Market Analysis and Insights

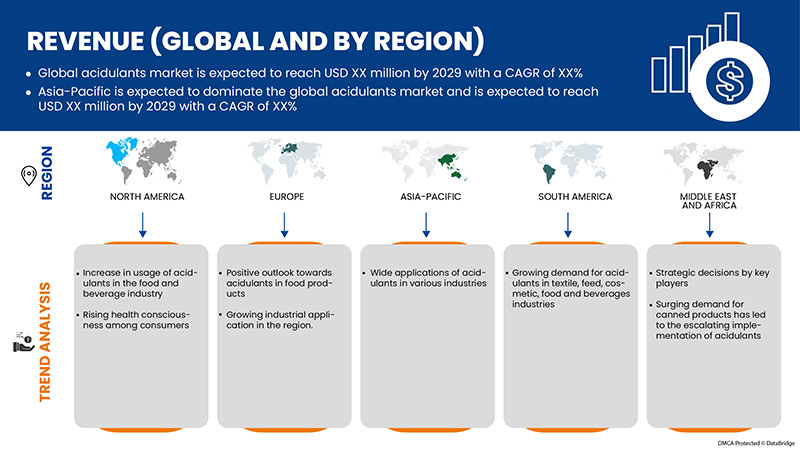

The global acidulants market is gaining significant growth due to the growing application in food & beverage, feed, chemical, cosmetic etc. industries. The increase in demand for acidulants in alcoholic beverages such as wine is also boosting the growth of the global acidulants market. However, stringent government regulations associated with acidulants and health risks associated with some acidulants, such as phosphoric acid is expected to restrain the market growth of acidulants market during the forecast period.

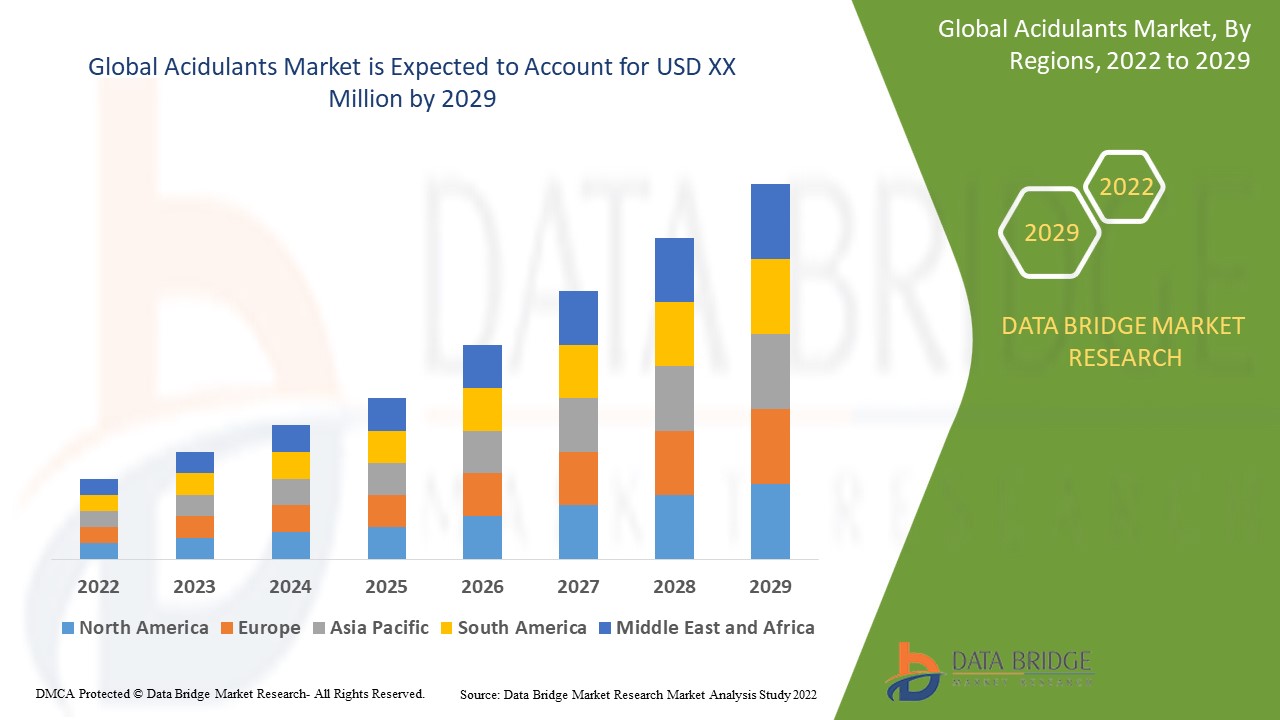

Data Bridge Market Research analyses that the global acidulants market will grow at a CAGR of 6.5% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Citric Acid, Sodium Citrate, Potassium Citrate, Acetic Acid, Formic Acid, Gluconic Acid, Malic Acid, Phosphoric Acid And Salts, Tartaric Acid, Lactic Acid, Tannic Acid, Fumaric Acid, Succinic Acid, and Ascorbic Acid) |

|

Countries Covered |

U.S., Canada, Mexico, China, Japan, Australia, India, South Korea, Malaysia, Singapore, Indonesia, Thailand, Vietnam, New Zealand, Philippines, and the rest of Asia-Pacific, U.K., France, Germany, Italy, Spain, Russia, Netherlands, Belgium, Turkey, Poland, Denmark, Sweden, Switzerland and Rest of Europe, South Africa, Oman, Qatar, Saudi Arabia, U.A.E., Kuwait and Rest of Middle East and Africa |

|

Market Players Covered |

Cargill, Incorporated, Brenntag, Tate & Lyle, ADM, Jungbunzlauer Suisse AG, Corbion, Bartek Ingredients Inc., INDUSTRIAL TECNICA PECUARIA, S.A., DIARYCHEM, Weifang Ensign Industry Co., Ltd, FBC Industries, Chemvera Specialty Chemicals Pvt. Ltd., Direct Food Ingredients, Richest Group, Suntran.cn, Foodchem International Corporation, Arshine Pharmaceutical Co., Limited, Hawkins Watts Limited, Arihant Chemical, and Innova Corporate |

Market Definition

Acidulants are chemical compounds that give a tart, sour, or acidic flavor to foods or enhance the perceived sweetness of foods. Acidulants can also function as leavening agents and emulsifiers in some kinds of processed foods. Though acidulants can lower pH, they differ from acidity regulators, which are food additives specifically intended to modify food stability or enzymes within it. Typical acidulants are acetic acid (for instance, in pickles) and citric acid. Many beverages, such as colas, contain phosphoric acid. Sour candies often are formulated with malic acid. Other acidulants used are fumaric acid, tartaric acid, lactic acid, and gluconic acid.

Global Acidulants Market Dynamics

Drivers

-

Growing demand for instant beverages, carbonated drinks, and fermented drinks is likely to favour acidulants market growth

Owing to busy lifestyles, instant beverages and carbonated drinks have become popular amongst consumers. Growth in the young population in developing countries, along with rising disposable income, is enabling consumers to buy ready-to-drink beverages such as instant beverages. In addition, the rising demand for processed food and beverages is also increasing the demand for carbonated drinks and instant beverages. In addition, product innovations such as low/no-calorie drinks are also attracting health-conscious consumers.

Thus, the growing demand for instant beverages, carbonated drinks, and fermented drinks is projected to drive the demand for acidulants over the years to come.

-

Rise in demand for acidulants such as malic acid, lactic acid, and sodium lactate in the confectionery industry

Acidulants that are used in confectionery, such as malic acid, lactic acid, and sodium lactate, have unique taste and flavor effects. It also boosts the impact of some aromatic flavor notes due to its volatility. In addition, nowadays, the combinations of acidulants are commonly used in confectionery. Furthermore, malic acid as well as fumaric acid provide more persistent sourness than other food acids at the same concentration and enhances fruit flavors, and boost the impact of high-intensity sweeteners.

Hence, the increased demand for confectionery products increases the demand for acidulants such as malic acid, lactic acid, fumaric acid, sodium lactate, and others by food manufacturers in order to fulfil the demands.

Opportunities

-

Biological production of citric acid and acetic acid

Consumers are shifting towards sustainable products and are opting for products that are manufactured with the help of sustainable ingredients. Hence, the demand for sustainable and cost-effective, and biological food ingredients (acidulants) such as citric acid and acetic acid is increasing among the manufacturers. However, the production of bio-succinic acid is quite difficult through a sustainable production that is microbial fermentation, although it is cost-effective.

Thus, due to the availability of a wide range of bacteria, fungi and yeasts, biological production of acidulants can be increased, and sustainable bio-acidulants products can be offered to the global food & beverages industry, as it holds huge opportunity for food & beverages products that include biologically sustainable ingredients.

Restraints/Challenges

- High prices of acidulants

Fluctuating prices of raw materials such as plant-based sources and higher prices for better quality acidulants have resulted in increased prices of acidulants. Additionally, higher food taxes and growing demand for acidulants result in high prices.

Acidulants such as gluconic acid, tannic acid, and tartaric acid have slightly higher prices as these acidulants have fewer applications in food-grade products. Hence the demand is less, and the production of these acidulants for food-grade applications is minimum which results in higher prices. High prices of acidulants may change purchase patterns for food processing manufacturers over other acidulants.

- Rules and regulation of food regulatory bodies on acidulants products

The rules and regulations for the approval of acidulants laid by governmental bodies are to ensure that the acidulants have no side effects, which may restrict the growth of the global acidulants market. The rising concern related to the side effects of acidulants on health has forced the government to lay down strict rules for product approval. The acidulants may lead to elevated blood pressure, the temporary reddish coloration of the eye, and others. Therefore, the amount of acidulant used is checked properly before using it in any product. Thus, the stringent regulations for the approval process may hamper the market's growth.

Post COVID-19 Impact on Global Acidulants Market

The COVID-19 has affected the market to some extent due to lockdown the manufacturing and production of many small and large companies was halted as well as the demand from the acidulants also was hampered which affected the market. Post-pandemic, the demand for acidulants is increased due to increasing demand for fermented beverages, soft drinks, and many others. Due to the change in many mandates and regulation, manufactures are enabled to design and launch new products in the market, which will help the growth of the market.

Recent Developments

- In March 2022, Brenntag SE acquired the Israeli specialty chemicals distributor Y.S. Ashkenazi Agencies Ltd, along with its subsidiary, Biochem Trading. This acquisition represents Brenntag's entry into the Israeli market. This acquisition will increase the goodwill of the company.

- In December 2021, Tate & Lyle, a leading global provider of food and beverage solutions and ingredients, announced that it had signed up for the UK's Food and Drink Federation's (FDF) Action on Fiber. This development will increase the customer base of the company.

Global Acidulants Market Scope

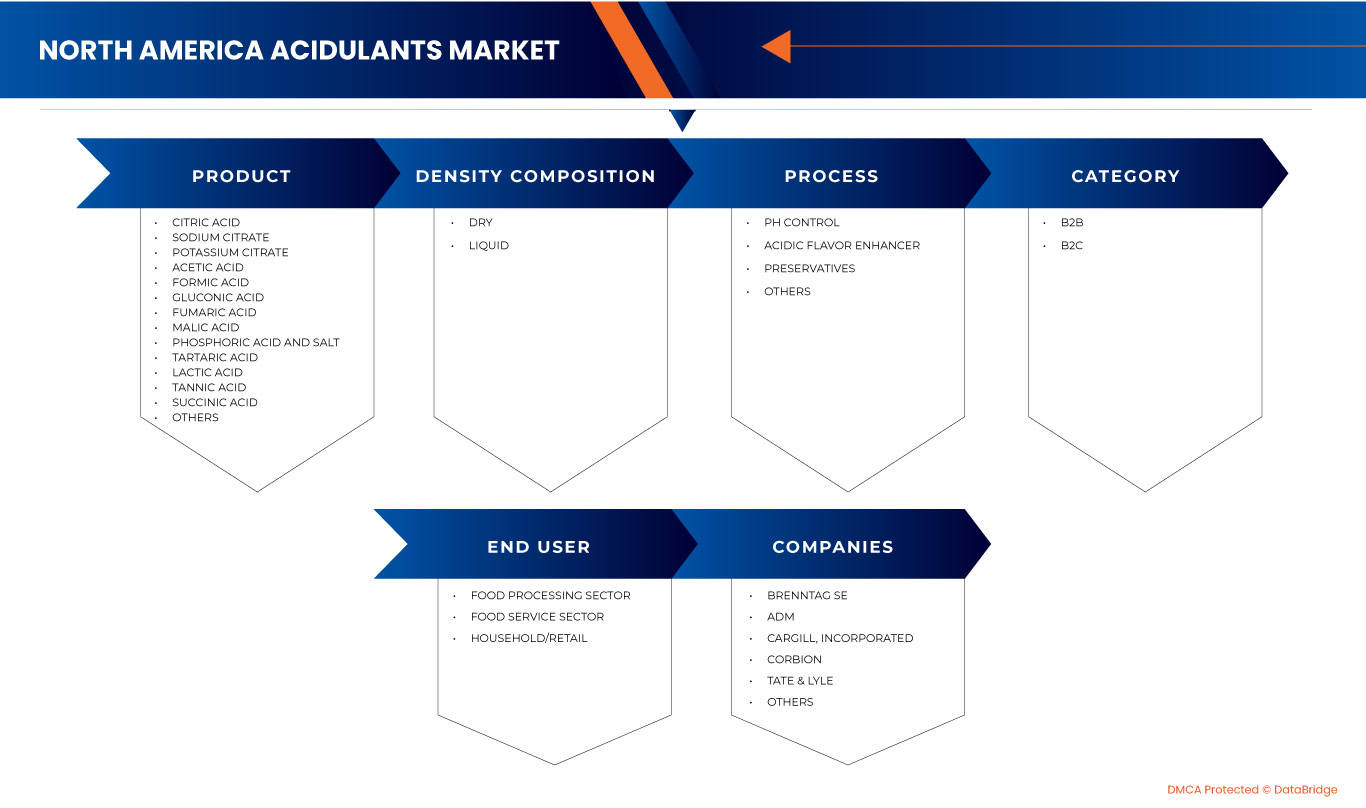

The global acidulants market is segmented into notable segments based on type. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Citric acid

- Sodium citrate

- Potassium citrate

- Acetic acid

- Formic acid

- Gluconic acid

- Fumaric acid

- Malic acid

- Phosphoric acid and salt

- Tartaric acid

- Lactic acid

- Tannic acid

- Succinic acid

- Ascorbic acid

On the basis of type, the acidulants market is segmented into citric acid, sodium citrate, potassium citrate, acetic acid, formic acid, gluconic acid, malic acid, phosphoric acid and salts, tartaric acid, lactic acid, tannic acid, fumaric acid, succinic acid.

Global Acidulants Market Regional Analysis/Insights

The global acidulants market is analyzed and market size insights and trends are provided based on as referenced above.

The countries covered in the global acidulants market report are U.S., Canada, Mexico, China, Japan, Australia, India, South Korea, Malaysia, Singapore, Indonesia, Thailand, Vietnam, New Zealand, Philippines, and the rest of Asia-Pacific, U.K., France, Germany, Italy, Spain, Russia, Netherlands, Belgium, Turkey, Poland, Denmark, Sweden, Switzerland and Rest of Europe, South Africa, Oman, Qatar, Saudi Arabia, U.A.E., Kuwait and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate the global acidulants market in terms of market share and market revenue and is estimated to maintain its dominance during the forecast period due to the growing surge for acidulants in various types of industries and growing consumer demand from the end users.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Global brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Acidulants Market Share Analysis

The global acidulants market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on global acidulants market.

Some of the major players operating in global acidulants market are Cargill, Incorporated, Brenntag, Tate & Lyle, ADM, Jungbunzlauer Suisse AG, Corbion, Bartek Ingredients Inc., INDUSTRIAL TECNICA PECUARIA, S.A., DIARYCHEM, Weifang Ensign Industry Co., Ltd, FBC Industries, Chemvera Specialty Chemicals Pvt. Ltd., Direct Food Ingredients, Richest Group, Suntran.cn, Foodchem International Corporation, Arshine Pharmaceutical Co., Limited, Hawkins Watts Limited, Arihant Chemical, and Innova Corporate.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 LIMITATIONS

2 GLOBAL ACIDULANTS MARKET – MARKET INSIGHTS

2.1 CITRIC ACID

2.2 LACTIC ACID

2.3 FUMARIC ACID

2.4 MALIC ACID

2.5 CETIC ACID

2.6 TARTARIC ACID

2.7 PHOSPHORIC ACID AND THEIR SALTS

2.8 SUCCINIC ACID

2.9 GLUCONIC ACID

2.1 SODIUM CITRATE

2.11 POTASSIUM CITRATE

2.12 TANNIC ACID

2.13 FORMIC ACID

2.14 ASCORBIC ACID

3 GLOBAL ACIDULANTS MARKET – PRODUCTION CAPACITY ANALYSIS

3.1 PRODUCTION CAPACITY ANALYSIS FOR EACH ACIDULANTS MARKET

3.1.1 CITRIC ACID

3.1.2 FORMIC ACID

3.1.3 SUCCINIC ACID

3.1.4 SODIUM CITRATE

3.1.5 PHOSPHORIC ACID AND SALT

3.1.6 TARTARIC ACID

3.1.7 FUMARIC ACID

3.1.8 MALIC ACID

3.1.9 LACTIC ACID

3.1.10 ACETIC ACID

3.1.11 TANNIC ACID

3.2 PRODUCTION LOCATION AND KEY MARKETS OF MAJOR PLAYERS

3.2.1 CARGILL INCORPORATED

3.2.1.1 PRODUCTION LOCATIONS

3.2.1.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.1.3 MARKETS THEY SELL TO

3.2.2 BRENNTAG SE

3.2.2.1 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.2.2 MARKETS THEY SELL TO

3.2.2.3 PRODUCTION LOCATIONS

3.2.3 ADM

3.2.3.1 PRODUCTION LOCATIONS

3.2.3.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.3.3 MARKETS THEY SELL TO

3.2.4 CORBION N.V

3.2.4.1 PRODUCTION LOCATIONS

3.2.4.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.4.3 MARKETS THEY SELL TO

3.2.5 TATE & LYLE

3.2.5.1 PRODUCTION LOCATIONS

3.2.5.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.5.3 MARKETS THEY SELL TO

3.2.6 JUNGBUNZLAUER SUISSE AG

3.2.6.1 PRODUCTION LOCATIONS

3.2.6.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.6.3 MARKETS THEY SELL TO

3.2.7 BARTEK INGREDIENTS INC.

3.2.7.1 PRODUCTION LOCATIONS

3.2.7.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.7.3 MARKETS THEY SELL TO

3.2.8 DAIRYCHEM

3.2.8.1 PRODUCTION LOCATIONS

3.2.8.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.8.3 MARKETS THEY SELL TO

3.2.9 WEIANG ENSIGN INDUSTRY CO., LTD.

3.2.9.1 PRODUCTION LOCATIONS

3.2.9.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.9.3 MARKETS THEY SELL TO

3.2.10 INDUSTRIAL TECNICA PECUARIA, S.A.

3.2.10.1 PRODUCTION LOCATIONS

3.2.10.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

3.2.10.3 MARKETS THEY SELL TO

4 GLOBAL ACIDULANTS MARKET – PRICING ANALYSIS

4.1 PRICING ANALYSIS FOR FOOD ACIDULANTS MARKET

5 GLOBAL ACIDULANTS MARKET – RAW MATERIAL ANALYSIS

5.1 CITRIC ACID

5.2 ACETIC ACID

5.3 SODIUM CITRATE

5.4 SUCCINIC ACID

5.5 LACTIC ACID

5.6 FUMARIC ACID

5.7 TARTARIC ACID

5.8 MALIC ACID

5.9 GLUCONIC ACID

5.1 PHOSPHORIC ACID AND SALT

6 GLOBAL ACIDULANTS MARKET – PORTER’S FIVE FORCES ANALYSIS

6.1 PORTER'S FIVE FORCES ANALYSIS FOR CITRIC ACID -

6.1.1 BUYER POWER

6.1.2 SUPPLIER POWER

6.1.3 THREAT OF NEW ENTRANTS

6.1.4 THREAT OF SUBSTITUTES

6.1.5 RIVALRY AMONG EXISTING COMPETITORS

6.2 PORTER'S FIVE FORCES ANALYSIS FOR LACTIC ACID -

6.2.1 BUYER POWER

6.2.2 SUPPLIER POWER

6.2.3 THREAT OF NEW ENTRANTS

6.2.4 THREAT OF SUBSTITUTES

6.2.5 RIVALRY AMONG EXISTING COMPETITORS

6.3 PORTER'S FIVE FORCES ANALYSIS FOR ACETIC ACID -

6.3.1 BUYER POWER

6.3.2 SUPPLIER POWER

6.3.3 THREAT OF NEW ENTRANTS

6.3.4 THREAT OF SUBSTITUTES

6.3.5 RIVALRY AMONG EXISTING COMPETITORS

6.4 PORTER'S FIVE FORCES ANALYSIS FOR FUMARIC ACID -

6.4.1 BUYER POWER

6.4.2 SUPPLIER POWER

6.4.3 THREAT OF NEW ENTRANTS

6.4.4 THREAT OF SUBSTITUTES

6.4.5 RIVALRY AMONG EXISTING COMPETITORS

6.5 PORTER'S FIVE FORCES ANALYSIS FOR TARTARIC ACID -

6.5.1 BUYER POWER

6.5.2 SUPPLIER POWER

6.5.3 THREAT OF NEW ENTRANTS

6.5.4 THREAT OF SUBSTITUTES

6.5.5 RIVALRY AMONG EXISTING COMPETITORS

6.6 PORTER'S FIVE FORCES ANALYSIS FOR MALIC ACID -

6.6.1 BUYER POWER

6.6.2 SUPPLIER POWER

6.6.3 THREAT OF NEW ENTRANTS

6.6.4 THREAT OF SUBSTITUTES

6.6.5 RIVALRY AMONG EXISTING COMPETITORS

6.7 PORTER'S FIVE FORCES ANALYSIS FOR GLUCONIC ACID -

6.7.1 BUYER POWER

6.7.2 SUPPLIER POWER

6.7.3 THREAT OF NEW ENTRANTS

6.7.4 THREAT OF SUBSTITUTES

6.7.5 RIVALRY AMONG EXISTING COMPETITORS

6.8 PORTER'S FIVE FORCES ANALYSIS FOR PHOSPHORIC ACID AND SALT -

6.8.1 BUYER POWER

6.8.2 SUPPLIER POWER

6.8.3 THREAT OF NEW ENTRANTS

6.8.4 THREAT OF SUBSTITUTES

6.8.5 RIVALRY AMONG EXISTING COMPETITORS

6.9 PORTER'S FIVE FORCES ANALYSIS FOR SUCCINIC ACID -

6.9.1 BUYER POWER

6.9.2 SUPPLIER POWER

6.9.3 THREAT OF NEW ENTRANTS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 RIVALRY AMONG EXISTING COMPETITORS

6.1 PORTER'S FIVE FORCES ANALYSIS FOR SODIUM CITRATE -

6.10.1 BUYER POWER

6.10.2 SUPPLIER POWER

6.10.3 THREAT OF NEW ENTRANTS

6.10.4 THREAT OF SUBSTITUTES

6.10.5 RIVALRY AMONG EXISTING COMPETITORS

7 GLOBAL ACIDULANTS MARKET – SWOT ANALYSIS

7.1 CITRIC ACID

7.2 ACETIC ACID

7.3 SODIUM CITRATE

7.4 SUCCINIC ACID

7.5 LACTIC ACID

7.6 FUMARIC ACID

7.7 TARTARIC ACID

7.8 MALIC ACID

7.9 GLUCONIC ACID

7.1 PHOSPHORIC ACID AND SALTS

8 GLOBAL ACIDULANTS MARKET – PATENT ANALYSIS

8.1 PATENT ANALYSIS

9 GLOBAL ACIDULANTS MARKET – RISK ANALYSIS

9.1 RISK ANALYSIS OF ACIDULANTS

9.1.1 CITRIC ACID

9.1.2 SODIUM CITRATE

9.1.3 ACETIC ACID

9.1.4 SUCCINIC ACID

9.1.5 MALIC ACID

9.1.6 TARTARIC ACID

9.1.7 POTASSIUM CITRATE

9.1.8 GLUCONIC ACID

9.1.9 FUMARIC ACID

9.1.10 LACTIC ACID

9.1.11 TANNIC ACID

9.1.12 FORMIC ACID

9.1.13 PHOSPHORIC ACID AND SALTS

9.2 RISK ANALYSIS (LIQUIDITY) – MAJOR PLAYERS

10 RUSSIA AND UKRAINE WAR IMPACT

10.1 COUNTRIES THAT ARE LIKELY TO BE IMPACTED THE MOST –

10.2 RISK OF CIVIL UNREST

List of Table

TABLE 1 GLOBAL ACIDULANTS MARKET, BY VOLUME, 2020-2029 (THOUSAND TONS)

TABLE 2 GLOBAL ACIDULANTS MARKET, BY VALUE, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 4 GLOBAL ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL CITRIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 6 GLOBAL CITRIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL LACTIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 8 GLOBAL LACTIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 9 GLOBAL FUMARIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 10 GLOBAL FUMARIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL MALIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 12 GLOBAL MALIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL ACETIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 14 GLOBAL ACETIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL TARTARIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 16 GLOBAL TARTARIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL PHOSPHORIC ACID AND THEIR SALTS IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 18 GLOBAL PHOSPHORIC ACID AND THEIR SALTS IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL SUCCINIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 20 GLOBAL SUCCINIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL GLUCONIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 22 GLOBAL GLUCONIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL SODIUM CITRATE IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 24 GLOBAL SODIUM CITRATE IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL POTASSIUM CITRATE IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 26 GLOBAL POTASSIUM CITRATE IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL TANNIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 28 GLOBAL TANNIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL FORMIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 30 GLOBAL FORMIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL ASCORBIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (THOUSAND TONS)

TABLE 32 GLOBAL ASCORBIC ACID IN ACIDULANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 CITRIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 34 FORMIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 35 SUCCINIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 36 SODIUM CITRATE - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 37 PHOSPHORIC ACID AND SALT - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 38 TARTARIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 39 FUMARIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 40 MALIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 41 LACTIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 42 ACETIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 43 TANNIC ACID - PRODUCTION CAPACITY BY MANUFACTURERS (TONS)

TABLE 44 GLOBAL AVERAGE SELLING PRICES OF ACIDULANTS, BY GRADE

TABLE 45 GLOBAL AVERAGE SELLING PRICES OF ACIDULANTS, BY REGION

TABLE 46 MICRO-ORGANISMS USED FOR THE PRODUCTION OF CITRIC ACID

TABLE 47 COMPARISON OF CITRIC ACID PRODUCTION FROM THE VARIOUS SUBSTRATES USING Y. LIPOLYTICA STRAINS

TABLE 48 CITRIC ACID APPLICATION IN DIFFERENT INDUSTRY

TABLE 49 MICROORGANISMS USED TO PRODUCE ACETIC ACID

TABLE 50 ACETIC ACID APPLICATION IN DIFFERENT INDUSTRY

TABLE 51 MICROORGANISMS USED FOR PRODUCING SODIUM CITRATE

TABLE 52 SODIUM CITRATE APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 53 MICROORGANISMS USED FOR BIO-SUCCINIC ACID PRODUCTION

TABLE 54 SUCCINIC ACID APPLICATION IN THE VARIOUS INDUSTRY -

TABLE 55 MICROORGANISMS USED TO PRODUCE LACTIC ACID-

TABLE 56 COMPARISON OF DIFFERENT STRAINS AND SUBSTRATES FOR LACTIC ACID PRODUCTION

TABLE 57 LACTIC ACID APPLICATION IN DIFFERENT INDUSTRIES -

TABLE 58 MICROORGANISMS USED IN THE PRODUCTION OF FUMARIC ACID

TABLE 59 FUMARIC ACID APPLICATION IN DIFFERENT VARIOUS INDUSTRY-

TABLE 60 TARTARIC ACID APPLICATION IN DIFFERENT INDUSTRY

TABLE 61 MALIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 62 APPLICATIONS OF GLUCONIC ACID IN DIFFERENT INDUSTRY-

TABLE 63 PHOSPHORIC ACID AND SALTS APPLICATION IN DIFFERENT VARIOUS INDUSTRY

Global Acidulants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acidulants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acidulants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.