Global Agricultural Mapping And Imaging Market

Market Size in USD Billion

CAGR :

%

USD

9.57 Billion

USD

24.71 Billion

2024

2032

USD

9.57 Billion

USD

24.71 Billion

2024

2032

| 2025 –2032 | |

| USD 9.57 Billion | |

| USD 24.71 Billion | |

|

|

|

|

Agricultural Mapping and Imaging Market Analysis

Agricultural mapping & imaging market is experiencing rapid growth driven by advancements in technology aimed at enhancing farm management efficiency and productivity. Integration of real-time imaging data with IoT and cloud platforms is revolutionizing agricultural practices, allowing for precise monitoring of crop health, soil conditions, and livestock management. This integration facilitates proactive decision-making, optimizing resource allocation and enhancing overall farm productivity.

Key players in the Agricultural mapping & imaging market are actively innovating to develop sophisticated mapping and imaging solutions. These technologies not only provide farmers with detailed insights into field conditions but also enable them to adopt precision farming practices effectively. The market's growth is further propelled by increasing global awareness of sustainable agricultural practices and regulatory initiatives promoting environmental conservation. Despite challenges related to initial investment costs and technology adoption barriers, the market is poised for substantial expansion, driven by the imperative to achieve sustainable agricultural outcomes through advanced mapping and imaging technologies.

Agricultural Mapping and Imaging Market Size

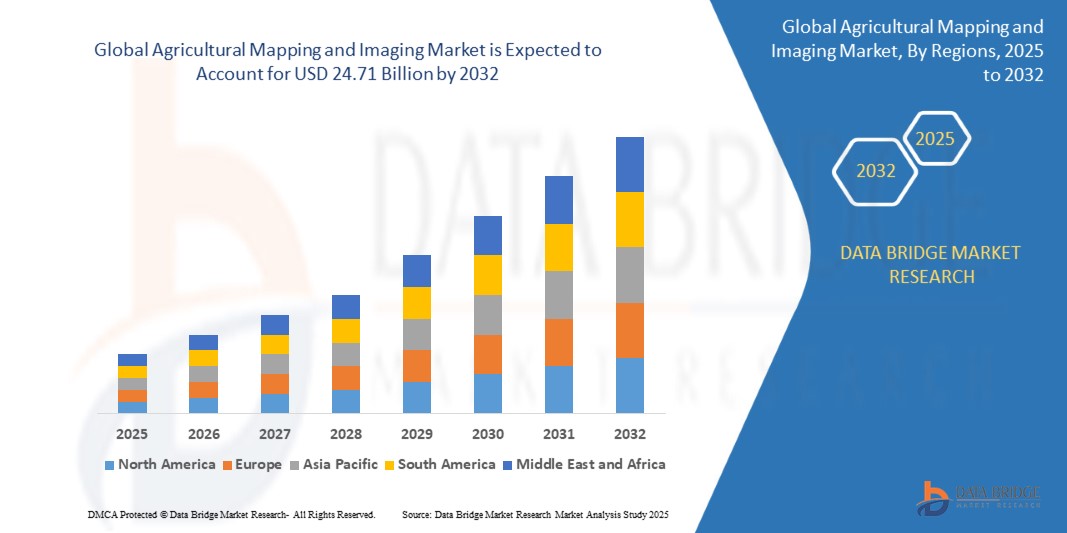

The global Agricultural Mapping and Imaging market size was valued at USD 9.57 billion in 2024 and is projected to reach USD 24.71 billion by 2032, with a CAGR of 12.58% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Agricultural Mapping and Imaging Market Segmentation

|

Attributes |

Agricultural Mapping and Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Yara, AGCO Corporation, Corteva, CNH Industrial N.V., Trimble Inc., Syngenta Crop Protection AG, Bayer AG, Raven Industries, Inc., DJI, Cargill, Incorporated, YANMAR HOLDINGS CO., LTD., Yamaha Motor Corporation, Semios, FarmWise Labs, Sentera, Esri, METER Group, Inc., Climate LLC., HUMMINGBIRD TECHNOLOGIES LIMITED, HIPHEN, Satellite Imaging Corporation, METER Group, AGRICOLUS, and Climate LLC |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Agricultural Mapping and Imaging Market Definition

Agricultural mapping & imaging refers to the systematic use of Geographic Information Systems (GIS), remote sensing technologies, and imaging techniques to collect, analyse, and visualize data related to agricultural landscapes. These technologies enable farmers, agronomists, and agricultural stakeholders to monitor and manage various aspects of crop cultivation and land use efficiently.

At its core, agricultural mapping involves the creation and updating of detailed maps that depict different agricultural features such as crop types, field boundaries, soil types, and water resources. These maps are generated using satellite imagery, aerial photography, and drone-mounted sensors that capture high-resolution data. By overlaying this spatial information with data on weather patterns, soil health, and vegetation indices, agricultural mapping provides valuable insights into crop growth dynamics, pest infestations, and environmental impacts. This spatial intelligence aids in making informed decisions about irrigation scheduling, fertilizer application, and crop rotation strategies, thereby optimizing agricultural productivity while minimizing resource wastage.

Agricultural Mapping and Imaging Market Dynamics

Drivers

- Increased Use of Drones, Satellite Imaging, and Advanced Sensors for Detailed and Accurate Agricultural Mapping

The increased use of drones, satellite imaging, and advanced sensors has revolutionized agricultural mapping and imaging by providing detailed and accurate data essential for precision farming. Drones equipped with multispectral and hyperspectral cameras can capture high-resolution images of crops, allowing farmers to monitor plant health, identify pest infestations, and optimize irrigation practices. Satellite imaging offers large-scale coverage and frequent updates, enabling the tracking of crop growth, soil moisture levels, and the impacts of climate change over vast areas. Advanced sensors, integrated with Internet of Things (IoT) technology, provide real-time data on soil conditions, weather patterns, and crop status, facilitating timely decision-making. Together, these technologies enhance productivity, reduce resource wastage, and even promote sustainable agricultural practices, ensuring better yields and environmental stewardship.

- Growing Adoption of Precision Agriculture Techniques

The growing adoption of precision agriculture techniques, supported by advancements in agricultural mapping and imaging technologies, is revolutionizing farming practices. Precision agriculture utilizes detailed data from drones, satellite imaging, and advanced sensors to tailor farming activities such as irrigation, fertilization, and pest management to specific field conditions. As precision agriculture continues to gain traction, the demand for sophisticated mapping and imaging solutions in agriculture is expected to rise, driving innovation and investment in the agricultural mapping & imaging sector.

Opportunities

- Integration of Real-time Imaging Data With IoT and Cloud Platforms for Improved Farm Management

Real-time imaging allows farmers to gather up-to-the-minute data on crop health, soil conditions, and environmental factors. When combined with IoT sensors placed throughout the farm, this data can be continuously monitored and analysed, providing farmers with a comprehensive view of their agricultural operations. This level of detailed and timely information enables more precise decision-making, leading to optimized resource use, reduced waste, and improved crop yields.

Cloud platform plays a crucial role in integration by offering scalable and accessible storage solutions for vast amount of data generated by imaging and IoT devices. These platforms facilitate advanced data analytics and machine learning applications, which can identify patterns and trends that traditional observation methods might miss. For instance, predictive analytics can forecast potential pest outbreaks or irrigation needs, allowing farmers to take pre-emptive actions. This enhances the efficiency and effectiveness of farm management practices and also helps in mitigating risks associated with crop failure and environmental changes.

- Growing Adoption of UAVs for Detailed and Large-Scale Agricultural Mapping and Monitoring

UAVs equipped with advanced imaging technologies, such as multispectral and hyperspectral cameras, LiDAR, and thermal sensors, offer unparalleled capabilities to capture high-resolution data of agricultural fields. This data includes crop health assessments, soil conditions, water management, and pest infestations, providing farmers with precise insights for targeted interventions.

One of the key advantages of UAVs in agricultural mapping is their ability to cover large areas quickly and efficiently, overcoming the limitations of traditional ground-based methods. By autonomously flying over fields, drones can capture data in realtime, allowing farmers to make timely decisions based on up-to-date information. This capability is crucial for optimizing resource allocation, improving crop yields, and minimizing environmental impact through precise application of inputs such as water, fertilizers, and pesticides.

Moreover, UAVs facilitate the integration of data with IoT and cloud platforms, enhancing data analytics and decision support systems for farmers. The combination of UAV-collected imagery with cloud computing enables scalable processing and storage of agricultural data, making it accessible for analysis and actionable insights. This seamless integration supports sustainable farming practices by enabling farmers to monitor crop growth patterns, detect anomalies early, and implement responsive strategies, thereby enhancing overall productivity and profitability.

Restraints/Challenges

- Stringent Regulations Regarding the Security and Privacy of Farm Data

Stringent regulations regarding the security and privacy of farm data have become paramount as agricultural technologies, such as IoT devices and precision farming systems, increasingly digitize farming operations. Governments worldwide are implementing policies to safeguard sensitive agricultural data from cyber threats and unauthorized access. These regulations aim to ensure farmers data rights, protect against data breaches that could compromise production strategies and financial information, and foster trust in digital agricultural technologies

- Poor Connectivity and Internet Access in Rural Areas

Poor connectivity and limited internet access in rural areas present significant challenges for the adoption and effectiveness of agricultural mapping & imaging technologies. These technologies, reliant on real-time data transmission and cloud-based services, often require stable internet connectivity to operate optimally. In areas with poor infrastructure, farmers may face difficulties in accessing timely updates, satellite imagery, and other critical data necessary for precision farming practices. This limitation hampers the seamless integration of mapping and imaging solutions into agricultural operations, impacting the ability to monitor crop health, soil conditions, and weather patterns accurately.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Agricultural Mapping and Imaging Market Scope

The market is segmented on the basis of offering, autonomy, deployment mode, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Hardware

- Software

- Services

Autonomy

- Semi-Autonomous

- Manual

- Autonomous

Deployment Mode

- Cloud

- On-Premise

Application

- Crop Health Monitoring

- Field Mapping

- Yield Monitoring

- Weather Monitoring and Forecasting

- Water Management

- Others

End User

- Farms

- Agro-Tech Companies

- Research Institutes

- Agrochemical Companies

Agricultural Mapping and Imaging Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, offering, autonomy, deployment mode, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Agricultural mapping & imaging market is dominated by North America is expected to dominate the market due to its advanced agricultural practices, extensive adoption of precision farming technologies, robust infrastructure supporting IoT and cloud computing, and significant investments in agricultural research and development. These factors collectively enhance the region's capability to integrate sophisticated mapping and imaging solutions effectively, driving higher adoption rates and market leadership in agricultural technology innovation.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Agricultural Mapping and Imaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Agricultural Mapping and Imaging Market Leaders Operating in the Market Are:

- Yara

- AGCO Corporation

- Corteva

- CNH Industrial N.V.

- Trimble Inc.

- Syngenta Crop Protection AG

- Bayer AG

- Raven Industries, Inc.

- DJI

- Cargill, Incorporated

- YANMAR HOLDINGS CO., LTD.

- Yamaha Motor Corporation

- Semios

- FarmWise Labs

- Sentera

- Esri

- METER Group, Inc.

- Climate LLC.

- HUMMINGBIRD TECHNOLOGIES LIMITED

- HIPHEN

- Satellite Imaging Corporation

- AGRICOLUS

Latest Developments in Agricultural Mapping and Imaging Market

- In December 2023, Yara India has launched an upgraded version of its FarmCare app, featuring new tools such as "map-my-farm," real-time weather updates, a fertilizer calculator, and a digital leaf colour chart, aimed at providing real-time agricultural solutions to farmers. This development enhances Yara's capabilities in Agricultural Mapping & Imaging by offering precise farm mapping, improved nitrogen assessment, and optimized fertilizer use, thereby empowering farmers and strengthening Yara's position as a leader in digital agriculture

- In April 2019, Yara and IBM have announced a collaboration to create a global digital farming platform that combines Yara's agronomic expertise with IBM's advanced technology. This development enhances Yara's capabilities in Agricultural Mapping & Imaging by enabling the creation of digital twins of fields, providing farmers with actionable insights through advanced analytics, weather data, and satellite images, ultimately optimizing crop yields and sustainability

- In January, AGCO GmbH launched FarmerCore to enhance farmer and dealer engagement by integrating digital and physical elements. Initially starting in select American regions, FarmerCore aimed to offer comprehensive service and support throughout the machinery ownership journey, with plans for global expansion in 2024. This initiative provided 24/7 online access for parts purchasing and support, improving productivity and sustainability for farmers

- In September 2023, AGCO GmbH announced plans to build a 300-acre test farm named “Dakota Smart Farm” in Casselton, North Dakota. The farm, led by AGCO-owned Appareo, aimed to develop precision agriculture technologies and high-value retrofit solutions. The project aimed to optimize crop production, resource utilization, and farm management, benefiting the company by enhancing its technological offerings and market position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.