Global Aerosol Cans Market

Market Size in USD Billion

CAGR :

%

USD

11.29 Billion

USD

19.52 Billion

2024

2032

USD

11.29 Billion

USD

19.52 Billion

2024

2032

| 2025 –2032 | |

| USD 11.29 Billion | |

| USD 19.52 Billion | |

|

|

|

|

Aerosol Cans Market Size

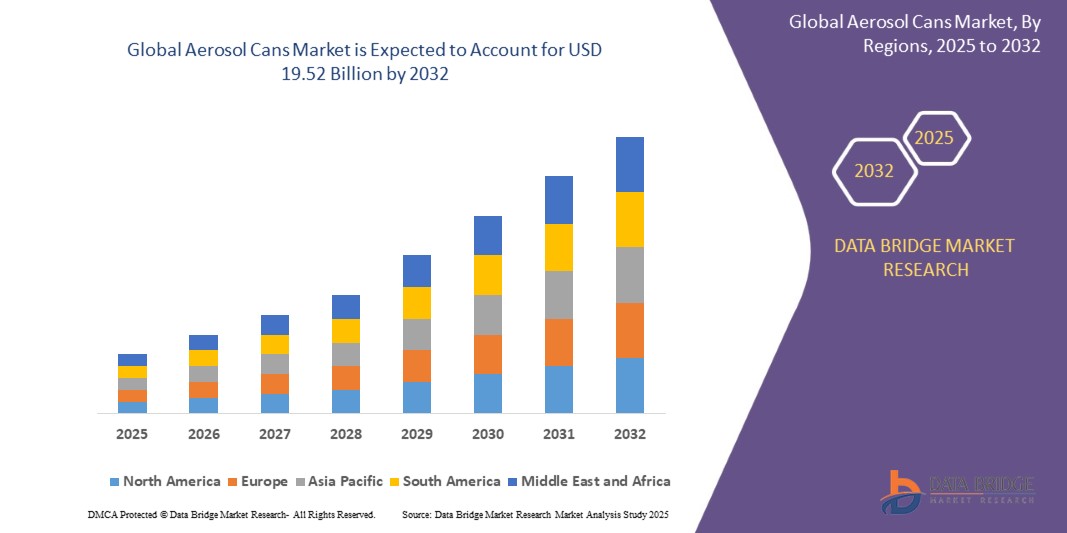

- The global aerosol cans market size was valued at USD 11.29 billion in 2024 and is expected to reach USD 19.52 billion by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by increasing consumer demand for convenient, sustainable, and safe aerosol packaging solutions across personal care, household, automotive, food & beverage, and healthcare sectors.

- Rapid urbanization, expansion of e-commerce, and rising awareness of eco-friendly recyclable packaging are also driving the market expansion.

Aerosol Cans Market Analysis

- Aerosol cans are pressurized containers that dispense products in fine mists, sprays, or foams, widely used in personal care (deodorants, hair sprays), household cleaning, automotive coatings, food toppings, and healthcare delivery systems.

- Their ability to provide precise dosing, product integrity, extended shelf life, and convenience enhances consumer appeal and brand differentiation.

- Aluminum dominates the material type segment due to its recyclability, corrosion resistance, and lightweight properties. Steel and plastic are used depending on application-specific requirements.

- Necked-in and straight wall cans are preferred for ergonomics and aesthetic appeal.

- The Asia-Pacific region leads growth due to rising disposable incomes, growing packaged goods industries, and expanding manufacturing capacity in China, India, and Southeast Asia.

- Europe holds the largest market share, driven by stringent environmental regulations and robust sustainability initiatives.

- Personal care remains the dominant end-use segment, followed by household and automotive sectors.

Report Scope and Aerosol Cans Market Segmentation

|

Attributes |

Aerosol Cans Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerosol Cans Market Trends

Growing Focus on Sustainable and Recyclable Aerosol Packaging

- The market is witnessing a strong trend toward development and adoption of sustainable aerosol cans, particularly aluminum and recyclable steel variants, to meet environmental regulations and circular economy goals.

- Increasing consumer and regulatory pressure on reducing carbon footprint, plastic waste, and Volatile Organic Compound (VOC) emissions is propelling innovations in eco-friendly propellants and light-weight packaging formats.

- The surge in e-commerce amplifies demand for durable, safe packaging that can withstand transit stresses while maintaining product integrity.

Aerosol Cans Market Dynamics

Driver

Rising Demand for Convenience and Portability in Personal Care and Household Products

- The aerosol cans market is significantly driven by increasing consumer preference for convenient, user-friendly packaging that delivers precise dosage and maintains product integrity. This is particularly evident in personal care products like deodorants, hair sprays, and skin care aerosols, as well as household products such as air fresheners, disinfectants, and cleaners. The ease of use and enhanced consumer experience encourage continued growth.

- Growing urbanization and expanding middle-class populations in emerging economies fuel demand for packaged convenience, further propelling aerosol can usage in ready-to-use food products, automotive coatings, and pharmaceuticals.

- E-commerce expansion amplifies the need for durable, protective packaging that can withstand shipment stresses while preserving product condition, driving innovation in aerosol can design, materials, and closures.

- Sustainability trends are propelling the shift toward lightweight, recyclable aluminum cans and steel alternatives, meeting consumer and regulatory demand for environmentally responsible packaging solutions. Companies are investing in product designs that facilitate recycling and reduce carbon footprints

- Innovations in propellant technologies—such as low-VOC and hydrocarbon blends—are gaining momentum, aligning with environmental regulations and consumer eco-consciousness.

- Premiumization and product differentiation are also driving adoption, with brands leveraging customized can shapes, finishes, and spray mechanisms to enhance shelf appeal and user engagement.

Restraint/Challenge

Raw Material Price Volatility, Regulatory Compliance Costs, and Technological Transition Challenges

- The aerosol cans market faces challenges related to fluctuating raw material prices, particularly aluminum and steel, which directly impact production costs and can squeeze manufacturer margins. These commodity price volatilities create uncertainty and complicate pricing strategies.

- Increasingly stringent environmental regulations aimed at reducing VOC emissions and controlling the lifecycle impacts of packaging materials impose additional compliance burdens on manufacturers. Meeting these requirements often necessitates significant investments in R&D, manufacturing upgrades, and certification processes.

- The technological shift from traditional materials and propellants to more sustainable and recyclable alternatives requires complex adjustments in production lines and supply chains, potentially causing delays and increased capital expenditure.

- Developing eco-friendly propellants that maintain product performance while complying with environmental standards remains challenging. The limited availability of cost-effective, environmentally benign propellant options could hamper market adoption speed.

- Smaller manufacturers and regional players may struggle with the capital outlays needed to innovate in sustainable materials and refined aerosol technologies, which might restrict their competitiveness and market penetration.

- Additionally, consumer concerns over aerosol safety and environmental impact—such as perceived risks of propellant flammability or emissions—may deter usage in certain product categories, limiting the growth potential in those segments.

Aerosol Cans Market Scope

The market is segmented on the basis of material type, propellant type, product type, and end-use industry.

- By Material Type

On the basis of material type, the aerosol cans market is segmented into aluminum, steel, and plastic. Aluminum is the dominant segment, holding the largest market revenue share in 2024 due to its recyclability, lightweight nature, and corrosion resistance, making it ideal for various personal care, household, and food packaging applications. Steel is used mainly for robust packaging requiring high strength, commonly in automotive and industrial aerosol products. Plastic, while less prevalent, is used for specialty containers and cost-sensitive products. The aluminum segment is expected to witness the fastest growth from 2025 to 2032, supported by increasing sustainability trends and regulatory mandates favoring recyclable packaging.

- By Propellant Type

The market is segmented into liquefied gas propellants and compressed gas propellants. Liquefied gas propellants dominate in volume and revenue due to their widespread application in personal care, household, and automotive sectors for effective product dispensing. Compressed gas propellants are preferred in food aerosol and pharmaceutical applications where safety and purity are critical. Liquefied gas propellants are expected to maintain market leadership through 2032 due to their efficiency and broad usage.

- By Product Type

On the basis of product type, aerosol cans are categorized into straight wall, necked-in, and shaped cans. Straight wall cans are the most common due to ease of manufacture and cost-effectiveness. Necked-in cans are growing in popularity for their ergonomic design and premium look, especially in personal care and cosmetics. Shaped cans serve niche markets requiring product differentiation and aesthetic appeal, particularly in premium cosmetics. The necked-in segment is projected to register the highest CAGR over the forecast period, driven by increasing demand for premiumized packaging.

- By End-Use Industry

The aerosol cans market is segmented into personal care, household products, automotive, food & beverages, healthcare, and others. The personal care segment accounts for the largest market share, led by products such as deodorants, hair sprays, and skincare aerosols. Household products, including air fresheners and insecticides, hold a significant share and are growing steadily. The automotive segment includes coatings and lubricants, while the food & beverages segment consists of whipped toppings and cooking sprays. Healthcare aerosols cater to pharmaceutical and medical delivery systems. Personal care is expected to remain the dominant segment through 2032 due to evolving consumer lifestyles and product innovations.

Aerosol Cans Market Regional Analysis

- Asia-Pacific dominates the Global Aerosol Cans Market with the largest revenue share of approximately 34.5% in 2024, driven by rapid urbanization, rising disposable incomes, and expanding manufacturing industries in countries such as China, India, Japan, and South Korea. The region benefits from a growing middle class, increased consumption of personal care, household, and packaged food products, and strong government support for sustainability and green packaging initiatives.

- Consumers and manufacturers in Asia-Pacific are increasingly adopting aerosol cans in personal care products, household cleaning, automotive coatings, and food packaging, fueled by demand for convenient, easy-to-use, and eco-friendly packaging solutions. Heightened environmental awareness and regulatory policies are accelerating the shift to lightweight, recyclable aluminum cans and the use of eco-friendly propellants.

- The region’s growth is further strengthened by ongoing investments in packaging innovation, expanding e-commerce platforms, and a vibrant export market supported by cost-effective production capabilities. Government initiatives promoting recyclable packaging, coupled with consumer preference for sustainable products, reinforce Asia-Pacific's market dominance in the aerosol cans sector.

U.S. Aerosol Cans Market Insight

The U.S. dominates the North American aerosol cans market in 2024, benefiting from a mature personal care, household, and automotive products sector. Strong demand for sustainable, recyclable aluminum cans and innovations in low-VOC propellants are driving growth. The market is further supported by rising consumer awareness of eco-friendly packaging and stringent regulatory frameworks on emissions and recyclability. E-commerce expansion also fuels demand for convenient, durable aerosol packaging that caters to on-the-go lifestyles. Major players focus on product premiumization and enhanced user experience through ergonomic and aesthetically appealing can designs.

Europe Aerosol Cans Market Insight

Europe's aerosol cans market is poised for robust growth, led by rigorous environmental regulations pushing sustainability and recyclability in packaging. Growing consumer demand for odorless, low-emission aerosols, along with the rise of eco-conscious brands, supports market expansion across personal care, household, food & beverage, and automotive sectors. Countries such as Germany, France, and the U.K. are key contributors, backed by advanced manufacturing capabilities and ongoing innovation in biodegradable propellants and lightweight materials. EU initiatives and research funding stimulate development of new aerosol technologies to meet stringent hygiene and packaging standards.

U.K. Aerosol Cans Market Insight

The U.K. aerosol cans market is expected to see considerable growth driven by increasing use in personal care cosmetics, household cleaning products, and food packaging. Consumer demand for sustainability and product safety encourages manufacturers to introduce recyclable aerosols and low-VOC propellants. Healthcare and hospitality industries are adopting aerosol applications for sanitization and functional use. The rising interest in premium and convenience packaging solutions also fuels demand. The market benefits from increasing regulatory focus and consumer awareness surrounding environmentally sound aerosol packaging.

Germany Aerosol Cans Market Insight

Germany’s aerosol cans market is projected to grow steadily, driven by its advanced automotive, personal care, and food & beverage industries. The country’s leadership in engineering and stringent environmental protection regulations push adoption of lightweight, recyclable aluminum cans and development of eco-friendly propellant technologies. Emphasis on reducing packaging waste and carbon footprint fosters investments in innovative aerosol designs that align with Germany’s sustainability goals. Moreover, high consumer demand for premium packaging and product safety standards sustains market expansion.

Asia-Pacific Aerosol Cans Market Insight

The Asia-Pacific region holds the largest revenue share in the aerosol cans market due to rapid urbanization, rising disposable incomes, and increasing packaged goods consumption across China, India, Japan, and South Korea. Demand is driven by expanding personal care, household, automotive, and food sectors. Government initiatives promoting sustainable packaging and food safety regulations bolster market penetration. The region benefits from cost-effective manufacturing, abundant raw material availability, and strong export activities. The growth of modern retail and e-commerce platforms further accelerates adoption of aerosol cans meeting consumer convenience and environmental preferences.

India Aerosol Cans Market Insight

India is projected to register a substantial CAGR in the aerosol cans market over the forecast period, supported by a growing middle class with increasing demand for convenience foods, cosmetics, and household products in aerosol form. Government initiatives such as “Make in India” and rising regulatory focus on sustainability are driving investments in domestic aerosol packaging manufacturing and eco-friendly product development. Increasing health and hygiene awareness post-pandemic encourages larger adoption of aerosolized personal care and disinfectant products. Expanding urbanization and e-commerce growth are critical growth factors.

China Aerosol Cans Market Insight

China leads the Asia-Pacific aerosol cans market in revenue share due to its vast manufacturing infrastructure, expanding middle-class population, and surging demand for personal care, food, automotive, and pharmaceutical aerosols. Government policies emphasize green packaging, food safety, and emission reduction, propelling development of recyclable aluminum cans and low-VOC propellants. The country actively invests in technological innovation, including automation and materials engineering, enhancing export capacity and domestic consumption. Rapid urbanization and growing health consciousness further fuel demand.

Aerosol Cans Market Share

The Aerosol Cans industry is primarily led by well-established companies, including:

- Ball Corporation (U.S.)

- Crown Holdings, Inc. (U.S.)

- Silgan Holdings Inc. (U.S.)

- Ardagh Group S.A. (Luxembourg)

- Toyo Seikan Group Holdings Ltd. (Japan)

- Global Closure Systems (France)

- Can-Pack S.A. (Poland)

- Rexam PLC (U.K.)

- Nampak Ltd. (South Africa)

- CCL Industries Inc. (Canada)

- EXAL Corporation (U.S.)

- Mauser Packaging Solutions (Germany)

- Colep Packaging Portugal, S.A. (Portugal)

- Trivium Packaging B.V. (Netherlands)

Latest Developments in Global Aerosol Cans Market

- In March 2025, Ball Corporation launched a lightweight, recyclable aluminum aerosol can targeting personal care and household products to enhance sustainability and recyclability.

- In January 2025, Crown Holdings introduced a new low-VOC propellant technology compatible with a broad spectrum of aerosol products, supporting compliance with stringent environmental regulations.

- In October 2024, Silgan Holdings expanded its production capacity in India to meet rising demand for personal care and food aerosol products with eco-conscious manufacturing practices.

- In July 2024, Ardagh Group unveiled a new range of shaped aerosol cans designed for premium cosmetics, offering improved ergonomics and consumer appeal.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.