Global Aestheticcosmetic Lasers Market

Market Size in USD Million

CAGR :

%

USD

3.79 Million

USD

8.92 Million

2024

2032

USD

3.79 Million

USD

8.92 Million

2024

2032

| 2025 –2032 | |

| USD 3.79 Million | |

| USD 8.92 Million | |

|

|

|

|

Aesthetic Cosmetic Lasers Market Size

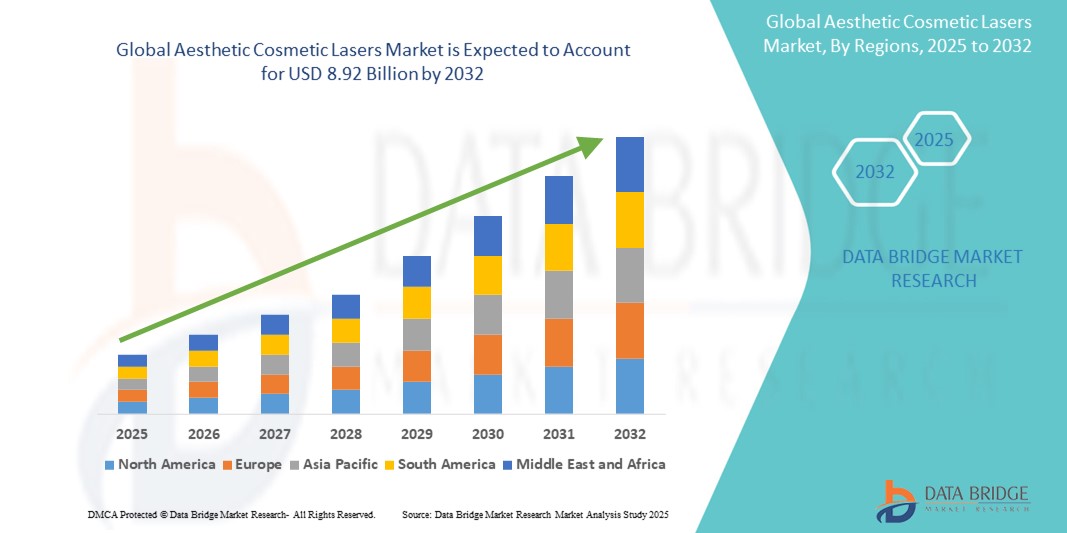

- The global aesthetic cosmetic lasers market size was valued at USD 3.79 billion in 2024 and is expected to reach USD 8.92 billion by 2032, at a CAGR of 11.30% during the forecast period

- This growth is driven by growing demand for minimally invasive cosmetic procedures and continuous advancements in laser technology

Aesthetic Cosmetic Lasers Market Analysis

- Aesthetic cosmetic lasers are advanced medical devices used for a variety of cosmetic procedures such as hair removal, skin resurfacing, tattoo removal, wrinkle reduction, and treatment of vascular and pigmented lesions. These lasers provide precise, non-invasive, and effective aesthetic solutions for improving skin appearance

- The increasing demand for non-invasive aesthetic procedures, rising awareness about personal appearance, and technological advancements in laser systems are key drivers propelling the aesthetic cosmetic lasers market forward

- North America is expected to dominate the aesthetic cosmetic lasers market with the largest market share of 38.90%, driven by advanced medical infrastructure, high disposable income, and strong demand for aesthetic enhancements among aging populations and younger demographics alike

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the aesthetic cosmetic lasers market, driven by rising aesthetic consciousness, booming medical tourism, and increasing availability of affordable cosmetic treatments

- The hair removal segment is expected to dominate the aesthetic cosmetic lasers market with the largest share of 27.52% in 2025 due to the growing preference for long-lasting hair reduction solutions, increasing awareness of personal grooming, rising disposable incomes, and advancements in laser technology that ensure greater safety and efficacy across diverse skin tones

Report Scope and Aesthetic Cosmetic Lasers Market Segmentation

|

Attributes |

Aesthetic Cosmetic Lasers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aesthetic Cosmetic Lasers Market Trends

“Rising Adoption of Combination Laser Therapies for Enhanced Results”

- A growing trend in the aesthetic cosmetic lasers market is the increasing use of combination laser therapies that merge multiple wavelengths or technologies such as fractional lasers, Nd:YAG, and intense pulsed light (IPL) to treat multiple skin concerns simultaneously

- These multi-modality systems allow practitioners to customize treatments for pigmentation, vascular lesions, and skin tightening in a single session, improving patient satisfaction and outcomes

- The trend is driven by consumer demand for faster, more effective, and minimally invasive aesthetic procedures with reduced downtime

- For instance, in March 2024, Sciton Inc. launched its Joule X platform with BBL HERO and HALO technology, combining broadband light and ablative/non-ablative wavelengths for advanced skin rejuvenation

- This integrated approach is expected to gain further traction as clinics seek to differentiate services and deliver superior, multi-targeted cosmetic solutions

Aesthetic Cosmetic Lasers Market Dynamics

Driver

“Growing Consumer Focus on Personal Aesthetics and Aging Reversal”

- The rising emphasis on beauty, anti-aging, and youthful appearance especially among millennials and Gen Z is fueling demand for non-surgical aesthetic procedures

- Changing social attitudes, the rise of social media influence, and the popularity of ‘Zoom face’ culture post-pandemic has boosted the appeal of cosmetic laser treatments

- Laser devices that treat wrinkles, acne scars, and skin laxity are seeing significant uptake in both male and female demographics across urban centers

- For instance, in January 2024, the American Society for Aesthetic Plastic Surgery (ASAPS) reported a 19% year-on-year increase in non-invasive laser treatments among individuals aged 25–40 in the U.S

- This generational shift is expected to drive sustained growth in the aesthetic cosmetic laser market over the coming years

Opportunity

“Technological Advancements in Portable and User-Friendly Laser Devices”

- Advances in device miniaturization and intuitive user interfaces have enabled the development of compact, portable aesthetic laser systems suited for both clinics and at-home use.

- Manufacturers are integrating cooling systems, touchscreen controls, and AI-powered skin sensors to improve safety, precision, and ease of use.

- This has opened opportunities for dermatologists and medispas to expand services, as well as for brands exploring direct-to-consumer home-use laser segments

- For instance, in February 2024, Tria Beauty expanded its product line with an upgraded laser hair removal device featuring adaptive power modulation and skin tone detection

- These innovations are expected to democratize laser treatments, making them more accessible to a broader consumer base globally

Restraint/Challenge

“High Cost of Equipment and Maintenance for Clinics”

- Professional-grade aesthetic laser systems involve significant upfront investment, with prices ranging from tens to hundreds of thousands of dollars depending on features

- Additional costs include periodic maintenance, consumables, and technician training posing a challenge for small and mid-sized clinics or startups

- This limits the availability of services in cost-sensitive markets and affects the scalability of aesthetic businesses in emerging regions

- Reducing device costs and offering flexible leasing or subscription models will be critical to overcoming these limitations and promoting wider market adoption

Aesthetic Cosmetic Lasers Market Scope

The market is segmented on the basis of type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-Users |

|

In 2025, the hair removal is projected to dominate the market with a largest share in application segment

The hair removal segment is expected to dominate the aesthetic cosmetic lasers market with the largest share of 27.52% in 2025 due to the growing preference for long-lasting hair reduction solutions, increasing awareness of personal grooming, rising disposable incomes, and advancements in laser technology that ensure greater safety and efficacy across diverse skin tones.

The medical Spas is expected to account for the largest share during the forecast period in end-users segment

In 2025, the medical Spas segment is expected to dominate the market, due to the rising demand for non-invasive aesthetic procedures, increasing consumer preference for personalized skincare treatments, and the integration of advanced technologies.

Aesthetic Cosmetic Lasers Market Regional Analysis

“North America Holds the Largest Share in the Aesthetic Cosmetic Lasers Market”

- North America is expected to dominate the aesthetic cosmetic lasers market with the largest market share of 38.90%, driven by advanced medical infrastructure, high disposable income, and strong demand for aesthetic enhancements among aging populations and younger demographics alike

- The U.S. leads the region owing to a surge in non-invasive cosmetic procedures, increasing acceptance of aesthetic treatments, and widespread availability of FDA-approved laser devices

- Continuous technological innovation, presence of key market players, and supportive regulations for aesthetic devices are further accelerating market growth and accessibility across both urban and suburban clinics

“Asia-Pacific is Projected to Register the Highest CAGR in the Aesthetic Cosmetic Lasers Market”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the aesthetic cosmetic lasers market, driven by rising aesthetic consciousness, booming medical tourism, and increasing availability of affordable cosmetic treatments

- Countries such as China, India, Japan, and South Korea are key growth engines, supported by a growing youth population, increased social media influence, and expanding disposable incomes

- China is investing in advanced aesthetic clinics in Tier 1 and Tier 2 cities, while India sees a growing trend of minimally invasive beauty treatments. South Korea, a global hub for cosmetic procedures, is leveraging its expertise and innovation in laser technologies

- The region’s cultural shift towards appearance enhancement, coupled with government support for private clinic expansions, is expected to significantly boost market momentum through 2030

Aesthetic Cosmetic Lasers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Aerolase Corp. (U.S.)

- Alma Lasers (Israel)

- Shenzhen Mindray Bio-Medical Electronics Co. (China)

- Cutera, Inc. (U.S.)

- Cynosure (U.S.)

- El.En. S.p.A. (Italy)

- Lumenis Be Ltd. (Israel)

- Sciton (U.S.)

- CANON MEDICAL SYSTEMS USA (U.S.)

- CHISON Medical Technologies Co., Ltd. (China)

- SharpLight Technologies Inc. (Canada)

- Bausch + Lomb (Canada)

- Candela Corporation (U.S.)

- Bausch Health Companies Inc. (Canada)

Latest Developments in Global Aesthetic Cosmetic Lasers Market

- In April 2025, Candela Corporation, a global leader in energy-based medical aesthetics, announced the launch of the Vbeam Pro, the only vascular laser FDA-cleared for use in pediatric patients, which integrates a 595 nm pulsed dye laser with a 1064 nm Nd:YAG wavelength to deliver enhanced precision and versatility in treatment

- In June 2024, Lumenis Be Ltd. introduced FoLix™, its FDA-approved proprietary fractional laser system designed for the treatment of hair loss, offering non-invasive results in 4–6 monthly sessions without the need for needles, surgery, or chemicals

- In April 2024, Hahn & Company announced the initiation of a merger process between Lutronic and Cynosure following the acquisition of Cynosure, forming the new parent company Cynosure Lutronic, Inc., aimed at combining resources and innovation to serve the aesthetic industry

- In April 2024, CUTERA, INC., a top provider of aesthetic and dermatological technologies, announced the launch of xeo+, a next-generation laser and light-based multi-application platform that builds on the company’s legacy of innovation and high performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.