Global Agricultural Wastewater Treatment Market Segmentation, By Technology (Physical Solutions, Chemical Solutions, Biological Solutions), Pollutant Source (Point Source, Non-point Source), Application (Farmland Runoff, Farm Wastewater, Others) – Industry Trends and Forecast to 2032

Agricultural Wastewater Treatment Market Analysis

Water is used in various industrial processes, from recovering natural resources in the oil and gas or mining industries to applications in agriculture and irrigation, construction, food and beverage, life sciences, and pharma & biopharma. The growing gap between water demand and supply necessitates efficient recycling, which can be accomplished by treating it with water treatment chemicals.

Agricultural Wastewater Treatment Market Size

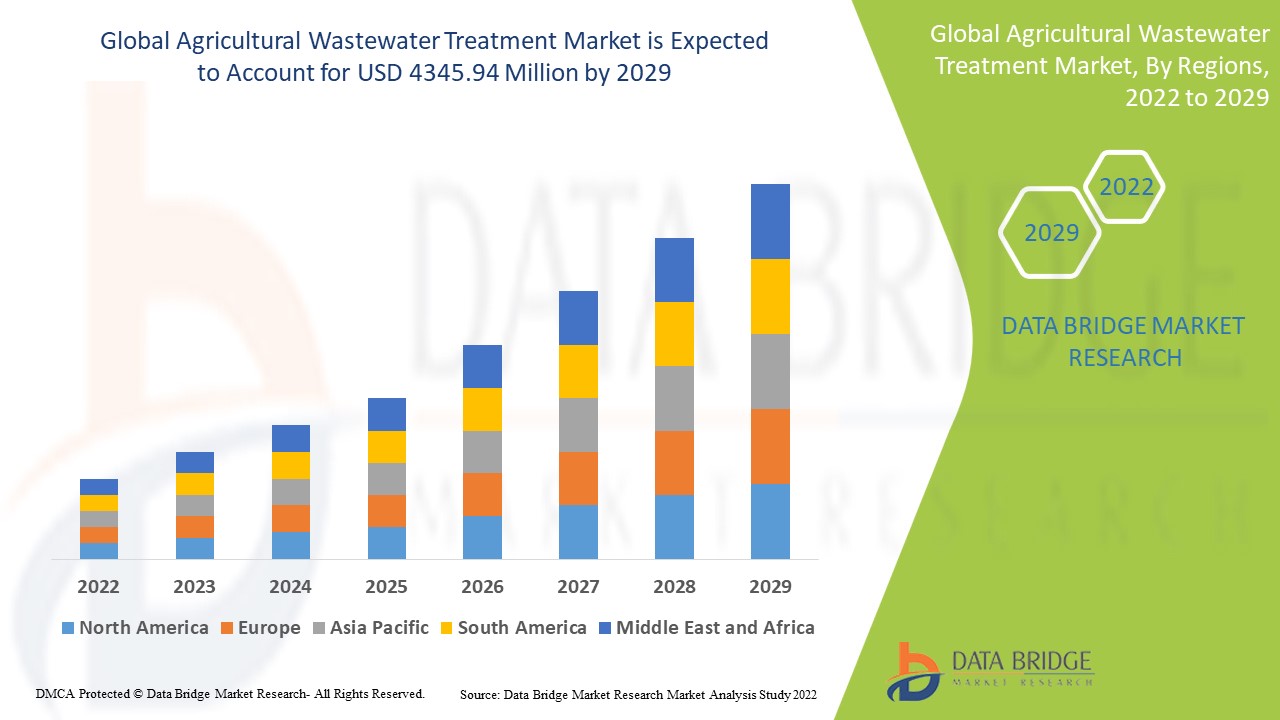

Global agricultural wastewater treatment market size was valued at USD 3.02 billion in 2024 and is projected to reach USD 5.38 billion by 2032, with a CAGR of 7.50% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes

|

Agricultural Wastewater Treatment Key Market Insights

|

|

Segmentation

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Key Market Players

|

BASF SE (Germany), Ecolab Inc. (US), Kemira (Finland), Suez (France), Veolia (France), Kurita Water Industries Ltd. (Japan), Thermax Limited (India), Dow (US), IDEX (US), LEWA GmbH (Germany), Ingersoll Rand (US), Dover Corporation (US), ProMinent (Germany), Grundfos Holding A/S, (Denmark), Watson-Marlow Fluid Technology Solutions (UK)

|

|

Market Opportunities

|

|

Agricultural Wastewater Treatment Market Definition

Agricultural wastewater treatment is a farm management program designed to control pollution from unsanitary surface runoff caused by chemicals in pesticides, animal slurry, fertilizer, crop residues, or irrigation water.

Agricultural Wastewater Treatment Market Dynamics

Drivers

- The rapid industrialization of automation and the food industry

The rapidly expanding automation and food safety market has increased the use of existing freshwater sources. A biological imbalance has also resulted from wastewater from various industries and agriculture being indiscriminately discarded into freshwater sources. As a result, freshwater sources are polluted due to multiple human activities, including the presence of chemical waste, which causes fires in lakes. Thus, the agricultural wastewater treatment market employs some chemicals in the handling of pesticides and other hazardous substances before the water is released into a river or other water resource, resulting in high demand for this resource.

- The high use of fertilizers in the agricultural sector

Agriculture also contributes to the high water use because it is the most crucial sector for emerging economies. As a result, the use of fertilizers is also increased, which results from the high demand for agricultural wastewater treatment during the forecast period. Similarly, rapidly depleting water resources around the world, rising water pollution issues as a result of increased agricultural activities, an increase in the agriculture industry, fertilizer consumption, and an increasing population are some of the key determinants that are expected to act as major growth drivers for the agricultural wastewater treatment market from 2025 to 2032.

Opportunity

In most markets, the low-cost commodity industrial wastewater treatment chemicals are being replaced by high-value and specialty formulations required by specific applications. This opens up the possibility of particular formulations needed by the oil and gas, chemical, mining, and metallurgy industries. Compared to conventional formulations, new products are typically more environmentally friendly and provide superior performance at lower loadings, increasing demand for such formulations.

Restraints

Stringent environmental legislation enacted by various agencies, such as the EPA, is the primary factor impeding the growth of the industrial wastewater treatment chemicals market. The growing concern about the environmental impact of chemicals has resulted in stringent regulatory constraints for water treatment chemical manufacturers. Currently, water treatment chemicals manufacturers are encouraged to use environmentally friendly alternatives. Manufacturers find it difficult to provide a replacement for standard formulations due to the ability of green alternative formulations to perform under extreme conditions. Furthermore, the use of green alternative chemical formulations increases the risk of bio-fouling, necessitating an additional dose of biocides, which reduces the cost efficiency of the installation.

This Agricultural wastewater treatment market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Agricultural wastewater treatment market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Agricultural Wastewater Treatment Market Scope

The Agricultural wastewater treatment market is segmented on the basis of technology, pollutant source and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Physical solutions

- Chemical solutions

- Biological solutions

Pollutant source

- Point source

- Non-point source

Application

- Farmland runoff

- Farm wastewater

- Others

Agricultural Wastewater Treatment Market Regional Analysis

The countries covered in the Agricultural wastewater treatment market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific leads the agricultural wastewater treatment market. Because of the growing agriculture industry, fertilizer consumption, rising water pollution issues due to increased farming activities and a growing population in the region, and high demand from emerging countries such as China and India.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Agricultural Wastewater Treatment Market Share

The agricultural wastewater treatment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Agricultural wastewater treatment market.

Agricultural Wastewater Treatment Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- Ecolab Inc. (US)

- Kemira (Finland)

- Suez (France)

- Veolia (France)

- Kurita Water Industries Ltd. (Japan)

- Thermax Limited (India)

- Dow (US)

- IDEX (US)

- LEWA GmbH (Germany)

- Ingersoll Rand (US)

- Dover Corporation (US)

- ProMinent (Germany)

- Grundfos Holding A/S, (Denmark)

- Watson-Marlow Fluid Technology Solutions (UK)

Latest Developments in Agricultural Wastewater Treatment Market

- In January 2021, AECOM announced a collaboration with the Bergen County Utilities Authority in Northern New Jersey and Columbia University (New York City) to monitor COVID-19 ribonucleic acid (RNA) in wastewater BCUA sewer shed

- In September 2020, Evoqua Water Technologies announced that it had acquired the privately held Aquapure Technologies of Cincinnati, a Hamilton, Ohio-based water service and equipment company that serves a variety of end-user applications, including agriculture. This acquisition will help Evoqua's service capabilities in Cincinnati, Ohio, and the surrounding area

- In July 2020, SUEZ announced that it had signed an agreement to acquire the Reverse Osmosis (RO) membrane portfolio from the specialty chemical company LANXESS

SKU-