Global Accelerometer Sensor Market, By Dimension (1-Axis, 2-Axis, 3-Axis), Industry Vertical (Consumer Electronics, Automotive, Aerospace and Defense, Industrial, Healthcare), Technology (CMOS, MEMS, NEMS, Others), Type (MEMS Accelerometer, Piezoelectric Accelerometer, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Various sensors have applications in numerous industry vertical, such as consumer electronic products, IT and telecommunication, and automotive, among others. Accelerometers are being widely used for measuring the acceleration of a moving body.

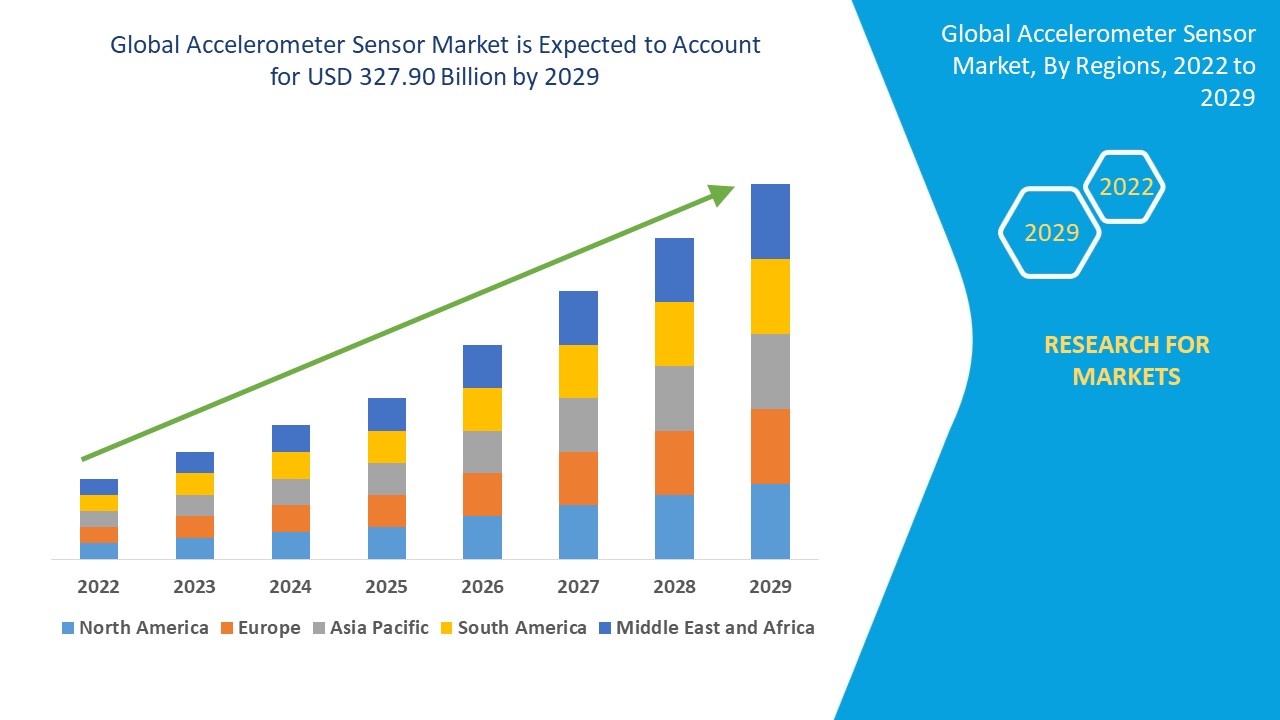

Global Accelerometer Sensor Market was valued at USD 190.84 billion in 2021 and is expected to reach USD 327.90 billion by 2029, registering a CAGR of 7.00% during the forecast period of 2022-2029. Automotive accounts for the largest industry vertical in the respective market owing to the increased product usage in vehicles to detect mechanical vibrations. The automotive sector accounts for the largest segment in the end use industry owing to the high adoption of these sensors to ensure that air inside the car is optimally regulated.

Market Definition

An accelerometer refers to a sensor that measures acceleration. It also measures change in velocity of an object with time. The measurement is utilized for determining whether a car or other vehicle is accelerating and at what speed. These sensors are being deployed for analyzing earthquakes by measuring seismic waves.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Dimension (1-Axis, 2-Axis, 3-Axis), Industry Vertical (Consumer Electronics, Automotive, Aerospace and Defense, Industrial, Healthcare), Technology (CMOS, MEMS, NEMS, Others), Type (MEMS Accelerometer, Piezoelectric Accelerometer, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

|

|

Market Players Covered

|

STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Qualcomm Technologies, Inc. (US), NXP Semiconductors. (Netherlands), Infineon Technologies AG (Germany), Texas Instruments Incorporated. (US), Robert Bosch GmbH (Germany), Microchip Technology Inc. (US), Honeywell International Inc. (US), ROHM Co. LTD. (Japan), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), TDK Corporation. (Japan), KIONIX, Inc. (US), Murata Manufacturing Co., Ltd. (Japan), Northrop Grumman LITEF GmbH (Germany), and Sensonor (Norway), among others

|

|

Market Opportunities

|

|

Accelerometer Sensor Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- High Adoption of Accelerometer

The increase in the adoption of accelerometer due to the benefits offered by these sensors, such as simple installation, good response at high frequencies, and low cost acts as one of the major factors driving the growth of accelerometer sensor market. These sensors are also used for measuring high vibration levels of robotic machinery in high-end industrial applications.

- Demand for Micro-Electromechanical System (MEMS)

The rise in demand for Micro-Electromechanical System (MEMS)-based vibration sensors, including aerospace and defense, and automobile, among others accelerate the market growth. Also, these sensors are capable of controlling the damage caused to critical materials during high-speed activities.

- Use in Navigation Systems

The surge in the navigation systems where GPS is not available, such as submarines and satellites further influence the market. The adoption of automated condition monitoring technologies for development of smart factories has a positive impact on the market.

Additionally, rapid industrialization, surge in investments and development of manufacturing sectors positively affect the accelerometer sensor market.

Opportunities

Furthermore, advent of machine learning and big data analytics and development of advanced sensor technologies extends profitable opportunities to the market players in the forecast period of 2021 to 2029. Also, adoption of IIoT in different industries for vibration monitoring is will further assist in the expansion of the market.

Restraints/Challenges

On the other hand, additional retrofitting costs for incorporating vibration monitoring solutions in existing machinery and adherence to regulatory standards are expected to obstruct market growth. Also, trade restrictions imposed by US on China, and limited accessibility to expertise at remote locations are projected to challenge the accelerometer sensor market in the forecast period of 2022-2029.

This accelerometer sensor market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on accelerometer sensor market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Accelerometer Sensor Market

COVID-19 has a major impact on the accelerometer sensor market. The factories in several countries witnessed shut downs in the initial stages of the pandemic as the governments implemented strict lockdowns in order to prevent the spread of the virus. In the post-pandemic, the lockdowns are being lifted and restrictions are being eased. Numerous companies were allowed to resume factory operations but at a limited capacity that use accelerometer sensor after the pandemic. The accelerometer sensor market is expected to gain its pace in the post-pandemic scenario owing to the easing on the restrictions.

Recent Developments

- STMicroelectronics announced the launch of AIS2IH, next-generation MEMS three-axis linear accelerometer in May’2021. This sensor is capable of improving resolution, mechanical robustness and stability to automotive applications, including telematics infotainment.

- Reality Analytics Inc. announced their partnership with Fujitsu Component Ltd. in September’2021 for bringing Fujitsu Component Ltd.’s contactless vibration sensor to manufacturing and industrial applications.

Global Accelerometer Sensor Market Scope and Market Size

The accelerometer sensor market is segmented on the basis of type, technology, dimension, and industry vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- MEMS Accelerometer

- Piezoelectric Accelerometer

- Others

Technology

Dimension

- 1-Axis

- 2-Axis

- 3-Axis

Industry Vertical

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Industrial

- Healthcare

Accelerometer Sensor Market Regional Analysis/Insights

The accelerometer sensor market is analyzed and market size insights and trends are provided by country, type, technology, dimension, and industry vertical as referenced above.

The countries covered in the accelerometer sensor market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the accelerometer sensor market because of the increased adoption of vibration sensors and well-established automotive sector within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 because of the increase in need for advanced vibration sensors in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Accelerometer Sensor Market

The accelerometer sensor market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to accelerometer sensor market.

Some of the major players operating in the accelerometer sensor market are

- STMicroelectronics (Switzerland)

- TE Connectivity (Switzerland)

- Qualcomm Technologies, Inc. (US)

- NXP Semiconductors. (Netherlands)

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated. (US)

- Robert Bosch GmbH (Germany)

- Microchip Technology Inc. (US)

- Honeywell International Inc. (US)

- ROHM Co. LTD. (Japan)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- TDK Corporation. (Japan)

- KIONIX, Inc. (US)

- Murata Manufacturing Co., Ltd. (Japan)

- Northrop Grumman LITEF GmbH (Germany)

- Sensonor (Norway)

SKU-