Global Ai In Bioinformatics Market

Market Size in USD Million

CAGR :

%

USD

2.53 Million

USD

3.20 Million

2022

2030

USD

2.53 Million

USD

3.20 Million

2022

2030

| 2023 –2030 | |

| USD 2.53 Million | |

| USD 3.20 Million | |

|

|

|

|

AI in Bioinformatics Market Analysis and Size

The reduction in the genetic sequencing cost has enhanced the demand of the market. The rising healthcare expenditure for better health services is also attributed to the growth of the market. The major market players are highly focused on various service launches and service approvals during this crucial period. In addition, the growing demand for bioinformatics and increasing public-private sector funding for bioinformatics are also contributing to the rising demand for the market.

The AI in bioinformatics market is growing in the forecast year due to the rise in market players and the availability of advanced services. Along with this, manufacturers are engaged in R&D activity for launching novel services in the market. The increasing advancements in bioinformatics technology are further boosting the market growth. However, the high cost of instrumentations and cybersecurity concerns in bioinformatics might hamper the growth of the AI in bioinformatics market in the forecast period.

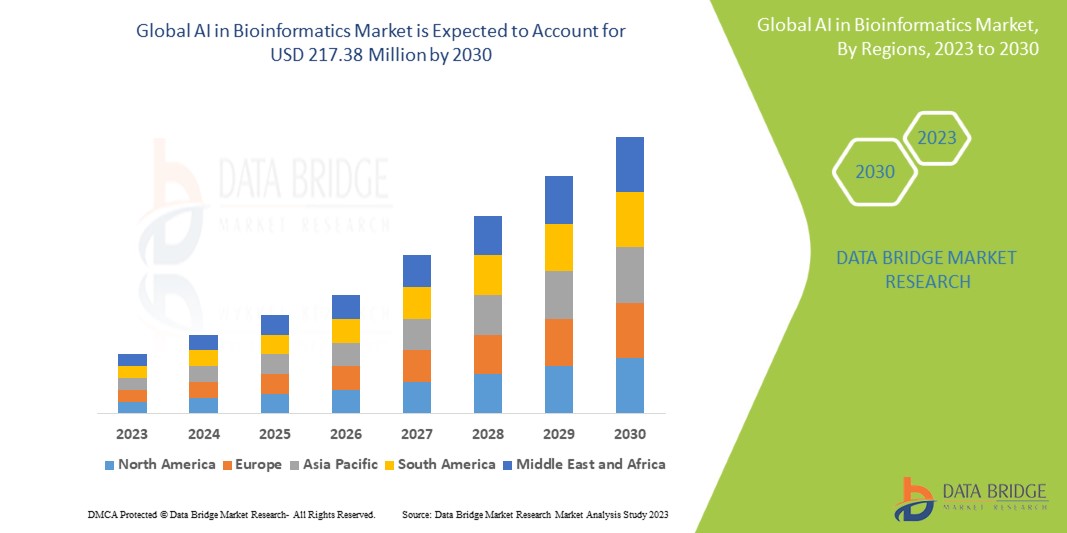

Data Bridge Market Research analyzes that the global AI in bioinformatics market is valued at USD 2.53 million in 2022 and is expected to reach USD 217.38 million by 2030, registering a CAGR of 42.7% during the forecast period of 2023-2030. “Services" accounts for the largest technology segment in the AI in bioinformatics market due to rapid developments in technological pathways to commercialize the use of handheld AI in bioinformatics. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Offering (Software, Services, Others), Type (Machine Learning, Deep Learning, Others), Products and Services (Knowledge Management Tools, Bioinformatics Platforms, Bioinformatic Services), Application (Genomics, Microarrays, System Biology, Text Mining, Chemoinformatics & Drug Design, Proteomics, Transcriptomics, DNA Sequencing, Metabolomics, Others), Sector (Medical Biotechnology, Animal Biotechnology, Plant Biotechnology, Environmental Biotechnology, Forensic Biotechnology, Others) |

|

Countries Covered |

U.S., Canada, Mexico. U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe, China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia-Pacific , South Africa, Saudi Arabia, U.A.E., Israel, Egypt and Rest of Middle East and Africa, Brazil, Argentina and Rest of South America |

|

Market Players Covered |

JADBio (U.S.), Gnosis Data Analysis (Israel), Fios Genomics (U.K.), SOPHiA GENETICS (Switzerland), Biomax Informatics Inc. (U.S.), DNASTAR (U.S.), Ardigen (Parent Company Selvita Group) (Poland), Source BioScience (U.K.), QIAGEN (Germany), NeoGenomics Laboratories (U.S.), CelbridgeScience (U.S), Eurofins Scientific (Luxembourg), Illumina, Inc. (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Insilico Medicine (U.S.), Strand Life Sciences (India), Dassault Systèmes (France), iNDX.Ai (U.S.), Paige AI, Inc. (U.S.), SomaLogic Operating Co., Inc. (U.S.), and among others |

|

Market Opportunities |

|

Market Definition

Bioinformatics is a sub-discipline that has to do with the analysis of sequences of biological molecules. It usually refers to genes, DNA, RNA, or protein and is particularly useful in comparing genes and other sequences in proteins and different sequences within an organism or between organisms, looking at the evolutionary relationships between organisms and using the patterns that exist across DNA and protein sequences to figure out what their function is.

Bioinformatics combines computer programming, big data and molecular biology, which enables scientists to understand and identify patterns in biological data. It is particularly useful in studying genomes and DNA sequencing, as it allows scientists to organize large amounts of data.

From genetics to toxicology to mycology and radiobiology, there are scores of branches of biology to specialize in. And out of the many, bioinformatics is one of the intriguing fields which enables you to identify, evaluate, store and retrieve biological information. Being an interdisciplinary field of study, it incorporates various applications of computer science, statistics and biology to develop software applications for understanding biological data like DNA sequencing, protein analysis, evolutionary genetics and others.

In the coming future, important decisions related to bioinformatics on drug discovery will be made by individuals who not only understand biology but can also use the bioinformatics tools and the knowledge they release to develop hypotheses and identify the quality target.

Global AI in Bioinformatics Market Dynamics

Drivers

- Growing demand for bioinformatics

As genomics focused, pharmacology continues to play a greater role in the treatment of various chronic diseases, especially cancer, next-generation sequencing (NGS) is evolving as a powerful tool for providing a deeper and more precise insight into molecular underpinnings of individual tumors and specific receptors. Informatics is essential in biological research, which involves biologists who learn programming, or computer programmers, mathematicians, or database managers to learn the foundations of biology.

- Reduction in the genetic sequencing cost

The strong demand for decreasing the cost of genomics and biomarker prediction has contributed to the creation of high-throughput genome sequencing, which often goes by the name next-generation sequencing (NGS). Thousands or millions of sequences in a single bioinformatics cycle are generated simultaneously. Dramatic upgrades to industrial NGS technologies have culminated in dramatic cutbacks in DNA sequencing cost-per-base. Thus recently, the main sequencing techniques have become the key subject of research, with sample design optimization taking a secondary function.

- Increasing public-private sector funding for bioinformatics

In order to improve the workflow for bioinformatics, the federal agencies, the public and the private agencies are providing funds in order to carry out bioinformatics projects and to scientists for research purposes. It is important to approach possible funders with a clear proposal and strategy of what is to be achieved in terms of bioinformatics capacity building in the institution as well as the intended outputs and outcomes. Many government bodies and private organizations across the globe are increasingly investing in the field of bioinformatics. These investments have largely resulted in data and technological advancements in bioinformatics services, which, in turn, have improved the quality of these services.

Opportunities

- Strategic initiatives of key players

The dramatic rise in the quality of research coupled with increasing research opportunities is because of various strategic initiatives taken by key market players. They are taking initiatives such as product launches, collaborations, mergers, acquisitions and many more over the years and are expected to lead and create more opportunities in the market.

By successfully working with new technology firms to ensure continued growth, creativity and viability in the industry, healthcare product suppliers have a huge opportunity. Health enterprises that implement technology-enabled technologies will explore new modes of goods for patient care, streamline processes and engage patients more.

Companies to discover and develop advanced bioinformatics products and these companies are launching new initiatives and collaborating with other key players to deliver more reliable results and services.

- Advancement in bioinformatics technology

The dimensions and cost of bioinformatics platforms and instruments are decreasing, allowing easier uptake by public health laboratories. Although currently, AI based bioinformatics requires highly specialized equipment and substantially skilled staff to analyze the data, it is unlikely that the bioinformatics revolution has finished. With rising technology, up-gradation of instruments and techniques is also needed, moreover, the bioinformatics market has a vast potential to upgrade in various applications and there are high chances of the advancement of bioinformatics techniques in the forecasted period.

Restraints/Challenges

- High cost of instrumentation

The cost of the device plays a major factor in the market. The AI based bioinformatics instrument is highly sophisticated and needs high validation and other specification, which increase. Genomics instruments are also equipped with advanced features and functionalities and are thus priced at a premium, ranging between USD 10–20 million. As pharmaceutical companies and research laboratories require many such systems, their capital expenditure on procuring multiple genomic instruments is very high. In the case of small and medium-sized pharmaceutical companies and research laboratories, it is not feasible for them to make such high investments in multiple genomics instruments. Hence, the high cost of AI based equipment is expected to restrain the market growth.

- Lack of skilled professionals to perform AI based bioinformatics technology

One of biology's most rapidly developing fields of study is bioinformatics, which involves developing and using computational tools for collecting, archiving, organizing, analyzing, and visualizing biological data. The advancement of technology has made it possible to reach the level of next-generation analysis from conventional data analysis methods. The advancement of the technology of bioinformatics requires various skill sets for its handling. As the bioinformatics platforms are highly automated and costly machines, the improper handling of such machines can damage their parts which can hamper achieving analysis and visualisation of biological data. Thereby, it will proportionally hamper the result of data processing. The dearth of skilled professionals having adequate skills and knowledge to perform next-generation sequencing, therefore, hampers the growth of the market.

This AI in bioinformatics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the AI in bioinformatics market contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In June 2022, SOPHiA GENETICS, a leader in data-driven medicine, announced at the ESHG Conference in Vienna that it has achieved CE-IVD certification for the analytical functionality supported by its cloud-based SOPHiA DDM™ Platform, an accessory to diagnostic applications. With this certification, the SOPHiA DDM™ Platform is now IVD-ready to support all applications and modules designed for diagnostic purposes in the European Union and other markets recognizing this certification. This has helped the company to increase its global presence in the market

- In December 2021, JADBio and BioLizard announced their partnership. BioLizard is agile bioinformatics and AI/ML company globally servicing clients in the life sciences, biotechnology and pharmaceutical industries. JADBio is a robust Automated Machine Learning platform that allows intuitive, timely and interactive creation of ML predictive models on BioMedical and Multi-omics data while allowing for knowledge (biomarker signature) discovery through its vast range of reporting and analysis. This has helped the company to expand its products and services portfolio in the market.

Global AI in Bioinformatics Market Scope

The AI in bioinformatics market is segmented on the basis of offering, type, products and services, application and sector. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Services

- Software

- Others

Type

- Machine Learning

- Deep Learning

- Others

Products and Services

- Bioinformatics Services

- Bioinformatics Platforms

- Knowledge Management Tools

Application

- Genomics

- Chemoinformatics & Drug Design

- Proteomics

- DNA Sequencing

- System Biology

- Transcriptomics

- Text Mining

- Microarrays

- Metabolomics

- Others

Sector

- Medical Biotechnology

- Animal Biotechnology

- Plant Biotechnology

- Environmental Biotechnology

- Forensic Biotechnology

- Others

Global AI in Bioinformatics Analysis/Insights

The AI in bioinformatics market is analyzed and market size insights and trends are provided by country, offering, type, products and services, application and sector as referenced above.

The countries covered in the AI in bioinformatics market report are U.S., Canada, Mexico in North America, U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, rest of Europe in Europe, China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, rest of Asia-Pacific in Asia-Pacific, South Africa, Saudi Arabia, U.A.E., Israel, Egypt and rest of Middle East and Africa (MEA) in Middle East and Africa, Brazil, Argentina and rest of South America in South America.

North America is expected to dominate the global AI in bioinformatics market due to the rising demand for advanced technology and drug development & design, which have accelerated the market growth. To cope with the increasing demand, companies and market players are initiating various strategies such as product launch, advancement, acquisition agreements and others which is expected to dive the market growth.

Asia-Pacific is expected to show significant growth in AI in Bioinformatics market during the forecast period of 2023 to 203o due to rapidly increasing government investments in healthcare infrastructure and AI research.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and AI in Bioinformatics Market Share Analysis

The AI in bioinformatics market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies focus on the AI in bioinformatics market.

The major players covered in the AI in bioinformatics market report are:

- JADBio (U.S.)

- Gnosis Data Analysis (Israel)

- Fios Genomics (U.K.)

- SOPHiA GENETICS (Switzerland)

- Biomax Informatics Inc. (U.S.)

- DNASTAR (U.S.)

- Ardigen (Parent Company Selvita Group) (Poland)

- Source BioScience (U.K.)

- QIAGEN (Germany)

- NeoGenomics Laboratories (U.S.)

- CelbridgeScience (U.S.)

- Eurofins Scientific (Luxembourg)

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Insilico Medicine (U.S.)

- Strand Life Sciences (India)

- Dassault Systèmes (France)

- iNDX.Ai (U.S.)

- Paige AI, Inc. (U.S.)

- SomaLogic Operating Co., Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AI IN BIOINFORMATICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AI IN BIOINFORMATICS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 SALES VOLUME

2.2.11 EPIDEMIOLOGY MODELLING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AI IN BIOINFORMATICS MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6. INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYSIS AND RECOMMENDATIONS

7. INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8. COST ANALYSIS BREAKDOWN

9. TECHNOLOGY ROADMAP

10. INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11. REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12. REIMBURSEMENT FRAMEWORK

13. OPPUTUNITY MAP ANALYSIS

14. INSTALLED BASE DATA

15. VALUE CHAIN ANALYSIS

16. HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.10 ECONOMIC DEVELOPMENT

17. GLOBAL AI IN BIOINFORMATICS MARKET, BY OFFERING

17.1 OVERVIEW

17.2 SOFTWARE

17.2.1 BY MODE

17.2.1.1. INTEGRATED

17.2.1.2. STANDALONE

17.2.2 BY DEPLOYMENT MODE

17.2.2.1. WEB-BASED

17.2.2.2. CLOUD-BASED

17.2.2.3. ON PREMISE

17.3 SERVICES

17.4 HARDWARE

18. GLOBAL AI IN BIOINFORMATICS MARKET , BY PRODUCT AND SERVICES

18.1 OVERVIEW

18.2 KNOWLEDGE MANAGEMENT TOOLS

18.2.1 GENERALISED KNOWLEDGE MANAGEMENT TOOLS

18.2.2 SPECIALISED KNOWLEDGE MANAGEMENT TOOLS

18.3 BIOINFORMATICS PLATFORMS

18.3.1 SEQUENCE ANALYSIS PLATFORMS

18.3.2 SEQUENCE ALIGNMENT PLATFORMS

18.3.3 SEQUENCE MANIPULATION PLATFORMS

18.3.4 STRUCTURAL ANALYSIS PLATFORMS

18.3.5 OTHERS

18.4 BIOINFORMATICS SERVICES

18.4.1 SEQUENCING SERVICES

18.4.2 DATABASE MANAGEMENT

18.4.3 DATA ANALYSIS

18.4.4 OTHERS

19. GLOBAL AI IN BIOINFORMATICS MARKET , BY TYPE

19.1 OVERVIEW

19.2 MACHINE LEARNING

19.2.1 SUPERVISED LEARNING

19.2.2 UNSUPERVISED LEARNING

19.3 DEEP LEARNING

19.4 NATURAL LANGUAGE PROCESSING (NLP)

19.5 NEURAL NETWORKS

19.6 OTHERS

20. GLOBAL AI IN BIOINFORMATICS MARKET , BY APPLICATION

20.1 OVERVIEW

20.2 GENOMICS

20.2.1 BY TYPE

20.2.1.1. SEQUENCE ANALYSIS

20.2.1.1.1. DNA

20.2.1.1.2. RNA

20.2.1.2. GENE EXPRESSION ANALYSIS AND CLUSTERING

20.2.1.3. VIRAL GENE-VARIANT REPORTING

20.2.1.4. OTHERS

20.2.2 BY OFFERING

20.2.2.1. SOFTWARE

20.2.2.1.1. BY MODE

20.2.2.1.1.1 INTEGRATED

20.2.2.1.1.2 STANDALONE

20.2.2.1.2. BY DEPLOYMENT MODE

20.2.2.1.2.1 WEB-BASED

20.2.2.1.2.2 CLOUD-BASED

20.2.2.1.2.3 ON PREMISE

20.2.2.2. SERVICES

20.2.2.3. HARDWARE

20.3 MICROARRAYS

20.3.1 SOFTWARE

20.3.1.1. BY MODE

20.3.1.1.1. INTEGRATED

20.3.1.1.2. STANDALONE

20.3.1.2. BY DEPLOYMENT MODE

20.3.1.2.1. WEB-BASED

20.3.1.2.2. CLOUD-BASED

20.3.1.2.3. ON PREMISE

20.3.2 SERVICES

20.3.3 HARDWARE

20.4 STRUCTURALBIOLOGY

20.4.1 SOFTWARE

20.4.1.1. BY MODE

20.4.1.1.1. INTEGRATED

20.4.1.1.2. STANDALONE

20.4.1.2. BY DEPLOYMENT MODE

20.4.1.2.1. WEB-BASED

20.4.1.2.2. CLOUD-BASED

20.4.1.2.3. ON PREMISE

20.4.2 SERVICES

20.4.3 HARDWARE

20.5 CHEMOINFORMATICS & DRUG DESIGN

20.5.1 BY PHASE

20.5.1.1. PRE-CLINICAL

20.5.1.2. HIV AND HEPATITIS C (HCV) PROTEASE CLEAVAGE PREDICTION

20.5.1.3. OTHERS

20.5.2 BY OFFERING

20.5.2.1. SOFTWARE

20.5.2.1.1. BY MODE

20.5.2.1.1.1 INTEGRATED

20.5.2.1.1.2 STANDALONE

20.5.2.1.2. BY DEPLOYMENT MODE

20.5.2.1.2.1 WEB-BASED

20.5.2.1.2.2 CLOUD-BASED

20.5.2.1.2.3 ON PREMISE

20.5.2.2. SERVICES

20.5.2.3. HARDWARE

20.6 PROTEOMICS

20.6.1 SOFTWARE

20.6.1.1. BY MODE

20.6.1.1.1. INTEGRATED

20.6.1.1.2. STANDALONE

20.6.1.2. BY DEPLOYMENT MODE

20.6.1.2.1. WEB-BASED

20.6.1.2.2. CLOUD-BASED

20.6.1.2.3. ON PREMISE

20.6.2 SERVICES

20.6.3 HARDWARE

20.7 TRANSCRIPTOMICS

20.7.1 SOFTWARE

20.7.1.1. BY MODE

20.7.1.1.1. INTEGRATED

20.7.1.1.2. STANDALONE

20.7.1.2. BY DEPLOYMENT MODE

20.7.1.2.1. WEB-BASED

20.7.1.2.2. CLOUD-BASED

20.7.1.2.3. ON PREMISE

20.7.2 SERVICES

20.7.3 HARDWARE

20.8 METABOLOMICS

20.8.1 SOFTWARE

20.8.1.1. BY MODE

20.8.1.1.1. INTEGRATED

20.8.1.1.2. STANDALONE

20.8.1.2. BY DEPLOYMENT MODE

20.8.1.2.1. WEB-BASED

20.8.1.2.2. CLOUD-BASED

20.8.1.2.3. ON PREMISE

20.8.2 SERVICES

20.8.3 HARDWARE

20.9 PRECISION MEDICINE

20.9.1 SOFTWARE

20.9.1.1. BY MODE

20.9.1.1.1. INTEGRATED

20.9.1.1.2. STANDALONE

20.9.1.2. BY DEPLOYMENT MODE

20.9.1.2.1. WEB-BASED

20.9.1.2.2. CLOUD-BASED

20.9.1.2.3. ON PREMISE

20.9.2 SERVICES

20.9.3 HARDWARE

20.10 MOLECULAR MODELING

20.10.1 SOFTWARE

20.10.1.1. BY MODE

20.10.1.1.1. INTEGRATED

20.10.1.1.2. STANDALONE

20.10.1.2. BY DEPLOYMENT MODE

20.10.1.2.1. WEB-BASED

20.10.1.2.2. CLOUD-BASED

20.10.1.2.3. ON PREMISE

20.10.2 SERVICES

20.10.3 HARDWARE

20.11 OTHERS

21. GLOBAL AI IN BIOINFORMATICS MARKET , BY SECTOR

21.1 OVERVIEW

21.2 MEDICAL BIOTECHNOLOGY

21.2.1 SOFTWARE

21.2.1.1. BY MODE

21.2.1.1.1. INTEGRATED

21.2.1.1.2. STANDALONE

21.2.1.2. BY DEPLOYMENT MODE

21.2.1.2.1. WEB-BASED

21.2.1.2.2. CLOUD-BASED

21.2.1.2.3. ON PREMISE

21.2.2 SERVICES

21.2.3 HARDWARE

21.3 ANIMAL BIOTECHNOLOGY

21.3.1 SOFTWARE

21.3.1.1. BY MODE

21.3.1.1.1. INTEGRATED

21.3.1.1.2. STANDALONE

21.3.1.2. BY DEPLOYMENT MODE

21.3.1.2.1. WEB-BASED

21.3.1.2.2. CLOUD-BASED

21.3.1.2.3. ON PREMISE

21.3.2 SERVICES

21.3.3 HARDWARE

21.4 PLANT BIOTECHNOLOGY

21.4.1 SOFTWARE

21.4.1.1. BY MODE

21.4.1.1.1. INTEGRATED

21.4.1.1.2. STANDALONE

21.4.1.2. BY DEPLOYMENT MODE

21.4.1.2.1. WEB-BASED

21.4.1.2.2. CLOUD-BASED

21.4.1.2.3. ON PREMISE

21.4.2 SERVICES

21.4.3 HARDWARE

21.5 ENVIRONMENTAL BIOTECHNOLOGY

21.5.1 SOFTWARE

21.5.1.1. BY MODE

21.5.1.1.1. INTEGRATED

21.5.1.1.2. STANDALONE

21.5.1.2. BY DEPLOYMENT MODE

21.5.1.2.1. WEB-BASED

21.5.1.2.2. CLOUD-BASED

21.5.1.2.3. ON PREMISE

21.5.2 SERVICES

21.5.3 HARDWARE

21.6 FORENSIC BIOTECHNOLOGY

21.6.1 SOFTWARE

21.6.1.1. BY MODE

21.6.1.1.1. INTEGRATED

21.6.1.1.2. STANDALONE

21.6.1.2. BY DEPLOYMENT MODE

21.6.1.2.1. WEB-BASED

21.6.1.2.2. CLOUD-BASED

21.6.1.2.3. ON PREMISE

21.6.2 SERVICES

21.6.3 HARDWARE

21.7 OTHERS

22. GLOBAL AI IN BIOINFORMATICS MARKET , BY END USER

22.1 OVERVIEW

22.2 PHARMA AND BIOPHARMA COMPANIES

22.2.1 SOFTWARE

22.2.1.1. BY MODE

22.2.1.1.1. INTEGRATED

22.2.1.1.2. STANDALONE

22.2.1.2. BY DEPLOYMENT MODE

22.2.1.2.1. WEB-BASED

22.2.1.2.2. CLOUD-BASED

22.2.1.2.3. ON PREMISE

22.2.2 SERVICES

22.2.3 HARDWARE

22.3 BIOTECH COMPANIES

22.3.1 SOFTWARE

22.3.1.1. BY MODE

22.3.1.1.1. INTEGRATED

22.3.1.1.2. STANDALONE

22.3.1.2. BY DEPLOYMENT MODE

22.3.1.2.1. WEB-BASED

22.3.1.2.2. CLOUD-BASED

22.3.1.2.3. ON PREMISE

22.3.2 SERVICES

22.3.3 HARDWARE

22.4 GOVERNMENT AGENCIES

22.4.1 SOFTWARE

22.4.1.1. BY MODE

22.4.1.1.1. INTEGRATED

22.4.1.1.2. STANDALONE

22.4.1.2. BY DEPLOYMENT MODE

22.4.1.2.1. WEB-BASED

22.4.1.2.2. CLOUD-BASED

22.4.1.2.3. ON PREMISE

22.4.2 SERVICES

22.4.3 HARDWARE

22.5 LABORATORIES

22.5.1 SOFTWARE

22.5.1.1. BY MODE

22.5.1.1.1. INTEGRATED

22.5.1.1.2. STANDALONE

22.5.1.2. BY DEPLOYMENT MODE

22.5.1.2.1. WEB-BASED

22.5.1.2.2. CLOUD-BASED

22.5.1.2.3. ON PREMISE

22.5.2 SERVICES

22.5.3 HARDWARE

22.6 RESEARCH AND ACADEMIC INSTITUTES

22.6.1 SOFTWARE

22.6.1.1. BY MODE

22.6.1.1.1. INTEGRATED

22.6.1.1.2. STANDALONE

22.6.1.2. BY DEPLOYMENT MODE

22.6.1.2.1. WEB-BASED

22.6.1.2.2. CLOUD-BASED

22.6.1.2.3. ON PREMISE

22.6.2 SERVICES

22.6.3 HARDWARE

22.7 OTHERS

23. GLOBAL AI IN BIOINFORMATICS MARKET , BY REGION

GLOBAL AI IN BIOINFORMATICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 FRANCE

23.2.3 U.K.

23.2.4 HUNGARY

23.2.5 LITHUANIA

23.2.6 AUSTRIA

23.2.7 IRELAND

23.2.8 NORWAY

23.2.9 POLAND

23.2.10 ITALY

23.2.11 SPAIN

23.2.12 RUSSIA

23.2.13 TURKEY

23.2.14 NETHERLANDS

23.2.15 SWITZERLAND

23.2.16 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 SINGAPORE

23.3.6 THAILAND

23.3.7 INDONESIA

23.3.8 MALAYSIA

23.3.9 PHILIPPINE

23.3.10 AUSTRALIA

23.3.11 NEW ZEALAND

23.3.12 VIETNAM

23.3.13 TAIWAN

23.3.14 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 SAUDI ARABIA

23.5.3 UAE

23.5.4 EGYPT

23.5.5 KUWAIT

23.5.6 ISRAEL

23.5.7 REST OF MIDDLE EAST AND AFRICA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24. GLOBAL AI IN BIOINFORMATICS MARKET , SWOT AND DBMR ANALYSIS

25. GLOBAL AI IN BIOINFORMATICS MARKET , COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26. GLOBAL AI IN BIOINFORMATICS MARKET , COMPANY PROFILE

26.1 ILLUMINA, INC

26.1.1 COMPANY OVERVIEW

26.1.2 GEOGRAPHIC PRESENCE

26.1.3 REVENUE ANALYSIS

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPEMENTS

26.2 DASSAULT SYSTÈMES

26.2.1 COMPANY OVERVIEW

26.2.2 GEOGRAPHIC PRESENCE

26.2.3 REVENUE ANALYSIS

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPEMENTS

26.3 AGILENT TECHNOLOGIES, INC + NVIDIA + AWS

26.3.1 COMPANY OVERVIEW

26.3.2 GEOGRAPHIC PRESENCE

26.3.3 REVENUE ANALYSIS

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPEMENTS

26.4 QIAGEN

26.4.1 COMPANY OVERVIEW

26.4.2 GEOGRAPHIC PRESENCE

26.4.3 REVENUE ANALYSIS

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPEMENTS

26.5 GNOSIS DATA ANALYSIS

26.5.1 COMPANY OVERVIEW

26.5.2 GEOGRAPHIC PRESENCE

26.5.3 REVENUE ANALYSIS

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPEMENTS

26.6 FIOS GENOMICS

26.6.1 COMPANY OVERVIEW

26.6.2 GEOGRAPHIC PRESENCE

26.6.3 REVENUE ANALYSIS

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPEMENTS

26.7 JADBIO – GNOSIS DA S.A.

26.7.1 COMPANY OVERVIEW

26.7.2 GEOGRAPHIC PRESENCE

26.7.3 REVENUE ANALYSIS

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPEMENTS

26.8 DNASTAR

26.8.1 COMPANY OVERVIEW

26.8.2 GEOGRAPHIC PRESENCE

26.8.3 REVENUE ANALYSIS

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPEMENTS

26.9 SOPHIA GENETICS

26.9.1 COMPANY OVERVIEW

26.9.2 GEOGRAPHIC PRESENCE

26.9.3 REVENUE ANALYSIS

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPEMENTS

26.10 BIOMAX INFORMATICS AG + MOLECULAR NETWORKS GMBH

26.10.1 COMPANY OVERVIEW

26.10.2 GEOGRAPHIC PRESENCE

26.10.3 REVENUE ANALYSIS

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPEMENTS

26.11 ARDIGEN

26.11.1 COMPANY OVERVIEW

26.11.2 GEOGRAPHIC PRESENCE

26.11.3 REVENUE ANALYSIS

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPEMENTS

26.12 SOURCE GENOMICS

26.12.1 COMPANY OVERVIEW

26.12.2 GEOGRAPHIC PRESENCE

26.12.3 REVENUE ANALYSIS

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPEMENTS

26.13 EUROFINS SCIENTIFIC

26.13.1 COMPANY OVERVIEW

26.13.2 GEOGRAPHIC PRESENCE

26.13.3 REVENUE ANALYSIS

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPEMENTS

26.14 INSILICO MEDICINE

26.14.1 COMPANY OVERVIEW

26.14.2 GEOGRAPHIC PRESENCE

26.14.3 REVENUE ANALYSIS

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPEMENTS

26.15 NEOGENOMICS LABORATORIES

26.15.1 COMPANY OVERVIEW

26.15.2 GEOGRAPHIC PRESENCE

26.15.3 REVENUE ANALYSIS

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPEMENTS

26.16 GENEDATA AG

26.16.1 COMPANY OVERVIEW

26.16.2 GEOGRAPHIC PRESENCE

26.16.3 REVENUE ANALYSIS

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPEMENTS

26.17 PLISADE BIO. + STRAND LIFE SCIENCES

26.17.1 COMPANY OVERVIEW

26.17.2 GEOGRAPHIC PRESENCE

26.17.3 REVENUE ANALYSIS

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPEMENTS

26.18 INDX.AI.

26.18.1 COMPANY OVERVIEW

26.18.2 GEOGRAPHIC PRESENCE

26.18.3 REVENUE ANALYSIS

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPEMENTS

26.19 PAIGE AI, INC.

26.19.1 COMPANY OVERVIEW

26.19.2 GEOGRAPHIC PRESENCE

26.19.3 REVENUE ANALYSIS

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPEMENTS

26.20 OWKIN

26.20.1 COMPANY OVERVIEW

26.20.2 GEOGRAPHIC PRESENCE

26.20.3 REVENUE ANALYSIS

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPEMENTS

26.21 INSITRO

26.21.1 COMPANY OVERVIEW

26.21.2 GEOGRAPHIC PRESENCE

26.21.3 REVENUE ANALYSIS

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPEMENTS

26.22 SHANGHAI ARTIFICIAL INTELLIGENCE LABORATORY

26.22.1 COMPANY OVERVIEW

26.22.2 GEOGRAPHIC PRESENCE

26.22.3 REVENUE ANALYSIS

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPEMENTS

26.23 IONLACE

26.23.1 COMPANY OVERVIEW

26.23.2 GEOGRAPHIC PRESENCE

26.23.3 REVENUE ANALYSIS

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPEMENTS

26.24 TAMARIND BIO

26.24.1 COMPANY OVERVIEW

26.24.2 GEOGRAPHIC PRESENCE

26.24.3 REVENUE ANALYSIS

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPEMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27. RELATED REPORTS

28. QUESTIONNAIRE

29. CONCLUSION

30. DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.