A2 Milk Market Analysis and Size

A2 milk aids in the development of immunity, stimulates metabolism, and provides Omega 3 fatty acids. A2 milk is gaining significant growth due to rising consumer awareness of their health and high nutrition content in A2 milk than regular milk. It is available in various forms and is easily available in the market. However, high prices of A2 milk and its products are expected to restrain the market growth of A2 milk during the forecasted period.

Some factors driving the market growth are the rise in A2 milk technology, increasing application of A2 milk in infant formulae surging the market, and growing awareness about health among consumers. However, limitations in the high prices of A2 milk are expected to hamper the market's growth.

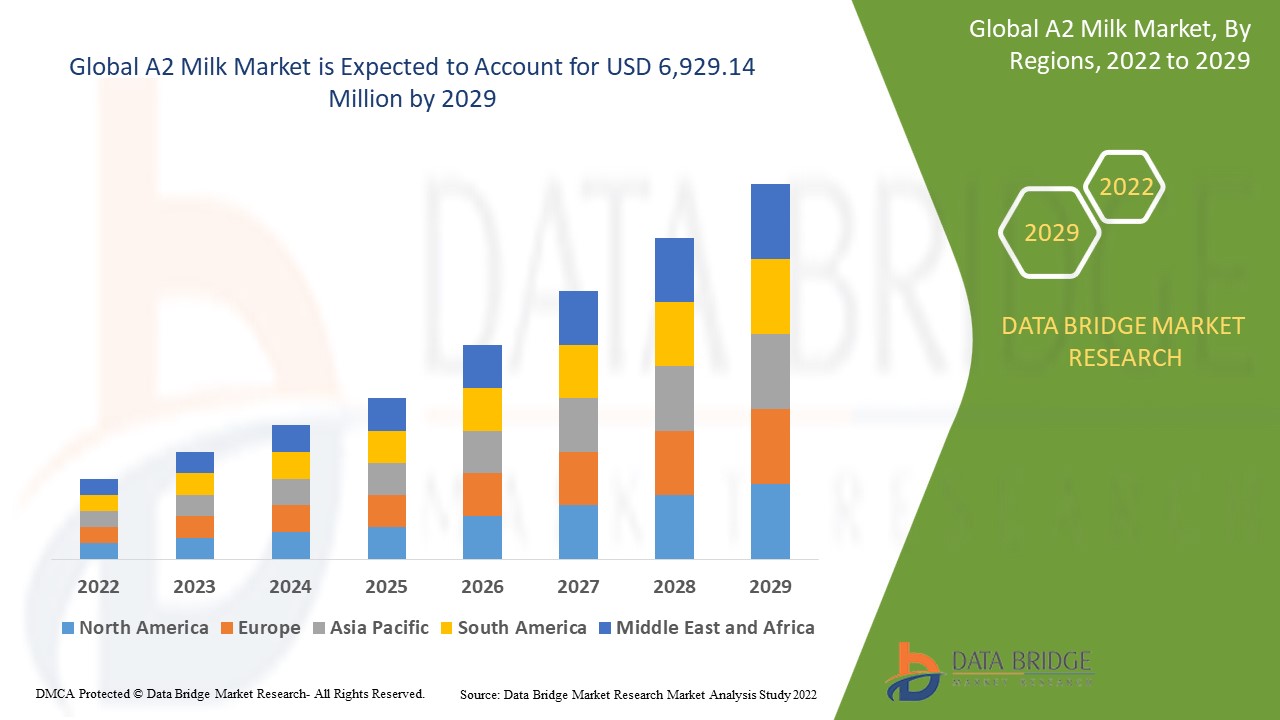

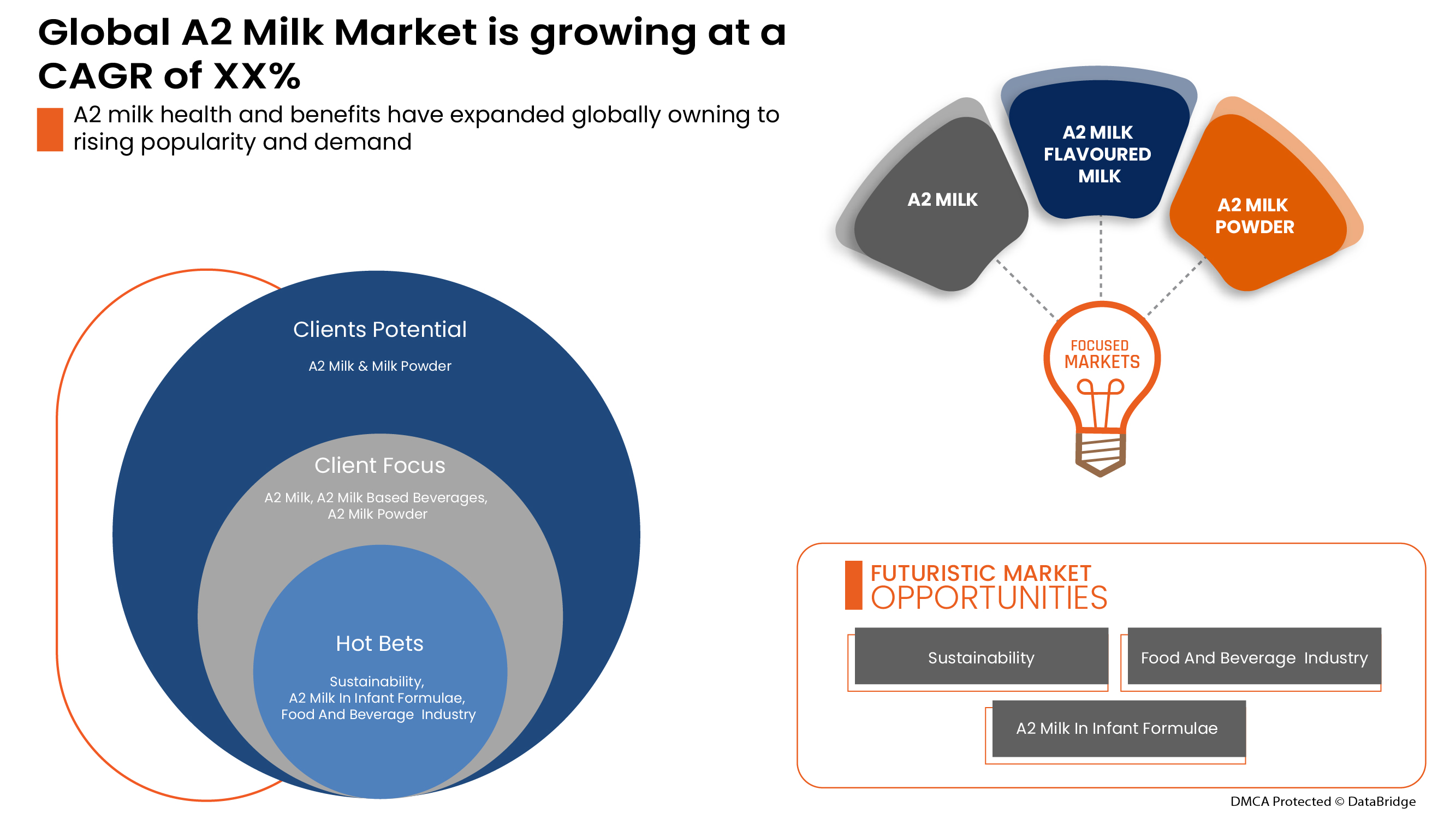

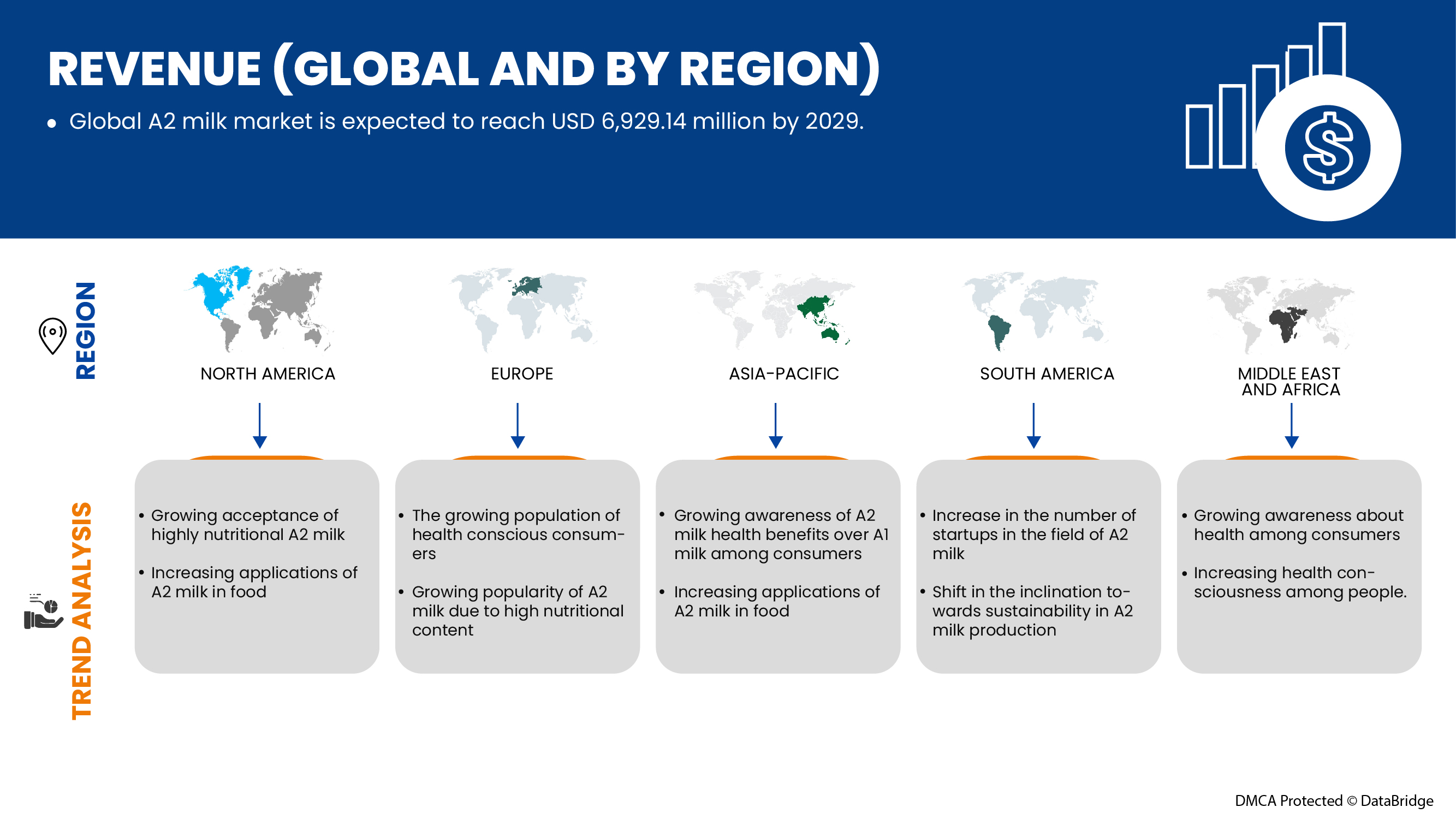

Data Bridge Market Research analyses that the A2 milk market is expected to reach USD 6,929.14 million by 2029, at a CAGR of 21.7% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Form (Powder and Liquid), Nature (Organic and Conventional), Fat Content (No Fat, Low Fat, Reduced Fat, and Whole Fat), Packaging Size (101-250 Ml/Gm, 250-500ml/Gm, 501-1000ml/Gm, and Above 1000 Ml/Gm), Packaging Form (Bottles, Cartons, Can, Jars, and Others) And Distribution Channel (Store Based Retailers and Non-Store Retailers) |

|

Countries Covered |

U.S., Canada, and Mexico, Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Turkey, Rest of Europe, China, New Zealand, Australia, India, Malaysia, Singapore, South Korea, Indonesia, Japan, Philippines, Thailand and Rest of Asia Pacific, South Africa, U.A.E., Saudi Arabia, Kuwait and rest of the Middle East and Africa, Brazil, Argentina, and Rest of South America. |

|

Market Players Covered |

GCMMF, Erden Creamery Pvt Ltd, PROVILAC, Ripley Farms LLC., Taw River Dairy, The a2 Milk Company Limited, Urban Farms Milk., Vedaaz Organics Pvt. Ltd., AVTARAN MILK, DOFE, Captain's Farm., Ksheerdham., Ayuda Organics, Veco Zuivel B.V., and Australia's Own. |

Market Definition

A2 milk is a type of cow's milk that lacks the A1 form of -casein proteins and mostly contains the A2 form. The A2 beta-casein protein in A2 milk quickly breaks down into amino acids for quick digestion, improving our overall health and increasing cow's milk's nutritional value. A2 cow milk contains minerals such as calcium, potassium, and phosphorus, which are required for strong bones and teeth, better muscle function, blood pressure regulation, tissue, and cell growth, and enhancing good cholesterol (HDL), as well as maintaining overall nourishment and well-being of the body.

A2 Milk Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers:

- Increased awareness about health among consumers

The growing awareness about health, food intake, and diets among consumers are the major driving force for the global A2 milk market. Over time, consumers know the pros and cons of the food they eat daily. A2 milk is highly nutritious and positively impacts a person's body due to the presence of A2 beta-casein protein. This A2 protein prevents various heart diseases, diabetes, and autism. With this, people are consuming A2 milk and prefer it for regular consumption. This change in the preference and development of awareness towards health is expected to boost the market growth of the global A2 milk market.

Thus, the growing health awareness and changing eating habits of end users are leading to more demand for A2 milk. This rising demand for A2 milk is expected to boost the global A2 milk market.

- High nutritional values in a2 compared to regular milk

A2 milk differs in protein type and structure from A1 milk. A2 milk is the best choice for boosting immunity and keeping healthy, and replacing regular milk with A2 milk benefits both mind and body by improving cognitive function and nourishing skin and hair. In addition, A2 milk prevents problems such as heart disease, lactose intolerance, diabetes, and autism. With abundant nutrition and numerous health benefits, consumers' demand for A2 milk is rising rapidly. End users prefer A2 milk over regular milk in different dairy products to maintain good health. Hence, A2 milk is proved to be more nutritious than regular milk.

Thus, the high nutrition value and more mineral content of A2 milk are leading to the higher demand and sales of A2 milk in the market. With this increasing demand, the global A2 milk market is expected to boost significantly.

Restraint

- High prices of a2 milk

The high prices of A2 milk over regular milk serve as a major restraint for market growth. The A2 milk and milk products have a price range double the regular milk in the market. The production of A2 milk is still limited as A2 milk cow breeds provide less milk per day, and due to this, companies are charging high costs for A2 milk to generate higher revenues. The end users of A2 dairy are the common men, and the presence of A2 milk in the market with a higher range is not affordable to plenty of people. Due to higher degrees, people prefer regular milk over A2 milk and its products. These high milk prices are a major restraining factor in the market growth.

Thus, the high prices of A2 milk and milk products enable consumers to use regular milk. This, in turn, is expected to restrain the growth of the global A2 milk market.

Opportunity

- Inclination of consumers over sustainable production of a2 milk

Sustainability protects the environment's health and bio capacity. Individual and community well-being is aided by sustainability. Sustainability promotes a better economy with less pollution and waste, fewer emissions, more employment, and equitable wealth distribution. A sustainable approach to A2 milk production reduces the environmental impact of dairy farming while increasing the dairy sector's animal welfare and social endorsement. Consumers with higher moral standards are more likely to be interested in purchasing A2 milk dairy products that are using sustainable innovations. Regular organic consumers have a more favorable attitude toward dairy products that use sustainable innovation. As a result, many A2 milk-based companies focus on sustainability in their production, processing, packaging, and other processes.

Thus, implementing sustainable approaches in almost every stage in A2 milk & A2 milk-based products production has provided various opportunities for market growth even in the forecasted period because consumers mostly prefer sustainable and organic products.

Challenge

- Growth in the trend of veganism among people

Veganism is a lifestyle that advocates for eliminating animal products from one's diet, specifically dairy, meat, and poultry. Veganism has evolved into a trend toward healthier living as more people become aware of the harm it is causing to the environment and animal species. Veganism's rationale is to stop stressing, exploiting, and killing animals to bring their species to an end. This veganism trend brings more natural milk alternatives, so most vegan adopted people avoid a2 milk-based products, even though A2 milk has a higher nutritional benefit than others. Since A2 milk is an animal-based product, the veganism trend will pose a significant challenge to the growth of the A2 milk market.

Thus, the veganism trend leads to minimal opt for dairy-based products by consumers, so this trend of veganism among people is expected to be a major challenge for global A2 milk market growth.

Post-COVID-19 Impact on Global A2 Milk Market

Post the pandemic, the demand for A2 milk has increased as there won't be any restrictions on movement; hence, the supply of products would be easy. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially increasing the demand for products. However, post-COVID, the need for A2 milk has increased significantly due to good protein content and other available nutrients.

Recent Developments

- In August 2022, the a2 Milk Company (a2MC) is partnering with KidsCan, the top organization in New Zealand that supports underprivileged children. As a Major Partner, a2MC will donate $130,000 annually for the first three years to help fund KidsCan programs and will organize staff and friend volunteerism to support KidsCan in carrying out its critically important mission

- In May 2022, the a2 Milk Company and Lincoln University are collaborating to introduce a new program to support sustainable dairy farming initiatives in New Zealand. The a2 Milk Company and Lincoln University, New Zealand's only specialist land-based university, joined forces to launch The Farm Sustainability Fund today

Global A2 Milk Market Scope

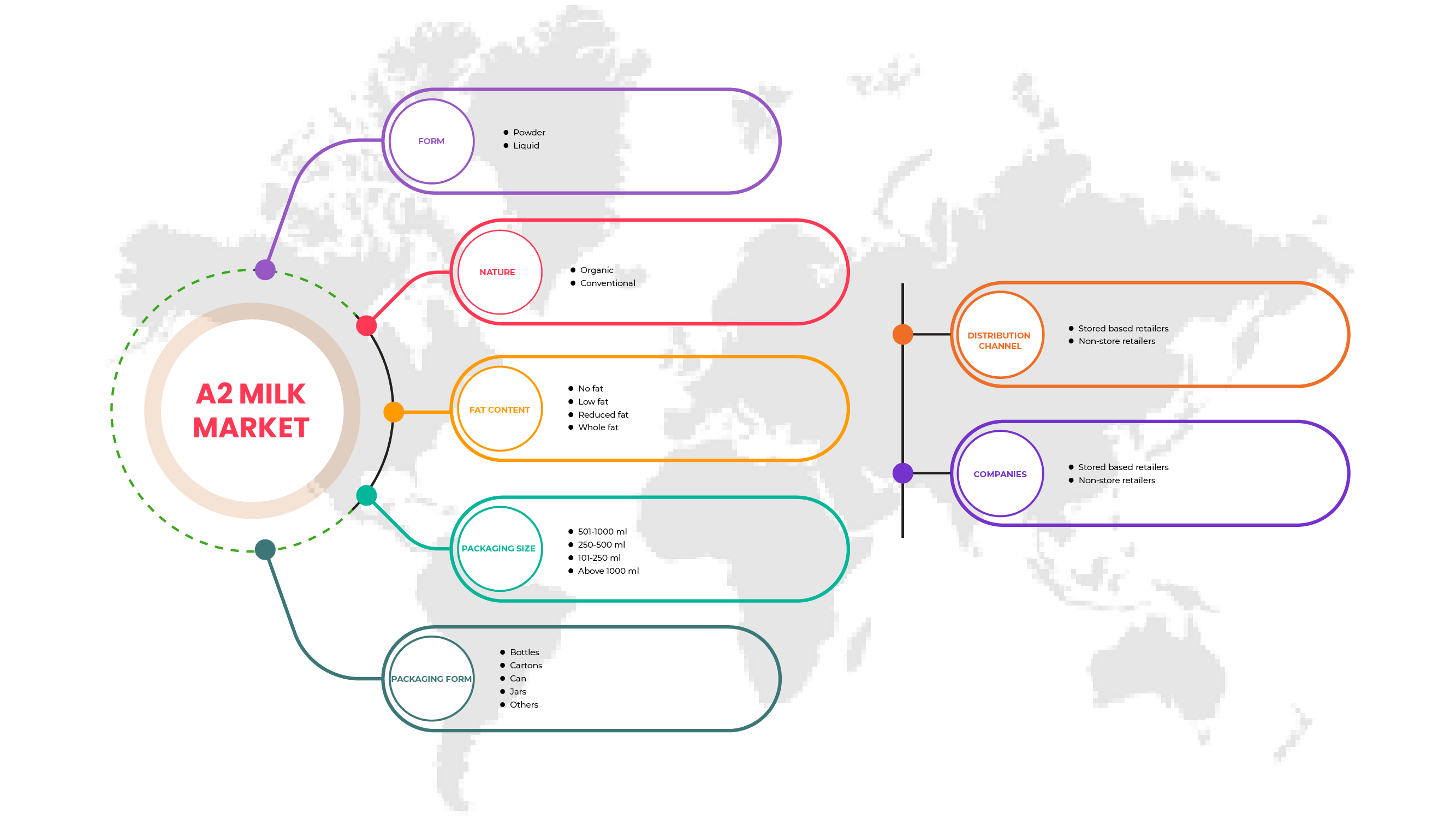

Global A2 milk market is segmented based on form, nature, fat content, packaging size, packaging form, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Form

- Powder

- Liquid

On the basis of form, the global A2 milk market is segmented into powder and liquid.

Nature

- Organic

- Conventional

On the basis of nature, the global A2 milk market is segmented into organic and conventional.

Fat Content

- No fat

- Low fat

- Reduced fat

- Whole fat

On the basis of fat content, the global A2 milk market is segmented into no fat, low fat, reduced fat, and whole fat.

Packaging Size

- 101-250ml/Gm

- 250-500ml/Gm

- 501-1000ml/Gm

- Above 1000ml/Gm

On the basis of packaging size, the global A2 milk market is segmented into 101-250 ml/gm, 250-500ml/gm, 501-1000ml/gm, and above 1000 ml/gm.

Packaging Form

- Bottles

- Cartons

- Can

- Jars

- Others

On the basis of packaging form, the global A2 milk market is segmented into bottles, cartons, can, jars, and others.

Distribution Channel

- Stored based retailers

- Non-store retailers

On the basis of distribution channel, the global A2 milk market is segmented into store based retailers and non-store retailers.

A2 Milk Market Regional Analysis/Insights

The A2 milk market is analyzed, and market size insights and trends are provided by country, form, nature, fat content, packaging size, packaging form, and distribution channel, as referenced above.

The countries covered in the global A2 milk market report are U.S., Canada, and Mexico, Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Turkey, Rest of Europe, China, New Zealand, Australia, India, Malaysia, Singapore, South Korea, Indonesia, Japan, Philippines, Thailand and Rest of Asia Pacific, South Africa, U.A.E., Saudi Arabia, Kuwait and rest of the Middle East and Africa, Brazil, Argentina, and Rest of South America.

Asia-Pacific is the largest market for A2 milk. Growing awareness of A2 milk health benefits over A1 milk among consumers is the major reason for the growth A2 milk market in Asia-Pacific. Moreover, the plant-based food market is growing progressively in the Asia-Pacific region. The growth of this market will directly impact the development of the A2 milk market. However, high prices of A2 milk are likely to restrict the market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that affect the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and A2 Milk Market Share Analysis

The A2 milk market competitive landscape provides details about the competitor. Components included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points are only related to the companies focusing on the A2 milk market.

Some of the major players operating in the A2 milk market are GCMMF, Erden Creamery Pvt Ltd, PROVILAC, Ripley Farms LLC., Taw River Dairy, The a2 Milk Company Limited, Urban Farms Milk., Vedaaz Organics Pvt. Ltd., AVTARAN MILK, DOFE, Captain's Farm., Ksheerdham., Ayuda Organics, Veco Zuivel B.V., and Australia's Own., and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL A2 MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT NUTRITIONAL QUALITY

4.1.2 PRODUCT PRICING

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 TRADE ANALYSIS

4.3.1 IMPORTS-EXPORTS OF THE GLOBAL A2 MILK MARKET

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF GLOBAL A2 MILK MARKET

4.4.1 INDUSTRY TRENDS

4.4.2 FUTURE PERSPECTIVE

4.5 RAW MATERIAL SOURCING ANALYSIS: GLOBAL A2 MILK MARKET

4.6 SUPPLY CHAIN OF THE GLOBAL A2 MILK MARKET

4.6.1 RAW A2 MILK PRODUCTION

4.6.2 PROCESSING AND PACKAGING

4.6.3 TRANSPORTATION AND DISTRIBUTION

4.6.4 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS

4.8 VALUE CHAIN ANALYSIS: GLOBAL A2 MILK MARKET

4.9 PORTER'S FIVE

4.9.1 PORTER'S FIVE FORCES ANALYSIS FOR GLOBAL A2 MILK MARKET

4.9.2 BARGAINING POWER OF SUPPLIERS

4.9.3 BARGAINING POWER OF BUYERS/CONSUMERS

4.9.4 THREAT OF NEW ENTRANTS

4.9.5 THREAT OF SUBSTITUTE PRODUCTS

4.9.6 INTENSITY OF COMPETITIVE RIVALRY

5 REGULATORY FRAMEWORK AND LABELLING FOR THE GLOBAL A2 MILK MARKET

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –GLOBAL A2 MILK MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 PRICING INDEX

7.1 FOB & B2B PRICES - GLOBAL A2 MILK MARKET

7.2 B2B PRICES - GLOBAL A2 MILK MARKET

8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

9 BRAND OUTLOOK

9.1 PRODUCT VS BRAND OVERVIEW

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING AWARENESS ABOUT HEALTH AMONG CONSUMERS

10.1.2 INCREASING APPLICATIONS OF A2 MILK IN INFANT FORMULAE

10.1.3 HIGH NUTRITIONAL VALUES IN A2 COMPARED TO REGULAR MILK

10.1.4 CONSUMERS EXPERIENCING HEALTH ISSUES DUE TO CONSUMPTION OF REGULAR MILK

10.2 RESTRAINT

10.2.1 HIGH PRICES OF A2 MILK

10.3 OPPORTUNITY

10.3.1 INCLINATION OF CONSUMERS OVER SUSTAINABLE PRODUCTION OF A2 MILK

10.4 CHALLENGES

10.4.1 GROWING TREND OF VEGANISM AMONG PEOPLE

10.4.2 HIGH INVESTMENT IN R&D FOR A2 MILK PRODUCTS

11 GLOBAL A2 MILK MARKET, BY FORM

11.1 OVERVIEW

11.2 LIQUID

11.3 POWDER

12 GLOBAL A2 MILK MARKET, BY NATURE

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 GLOBAL A2 MILK MARKET, BY FAT CONTENT

13.1 OVERVIEW

13.2 WHOLE FAT

13.3 LOW FAT

13.4 REDUCED FAT

13.5 NO FAT

14 GLOBAL A2 MILK MARKET, BY PACKAGIING SIZE

14.1 OVERVIEW

14.2 501-1000 ML

14.3 250-500 ML

14.4 101-250 ML

14.5 ABOVE 1000 ML

15 GLOBAL A2 MILK MARKET, BY PACKAGING FORM

15.1 OVERVIEW

15.2 BOTTLES

15.2.1 PLASTIC

15.2.2 GLASS

15.3 CARTONS

15.4 CAN

15.5 JARS

15.6 OTHERS

16 GLOBAL A2 MILK MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 NON-STORE RETAILERS

16.2.1 ONLINE

16.2.2 VENDING MACHINE

16.3 STORE BASED RETAILERS

16.3.1 SUPERMARKETS/HYPERMARKETS

16.3.2 CONVENIENCE STORES

16.3.3 GROCERY STORES

16.3.4 SPECIALTY STORES

17 GLOBAL A2 MILK MARKET, BY REGION

17.1 OVERVIEW

17.2 ASIA-PACIFIC

17.2.1 CHINA

17.2.2 NEW ZEALAND

17.2.3 AUSTRALIA

17.2.4 INDIA

17.2.5 MALAYSIA

17.2.6 SINGAPORE

17.2.7 SOUTH KOREA

17.2.8 INDONESIA

17.2.9 JAPAN

17.2.10 PHILIPPINES

17.2.11 THAILAND

17.2.12 REST OF ASIA-PACIFIC

17.3 EUROPE

17.3.1 GERMANY

17.3.2 NETHERLANDS

17.3.3 SWITZERLAND

17.3.4 RUSSIA

17.3.5 U.K.

17.3.6 FRANCE

17.3.7 SPAIN

17.3.8 REST OF EUROPE

17.4 NORTH AMERICA

17.4.1 U.S.

17.4.2 CANADA

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 UAE

17.6.3 REST OF MIDDLE EAST AND AFRICA

18 COMPANY LANDSCAPE: GLOBAL A2 MILK MARKET

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THE A2 MILK COMPANY LIMITED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 GCMMF

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 CAPTAIN’S FARM

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 VEDAAZ ORGANICS PVT. LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 URBAN FARMS MILK

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 AUSTRALIA'S OWN

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 AVTARAN MILK

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AYUDA ORGANICS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 DOFE

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 ERDEN CREAMERY PRIVATE LIMITED

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 KSHEERDHAM

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 PROVILAC DAIRY FARMS PVT. LTD

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 RIPLEY FARMS LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 TAW RIVER DAIRY

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 VECO ZUIVEL B.V.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 FREE ON BOARD (FOB) OF A2 MILK

TABLE 2 BRAND COMPARATIVE ANALYSIS OF THE GLOBAL A2 MILK MARKET

TABLE 3 GLOBAL A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL LIQUID IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL POWDER IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL CONVENTIONAL IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL ORGANIC IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL WHOLE FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL LOW FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL REDUCED FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL NO FAT IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL 501-1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL 250-500 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL 101-250 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL ABOVE 1000 ML IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL BOTTLES IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL CARTONS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL CAN IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL JARS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL OTHERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL NON-STORE RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL STORE BASED RETAILERS IN A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL A2 MILK MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 CHINA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 44 CHINA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 45 CHINA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 46 CHINA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 47 CHINA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 CHINA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 CHINA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CHINA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NEW ZEALAND A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 52 NEW ZEALAND A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 53 NEW ZEALAND A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 54 NEW ZEALAND A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 55 NEW ZEALAND A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 56 NEW ZEALAND BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NEW ZEALAND A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 NEW ZEALAND STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NEW ZEALAND NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 AUSTRALIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 61 AUSTRALIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 AUSTRALIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 63 AUSTRALIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 64 AUSTRALIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 INDIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 INDIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 71 INDIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 72 INDIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 73 INDIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 74 INDIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 INDIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MALAYSIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 MALAYSIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 80 MALAYSIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 81 MALAYSIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 82 MALAYSIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 MALAYSIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 MALAYSIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MALAYSIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SINGAPORE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 88 SINGAPORE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 89 SINGAPORE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 90 SINGAPORE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 91 SINGAPORE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 92 SINGAPORE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SINGAPORE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 TABLE 41 SOUTH KOREA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 107 INDONESIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 109 INDONESIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 110 INDONESIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDONESIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 INDONESIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDONESIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 JAPAN A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 115 JAPAN A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 116 JAPAN A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 117 JAPAN A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 118 JAPAN A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 119 JAPAN BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 JAPAN A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 JAPAN STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 JAPAN NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 PHILIPPINES A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 124 PHILIPPINES A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 125 PHILIPPINES A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 126 PHILIPPINES A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 127 PHILIPPINES A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 128 PHILIPPINES BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 PHILIPPINES A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 PHILIPPINES STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 PHILIPPINES NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 133 THAILAND A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 135 THAILAND A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 137 THAILAND BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 THAILAND STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 REST OF ASIA-PACIFIC A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 EUROPE A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 143 EUROPE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 144 EUROPE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 145 EUROPE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 146 EUROPE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 147 EUROPE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 148 EUROPE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 EUROPE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 150 EUROPE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 EUROPE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 GERMANY A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 153 GERMANY A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 154 GERMANY A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 155 GERMANY A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 156 GERMANY A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 157 GERMANY BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 GERMANY A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 159 GERMANY STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 GERMANY NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 NETHERLANDS A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 NETHERLANDS NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 SWITZERLAND A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 171 SWITZERLAND A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 172 SWITZERLAND A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 173 SWITZERLAND A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 174 SWITZERLAND A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 175 SWITZERLAND BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SWITZERLAND A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 177 SWITZERLAND STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 SWITZERLAND NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 RUSSIA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 180 RUSSIA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 181 RUSSIA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 182 RUSSIA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 183 RUSSIA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 184 RUSSIA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 RUSSIA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 186 RUSSIA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 RUSSIA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 U.K. A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 189 U.K. A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 190 U.K. A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 191 U.K. A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 192 U.K. A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 193 U.K. BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.K. A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 195 U.K. STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.K. NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 FRANCE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 198 FRANCE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 199 FRANCE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 200 FRANCE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 201 FRANCE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 202 FRANCE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 FRANCE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 204 FRANCE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 FRANCE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 SPAIN A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 207 SPAIN A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 208 SPAIN A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 209 SPAIN A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 210 SPAIN A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 211 SPAIN BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 SPAIN A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 213 SPAIN STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 SPAIN NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 REST OF EUROPE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 216 NORTH AMERICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 217 NORTH AMERICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 218 NORTH AMERICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 219 NORTH AMERICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 220 NORTH AMERICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 221 NORTH AMERICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 222 NORTH AMERICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 NORTH AMERICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 224 NORTH AMERICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 NORTH AMERICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 U.S. A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 227 U.S. A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 228 U.S. A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 229 U.S. A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 230 U.S. A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 231 U.S. BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 U.S. A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 233 U.S. STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 U.S. NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 CANADA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 236 CANADA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 237 CANADA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 238 CANADA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 239 CANADA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 240 CANADA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 CANADA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 242 CANADA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 CANADA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 SOUTH AMERICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 245 SOUTH AMERICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 246 SOUTH AMERICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 247 SOUTH AMERICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 248 SOUTH AMERICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 249 SOUTH AMERICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 250 SOUTH AMERICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 SOUTH AMERICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 252 SOUTH AMERICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 SOUTH AMERICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 BRAZIL A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 255 BRAZIL A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 256 BRAZIL A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 257 BRAZIL A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 258 BRAZIL A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 259 BRAZIL BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 BRAZIL A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 261 BRAZIL STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 BRAZIL NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 ARGENTINA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 264 ARGENTINA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 265 ARGENTINA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 266 ARGENTINA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 267 ARGENTINA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 268 ARGENTINA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 ARGENTINA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 270 ARGENTINA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 ARGENTINA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 273 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 274 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 275 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 276 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 277 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 278 MIDDLE-EAST AND AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 MIDDLE-EAST AND AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 280 MIDDLE-EAST AND AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 MIDDLE-EAST AND AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 SOUTH AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 283 SOUTH AFRICA A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 284 SOUTH AFRICA A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 285 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 286 SOUTH AFRICA A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 287 SOUTH AFRICA BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 SOUTH AFRICA A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 SOUTH AFRICA STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 SOUTH AFRICA NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 UAE A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 292 UAE A2 MILK MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 293 UAE A2 MILK MARKET, BY FAT CONTENT, 2020-2029 (USD MILLION)

TABLE 294 UAE A2 MILK MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 295 UAE A2 MILK MARKET, BY PACKAGING FORM, 2020-2029 (USD MILLION)

TABLE 296 UAE BOTTLES IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 UAE A2 MILK MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 298 UAE STORE BASED RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 UAE NON-STORE RETAILERS IN A2 MILK MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 REST OF MIDDLE EAST AND AFRICA A2 MILK MARKET, BY FORM, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 GLOBAL A2 MILK MARKET: SEGMENTATION

FIGURE 2 GLOBAL A2 MILK MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL A2 MILK MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL A2 MILK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL A2 MILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL A2 MILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL A2 MILK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL A2 MILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL A2 MILK MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE GLOBAL A2 MILK MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASING APPLICATION OF A2 MILK IN THE FOOD INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL A2 MILK MARKET IN THE FORECAST PERIOD

FIGURE 12 LIQUID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL A2 MILK MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR A2 MILK MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 14 SUPPLY CHAIN OF THE GLOBAL A2 MILK MARKET

FIGURE 15 VALUE CHAIN OF A2 MILK

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL A2 MILK MARKET

FIGURE 17 GLOBAL A2 MILK MARKET: BY FORM, 2021

FIGURE 18 GLOBAL A2 MILK MARKET: BY NATURE, 2021

FIGURE 19 GLOBAL A2 MILK MARKET: BY FAT CONTENT, 2021

FIGURE 20 GLOBAL A2 MILK MARKET: BY PACKAGING SIZE, 2021

FIGURE 21 GLOBAL A2 MILK MARKET: BY PACKAGING FORM, 2021

FIGURE 22 GLOBAL A2 MILK MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 GLOBAL A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 24 GLOBAL A2 MILK MARKET: BY REGION (2021)

FIGURE 25 GLOBAL A2 MILK MARKET: BY REGION (2022 & 2029)

FIGURE 26 GLOBAL A2 MILK MARKET: BY REGION (2021 & 2029)

FIGURE 27 GLOBAL A2 MILK MARKET: BY FORM (2022-2029)

FIGURE 28 ASIA-PACIFIC A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 29 ASIA-PACIFIC A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 30 ASIA-PACIFIC A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 ASIA-PACIFIC A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 ASIA-PACIFIC A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 33 EUROPE A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 38 NORTH AMERICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 43 SOUTH AMERICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 44 SOUTH AMERICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 45 SOUTH AMERICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 SOUTH AMERICA A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 SOUTH AMERICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA A2 MILK MARKET: SNAPSHOT (2021)

FIGURE 49 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021)

FIGURE 50 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 MIDDLE EAST AND AFRICA A2 MILK MARKET: BY FORM (2022 & 2029)

FIGURE 53 GLOBAL A2 MILK MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 NORTH AMERICA A2 MILK MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 EUROPE A2 MILK MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 ASIA-PACIFIC A2 MILK MARKET: COMPANY SHARE 2021 (%)

Global A2 Milk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global A2 Milk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global A2 Milk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.