Global Acetonitrile Market

Market Size in USD Million

CAGR :

%

USD

314.51 Million

USD

456.94 Million

2024

2032

USD

314.51 Million

USD

456.94 Million

2024

2032

| 2025 –2032 | |

| USD 314.51 Million | |

| USD 456.94 Million | |

|

|

|

|

Acetonitrile Market Size

Acetonitrile Market Size

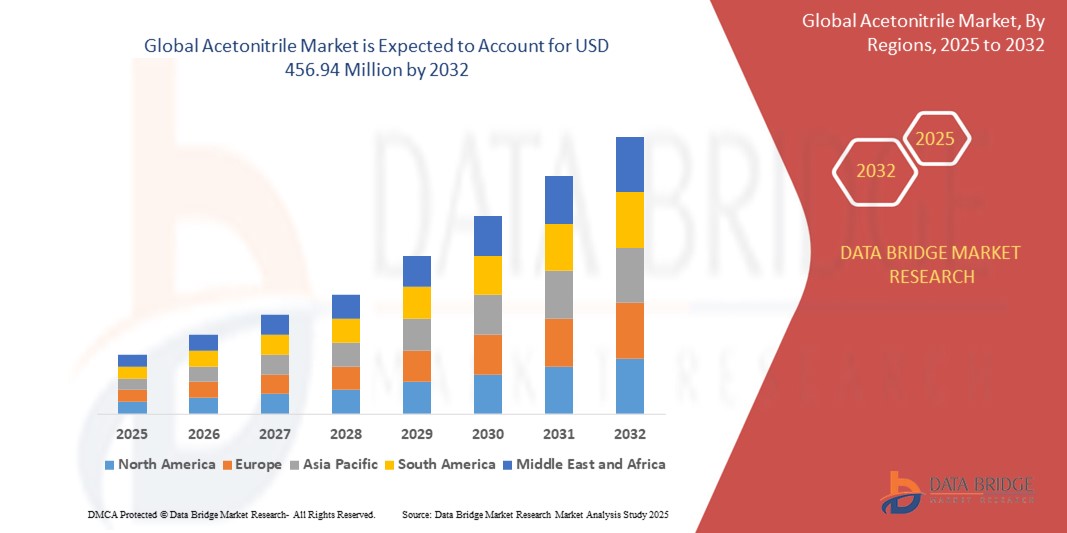

- The global Acetonitrile market size was valued at USD 314.51 million in 2024 and is expected to reach USD 456.94 million by 2032, at a CAGR of 4.78% during the forecast period

- This growth is driven by factors such as the increasing demand for acetonitrile in the pharmaceutical and biotechnology industries, the growth of the chemical synthesis sector, the expansion of the global electronics industry, and the rising use of acetonitrile as a solvent in laboratories

Acetonitrile Market Analysis

- Acetonitrile also called methyl cyanide or cyanomethane refers to a colorless chemical compound in liquid form representing chemical formula CH3CN. The chemical is known to be the most basic and simple organic nitrile which is generally produced as an acrylonitrile manufacture by-product.

- It is used as an acrylonitrile manufacture by-product for butadiene purification. It is extensively utilized in various industrial applications such as pharmaceutical industry for synthesizing new pesticides, medicaments, pesticides, vitamin B1 and other products.

- North America is expected to dominate the acetonitrile’s market due to its well-established pharmaceutical and biotechnology industries

- Asia-Pacific is expected to be the fastest growing region in the Acetonitrile market during the experiencing rapid industrialization

- Solvent segment is expected to dominate the market with a market share of 61.7% due to its widespread use in various applications such as high-performance liquid chromatography (HPLC) and as a medium-polarity non-protic solvent in laboratory settings

Report Scope and Acetonitrile Market Segmentation

|

Attributes |

Acetonitrile Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acetonitrile Market Trends

“Increasing Use of Acetonitrile in Pharmaceutical and Biotech Industries”

- One of the key trends in the global acetonitrile market is its growing use in the pharmaceutical and biotechnology sectors. Acetonitrile is widely used as a solvent in the synthesis of active pharmaceutical ingredients (APIs), and in high-performance liquid chromatography (HPLC) for drug analysis. As pharmaceutical research and drug manufacturing expand globally, acetonitrile’s demand is rising

- The increasing focus on biopharmaceuticals and biologics is contributing to the higher use of acetonitrile. The development of biologic drugs requires high-purity solvents for the extraction and purification of proteins and antibodies. Acetonitrile is ideal for this purpose, driving the trend of higher consumption in biotech labs and production facilities

- With increasing regulatory requirements, especially in developed markets such as the U.S. and Europe, the demand for high-quality solvents such as acetonitrile is increasing. These solvents are required to meet stringent standards set by agencies such as the FDA and EMA for pharmaceutical manufacturing and testing

- Advances in analytical testing methods and technologies such as HPLC and mass spectrometry are driving the need for acetonitrile. These methods are commonly used in laboratories for drug testing, environmental analysis, and quality control, reinforcing the trend of increased acetonitrile consumption in research and development

- For Instance, leading pharmaceutical companies such as Merck & Co. are investing in R&D for the development of complex drugs, thereby increasing the demand for solvents such as acetonitrile for both drug synthesis and analysis

Acetonitrile Market Dynamics

Driver

“Growth of Pharmaceutical and Biotechnology Sectors”

- The rapid growth in pharmaceutical research and drug development is a major driver of acetonitrile demand. Acetonitrile is widely used as a solvent in the synthesis of APIs, which are essential in drug formulations. The expansion of R&D in biotechnology, especially in developing countries, is boosting the demand for acetonitrile as a critical solvent in drug production processes

- The global market for biologics and biosimilars is growing exponentially, driven by increasing investments in healthcare and demand for advanced treatments. These products require high-quality solvents for purification and analysis, contributing to the rising use of acetonitrile in the biotechnology sector

- Acetonitrile is also used in medical research, including in the development of diagnostic assays and vaccines. With the growing need for cutting-edge medical research, particularly in cancer treatments and gene therapies, the demand for acetonitrile in laboratories is increasing

- Governments and private sectors are investing more in healthcare, increasing the demand for pharmaceuticals and healthcare products. As the pharmaceutical industry grows, acetonitrile is needed in the formulation, testing, and production of drugs, further fueling market demand

- For Instance, Biotech Expansion in Asia, the expansion of biotech industries in regions such as China and India is a significant driver. As these markets grow, so does the demand for high-quality solvents such as acetonitrile for drug manufacturing and testing purposes

Opportunity

“Rising Demand from Emerging Markets”

- Emerging markets, particularly in the Asia-Pacific region, present significant growth opportunities for the acetonitrile market. With the rapid industrialization of countries such as China and India, the demand for acetonitrile is increasing due to its use in pharmaceuticals, chemicals, and electronics. The growing demand for high-quality solvents in these regions is an untapped opportunity for market players

- Governments and private companies are investing heavily in biotechnology research and development, particularly in the Asia-Pacific region. This surge in R&D activities offers growth opportunities for acetonitrile as it is widely used in biopharmaceutical and biotechnology labs for solvent extraction and purification

- As the market for generic drugs expands, the demand for acetonitrile as a solvent in the production of generic APIs is also growing. Emerging markets are a key focus for the production of generic drugs, as these regions have lower manufacturing costs compared to developed markets

- Acetonitrile suppliers can tap into opportunities by forming strategic partnerships with pharmaceutical companies in emerging markets. These collaborations could drive further demand for high-purity acetonitrile in drug manufacturing and laboratory testing

- For Instance, India's rapidly growing pharmaceutical industry is a key opportunity. The country is one of the largest producers of generic drugs, and as demand for these drugs grows, so does the need for acetonitrile in the production processes

Restraint/Challenge

“Price Volatility and Supply Chain Disruptions”

- The production of acetonitrile involves raw materials such as propylene and ammonia, whose prices can be volatile. Fluctuations in the price of these raw materials impact the overall cost of acetonitrile, making it less predictable for manufacturers. This price volatility can hinder market growth and make it difficult for producers to maintain stable profit margins

- The supply chain for acetonitrile is often disrupted by factors such as geopolitical instability, natural disasters, and changes in trade policies. For example, the ongoing trade tensions between the U.S. and China have led to uncertainty in the availability of raw materials and shipping delays, which can affect acetonitrile production and distribution

- Acetonitrile is a hazardous material, and its production involves significant environmental impact, including toxic by-products and waste. Growing concerns about environmental sustainability and stricter regulatory requirements are pushing manufacturers to adopt cleaner production methods, which can increase production costs

- As acetonitrile is expensive and poses environmental challenges, industries are exploring alternative solvents that are less costly and more environmentally friendly. For example, industries are increasingly adopting solvents such as dimethyl sulfoxide (DMSO) and other green solvents, which could pose a competitive threat to the acetonitrile market

- For Instance, the COVID-19 pandemic caused widespread disruptions to global supply chains, affecting the availability and price of acetonitrile, particularly in the first half of 2020. Such events highlight the vulnerability of the market to external factors

Acetonitrile Market Scope

The market is segmented on the basis of type, application and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-User |

|

In 2025, the solvent is projected to dominate the market with a largest share in type segment

The solvent segment is expected to dominate the acetonitrile market with the largest share of 61.7% in 2025 due to its widespread use in various applications such as high-performance liquid chromatography (HPLC) and as a medium-polarity non-protic solvent in laboratory settings. acetonitrile's properties, including low viscosity, high dielectric constant, and compatibility with a wide range of analytes, make it an ideal solvent for chromatographic techniques such as HPLC and liquid chromatography-mass spectrometry (LCMS).

The pharmaceutical Industry is expected to account for the largest share during the forecast period in technology market

In 2025, the pharmaceutical Industry segment is expected to dominate the market with the largest market share of 29% due to widely used as a solvent in the manufacturing of antibiotics and in drug recrystallization due to its exceptional physical and chemical properties, including low viscosity and low freezing/boiling points. The increasing usage of these products as a derivative in the pharmaceutical industry is a major factor driving the growth of the derivative segment.

Acetonitrile Market Regional Analysis

“North America Holds the Largest Share in the Acetonitrile Market”

- North America, particularly the U.S., is the leading consumer of acetonitrile due to its well-established pharmaceutical and biotechnology industries. Acetonitrile is used extensively in drug development, manufacturing processes, and analytical testing, which drives its demand in the region

- The region has a highly developed chemical manufacturing sector, which uses acetonitrile as a solvent in various chemical processes, including organic synthesis, which further boosts market demand

- North America is a global hub for research and development activities. Acetonitrile is used in high-performance liquid chromatography (HPLC) and other analytical techniques, which are essential in pharmaceuticals, environmental analysis, and food safety testing

- Strict regulatory frameworks such as the FDA and EPA in the U.S. ensure the high quality and safety standards of acetonitrile, which increases the confidence of manufacturers and end-users. Additionally, ongoing innovation and technological advancements in chemical production processes fuel the demand

- The strong industrial base and mature market make North America the dominant region, with the U.S. contributing significantly to both production and consumption, ensuring market stability and sustained demand for acetonitrile

“Asia-Pacific is Projected to Register the Highest CAGR in the Acetonitrile Market”

- The Asia-Pacific region, particularly countries such as China, India, and Japan, is experiencing rapid industrialization. This growth is driving the demand for acetonitrile, especially in sectors such as pharmaceuticals, chemicals, and electronics, which are expanding rapidly

- APAC's pharmaceutical and biotechnology industries are growing at a fast pace, particularly in India and China. The increasing need for high-quality solvents in drug manufacturing and research activities significantly contributes to acetonitrile consumption in these markets

- The electronics industry in Asia, particularly in countries such as China and South Korea, uses acetonitrile in the production of high-performance components. The region's role as a global manufacturing hub for electronics is a key factor driving the growth of the acetonitrile market

- Countries such as India and China are investing more in environmental testing and agricultural research, which further increases the need for acetonitrile in laboratory and analytical applications

- The low-cost manufacturing capabilities in countries such as China and India make the region an attractive hub for the production of acetonitrile. This, combined with strong local demand and export opportunities, contributes to APAC's rapid growth in the acetonitrile market

- Governments in the region are investing in the development of advanced manufacturing facilities and encouraging R&D, which is expected to fuel further growth in the acetonitrile market

Acetonitrile Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GREENFIELD GLOBAL INC. (Canada)

- INEOS (U.K.)

- Connect Chemicals (Germany)

- secco.com.cn (China)

- Honeywell International Inc. (U.S.)

- Robinson Brothers (U.K.)

- Hunan Chem. Europe B.V. (Netherlands)

- Mitsubishi Chemical Corporation (Japan)

- Zibo Luzhong Chemical Light Industry Co., Ltd. (China)

- Formosa Plastics Corp (Taiwan)

- Nova Molecular Technologies (U.S.)

- Biosolve Chimie (France)

- Avantor, Inc. (U.S.)

- Asahi Kasei Corporation (Japan)

- Imperial Chemical Corporation (U.K.)

- Alfa Aesar (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- GFS Chemicals, Inc. (U.S.)

- Jilin Provincial Chemicals Import & Export Co., Ltd. (China)

- Standard Reagents Pvt. Ltd. (India)

- Tedia Company (U.S.)

- TAEKWANG INDUSTRIAL CO., LTD. (South Korea)

- Nantong Acetic Acid Chemical Co., Ltd. (China)

Latest Developments in Global Acetonitrile Market

- In April 2024, INEOS announced the launch of the world’s first bio-based acetonitrile product meant for pharmaceutical industry. The new product named INVIREO would enable a 90% reduction in the carbon footprint for INEOS Nitriles

- In April 2022, INEOS Nitriles announced the plan to invest and raise a world scale acetonitrile manufacturing facility at its operational location in Kln, Germany. The move is expected to cater to the increasing demand from the region’s pharma and petrochemical industry

- In April 2022, INEOS Nitriles, the world's largest producer of acetonitrile, announced its plans to invest in a world-scale acetonitrile manufacturing plant at its primary operational location in Köln, Germany

- In July 2022, PetroChina launched a USD 4.52 billion program to expand a subsidiary refinery in southern China into an integrated petrochemicals complex

- In April 2022, INOES AG has planned to invest in the world-scale acetonitrile manufacturing facility in Koln, Germany. This new facility aims to enhance the supply position of the company in the European region, along with catering to the healthcare sector of the region

- In March 2022, Tedia Company, Inc. partnered with New York-based Newbold Enterprises Fairfield. This partnership is aiming towards the strategic expansion of Tedia’s capacity and capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acetonitrile Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acetonitrile Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acetonitrile Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.