Global Agrigenomics For Livestock Market

Market Size in USD Billion

CAGR :

%

USD

3.30 Billion

USD

6.11 Billion

2021

2029

USD

3.30 Billion

USD

6.11 Billion

2021

2029

| 2022 –2029 | |

| USD 3.30 Billion | |

| USD 6.11 Billion | |

|

|

|

|

Agrigenomics for Livestock Market Analysis and Size

The agrigenomics industry is growing as a result of significant technological advancements, including a shift from single-gene sequencing to whole-genome sequencing, as well as an increase in genome composition and gene function studies. The increased use of genome sequencing in livestock enables the study of parent lineage as well as the understanding of infectious organisms such as bacteria and viruses that infest or reside in them.

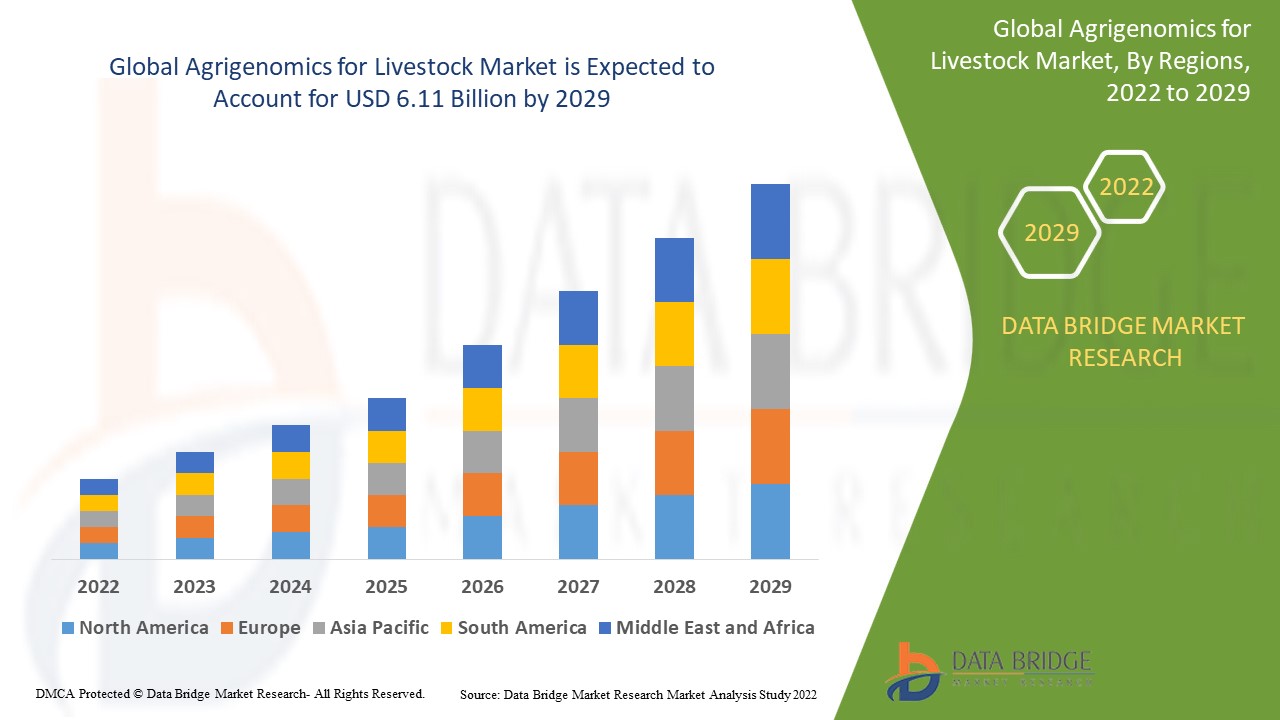

Data Bridge Market Research analyses that the agrigenomics for livestock market was valued at USD 3.3 billion in 2021 and is expected to reach the value of USD 6.11 billion by 2029, at a CAGR of 8.00% during the forecast period. The market is expanding due to growing concerns about animal health. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, technological advancements and patent analysis.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Offering (DNA Extraction and Purification, DNA/RNA Sequencing, Genotyping, Gene Expression Profiling, Marker-Assisted Selection, GMO/Trait Purity Testing, Other), Sequencer Type (Sanger Sequencing, Illumina Hi Seq Family, Pacbio Sequencers, Solid Sequencers, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

SGS SA (Switzerland), Bureau Veritas (France), Eurofins Scientific (Luxembourg), Intertek Group plc (U.K.), Mérieux NutriSciences (U.S.), ALS Limited (Australia), Neogen (U.S.) AsureQuality (New Zealand), Charm Sciences (U.S.), Premier Analytical Services (U.K.), Dairyland Laboratories (U.S.), Bio-Check (U.K.), AES Laboratories (India), IEH Laboratories and Consulting Group (U.S.), Envirologix Inc. (U.S.), EMSL Analytical, Inc. (U.S.), and Krishgen Biosystems (U.S.) |

|

Opportunities |

|

Market Definition

Agrigenomics is the study of genetically modified plants and livestock and how genes affect production. The use of genomics in agriculture allows for increased sustainable livestock output and productivity. The resolution of the next-generation sequence allows researchers to investigate the transmission patterns of infectious pathogens over time, thus contributing to the development of effective medicine.

Agrigenomics for Livestock Market Dynamics

Drivers

- Rapid advancements in tools and technique

Rapid advances in functional genomics, such as the adoption of massively parallel sequencing technology and the development of methods to study cellular behaviour at the molecular level, are propelling the global agrigenomics market. In terms of crop selection scope, speed, and efficiency, molecular marker-assisted crop breeding outperforms traditional breeding programmes in agriculture. According to advanced genome characterization tools, crops can have higher quality and yield while using fewer fertilisers, herbicides, and water.

- Growing global population burden and rising research and development activities

Rising food consumption, increased use of advanced tools and techniques for genome testing, and rising government-funded research and development investments. Furthermore, the growing global population burden and rising demand for livestock and dairy products are some of the other factors influencing global agrigenomics market growth. Some of the factors assisting the market's growth are the introduction of technological advancements in genome databases by livestock breeders and an increase in demand from breeders for high quality livestock animals.

Opportunity

The expansion of the agrigenomics market beyond food and nutritional security is dependent on broadening the application spectrum. Genome analysis tools and techniques can also aid in the detection of food safety issues such as spoilage and contamination, adulteration, and economic fraud, as well as traceability from farm to fork. By providing unprecedented access to genomic information, New Breeding Techniques (NBT) based on applied genetics have transformed crop and livestock breeding strategies. Genomics has also provided data on the biological status of critical resources such as fisheries, crops, and livestock health with great success.

Restraints

However, the low adoption of automated instruments is acting as a market restraint for the agrigenomics for livestock market during the forecasted period, whereas one of the most significant challenges to the market's growth is the hazardous effects that limit certain research practises.

This agrigenomics for livestock market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the agrigenomics for livestock market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Agrigenomics for Livestock Market

The COVID-19 outbreak has created significant medical, social, and economic challenges. Whereas the medical community is focused on developing successful diagnostic and medical treatment, the agricultural and food processing industries are focusing on restoring efficient food production, logistics, and supply chain efficiency, as well as creating buffer systems to absorb future supply-demand shocks. Aside from commodity producers and suppliers, seed manufacturers, trait developers, and genomics researchers are all focusing on capacity-building solutions in the aftermath of the COVID-19 pandemic. Agricultural genomics is progressing toward using gene-editing techniques to create many anti-bacterial, anti-fungal, and anti-viral solutions.

Recent Development

- LGC announced the expansion of its regulated bioanalytical LC-MS service in November 2020 with the installation of a high-resolution mass spectrometer, the SCIEX TripleTOF 6600 LC-MS/MS System.

- Thermo Fisher's newly released platform in November 2019 is the first fully integrated, next-generation sequencing platform with an automated sample-to-report workflow that delivers results economically in a single day.

- Illumina, Inc. announced the NovaSeq S4 flow cell reagent kit and NovaSeq Xp workflow for its NovaSeq 6000 System in January 2017. The NovaSeq platform's power and flexibility are aided by flow cell innovation. The addition of this new flow cell and workflow to the platform expands its capabilities.

Global Agrigenomics for Livestock Market Scope

The agrigenomics for livestock market is segmented on the basis of offering and sequencer type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- DNA Extraction and Purification

- DNA/RNA Sequencing

- Genotyping

- Gene Expression Profiling

- Marker-Assisted Selection

- GMO/Trait Purity Testing

- Other

Sequencer type

- Sanger Sequencing

- Illumina Hi Seq Family

- Pacbio Sequencers

- Solid Sequencers

- Others

Agrigenomics for Livestock Market Regional Analysis/Insights

The agrigenomics for livestock market is analysed and market size insights and trends are provided by country, offering and sequencer type as referenced above.

The countries covered in the agrigenomics for livestock market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The agrigenomics market was dominated by North America. The United States accounted for the largest country-level share due to advances in sequencing and molecular breeding, which are used in applications such as food and agriculture, animal health, and public health. North American countries produce a significant amount of G.M. crops each year, including canola, maize, soybeans, and sugar beets.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Agrigenomics for Livestock Market Share Analysis

The agrigenomics for livestock market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to agrigenomics for livestock market.

Some of the major players operating in the agrigenomics for livestock market are:

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Eurofins Scientific (Luxembourg)

- Intertek Group plc (U.K.)

- Mérieux NutriSciences (U.S.)

- ALS Limited (Australia)

- Neogen (U.S.)

- AsureQuality (New Zealand)

- Charm Sciences (U.S.)

- Premier Analytical Services (U.K.)

- Dairyland Laboratories (U.S.)

- Bio-Check (U.K.)

- AES Laboratories (India)

- IEH Laboratories and Consulting Group (U.S.)

- Envirologix Inc. (U.S.)

- EMSL Analytical, Inc. (U.S.)

- Krishgen Biosystems (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.