Global Aircraft Communication System Market

Market Size in USD Billion

CAGR :

%

USD

7.12 Billion

USD

16.53 Billion

2025

2033

USD

7.12 Billion

USD

16.53 Billion

2025

2033

| 2026 –2033 | |

| USD 7.12 Billion | |

| USD 16.53 Billion | |

|

|

|

|

Aircraft Communication System Market Size

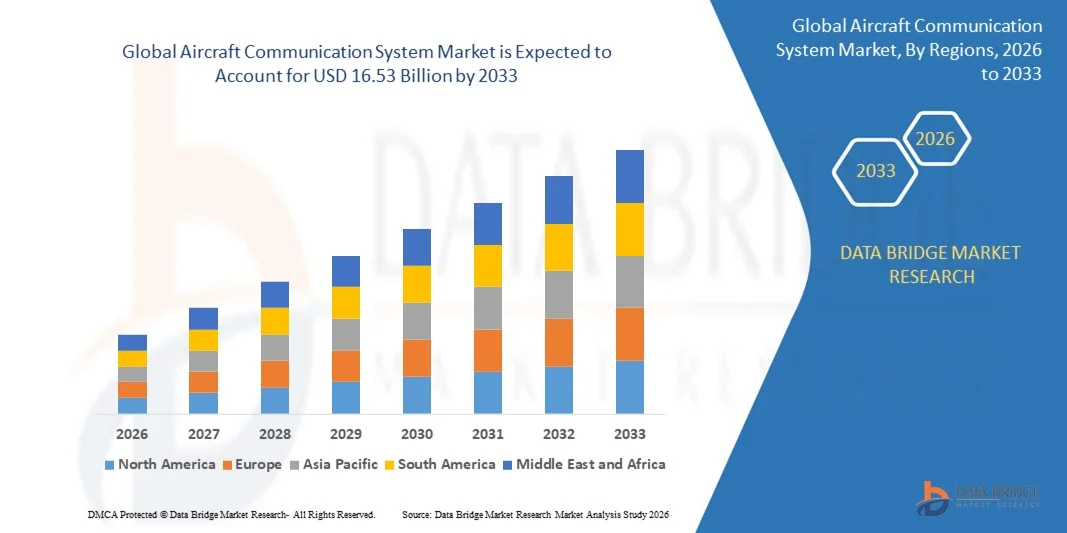

- The global aircraft communication system market size was valued at USD 7.12 billion in 2025 and is expected to reach USD 16.53 billion by 2033, at a CAGR of 11.10% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced avionics systems driven by increasing aircraft production, fleet modernisation programmes, and the expansion of commercial aviation

- Growing emphasis on real-time data transmission, secure voice and data communication, and enhanced air traffic management capabilities is supporting sustained market expansion

Aircraft Communication System Market Analysis

- The aircraft communication system market is witnessing steady growth due to the increasing integration of digital and software-defined communication technologies that improve reliability, bandwidth efficiency, and operational safety

- Technological advancements such as satellite-based communication, IP-enabled avionics, and next-generation air-ground communication systems are transforming cockpit and cabin connectivity while supporting compliance with evolving aviation safety standards

- North America dominated the aircraft communication system market with the largest revenue share in 2025, driven by strong investments in aviation infrastructure, high aircraft production rates, and early adoption of advanced avionics and communication technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global aircraft communication system market, driven by increasing air passenger traffic, large-scale aircraft deliveries, rising defence budgets, and growing adoption of advanced communication technologies across emerging economies

- The antenna segment held the largest market revenue share in 2025 driven by the increasing installation of advanced communication antennas to support satellite-based and air-to-ground connectivity across commercial and military aircraft. Antennas play a critical role in ensuring reliable signal transmission, improved bandwidth, and consistent communication performance under varying flight conditions

Report Scope and Aircraft Communication System Market Segmentation

|

Attributes |

Aircraft Communication System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Communication System Market Trends

Rising Demand for Secure and High-Reliability Aircraft Communication Systems

- Growing emphasis on aviation safety, operational efficiency, and real-time information exchange is significantly shaping the aircraft communication system market. Airlines, aircraft operators, and air navigation service providers are increasingly adopting advanced communication systems to ensure secure voice and data transmission between aircraft and ground stations

- Increasing air traffic density and the expansion of commercial and business aviation are driving the need for reliable air-to-ground and air-to-air communication solutions. Modern aircraft communication systems support enhanced situational awareness, flight tracking, and coordination, helping reduce operational risks and improve flight efficiency

- Regulatory focus on modernising air traffic management and improving communication infrastructure is encouraging the adoption of next-generation technologies such as satellite-based communication, data link systems, and IP-enabled avionics. Compliance with evolving aviation safety and communication standards is reinforcing this trend

- For instance, in 2024, aircraft manufacturers and avionics suppliers such as Honeywell in the U.S. and Thales in France expanded the integration of satellite communication and secure data link systems across new commercial and military aircraft platforms to enhance connectivity and operational reliability

- While demand for advanced communication systems is rising, sustained market growth depends on system interoperability, cybersecurity resilience, and cost-efficient upgrades. Companies are focusing on scalable, software-driven communication architectures to support future air traffic growth and evolving regulatory requirements

Aircraft Communication System Market Dynamics

Driver

Rising Focus on Aviation Safety, Connectivity, and Regulatory Compliance

- Increasing awareness of the critical role of communication systems in ensuring flight safety and operational continuity is a major driver for the aircraft communication system market. Airlines and operators are investing in reliable and secure communication technologies to meet safety standards and enhance operational performance

- Expanding applications across commercial, military, and business aviation are supporting market growth. Advanced communication systems enable real-time data exchange, improved flight management, and effective coordination with air traffic control, helping operators meet stringent safety and efficiency expectations

- Aircraft manufacturers and avionics providers are actively deploying advanced technologies such as satellite communication, VHF data link, and software-defined radios to improve bandwidth, coverage, and communication reliability. These initiatives are aligned with increasing demand for digitalisation and next-generation air traffic management systems

- For instance, in 2023, Collins Aerospace in the U.S. and L3Harris Technologies reported increased deployment of secure and high-capacity communication systems across military and commercial aircraft fleets to support mission-critical operations and regulatory compliance

- Although safety and connectivity requirements are driving adoption, continued growth depends on cost optimisation, seamless integration with existing avionics, and availability of certified communication infrastructure across global airspace

Restraint/Challenge

High Costs and Complex Integration Requirements

- The high cost of advanced aircraft communication systems, including satellite terminals, antennas, and certified avionics hardware, remains a key challenge, particularly for small and mid-sized operators. Installation, certification, and maintenance expenses add to the overall cost burden

- Complexity in integrating new communication systems with legacy avionics and aircraft platforms can delay adoption. Ensuring interoperability, cybersecurity protection, and compliance with multiple aviation standards increases technical and operational challenges for operators and manufacturers

- Infrastructure limitations and spectrum availability constraints also affect market growth. Reliable satellite coverage, ground station availability, and frequency management are critical for consistent communication performance

- For instance, in 2024, regional airlines and charter operators in parts of Latin America and Africa reported slower adoption of advanced aircraft communication systems due to high upgrade costs, certification complexity, and limited supporting infrastructure

- Addressing these challenges will require cost-effective system designs, standardised integration frameworks, and collaborative efforts between regulators, aircraft manufacturers, and communication service providers. In addition, investments in scalable and software-driven communication solutions will be essential to support long-term market expansion

Aircraft Communication System Market Scope

The market is segmented on the basis of component, product, aircraft type, and distribution channel.

- By Component

On the basis of component, the aircraft communication system market is segmented into Antenna, Transponder, Receiver, Transmitter, Transceiver, Display and Processor, and Others. The antenna segment held the largest market revenue share in 2025 driven by the increasing installation of advanced communication antennas to support satellite-based and air-to-ground connectivity across commercial and military aircraft. Antennas play a critical role in ensuring reliable signal transmission, improved bandwidth, and consistent communication performance under varying flight conditions.

The transceiver segment is expected to witness the fastest growth rate from 2026 to 2033 supported by the rising adoption of integrated and software-defined communication systems. Transceivers enable both transmission and reception of signals within a single unit, reducing system complexity and supporting next-generation digital communication architectures.

- By Product

On the basis of product, the aircraft communication system market is segmented into SATCOM, VHF/UHF/L-Band, HF Communication, Data Link Communication, and Others. The SATCOM segment accounted for the largest market share in 2025 due to its ability to provide long-range, high-capacity, and reliable communication for commercial, military, and business aviation. SATCOM systems support real-time data exchange, cockpit connectivity, and passenger communication services.

The data link communication segment is expected to witness the fastest growth rate from 2026 to 2033 driven by increasing implementation of digital air traffic management and flight information systems. Data link solutions improve communication efficiency, reduce voice congestion, and enhance flight safety through automated message exchange.

- By Aircraft Type

On the basis of aircraft type, the market is segmented into Commercial Aircraft, Military Aircraft, Helicopters, and Spacecraft. The commercial aircraft segment dominated the market in 2025 supported by rising air passenger traffic, fleet expansion, and increasing demand for advanced avionics and connectivity solutions. Airlines are investing in modern communication systems to improve operational efficiency and comply with evolving regulatory requirements.

The military aircraft segment is expected to witness the fastest growth rate from 2026 to 2033 owing to increased defence spending and the need for secure, resilient, and mission-critical communication systems. Advanced communication technologies are essential for surveillance, coordination, and real-time battlefield awareness.

By Distribution Channel

On the basis of distribution channel, the aircraft communication system market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM segment held the largest market share in 2025 due to the integration of advanced communication systems during new aircraft manufacturing. Aircraft manufacturers increasingly collaborate with avionics suppliers to embed next-generation communication solutions at the production stage.

The aftermarket segment is projected to grow steadily from 2026 to 2033 driven by retrofit demand, fleet modernisation programmes, and regulatory upgrades. Airlines and operators are upgrading existing aircraft with advanced communication systems to enhance connectivity, safety, and operational performance.

Aircraft Communication System Market Regional Analysis

- North America dominated the aircraft communication system market with the largest revenue share in 2025, driven by strong investments in aviation infrastructure, high aircraft production rates, and early adoption of advanced avionics and communication technologies

- Aircraft operators in the region place high importance on secure, reliable, and high-bandwidth communication systems to support flight safety, air traffic management, and real-time data exchange

- This dominance is further supported by the presence of leading aircraft manufacturers and avionics providers, robust defence spending, and continuous upgrades of commercial and military aircraft fleets

U.S. Aircraft Communication System Market Insight

The U.S. aircraft communication system market captured the largest revenue share in 2025 within North America, supported by a large commercial aviation fleet and significant military aviation expenditure. Airlines and defence agencies are increasingly investing in next-generation communication systems to enhance connectivity, situational awareness, and operational efficiency. The growing adoption of satellite communication, data link technologies, and software-defined radios is further strengthening market growth. In addition, ongoing air traffic modernisation initiatives are accelerating demand for advanced communication solutions.

Europe Aircraft Communication System Market Insight

The Europe aircraft communication system market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent aviation safety regulations and increasing focus on modernising air traffic management systems. Rising demand for efficient communication across commercial, military, and business aviation is supporting market expansion. European countries are investing in satellite-based and digital communication technologies to improve airspace efficiency and reduce congestion. The region is also seeing increased adoption across new aircraft deliveries and retrofit programmes.

U.K. Aircraft Communication System Market Insight

The U.K. aircraft communication system market is expected to witness strong growth from 2026 to 2033, supported by continuous investments in defence aviation and air traffic management infrastructure. The need for secure and resilient communication systems is rising across both military and commercial aircraft operations. The U.K.’s emphasis on advanced aerospace technologies and participation in multinational aviation programmes is contributing to increased adoption of next-generation communication systems.

Germany Aircraft Communication System Market Insight

The Germany aircraft communication system market is expected to witness notable growth from 2026 to 2033, driven by the country’s strong aerospace manufacturing base and focus on technological innovation. Increasing demand for advanced avionics and communication solutions in commercial and military aircraft is supporting market expansion. Germany’s emphasis on digitalisation, safety compliance, and efficient airspace management is encouraging adoption of modern aircraft communication technologies.

Asia-Pacific Aircraft Communication System Market Insight

The Asia-Pacific aircraft communication system market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid expansion of commercial aviation, rising air passenger traffic, and increasing defence spending. Countries such as China, Japan, and India are investing heavily in new aircraft procurement and aviation infrastructure upgrades. The growing focus on improving air traffic management and flight safety is accelerating demand for advanced communication systems across the region.

Japan Aircraft Communication System Market Insight

The Japan aircraft communication system market is expected to witness strong growth from 2026 to 2033 due to increasing investments in commercial aviation and defence modernisation. Japan’s advanced technological ecosystem and focus on high-reliability communication systems are driving adoption. Integration of satellite communication and data link systems to enhance flight safety and operational efficiency is supporting market growth across civil and military aviation sectors.

China Aircraft Communication System Market Insight

The China aircraft communication system market accounted for the largest revenue share in Asia Pacific in 2025, supported by rapid fleet expansion, strong domestic aircraft manufacturing capabilities, and large-scale investments in aviation infrastructure. China’s focus on modernising air traffic management and enhancing communication capabilities across commercial and military aircraft is driving demand. The development of smart airports and next-generation aviation systems is further propelling market growth.

Aircraft Communication System Market Share

The Aircraft Communication System industry is primarily led by well-established companies, including:

- Collins Aerospace (U.S.)

- Honeywell International Inc. (U.S.)

- Northrop Grumman (U.S.)

- Thales Group (France)

- Raytheon Company (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Cobham Limited (U.K.)

- General Dynamics Mission Systems, Inc. (U.S.)

- Iridium Communications Inc. (U.S.)

- Viasat, Inc. (U.S.)

- Rohde & Schwarz (Germany)

- Lockheed Martin Corporation (U.S.)

Latest Developments in Global Aircraft Communication System Market

- In June 2025, Airbus Defence & Space, in collaboration with Thales, secured a contract to integrate a safety satellite communication system into the A400M military transport aircraft, enhancing secure connectivity, mission coordination, and operational safety for military aviation, thereby strengthening demand for advanced SATCOM solutions in defence aircraft

- In May 2025, Honeywell, through L3Harris Technologies, upgraded the U.S. Army’s Airborne Reconnaissance and Electronic Warfare System (ARES) with its JetWave X satellite communication system, improving high-speed, resilient airborne connectivity and reinforcing the market shift toward high-capacity military communication systems

- In November 2024, L3Harris Technologies received a USD 999 million contract from the U.S. Navy to deliver MIDS JTRS Link 16 software-defined radios for air, ground, and maritime platforms, significantly enhancing secure, interoperable communications and driving large-scale adoption of software-defined communication technologies.

- In September 2024, Viasat, Inc. was awarded a USD 33.6 million contract by the U.S. Air Force Research Laboratory to develop AESA-based satellite communication systems for tactical aircraft, strengthening next-generation SATCOM capabilities.

- In April 2024, Thales completed the acquisition of Cobham Aerospace Communications, expanding its cockpit safety and connected avionics portfolio, while L3Harris Technologies secured contracts with Air India for voice and data recorders and BAE Systems received a USD 459 million U.S. Department of Defense contract for advanced aviation radio systems, collectively boosting innovation, safety, and modernization across the aircraft communication system market

- In November 2023, Embraer delivered its fifth upgraded E-99M aircraft to the Brazilian Air Force, featuring advanced software-defined radios, mission audio systems, and enhanced data link architecture, improving airborne surveillance and communication capabilities. This development underscores growing demand for integrated, digital communication systems in military and special mission aircraft, supporting long-term market expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.