Global Aerospace Plastics Market

Market Size in USD Billion

CAGR :

%

USD

0.85 Billion

USD

1.41 Billion

2024

2032

USD

0.85 Billion

USD

1.41 Billion

2024

2032

| 2025 –2032 | |

| USD 0.85 Billion | |

| USD 1.41 Billion | |

|

|

|

|

Aerospace Plastics Market Size

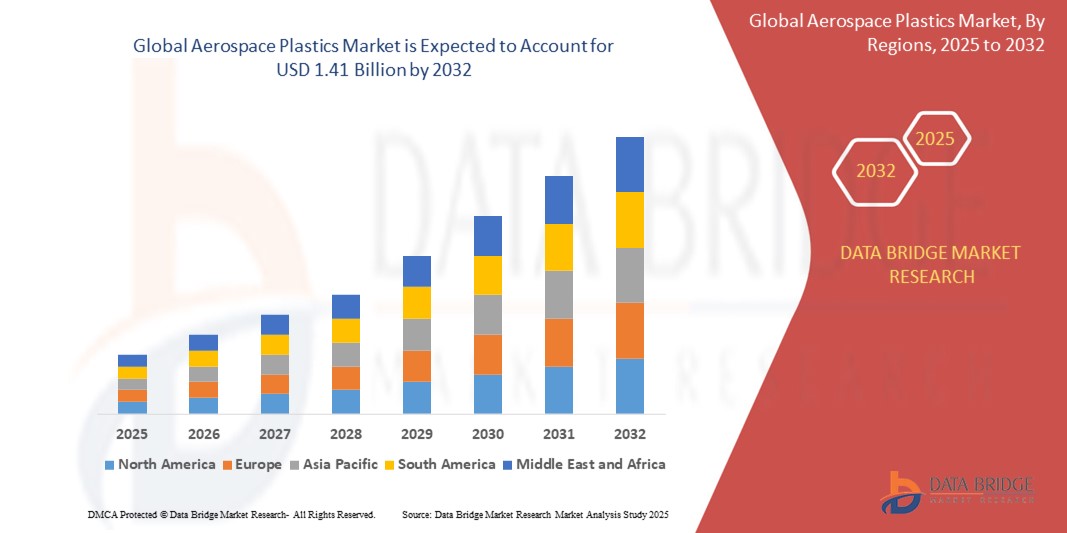

- The global aerospace plastics market size was valued at USD 0.85 billion in 2024 and is expected to reach USD 1.41 billion by 2032, growing at a CAGR of 6.50% during the forecast period.

- The growth is primarily driven by the rising demand for lightweight materials to enhance fuel efficiency, increasing aircraft production, and expanding defense budgets globally.

Aerospace Plastics Market Analysis

- Aerospace plastics are high-performance polymeric materials used in the aerospace sector for applications where strength-to-weight ratio, durability, and chemical resistance are critical. These materials are widely applied in interior components, fuselage parts, and engine components, helping reduce aircraft weight and improve fuel economy.

- The market is experiencing stable and consistent growth, supported by increasing commercial air traffic, rising preference for fuel-efficient aircraft, and growing investments in military aviation modernization programs.

- North America is expected to dominate the aerospace plastics market with a market share of 38.27%, attributed to the presence of major aircraft OEMs such as Boeing and Lockheed Martin, along with ongoing upgrades in commercial and defense aviation fleets.

- Asia-Pacific is anticipated to be the fastest growing region during the forecast period, supported by rapid expansion in air travel, increasing aircraft procurement by regional carriers, and government initiatives for indigenous aircraft manufacturing in countries like India and China.

- Among types, the polyetheretherketone (PEEK) segment is expected to lead the market with a share of 29.64%, owing to its exceptional thermal stability, chemical resistance, and mechanical strength, making it ideal for demanding applications such as engine parts and structural components in both commercial and military aircraft.

Report Scope and Aerospace Plastics Market Segmentation

|

Attributes |

Aerospace Plastics Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerospace Plastics Market Trends

“Growing Adoption of Lightweight, Fuel-Efficient Aircraft Components”

- A key trend in the global aerospace plastics market is the growing adoption of lightweight plastic components to enhance fuel efficiency, reduce carbon emissions, and optimize aircraft performance.

- This trend is strongly influenced by stringent environmental regulations, rising jet fuel costs, and the aerospace industry's push toward sustainable aviation and operational efficiency.

- For instance, leading aerospace manufacturers such as Boeing and Airbus are increasingly integrating high-performance thermoplastics like PEEK, PMMA, and polycarbonate into aircraft interiors, structural parts, and propulsion systems to replace traditional metal components and reduce aircraft weight.

- Lightweight aerospace plastics enable lower fuel consumption, increased payload capacity, and improved range, making them ideal for new-generation aircraft platforms.

- As the industry transitions toward hybrid and electric aircraft, the demand for advanced plastics that combine electrical insulation, thermal resistance, and structural integrity is expected to surge further.

- With ongoing innovation in flame-retardant, recyclable, and high-temperature-resistant plastics, the trend toward lightweighting is set to remain a major driver of technological advancement in aerospace manufacturing.

Aerospace Plastics Market Dynamics

Driver

“Rising Aircraft Production and Fleet Modernization”

- One of the major growth drivers in the aerospace plastics market is the rising production of commercial and military aircraft, coupled with increasing efforts to modernize existing fleets with lighter, more efficient components.

- The push for next-generation aircraft with better performance, lower emissions, and improved passenger comfort is accelerating the use of advanced plastics in both primary and secondary aircraft structures.

- Aerospace plastics offer excellent strength-to-weight ratio, corrosion resistance, and design flexibility, making them ideal substitutes for metals in critical aircraft systems.

- As airlines look to improve fuel efficiency and meet environmental targets, manufacturers are scaling up the use of plastics in areas such as aerostructures, cabin interiors, and propulsion systems.

For instance,

- Hexcel Corporation and Solvay S.A. are developing aerospace-grade thermoplastics and thermoset composites that meet stringent FAA requirements while reducing aircraft weight and enhancing fuel efficiency.

- Toray Industries is also investing in the production of carbon-fiber-reinforced plastic (CFRP) systems using polymer matrices for aerostructures.

- The combined effect of growing air travel, fleet renewal programs, and regulatory mandates for efficiency is expected to drive sustained demand for high-performance aerospace plastics through 2032.

Restraint/Challenge

“High Processing Costs and Regulatory Barriers”

- A significant restraint in the aerospace plastics market is the high processing cost and stringent regulatory approval process associated with aerospace-grade plastic materials.

- Advanced thermoplastics like PEEK, PPS, and PEI require sophisticated production techniques, precise quality control, and long certification timelines to meet aviation safety and performance standards.

- These complexities increase initial investment and time-to-market, deterring small and medium suppliers from entering the market and raising costs for aircraft OEMs.

- For instance, plastics used in aerospace applications must pass rigorous flammability, smoke, and toxicity (FST) tests and meet international regulatory certifications such as FAR 25.853, making material qualification both costly and time-consuming.

- Additionally, the limited recyclability and end-of-life management of high-performance plastics present further sustainability challenges for manufacturers and operators.

- While the benefits of aerospace plastics are significant, their higher cost compared to metals or commodity plastics, along with certification constraints, may slow adoption, especially in cost-sensitive defense and regional aviation markets.

Aerospace Plastics Market Scope

The market is segmented on the basis of type, application, and end-use.

- By Type

On the basis of type, the Aerospace Plastics Market is segmented into Polyetheretherketone (PEEK), Polycarbonate, Polymethyl Methacrylate (PMMA), Polyamide, Polyphenylene Sulfide (PPS), and Others. The Polyetheretherketone (PEEK) segment dominates the largest market revenue share of 31.5% in 2025, owing to its exceptional strength-to-weight ratio, high-temperature resistance, and flame retardancy, making it ideal for critical aerospace components including engine parts and structural assemblies.

However, the Polycarbonate segment is projected to grow at the highest CAGR of 6.82% during the forecast period of 2025–2032, driven by its extensive use in aircraft interiors and windows due to impact resistance, transparency, and lightweight properties, which align with industry efforts toward enhancing fuel efficiency and passenger comfort.

- By Application

Based on application, the Aerospace Plastics Market is segmented into Aerostructure, Cabin Interiors, Propulsion System, Equipment, and Others. The Cabin Interiors segment held the largest market share of 34.7% in 2025, primarily attributed to the rising demand for durable, lightweight, and aesthetically appealing plastics used in seats, panels, overhead bins, and other interior components. This demand is further supported by airline fleet modernization and growing air passenger traffic.

However, the Aerostructure segment is expected to record the highest CAGR of 7.23% during the forecast period. This growth is driven by the rising adoption of carbon-reinforced and high-performance plastics in fuselage, wings, and other structural components, where reduced weight contributes directly to fuel efficiency and emissions reduction.

- By End-Use

On the basis of end use, the Aerospace Plastics Market is categorized into Commercial Aviation, Military Aviation, and General Aviation. The Commercial Aviation segment accounted for the largest market share of 59.2% in 2025, due to the continued expansion of commercial airline fleets and increasing production of next-generation aircraft, which prioritize lightweight materials for cost and performance advantages.

Meanwhile, the Military Aviation segment is projected to grow at the highest CAGR of 6.95% during 2025–2032, fueled by increased defense budgets, modernization of air fleets, and demand for high-performance materials that offer enhanced durability, heat resistance, and survivability in extreme conditions.

Global Aerospace Plastics Market Regional Analysis

North America Aerospace Plastics Market Insight

North America commands a leading position in the global aerospace plastics market, backed by the presence of major aircraft manufacturers, strong defense budgets, and continuous investments in aviation modernization programs. The region's focus on fuel efficiency and emissions reduction has significantly increased the adoption of lightweight and high-performance plastics in commercial and military aviation.

- U.S. Aerospace Plastics Market Insight

The U.S. aerospace plastics market holds the largest revenue share in North America in 2025, driven by the country’s robust aerospace sector, including OEMs such as Boeing and Lockheed Martin. The widespread use of thermoplastics and composites in fuselage components, cabin interiors, and propulsion systems is enhancing aircraft performance while reducing operational costs. Ongoing innovations in flame-retardant and low-smoke plastics are further propelling growth.

- Canada Aerospace Plastics Market Insight

Canada’s aerospace plastics market is witnessing stable growth, supported by its thriving aerospace manufacturing base, particularly in Quebec. The increasing demand for lightweight materials in regional jets and helicopters is stimulating the use of polycarbonate, PEEK, and PMMA in interior and structural applications. Government support for aerospace R&D and sustainability initiatives is encouraging the integration of recyclable and high-strength plastic materials.

Europe Aerospace Plastics Market Insight

Europe is expected to experience strong growth in the aerospace plastics market over the forecast period, driven by stringent EU regulations on aircraft emissions, weight optimization, and sustainability. The presence of leading aircraft manufacturers like Airbus and growing investment in electric and hybrid aviation are accelerating the adoption of advanced plastic materials in aerostructures and cabin systems.

- Germany Aerospace Plastics Market Insight

Germany holds a significant share in the European aerospace plastics market, fueled by its precision engineering capabilities and strong aircraft component supply chain. The use of high-performance thermoplastics in aircraft exteriors, brackets, and engine parts is expanding. Moreover, Germany’s commitment to carbon neutrality is encouraging OEMs and tier suppliers to explore bio-based and recyclable plastic alternatives.

- France Aerospace Plastics Market Insight

France’s aerospace plastics market is poised for notable expansion, underpinned by its role as a global aerospace hub and home to Airbus headquarters. The country's push toward low-emission aircraft and increased aircraft production rates is driving the demand for lightweight polymers in aerostructures and interiors. Public-private partnerships focused on next-gen aviation technologies are boosting innovation in aerospace-grade plastic formulations.

Asia-Pacific Aerospace Plastics Market Insight

Asia-Pacific is projected to register the fastest CAGR in the aerospace plastics market from 2025 to 2032, due to rising air travel, rapid fleet expansion, and significant investments in domestic aircraft manufacturing programs. Countries like China and India are scaling up their aerospace infrastructure and aiming to reduce import dependency by boosting local production of advanced materials, including aerospace plastics.

- China Aerospace Plastics Market Insight

China leads the Asia-Pacific aerospace plastics market, supported by its growing indigenous aircraft development programs such as the COMAC C919. The rising use of polymers in fuselage panels, cabin components, and ventilation systems is driven by their weight-saving benefits and design flexibility. Government emphasis on domestic aviation self-reliance and sustainable material use is propelling further market growth.

- India Aerospace Plastics Market Insight

India’s aerospace plastics market is expected to grow at an impressive CAGR, fueled by increasing investments in military aviation, MRO (Maintenance, Repair, and Overhaul) services, and indigenous aircraft production under the "Make in India" initiative. The growing need for fuel-efficient and lightweight aircraft is encouraging the use of thermoplastics and composites across multiple applications. Additionally, collaborations with global aerospace firms are enhancing local capabilities in aerospace-grade plastic processing.

Aerospace Plastics Market Share

The Aerospace Plastics industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- SABIC (Saudi Basic Industries Corporation) (Saudi Arabia)

- Hexcel Corporation (U.S.)

- Victrex plc (UK)

- Solvay S.A. (Belgium)

- Arkema S.A. (France)

- Drake Plastics Ltd. Co. (U.S.)

- Ensinger GmbH (Germany)

- Röchling Group (Germany)

- Toray Industries, Inc. (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- Teijin Limited (Japan)

- PolyOne Corporation (now Avient Corporation) (U.S.)

- Celanese Corporation (U.S.)

Latest Developments in Global Aerospace Plastics Market

- In March 2025, Solvay S.A. (Belgium) announced the expansion of its Amodel® PPA portfolio, introducing new aerospace-grade formulations with enhanced flame retardancy and mechanical strength. This development aims to meet the increasing demand for lightweight, high-performance polymers in aircraft interiors and electrical systems, supporting compliance with stringent safety standards and reducing overall aircraft weight.

- In February 2025, Toray Industries, Inc. (Japan) launched a new high-heat-resistant PEEK resin under its TorayPEEK™ brand, designed specifically for aerospace propulsion systems and structural components. This material offers superior thermal and chemical resistance, reinforcing Toray’s position as a critical supplier of advanced thermoplastics in next-generation aircraft designs.

- In August 2024, Hexcel Corporation (U.S.) inaugurated a new aerospace thermoplastics research center in Salt Lake City, Utah. The facility will focus on developing advanced carbon fiber-reinforced thermoplastic composites for commercial and military aviation applications. The investment aligns with Hexcel’s strategic initiative to offer lighter and more sustainable alternatives to traditional metal-based components.

- In May 2024, Victrex plc (UK) unveiled a collaboration with Tri-Mack Plastics to produce aerospace-qualified composite brackets using Victrex AE™ 250 UDT thermoplastic composite. These lightweight, corrosion-resistant components are designed to replace traditional metallic parts, enabling fuel efficiency and compliance with evolving aerospace design requirements.

- In April 2024, BASF SE (Germany) launched Ultrason® E2010, a new high-performance polyethersulfone (PESU) grade targeted for aerospace interior panels and ventilation systems. This product offers excellent flame resistance, dimensional stability, and low smoke density, helping aircraft manufacturers meet strict global safety standards.

- In January 2024, SABIC (Saudi Arabia) introduced a new LEXAN™ polycarbonate film solution tailored for aerospace display panels and cabin window applications. This product enhances optical clarity, durability, and ease of processing, addressing growing demand for lighter, impact-resistant materials in commercial aircraft.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace Plastics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace Plastics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace Plastics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.