Global Aerospace And Defense C Class Parts Market

Market Size in USD Billion

CAGR :

%

USD

16.77 Billion

USD

24.78 Billion

2021

2029

USD

16.77 Billion

USD

24.78 Billion

2021

2029

| 2022 –2029 | |

| USD 16.77 Billion | |

| USD 24.78 Billion | |

|

|

|

|

Aerospace and Defense C Class Parts Market Analysis and Size

The selection of superior parts are a vital factor in aerospace and defense industries. It affects several aspects of the aircraft performance from the design phase to disposal, such as safety and reliability, lifecycle cost, recyclability, structural efficiency, flight performance, payload, energy consumption and disposability. The "fasteners" is the fastest growing product segment due high consumption of fasteners, including washers, nuts, seals, rivets, bolts, screws and rings, which are used as important components in the assembly of aircraft parts. Furthermore, the demand for aerospace and defense c-class parts in aviation applications is rising due to growing emphasis on improving aircraft comfort and safety during the forecast period.

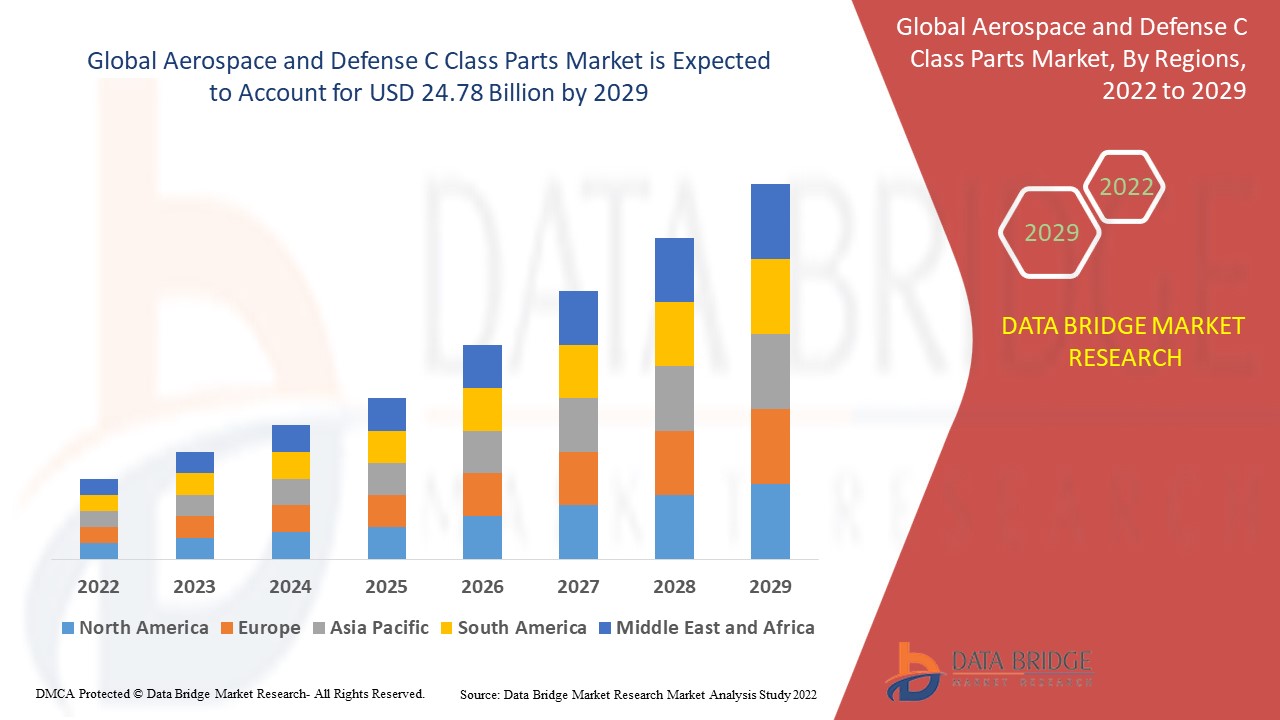

Data Bridge Market Research analyses that the aerospace and defense C class parts market was valued at USD 16.77 billion in 2021 and is expected to reach USD 24.78 billion by 2029, registering a CAGR of 5.00% during the forecast period of 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Aerospace and Defense C Class Parts Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Fasteners, Bearings, Electrical Parts, Machined Parts), Application (Engine, Aerostructure, Interiors, Equipment, Safety, and Support; Avionics), End-Use (Commercial, Military, Business and General Aviation, Others), Distribution Channel (OEM, Aftermarkets), Aircraft Type (Commercial Aircraft, Regional Aircraft, General Aviation, Helicopter, Military Aircraft) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Eaton (Ireland), NTN BEARING CORPORATION OF AMERICA (U.S.), Amphenol Aerospace (U.S.), Berkshire Hathaway Inc., (U.S.), Arconic (U.S.), RBC Bearings Incorporated (U.S.), Stanley Black & Decker, Inc. (U.S.), TriMas (U.S.), National Aerospace Fasteners Corporation (Taiwan), LISI AEROSPACE (France), Triumph Group (U.S.), Safran (France), SKF (Sweden), TE Connectivity (Switzerland), Satcom Direct, Inc. (U.S.), Boeing (U.S.), Airbus S.A.S (France), Embraer (Brazil), ATR (France), Lockheed Martin Corporation (U.S.), Textron Aviation Inc., (U.S.) |

|

Market Opportunities |

|

Market Definition

Aerospace and defense C class are high-volume and low-cost commodity parts, such as bearings and fasteners. Fasteners include rivets, nuts, seals, bolts, screws, washers and rings, which are important components in aircraft assembly. While bearings are used to eliminate ladder cracking and heat damage in landing gear struts or shock absorbers.

Global Aerospace and Defense C Class Parts Market Dynamics

Drivers

- Rising demand for effective fasteners

Fasteners are hardware tools that combine two or more objects in aircraft manufacturing and designing. The fasteners' consumption increases because it includes nuts, seals, rivets, bolts, screws, washers and rings. These components are used as essential components in the assembly of aircraft parts. The rising demand for high corrosion-resistant and lightweight fasteners is the major factor that is boosting the need for the global aerospace and defense c-class parts market.

- Growing Defense Expenditures

Military spending has increased considerably in last few years globally. According to the Stockholm International Peace Research Institute (SIPRI) report, global military expenditure risen by approximately 2.6% from 2017 to 2018. The rise in defense expenditure is projected to boost the demand for technologically advanced aircraft such as helicopters, fighter jets and transport aircraft, this is anticipated to propel the growth of the aerospace and defense c-class parts market.

Moreover, the growing aerospace industry, increasing usages of the product in aerospace applications to improve the strength and durability and of aircraft panels are expected to boost the demand of the aerospace and defense c-class parts in the market. Also, the rising number of passenger traffic and easy availability of customised components are other important factors that will likely increase the growth of the aerospace and defense C class parts market during the forecast period of 2022-2029.

Opportunities

- Expansion of air tourism industry

The expansion of the air tourism industry is increasing the sales of commercial aircraft, which is anticipated to directly affect the sales of aerospace and defense c-class parts. Several countries are investing more in the aviation sector to increase air connectivity across all over cities and other foreign countries, which is expected to fuel the growth of the aerospace and defense c-class parts market.

- Technological advancement

The manufacturers are focusing on technological advancements so the companies are delivering modern and sophisticated mount solutions. The company aims to help in decrease development costs and reduce development time with the reference design and software for smart and energy-efficient aerospace and defense c-class parts which are expected to increase the demand of the aerospace and defense c-class parts and create beneficial opportunities for the market rate.

Restraints/ Challenges

- Disadvantages associated with aerospace and defense C class parts market

Availability of product substitute and prevalence of non-trusted manufacturers will be expected to act as market restraints factor for the aerospace and defense c-class parts market and will inhibit the market's growth in the forecast period of 2022-2029.

This aerospace and defense C class parts market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the aerospace and defense C class parts market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Aerospace and Defense C-Class Parts Market

The aerospace and defense c-class parts manufacturer mostly depends on the production activities shut down during this pandemic and disrupted the supply chain network. Most aerospace and defense c-class parts manufacturers are uncertain about the normal plant activities to resume on a regular basis due to this COVID-19 pandemic, which is majorly hampering the demand and supply network of the targeted company. During this pandemic, many problems have been created, such as the closure of factories and the unavailability of workforce in the affected nations. This ultimately led to a main liquidity problem for the aerospace and defense c-class parts manufacturer.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Global Aerospace and Defense C Class Parts Market Scope

The aerospace and defense C class parts market is segmented on the basis of product, application, end-use, distribution channel and aircraft type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Fasteners

- Bearings

- Electrical Parts

- Machined Parts

Application

- Engine

- Aerostructure

- Interiors

- Equipment

- Safety and Support

- Avionics

End-Use

- Commercial

- Military

- Business and General Aviation

- Others

Distribution Channel

- OEM

- Aftermarkets

Aircraft Type

- Commercial Aircraft

- Regional Aircraft

- General Aviation

- Helicopter

- Military Aircraft

Aerospace and Defense C Class Parts Market Regional Analysis/Insights

The aerospace and defense C class parts market is analysed and market size insights and trends are provided by country, product, application, end-use, distribution channel and aircraft type as referenced above.

The countries covered in the aerospace and defense C class parts market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the aerospace and defense C class parts market in terms of market share due to the rapid growth in the manufacture of cabin interior components. This is due to the prevalence of well-established aviation industry with the developing defence industry in this region.

Asia-Pacific is expected to be the fastest developing regions during the forecast period of 2022-2029 due to the growing military spending. Moreover, rising levels of disposable income of the people and increasing demand for military aircraft are some other major factors that will likely increase the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Aerospace and Defense C Class Parts Market Share Analysis

The aerospace and defense C class parts market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies focus related to aerospace and defense C class parts market.

Some of the major players operating in the aerospace and defense C class parts market are:

- Eaton. (Ireland)

- NTN BEARING CORPORATION OF AMERICA (U.S.)

- Amphenol Aerospace (U.S.)

- Berkshire Hathaway Inc., (U.S.)

- Arconic (U.S.)

- RBC Bearings Incorporated (U.S.)

- Stanley Black & Decker, Inc. (U.S.)

- TriMas (U.S.)

- National Aerospace Fasteners Corporation (Taiwan)

- LISI AEROSPACE (France)

- Triumph Group (U.S.)

- Safran (France)

- SKF (Sweden)

- TE Connectivity (Switzerland)

- Satcom Direct, Inc. (U.S.)

- Boeing (U.S.)

- Airbus S.A.S (France)

- Embraer (Brazil)

- ATR (France)

- Lockheed Martin Corporation (U.S.)

- Textron Aviation Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace And Defense C Class Parts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace And Defense C Class Parts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace And Defense C Class Parts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.