Global Acrylic Processing Aid Market

Market Size in USD Million

CAGR :

%

USD

803.29 Million

USD

1,411.47 Million

2024

2032

USD

803.29 Million

USD

1,411.47 Million

2024

2032

| 2025 –2032 | |

| USD 803.29 Million | |

| USD 1,411.47 Million | |

|

|

|

Acrylic Processing Aid Market Analysis

There has been immense growth in the chemical industry from last few years. Additionally, the growing demand for acrylic processing aids in sectors like automotive, consumer products, building and construction, and packaging is the primary factor driving the market. These determinants are estimated to significantly accelerate the market expansion rate over the forecast period.

Acrylic Processing Aid Market Size

Global acrylic processing aid market size was valued at USD 803.29 million in 2024 and is projected to reach USD 1411.47 million by 2032, with a CAGR of 7.30% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Acrylic Processing Aid Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Key Market Players |

Ashland (U.S.), Arkema (France), BASF SE (Germany), Kemira (Finland), The Lubrizol Corporation (U.S.), NIPPON SHOKUBAI CO. LTD (Japan), Dow (U.S.), Henan Qingshuiyuan Technology CO., Ltd., (China), Aurora Fine Chemicals (U.S.), Zouping Dongfang Chemical Co., Ltd. (China), ACURO ORGANICS LIMITED (U.S.), Maxwell Additives Pvt. Ltd (India), Chemtex Speciality Limited (India), Polysciences, Inc.(U.S.), PROTEX INTERNATIONAL (France), Evonik Industries AG (Germany) |

|

Market Opportunities |

|

Acrylic Processing Aid Market Definition

Acrylic processing aid is usually used for the fusion and homogeneity of polyvinyl chloride. Because it offers quicker merging, increased production yield, greater melt flexibility and strength, less plate-out, improved surface shine and finishing, better thickness, and improved tensile strength, acrylic processing aid is employed by PVC makers.

Acrylic Processing Aid Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing Demand for Acrylic Processing Aid

Growing demand for affordable tools to assist in the production of plastic goods, rising product usage across a range of end-use applications, and the prevalence of affordable and flexible materials are some of the factors supporting the growth of the acrylic processing aid market over the forecast period. On the other hand, expanding applications from the automotive and construction sectors will further increase a number of favorable factors that will contribute to the expansion of the acrylic processing aid market over the time covered by the forecast period. The main purposes of acrylic processing assistance are to improve process ability, decrease the shark skin effect during extrusion, and boost plastic materials flow. In important end-use industries like packaging, building & construction, automotive, consumer products, and others, use of acrylic processing aid in plastics is gaining traction.

Furthermore, the comparing PVC to more traditional materials like metals, glass, paper, and ceramics, it has better mechanical, electrical, abrasion, chemical, and other qualities. It promotes quicker fusion, higher production output, improved melt strength and elasticity, decreased plate-out and melt texture, improved surface gloss and finishing, better thickness, and greater tensile strength, PVC manufacturers use acrylic as a processing aid during the fabrication process. Additionally, the expansion of the end-use industries is projected to bolster the market's growth.

Opportunities

- New Technologies and Investments

Furthermore, market players are further developing new technologies for polymerization and are also to produce better-quality plastics with enhanced features extend profitable opportunities to the market players in the forecast period of 2025 to 2032. Additionally, the growing investments and funding for the product will further expand the future growth of the acrylic processing aid market.

Restraints/Challenges

- Lack Of Funding

However, due to a lack of funding, small businesses rarely invest in research and development activities. This has a detrimental effect on the overall growth of acrylic processing aid in the area.

- Huge Repairing Costs

Additionally, the majority of the pipes and fittings are underground and therefore any malfunction or failure could result in much more expensive repairs, which will further challenge the acrylic processing aid market growth rate.

This acrylic processing aid market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the acrylic processing aid market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Acrylic Processing Aid Market Scope

The acrylic processing aid market is segmented on the basis of polymer type, fabrication process, application and end-use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Polymer Type

- Polyvinyl Chloride

- Others

Fabrication Process

- Extrusion

- Injection Molding

- Others

Application

- Pipes and Fitting

- Door and Window

- Packaging and Films

- Furniture

- Footwear

- Others

End-Use Industry

- Building and Construction

- Packaging

- Consumer Goods

- Automotive

- Others

Acrylic Processing Aid Market Regional Analysis

The acrylic processing aid market is analyzed and market size insights and trends are provided by country, polymer type, fabrication process, application and end-use industry as referenced above.

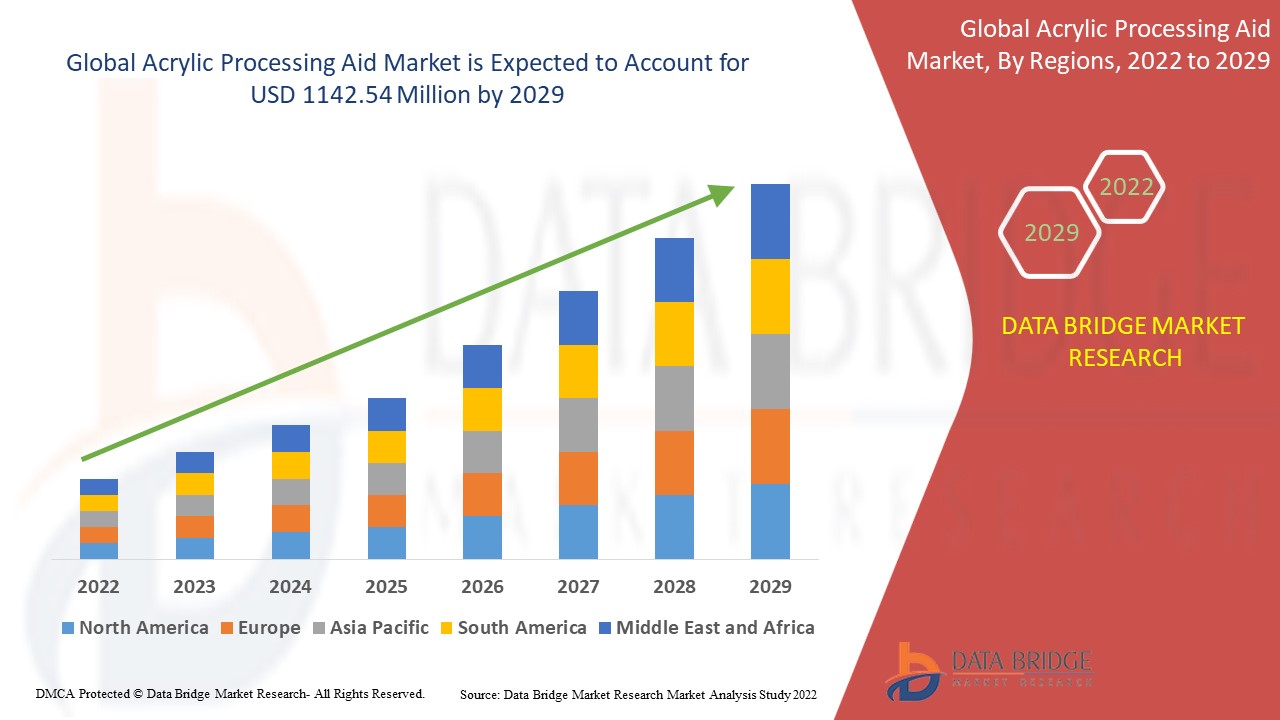

The countries covered in the acrylic processing aid market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market in terms of market share and revenue, and this dominance is expected to continue during the forecast period of 2025-2032. The increasing automotive and packaging applications in the region are driving market growth in this region.

Asia-Pacific, on the other hand, is expected to grow rapidly over the forecast period of 2025-2032, owing to increased investment from various end-use industries as well as increased spending by the region's middle-class population.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Acrylic Processing Aid Market Share

The acrylic processing aid market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to acrylic processing aid market.

Acrylic Processing Aid Market Leaders Operating in the Market Are:

- Ashland (U.S.)

- Arkema (France)

- BASF SE (Germany)

- Kemira (Finland)

- The Lubrizol Corporation (U.S.)

- NIPPON SHOKUBAI CO. LTD (Japan)

- Dow (U.S.)

- Henan Qingshuiyuan Technology CO., Ltd., (China)

- Aurora Fine Chemicals (U.S.)

- Zouping Dongfang Chemical Co., Ltd. (China)

- ACURO ORGANICS LIMITED (U.S.)

- Maxwell Additives Pvt. Ltd (India)

- Chemtex Speciality Limited (India)

- Polysciences, Inc. (U.S.)

- PROTEX INTERNATIONAL (France)

- Evonik Industries AG (Germany)

Latest Developments in Acrylic Processing Aid Market

- In July 2020, A new process aid from Arkema called PLASTISTRENGTH 562 NA is intended to assist PVC converters in striking a better balance between formulation cost and processing performance. This novel technology offers constant PVC fusion and filler integration, increased melt power, and effective processing in both rigid and semi-rigid extruded or calendared PVC products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acrylic Processing Aid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acrylic Processing Aid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acrylic Processing Aid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.