Global Agriculture Chemical Packaging Market

Market Size in USD Billion

CAGR :

%

USD

2.06 Billion

USD

2.95 Billion

2025

2033

USD

2.06 Billion

USD

2.95 Billion

2025

2033

| 2026 –2033 | |

| USD 2.06 Billion | |

| USD 2.95 Billion | |

|

|

|

|

Agriculture Chemical Packaging Market Size

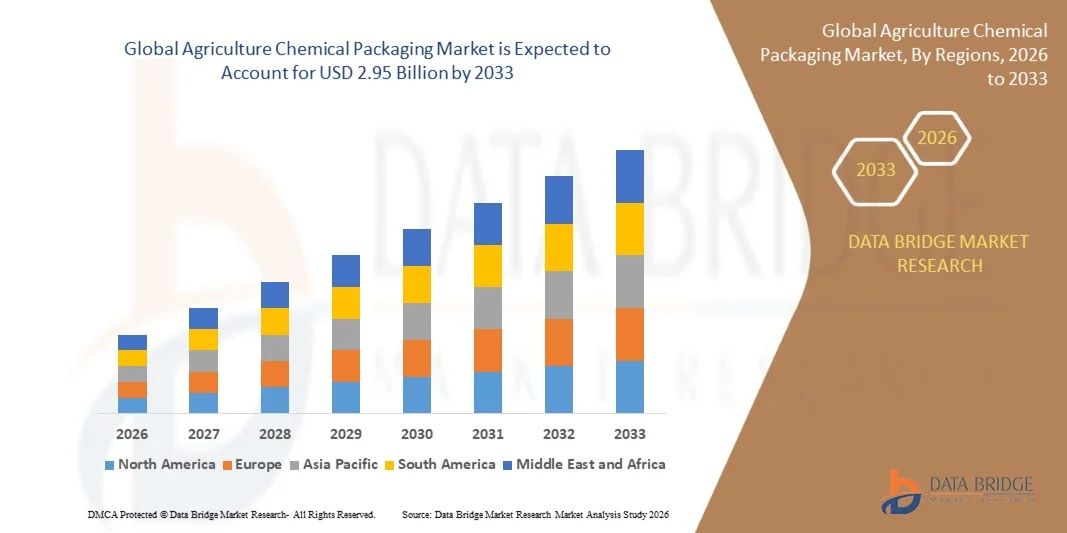

- The global agriculture chemical packaging market size was valued at USD 2.06 billion in 2025 and is expected to reach USD 2.95 billion by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the increasing global demand for crop protection products, fertilizers, and other agrochemicals, which is driving the need for safe, durable, and efficient packaging solutions for storage, transport, and handling

- Furthermore, rising focus on sustainability, regulatory compliance, and environmentally friendly packaging materials is encouraging manufacturers to adopt recyclable, reusable, and high-performance packaging formats. These converging factors are accelerating the uptake of advanced agriculture chemical packaging solutions, thereby significantly boosting the industry's growth

Agriculture Chemical Packaging Market Analysis

- Agriculture chemical packaging, including pouches, bags, drums, bottles, and rigid containers, is increasingly essential for the safe storage, transport, and application of agrochemicals, ensuring chemical stability, preventing leakage, and reducing environmental hazards

- The escalating demand for these packaging solutions is primarily fueled by the expansion of large-scale commercial farming, increasing agrochemical consumption, and rising awareness of chemical safety among farmers and distributors, driving adoption of high-quality and compliant packaging formats

- Asia-Pacific dominated the agriculture chemical packaging market with a share of 46.5% in 2025, due to extensive agricultural activity, high consumption of fertilizers and crop protection chemicals, and expanding agrochemical manufacturing capacity

- North America is expected to be the fastest growing region in the agriculture chemical packaging market during the forecast period due to large-scale commercial farming, high usage of crop protection chemicals, and advanced agrochemical distribution networks

- Paper & paperboards segment dominated the market with a market share of 46.5% in 2025, due to its growing adoption as a sustainable and recyclable packaging material for agricultural chemicals. Increasing regulatory pressure to reduce plastic usage and rising environmental awareness among manufacturers have accelerated the shift toward paper-based packaging formats

Report Scope and Agriculture Chemical Packaging Market Segmentation

|

Attributes |

Agriculture Chemical Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agriculture Chemical Packaging Market Trends

“Rising Adoption of Sustainable and Eco-Friendly Packaging”

- A significant trend in the agriculture chemical packaging market is the growing shift toward sustainable and eco-friendly packaging solutions driven by increasing environmental awareness and regulatory pressure on chemical containment. Companies are focusing on reducing plastic usage, incorporating biodegradable materials, and adopting recyclable packaging to minimize ecological impact and improve supply chain sustainability

- For instance, BASF has implemented eco-friendly packaging initiatives for its crop protection products, introducing refillable and recyclable containers that reduce plastic waste and promote circularity in agrochemical distribution. Such practices are encouraging other key players to innovate packaging that meets both environmental standards and farmer convenience

- The market is witnessing increased adoption of lightweight yet durable packaging materials such as high-density polyethylene (HDPE) and polypropylene (PP), which enhance chemical safety during transportation and storage while lowering carbon footprint. These materials help prevent leakage, contamination, and spillage, ensuring safer agrochemical handling

- Farmers and distributors are showing preference for packaging designs that optimize storage and transport efficiency, such as stackable drums, modular containers, and multi-dose sachets. This trend is driving product differentiation and encouraging companies to align packaging innovation with user-friendly handling and cost-effectiveness

- Companies are exploring smart packaging technologies integrated with QR codes and RFID tags to enable traceability, monitor shelf life, and ensure regulatory compliance. This approach is increasing transparency across supply chains and supporting better inventory management in agriculture chemical distribution

- The adoption of sustainable and functional packaging solutions is strengthening partnerships between agrochemical manufacturers, suppliers, and environmental organizations. This trend underscores the market’s movement toward greener operations while maintaining product performance and safety

Agriculture Chemical Packaging Market Dynamics

Driver

“Growing Global Demand for Agrochemicals and Crop Protection Products”

- The rising global population and the need for higher crop yields are fueling demand for agrochemicals and crop protection products, which in turn is driving the need for robust and reliable packaging. Secure and efficient packaging ensures product stability, minimizes spillage, and facilitates safe handling during distribution and application

- For instance, Syngenta relies on advanced HDPE and polypropylene containers to package its herbicides and pesticides, ensuring product integrity and compliance with global transport regulations. These packaging solutions support the company’s global supply chain while reducing the risk of chemical degradation

- Expanding adoption of modern agricultural practices and precision farming techniques is boosting the consumption of packaged agrochemicals. Farmers increasingly rely on pre-measured doses and ergonomically designed containers to enhance ease of use, safety, and accurate application

- Rising exports of crop protection chemicals are increasing demand for standardized and compliant packaging that meets international safety and shipping standards. This trend is creating opportunities for packaging manufacturers to innovate and offer solutions tailored to global logistics requirements

- The overall increase in agricultural intensification and mechanized farming continues to drive the requirement for efficient, durable, and safe packaging solutions. This sustained demand positions agriculture chemical packaging as a critical component of the agrochemical industry

Restraint/Challenge

“Volatility in Raw Material Prices and Regulatory Compliance”

- The agriculture chemical packaging market faces challenges due to fluctuations in raw material costs, such as polyethylene, polypropylene, and specialty polymers, which affect production expenses and pricing stability. Manufacturers must manage supply chain volatility while maintaining competitive pricing and quality standards

- For instance, companies such as Dow Chemical experience periodic price spikes in polymer feedstocks, which directly impact the cost of producing HDPE and PP containers for agrochemicals. This volatility can reduce profit margins and complicate long-term procurement strategies

- Strict regulatory requirements governing chemical storage, transportation, and environmental safety add complexity to packaging design and production. Manufacturers must comply with regional and international guidelines to avoid penalties, recalls, and reputational risks

- Sustainability mandates and evolving environmental regulations require packaging innovations that meet biodegradability, recyclability, and safety standards, often increasing research and development costs. Companies must balance regulatory compliance with operational efficiency and market competitiveness

- The cumulative effect of raw material volatility, regulatory pressures, and performance requirements continues to challenge manufacturers to optimize production, innovate responsibly, and deliver packaging solutions that satisfy both environmental and functional expectations

Agriculture Chemical Packaging Market Scope

The market is segmented on the basis of product and material.

• By Product

On the basis of product, the agriculture chemical packaging market is segmented into pouches & bags, drums, bottles & cans, and others. The drums segment dominated the market in 2025, driven by its high durability, large-volume handling capacity, and strong resistance to chemical reactions during storage and transportation. Drums are widely preferred for bulk agrochemicals such as pesticides, herbicides, and liquid fertilizers, as they minimize leakage risks and ensure compliance with stringent safety regulations. Their reusability and compatibility with automated filling and handling systems further strengthen their dominance across large-scale agricultural supply chains.

The pouches & bags segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising demand for lightweight, flexible, and cost-efficient packaging solutions. These formats are increasingly adopted for powdered and granular agrochemicals due to reduced material usage, lower transportation costs, and improved convenience for small and mid-sized farmers. Advancements in multilayer barrier films enhancing moisture and contamination protection are further accelerating adoption across emerging agricultural markets.

• By Material

On the basis of material, the agriculture chemical packaging market is segmented into plastic, metal, paper & paperboards, composite materials, and others. The paper & paperboards segment held the largest market revenue share of 46.5% in 2025, driven by its growing adoption as a sustainable and recyclable packaging material for agricultural chemicals. Increasing regulatory pressure to reduce plastic usage and rising environmental awareness among manufacturers have accelerated the shift toward paper-based packaging formats. Paper & paperboard solutions offer adequate strength, printability, and cost efficiency for dry and semi-solid agrochemical products, supporting their widespread acceptance across agricultural supply chains.

The composite materials segment is expected to register the fastest growth during the forecast period, driven by increasing emphasis on enhanced safety, extended shelf life, and regulatory compliance. Composite packaging combines multiple material layers to deliver improved strength, barrier performance, and environmental resistance, particularly for high-value or hazardous agrochemicals. Growing focus on sustainable yet high-performance packaging solutions is accelerating the shift toward composite materials in advanced agricultural markets.

Agriculture Chemical Packaging Market Regional Analysis

- Asia-Pacific dominated the agriculture chemical packaging market with the largest revenue share of 46.5% in 2025, driven by extensive agricultural activity, high consumption of fertilizers and crop protection chemicals, and expanding agrochemical manufacturing capacity

- The region’s large farming population, cost-efficient packaging production, and rising demand for safe storage and transportation of agricultural chemicals are accelerating market growth

- Supportive government initiatives for agricultural productivity, increasing exports of agrochemicals, and rapid industrialization across developing economies are strengthening demand for advanced packaging solutions

China Agriculture Chemical Packaging Market Insight

China held the largest share in the Asia-Pacific agriculture chemical packaging market in 2025, supported by its position as a leading producer and exporter of agrochemicals. The country’s strong manufacturing base, large-scale farming operations, and well-developed packaging infrastructure drive sustained demand. Increasing focus on regulatory compliance, safe handling, and export-ready packaging formats is further boosting market expansion.

India Agriculture Chemical Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising agrochemical consumption, expanding fertilizer usage, and government-led initiatives to modernize agriculture. Growth in domestic agrochemical manufacturing and increasing awareness of safe chemical storage among farmers are driving packaging demand. The shift toward organized distribution channels and improved rural supply chains is also supporting rapid market growth.

Europe Agriculture Chemical Packaging Market Insight

The Europe agriculture chemical packaging market is growing steadily, supported by strict regulations on chemical safety, sustainability, and labeling. High adoption of environmentally responsible packaging materials and strong emphasis on compliance-driven packaging designs are key growth factors. Demand is particularly strong for packaging solutions that ensure traceability, durability, and reduced environmental impact.

Germany Agriculture Chemical Packaging Market Insight

Germany’s market is driven by its advanced chemical industry, strong focus on sustainable packaging solutions, and leadership in regulatory-compliant agrochemical production. The country emphasizes high-quality, recyclable, and precision-engineered packaging to meet stringent EU standards. Continuous investment in R&D and sustainable materials is supporting long-term market development.

U.K. Agriculture Chemical Packaging Market Insight

The U.K. market is supported by a mature agricultural sector, growing emphasis on sustainable farming practices, and increasing regulatory scrutiny on agrochemical handling. Rising adoption of eco-friendly and compliant packaging formats is shaping market demand. Investments in innovation and supply chain resilience are further strengthening the country’s role in the regional market.

North America Agriculture Chemical Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by large-scale commercial farming, high usage of crop protection chemicals, and advanced agrochemical distribution networks. Strong focus on safety standards, automation, and durable packaging formats is boosting demand. Increased adoption of sustainable and high-performance packaging solutions is further supporting growth.

U.S. Agriculture Chemical Packaging Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its highly developed agricultural industry and significant agrochemical consumption. Strong regulatory frameworks, emphasis on safe handling, and widespread adoption of advanced packaging technologies support market leadership. Presence of major agrochemical producers and packaging manufacturers further reinforces the U.S.’s dominant position.

Agriculture Chemical Packaging Market Share

The agriculture chemical packaging industry is primarily led by well-established companies, including:

- Greif Inc. (U.S.)

- Amcor Plc (Australia)

- Sonoco Products Company (U.S.)

- Mondi Group (U.K.)

- Packaging Corporation of America (U.S.)

- NNZ Group (Netherlands)

- LC Packaging International BV (Netherlands)

- Silgan Holdings, Inc. (U.S.)

- ProAmpac (U.S.)

- Schütz GmbH & Co. KGaA (Germany)

- ALPLA Group (Austria)

- CDF Corporation (U.S.)

- CurTec (Netherlands)

- Scholle IPN (U.S.)

Latest Developments in Global Agriculture Chemical Packaging Market

- In June 2025, Mauser Packaging Solutions inaugurated a new reconditioning and recycling facility at the BASF site in Tarragona, Spain. This facility enhances the agriculture chemical packaging market by reconditioning intermediate bulk containers (IBCs) and producing high-quality post-consumer recycled (PCR) plastic from end-of-life industrial packaging. The initiative improves logistics efficiency, reduces carbon emissions, and promotes safer handling of hazardous agrochemicals, positioning Mauser as a key player in sustainable packaging solutions across Europe

- In April 2025, Amcor plc completed its all-stock acquisition of Berry Global Inc., forming a global packaging leader with operations spanning 140 countries, 400 facilities, and 75,000 employees. This merger strengthens the agriculture chemical packaging market by expanding Amcor’s material science capabilities, enabling innovation in high-performance and sustainable packaging solutions. The combined scale and expertise are expected to deliver improved product consistency, operational efficiency, and market reach, supporting long-term growth in the global agrochemical packaging sector

- In June 2022, Greif launched a lightweight, high-performance jerrycan in Brazil suitable for chemicals, agrochemicals, flavors, beverages, and fragrances. This development influences the agriculture chemical packaging market by offering a durable yet lighter packaging option, reducing transportation costs, and improving handling safety for agrochemical products. Its versatile design supports diverse chemical formulations, making it a competitive solution for emerging and established markets in South America

- In September 2021, Syngenta introduced an innovative agrochemical packaging in Brazil, developed in partnership with Unipac. The packaging technology eliminates solvents and prevents emissions of solid residues, directly supporting environmental sustainability in the agrochemical sector. This advancement enhances the market by promoting safer, greener handling of agrochemicals, improving regulatory compliance, and demonstrating a shift toward eco-conscious packaging solutions in Latin America

- In August 2021, Braskem launched a new polyethylene resin designed for rigid packaging in the chemicals and agrochemicals sector. The product, fully recyclable and engineered for high rigidity and impact resistance, strengthens the agriculture chemical packaging market by meeting the growing demand for sustainable, durable, and environmentally compliant containers. Its enhanced mechanical properties allow safer storage and transportation under challenging conditions, addressing both operational efficiency and regulatory requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Agriculture Chemical Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Agriculture Chemical Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Agriculture Chemical Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.