invest in improved seating comfort. The expansion of both full-service and low-cost carriers across the region is accelerating demand for advanced yet cost-efficient seat actuation systems.

Japan Aircraft Seat Actuation Systems Market Insight

The Japan aircraft seat actuation systems market is gaining traction due to the country’s strong focus on passenger comfort, service quality, and technological sophistication. Japanese airlines emphasize precision-engineered seating solutions with smooth and reliable actuation performance. The integration of compact, lightweight electromechanical systems supports the growing demand for premium cabin upgrades and efficient aircraft interior designs.

China Aircraft Seat Actuation Systems Market Insight

The China aircraft seat actuation systems market accounted for the largest revenue share in Asia Pacific in 2025, supported by massive growth in domestic and international air travel. Rapid expansion of airline fleets and increasing aircraft deliveries are driving demand for seat actuation systems across all seat classes. China’s strong push toward aviation self-reliance, along with rising investment in locally manufactured aircraft components, is further strengthening market growth.

Aircraft Seat Actuation Systems Market Share

The aircraft seat actuation systems industry is primarily led by well-established companies, including:

- Astronics Corporation (U.S.)

- ITT Inc. (U.S.)

- Collins Aerospace (U.S.)

- Bühler Motor GmbH (Germany)

- Meggitt PLC (U.K.)

- Safran (France)

- BAE Systems (U.K.)

- Moog Inc. (U.S.)

- KID-Systeme GmbH (Germany)

- Lee Air, Inc. (U.S.)

- maxon (Switzerland)

- Kyntronics (U.S.)

- Elektro-Metall Export GmbH (Germany)

- GGI Solutions (U.S.)

- Portescap (U.S.)

- Precipart (U.S.)

- QuEST Global Services Pte. Ltd. (Singapore)

- Imagik International Corp (U.S.)

- Mid-Continent Instrument Co., Inc. (U.S.)

- Mesag System AG (Switzerland)

- Kyntec Corporation (U.S.)

- Rollon S.p.A. (Italy)

- TestWorks Group Ltd (U.K.)

- NOOK Industries, Inc. (U.S.)

- InFlight Peripherals Ltd (U.K.)

Latest Developments in Global Aircraft Seat Actuation Systems Market

- In July 2025, Safran completed the acquisition of Collins Aerospace’s flight control and actuation operations, significantly strengthening its position in the global aircraft actuation systems market. This development enhances Safran’s portfolio across both commercial and military aviation by expanding its capabilities in critical flight control technologies. The acquisition supports deeper system integration opportunities and reinforces Safran’s competitiveness in next-generation aircraft programs

- In April 2025, Collins Aerospace launched advanced aftermarket seating solutions featuring its Pinnacle main cabin seats, directly impacting the aircraft seat actuation systems market by increasing demand for retrofit and upgrade solutions. This introduction allows airlines to enhance passenger comfort without full aircraft replacement, driving growth in the aftermarket segment. The focus on modular and upgradable seating systems supports recurring revenue streams and fleet modernization trends

- In March 2025, ITT Inc., through its Enidine and Compact brands, showcased upgraded motion control solutions and enhanced customization software at ProMat 2025, influencing the actuation systems market through improved design flexibility and performance reliability. These advancements enable aerospace customers to tailor actuation components more efficiently to specific aircraft and seating requirements. The emphasis on customization strengthens supplier value in complex aircraft interior and control applications

- In December 2024, Woodward announced an agreement to acquire Safran Electronics & Defense’s North American electromechanical actuation business, reinforcing Woodward’s presence in advanced aircraft actuation technologies. Full ownership of the Horizontal Stabilizer Trim Actuation systems expands Woodward’s role in flight-critical electromechanical solutions used in major aircraft platforms. This move supports long-term growth by aligning Woodward with next-generation aircraft development programs

- In November 2024, Rollon announced the expansion of its U.S. manufacturing footprint with a new facility in Michigan and a new office in New Jersey, strengthening supply capabilities for actuators and multi-axis systems. This expansion enhances Rollon’s ability to serve aerospace customers with localized production and engineering support. Increased manufacturing capacity directly supports rising demand for precision actuation solutions across aircraft, automation, and industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.