Global Access Control Market Segmentation, By Technology (Authentication System, Detection Systems, Alarm Panels, Communication Devices, and Perimeter Security Systems), Component (Hardware and Software), Vertical (Commercial, Military and Defense, Government, and Others), Service (Installation and Integration, Maintenance and Support, and Access Control as a Service (ACaaS)) – Industry Trends and Forecast to 2032

Access Control Market Analysis

The access control market is experiencing significant growth, driven by rising security concerns, technological advancements, and increasing adoption across various industries. The demand for robust security solutions has surged due to growing cyber threats, unauthorized access incidents, and the need for efficient identity verification. Advancements in biometrics, AI-powered authentication, and cloud-based access control systems have revolutionized the industry, offering enhanced security, real-time monitoring, and seamless integration with IoT devices. Mobile-based access solutions, facial recognition, and multi-factor authentication are becoming standard features, improving convenience and security. The integration of AI and machine learning enables predictive analytics, helping organizations identify potential security breaches before they occur. In addition, cloud-based platforms allow remote access management, reducing infrastructure costs while enhancing scalability. Industries such as healthcare, banking, government, and commercial sectors are adopting smart access control systems to ensure safety and regulatory compliance. The Asia-Pacific region is witnessing rapid adoption due to urbanization and smart city initiatives, while North America remains dominant due to stringent security regulations. As technology continues to evolve, the access control market is poised for sustained growth, ensuring advanced and reliable security solutions.

Access Control Market Size

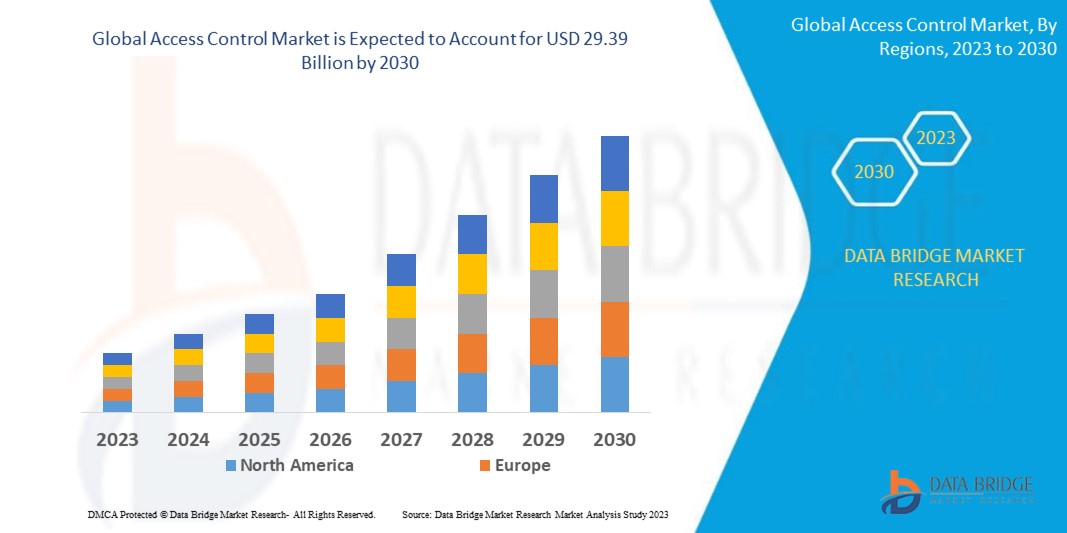

The global access control market size was valued at USD 18.01 billion in 2024 and is projected to reach USD 34.59 billion by 2032, with a CAGR of8.50% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Access Control Market Trends

“Increasing Integration of with AI-Powered Biometric Authentication”

The access control market is rapidly evolving, with AI-powered biometric authentication emerging as a key trend driving innovation. Organizations are increasingly integrating artificial intelligence (AI) with biometric access control to enhance security, improve identity verification, and streamline access management. Facial recognition, fingerprint scanning, and iris detection are being optimized using machine learning algorithms, ensuring greater accuracy and fraud prevention. For instance, companies such as IDEMIA and Suprema Inc. are developing AI-driven facial recognition systems that adapt to changes in a person’s appearance over time, reducing false rejections. The adoption of cloud-based access control solutions further enhances scalability, allowing remote authentication and real-time monitoring. In high-security environments such as banking, data centers, and corporate offices, AI-powered biometrics provide multi-factor authentication (MFA), strengthening defense against unauthorized access. As cybersecurity threats grow, the fusion of AI and biometrics is set to redefine the access control market, ensuring robust, intelligent, and adaptive security solutions.

Report Scope and Access Control Market Segmentation

|

Attributes

|

Access Control Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

ASSA ABLOY (Sweden), Johnson Controls (Ireland), dormakaba Group (Switzerland), Allegion plc (Ireland), Honeywell International Inc. (U.S.), Nedap N.V. (Netherlands), Identiv, Inc. (U.S.), Suprema Inc. (South Korea), IDEMIA (France), Thales (France), AMAG (U.S.), Gunnebo AB (Sweden), NEC Corporation (Japan), Napco Security Technologies, Inc. (U.S.), HID Global Corporation (U.S.), and Acre Security (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Access Control Market Definition

Access control refers to a security mechanism that regulates and restricts unauthorized entry to physical or digital systems, ensuring that only authorized individuals can access specific resources, locations, or information. It encompasses physical access control (such as keycards, biometric authentication, and smart locks) and logical access control (such as passwords, multi-factor authentication, and role-based permissions in digital systems).

Access Control Market Dynamics

Drivers

- Rising Security Concerns

The increasing frequency of cyber threats, unauthorized access, and physical security breaches is a major driver of the access control market. Organizations across industries are prioritizing advanced security solutions to safeguard sensitive data, assets, and personnel. The rise in cyberattacks, identity fraud, and insider threats has pushed companies to adopt biometric authentication, multi-factor authentication (MFA), and AI-driven access control to mitigate risks. For instance, financial institutions and data centers implement AI-powered facial recognition and fingerprint scanning to restrict unauthorized entry, ensuring that only verified personnel can access critical areas. In addition, government agencies and corporate offices are deploying cloud-based access control systems with real-time monitoring to track and prevent potential breaches. As security threats evolve, businesses and institutions are expected to invest heavily in high-tech access control solutions, fueling the market’s growth.

- Expansion of Smart Cities & Infrastructure Development

The rapid development of smart cities and modern infrastructure is significantly driving the demand for advanced access control systems. As urban areas expand, governments and businesses are integrating IoT-enabled security solutions, AI-driven surveillance, and cloud-based access management to enhance safety and efficiency. Smart buildings, transportation hubs, and residential complexes are incorporating contactless access control solutions such as mobile credentials, NFC, and biometric authentication for seamless entry management. For instance, China and India are investing heavily in smart city projects, leading to a surge in automated security solutions for commercial and residential buildings. In the U.S., modern infrastructure projects emphasize secure access management in public spaces, data centers, and corporate environments. As urbanization continues, the need for scalable, integrated access control solutions will rise, making this a key factor in the market’s expansion.

Opportunities

- Increasing Technological Advancements

Rapid innovations in biometrics, artificial intelligence (AI), Internet of Things (IoT), and cloud-based security solutions are reshaping the access control market, presenting significant opportunities for growth. The integration of AI-powered facial recognition, fingerprint scanning, and voice authentication enhances accuracy, reduces fraud, and streamlines access management. In addition, cloud-based access control systems enable remote monitoring, real-time analytics, and centralized security management, making them ideal for large enterprises and multi-location businesses. For instance, companies such as Suprema Inc. and IDEMIA are developing AI-driven biometric solutions that continuously learn and adapt to user behavior, improving security while enhancing user convenience. Moreover, the rise of smart locks and mobile-based access control using NFC and Bluetooth has made security systems more flexible and contactless, aligning with post-pandemic trends. As organizations seek scalable, AI-enhanced, and remotely accessible security solutions, technological advancements will continue to open new market opportunities.

- Increasing Regulatory Compliance and Data Protection Laws

Stringent government regulations and industry-specific data protection laws are driving demand for advanced access control solutions, creating a lucrative market opportunity. Regulations such as GDPR (General Data Protection Regulation), HIPAA (Health Insurance Portability and Accountability Act), and SOC 2 compliance require organizations to implement strict identity verification, access restrictions, and audit trails to safeguard sensitive information. This has accelerated the adoption of multi-factor authentication (MFA), biometric security, and encrypted access control systems. For instance, in the healthcare sector, hospitals must comply with HIPAA by securing patient data and restricting unauthorized personnel from accessing medical records. Similarly, financial institutions must adhere to GDPR and PCI DSS to protect customer information, leading to increased investments in role-based access control (RBAC) and AI-driven security solutions. As regulatory requirements become more stringent worldwide, businesses will continue to invest in compliant access control technologies, driving market expansion.

Restraints/Challenges

- High Implementation Costs

Implementing a modern access control system is a costly affair, especially for organizations upgrading from traditional key-based or card-based systems to biometric authentication, AI-powered surveillance, or cloud-based access control. The high upfront costs include hardware procurement (biometric scanners, RFID readers, smart locks), software licensing, integration with existing security infrastructure, and personnel training. For instance, installing a biometric access control system in a multi-location corporate office can cost hundreds of thousands of dollars, making it a barrier for small and medium-sized enterprises (SMEs). This presents a significant market challenge, as many businesses opt to retain outdated access control methods, exposing them to security risks. Vendors must find ways to offer cost-effective, scalable solutions to drive broader adoption.

- User Resistance and Adoption Barriers

User resistance and adoption barriers pose a significant challenge in the access control market, as many organizations and individuals hesitate to transition from traditional security measures to advanced digital access solutions. Privacy concerns, particularly regarding biometric authentication such as facial recognition and fingerprint scanning, deter users due to fears of data misuse or surveillance. Additionally, businesses often face employee pushback when implementing new access control systems, as they require training and adaptation, leading to productivity slowdowns. For instance, companies integrating biometric attendance systems have reported employee reluctance due to concerns over fingerprint data storage and potential misuse. This resistance delays market penetration and forces vendors to invest in user education, compliance assurances, and alternative authentication methods to drive adoption.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Access Control Market Scope

The market is segmented on the basis of technology, component, vertical, and service. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Authentication System

- Detection Systems

- Alarm Panels

- Communication Devices

- Perimeter Security Systems

Component

- Hardware

- Software

Vertical

- Commercial

- Military and Defense

- Government

- Others

Service

- Installation and Integration

- Maintenance and Support

- Access Control as a Service (ACaaS)

Access Control Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, technology, component, vertical, and service as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the access control market, driven by a growing threat landscape marked by a rise in cyber and malware attacks. This has led to stricter security measures across multiple sectors. In addition, the strong presence of governmental bodies and security agencies further amplifies the demand for advanced access control solutions.

Asia-Pacific is projected to witness fastest growth in the access control market, driven by an expanding construction sector, a thriving manufacturing industry, and a rising crime rate. In China, the smart door lock market has seen exceptional growth, fueled by advancements in biometric recognition and wireless communication technologies, along with a growing adoption of mobile-based access control solutions. Similarly, India is witnessing a significant increase in the deployment of access control solutions across various sectors, including data centers, office complexes, hospitality, retail, and government facilities.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Access Control Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Access Control Market Leaders Operating in the Market Are:

- ASSA ABLOY (Sweden)

- Johnson Controls (Ireland)

- dormakaba Group (Switzerland)

- Allegion plc (Ireland)

- Honeywell International Inc. (U.S.)

- Nedap N.V. (Netherlands)

- Identiv, Inc. (U.S.)

- Suprema Inc. (South Korea)

- IDEMIA (France)

- Thales (France)

- AMAG (U.S.)

- Gunnebo AB (Sweden)

- NEC Corporation (Japan)

- Napco Security Technologies, Inc. (U.S.)

- HID Global Corporation (U.S.)

- Acre Security (U.S.)

Latest Developments in Access Control Market

- In June 2024, Control iD, a provider of access control systems, partnered with Paravision, an AI software company, to launch its latest product, iDFace Max, featuring facial identification technology. The iDFace Max stands out with advanced facial recognition, a durable design, seamless connectivity, and embedded web-based software

- In June 2024, Carrier Global Corporation, a leader in intelligent climate and energy solutions, finalized the sale of its security division, Global Access Solutions, to Honeywell International Inc. The transaction was completed with an enterprise value of USD 4.95 billion

- In February 2024, Hangzhou Hikvision Digital Technology Co., Ltd., a manufacturer of video surveillance equipment, introduced its 2nd generation professional access control system to enhance access management capabilities. The upgraded system offers key features such as easy web-based management, flexible authentication options, and professional access applications

- In June 2023, Thales announced the acquisition of Tesserent, marking a strategic step in advancing its cybersecurity development roadmap. This acquisition is designed to provide the company with a comprehensive suite of cybersecurity solutions and services tailored for medium and enterprise-level businesses, while also supporting its expansion in Australia and New Zealand amid an expected double-digit market growth through 2026

- In April 2023, Honeywell International Inc. launched the Morley-IAS Max fire detection and alarm system, demonstrating its commitment to improving building and occupant safety. This addition to its product portfolio strengthens its market presence while attracting new customers, driving accelerated revenue growth

- In March 2023, Axis Communications and Genetec Inc. collaborated to introduce Axis, an enterprise-level access control solution. This innovation combines Genetec’s access control software with Axis network door controllers into a single, streamlined package, simplifying deployment. As the first solution of its kind, Axis leverages Genetec’s technology to provide integrated security, public safety, operational, and business intelligence solutions

SKU-