Global 3d Printed Organs Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

4.58 Billion

2025

2033

USD

1.57 Billion

USD

4.58 Billion

2025

2033

| 2026 –2033 | |

| USD 1.57 Billion | |

| USD 4.58 Billion | |

|

|

|

|

3D-Printed Organs Market Size

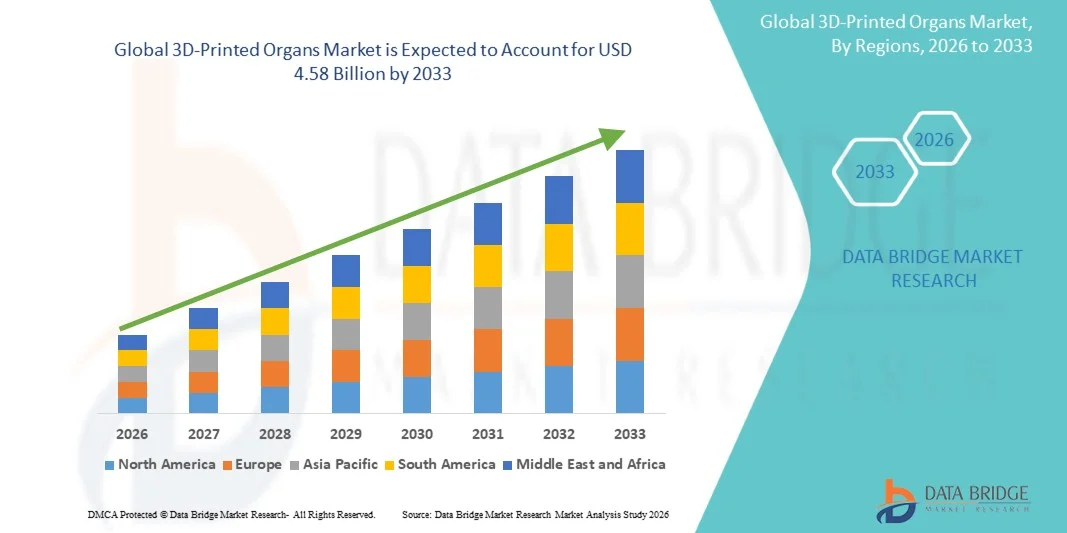

- The global 3D-Printed Organs market size was valued at USD 1.57 billion in 2025 and is expected to reach USD 4.58 billion by 2033, at a CAGR of 14.32% during the forecast period

- The market growth is largely driven by rapid advancements in 3D bioprinting technologies, biomaterials, and tissue engineering, alongside increasing adoption of regenerative medicine and personalized healthcare solutions, enabling the development of complex, patient-specific organs and tissues for research and therapeutic applications

- Furthermore, rising demand for alternatives to organ transplantation shortages, growing investments in R&D by biopharmaceutical companies and research institutes, and increasing use of 3D-printed organs in drug testing and disease modeling are accelerating the uptake of 3D-Printed Organs solutions, thereby significantly boosting the overall market growth

3D-Printed Organs Market Analysis

- 3D-Printed organs, created using advanced bioprinting technologies and bio-inks composed of living cells, are emerging as transformative solutions in regenerative medicine and transplantation due to their potential to closely mimic the structure and function of human tissues and organs

- The growing demand for 3D-Printed organs is primarily driven by the global shortage of donor organs, rising prevalence of chronic and organ-failure diseases, and increasing adoption of personalized and precision medicine approaches, along with expanding use in drug discovery and disease modeling

- North America dominated the 3D-printed organs market with the largest revenue share of approximately 42.05% in 2025, supported by strong research funding, advanced healthcare infrastructure, early adoption of bioprinting technologies, and the presence of leading biotechnology firms and academic research institutions, with the U.S. witnessing significant progress through collaborations between universities, hospitals, and bioprinting companies

- Asia-Pacific is expected to be the fastest-growing region in the 3D-printed organs market during the forecast period, driven by increasing healthcare investments, expanding biotechnology sectors, rising awareness of regenerative medicine, and supportive government initiatives in countries such as China, Japan, and South Korea

- The syringe-based technology segment dominated the market with a revenue share of about 41.9% in 2025, owing to its wide adoption, cost-effectiveness, and ability to precisely deposit high-viscosity bio-inks containing living cells

Report Scope and 3D-Printed Organs Market Segmentation

|

Attributes |

3D-Printed Organs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

3D-Printed Organs Market Trends

“Advancements in Bioprinting Technologies and Tissue Engineering”

- A significant and accelerating trend in the global 3D-printed organs market is the rapid advancement of bioprinting technologies combined with breakthroughs in tissue engineering and regenerative medicine. These innovations are enhancing the structural complexity, functionality, and viability of printed tissues and organs

- For instance, in January 2024, Organovo Holdings, Inc. reported progress in its 3D-bioprinted liver tissue programs, demonstrating improved tissue maturation and functionality for preclinical research and drug toxicity testing, highlighting real-world advancements in organ bioprinting

- Continuous improvements in bio-inks, including cell-laden hydrogels and biomaterials that closely mimic extracellular matrices, are enabling better cell viability and vascularization. These developments support the creation of more physiologically relevant organ models

- The integration of automation and precision printing technologies allows for higher reproducibility, scalability, and customization of 3D-printed organs. This is particularly valuable for patient-specific models and personalized medicine applications

- Increased collaboration between biotechnology companies, academic institutions, and research hospitals is accelerating innovation and shortening development timelines for complex organ constructs. These partnerships are expanding clinical and research use cases

- The growing adoption of 3D-printed tissues for drug discovery, disease modeling, and transplantation research is reshaping expectations around organ availability and regenerative therapies, driving sustained market interest and investment

3D-Printed Organs Market Dynamics

Driver

“Rising Demand for Organ Transplant Alternatives and Regenerative Medicine”

- The global shortage of donor organs and the increasing burden of chronic diseases are key drivers boosting demand for 3D-printed organs. Patients with end-stage organ failure often face long waiting times, creating an urgent need for alternative solutions

- For instance, in May 2023, Prellis Biologics announced advancements in vascularized tissue printing, aiming to address one of the major challenges in creating transplant-ready organs, supporting future therapeutic applications

- 3D-printed organs offer the potential to reduce transplant rejection risks by enabling patient-specific designs using autologous cells. This significantly improves compatibility and long-term outcomes

- The expanding focus on regenerative medicine and personalized healthcare is encouraging adoption of bioprinted tissues for both research and therapeutic purposes

- Supportive government funding, rising investments from venture capital firms, and increasing clinical trials in tissue engineering further propel market growth. The use of 3D-printed organs in drug testing also reduces reliance on animal models, supporting ethical and cost-efficient research

Restraint/Challenge

“High Development Costs, Regulatory Complexity, and Technical Limitations”

- High costs associated with advanced bioprinters, specialized biomaterials, and skilled labor present a significant barrier to widespread adoption, especially for smaller research institutions

- For instance, regulatory agencies such as the FDA and EMA require extensive validation, safety testing, and clinical evidence before approving bioprinted tissues for human use, prolonging commercialization timelines

- Technical challenges related to vascularization, long-term functionality, and scalability of fully functional organs remain unresolved, limiting immediate clinical deployment

- Ethical concerns, regulatory uncertainty, and lack of standardized manufacturing protocols also slow adoption across regions

- Overcoming these challenges will require sustained R&D investment, clearer regulatory frameworks, technological standardization, and cost optimization to enable broader clinical and commercial use of 3D-Printed Organs in the long term

3D-Printed Organs Market Scope

The market is segmented on the basis of organ type, technology, and end user.

• By Organ Type

On the basis of organ type, the Global 3D-Printed Organs market is segmented into kidney, liver, heart, cornea, bones, skin, and others. The kidney segment dominated the largest market revenue share of approximately 38.6% in 2025, driven by the rising global prevalence of chronic kidney disease, end-stage renal failure, and the severe shortage of donor kidneys for transplantation. Kidneys are among the most transplanted organs worldwide, making them a primary focus for regenerative medicine research. 3D-printed kidney models are widely used in drug toxicity testing, disease modeling, and early-stage transplant research. Advances in bioprinting precision and cell viability have enabled better replication of nephron structures. Increasing funding for renal research and strong collaboration between academic institutions and biotechnology firms further support dominance. The segment also benefits from high clinical demand and long transplant waiting lists. Growing interest in personalized treatment options reinforces its leading position.

The liver segment is expected to witness the fastest growth, registering a CAGR of around 15.2% from 2026 to 2033, due to the rising incidence of liver diseases such as cirrhosis, hepatitis, and fatty liver disorders. Liver tissues are extensively used in pharmaceutical research for drug metabolism and toxicity screening. 3D-bioprinted liver constructs offer high predictive accuracy, reducing reliance on animal testing. Increasing adoption by pharmaceutical companies accelerates demand. Continuous improvements in vascularization and tissue functionality further boost growth. The liver segment also benefits from strong industrial and research applications. Expanding investments in regenerative medicine support rapid expansion.

• By Technology

On the basis of technology, the market is segmented into magnetic levitation, inkjet-based, syringe-based, laser-based, and others. The syringe-based technology segment dominated the market with a revenue share of about 41.9% in 2025, owing to its wide adoption, cost-effectiveness, and ability to precisely deposit high-viscosity bio-inks containing living cells. This technology is highly versatile and compatible with multiple biomaterials. Syringe-based systems are extensively used in research laboratories and academic settings. They enable high cell density printing, which is critical for tissue formation. The availability of commercially scalable systems strengthens adoption. Ease of customization and reproducibility further contribute to dominance. Its broad application across multiple organ types reinforces its leading position.

The laser-based technology segment is projected to grow at the fastest CAGR of nearly 14.6% from 2026 to 2033, driven by its high printing resolution, cell viability, and precision in complex tissue structures. Laser-based bioprinting enables non-contact deposition, reducing contamination risks. It is increasingly adopted for highly sensitive tissues such as cornea and neural tissues. Technological advancements are improving scalability and cost efficiency. Growing use in advanced regenerative research supports rapid growth. Strong interest from research institutions accelerates adoption.

• By End User

On the basis of end user, the market is segmented into hospitals, research centers/laboratories, medical colleges, and others. The research centers and laboratories segment dominated the market with a revenue share of approximately 44.3% in 2025, driven by extensive use of 3D-printed organs for drug discovery, toxicology studies, and disease modeling. Research institutions are at the forefront of innovation in bioprinting technologies. Strong government and private funding supports sustained adoption. These centers benefit from early access to emerging technologies. High research output and collaborative programs reinforce dominance. Increasing emphasis on alternative testing methods further boosts demand.

The hospital segment is expected to register the fastest growth, with a CAGR of around 13.8% from 2026 to 2033, owing to the growing focus on regenerative medicine and future transplant applications. Hospitals are increasingly involved in clinical research and translational studies. Rising adoption of personalized medicine supports growth. Expansion of advanced healthcare infrastructure enables integration of bioprinting technologies. Surge in chronic disease burden drives long-term demand. Clinical trials and pilot transplant programs further accelerate market expansion.

3D-Printed Organs Market Regional Analysis

- North America dominated the 3D-printed organs market with the largest revenue share of approximately 42.05% in 2025, supported by strong research funding, advanced healthcare infrastructure, early adoption of bioprinting technologies, and the presence of leading biotechnology companies and academic research institutions focused on regenerative medicine and tissue engineering

- The region benefits from significant investments in R&D, increasing collaboration between hospitals, universities, and biotechnology firms, and a rising focus on addressing organ shortages through innovative solutions, which continues to accelerate technological progress and commercialization efforts

- Favorable regulatory support for advanced medical research, along with high healthcare expenditure and access to cutting-edge clinical facilities, has further strengthened North America’s leadership in the global 3D-Printed Organs market

U.S. 3D-Printed Organs Market Insight

The U.S. 3D-printed organs market accounted for the largest share within North America in 2025, driven by substantial federal and private funding for bioprinting research, a strong ecosystem of biotechnology startups, and the presence of renowned research universities and hospitals. The country is witnessing notable progress through partnerships between academic institutions, healthcare providers, and bioprinting companies aimed at developing functional tissues and organs for transplantation, drug testing, and personalized medicine. Additionally, growing awareness regarding organ shortages and advancements in stem cell research are further supporting market expansion in the U.S.

Europe 3D-Printed Organs Market Insight

The Europe 3D-printed organs market is projected to grow at a steady and substantial CAGR over the forecast period, driven by increasing government support for regenerative medicine, strong academic research capabilities, and rising investments in biotechnology. Countries across the region are actively funding tissue engineering and bioprinting projects to improve transplant outcomes and reduce dependency on donor organs. The region is also benefiting from growing collaboration between research institutes and medical device companies.

U.K. 3D-Printed Organs Market Insight

The U.K. 3D-printed organs market is expected to register notable growth during the forecast period, supported by strong research initiatives, public–private partnerships, and increasing focus on translational medicine. The presence of world-class universities and biomedical research centers, along with supportive funding for regenerative medicine, is accelerating the development of bioprinted tissues and organ models for clinical and research applications.

Germany 3D-Printed Organs Market Insight

Germany’s 3D-printed organs market is anticipated to expand at a healthy CAGR, driven by its well-established healthcare system, strong emphasis on biomedical engineering, and growing investments in advanced manufacturing technologies. The country’s focus on innovation, precision medicine, and medical research infrastructure is fostering the adoption of bioprinting technologies in both academic and clinical environments.

Asia-Pacific 3D-Printed Organs Market Insight

The Asia-Pacific 3D-printed organs market is expected to be the fastest-growing region during the forecast period, fueled by increasing healthcare investments, expanding biotechnology sectors, rising awareness of regenerative medicine, and supportive government initiatives. Rapid advancements in medical research capabilities and growing demand for alternative solutions to organ transplantation are creating a favorable environment for market growth across the region.

Japan 3D-Printed Organs Market Insight

The Japan 3D-printed organs market is gaining momentum due to the country’s strong technological expertise, aging population, and increasing focus on regenerative therapies. Japan’s advanced research infrastructure and government-backed initiatives in regenerative medicine are driving innovation in bioprinting technologies, particularly for tissue regeneration and organ repair applications.

China 3D-Printed Organs Market Insight

China3D-printed organs market accounted for a significant share of the Asia-Pacific 3D-Printed Organs market in 2025, driven by expanding healthcare infrastructure, strong government support for biotechnology innovation, and rising investments in regenerative medicine research. The country’s large patient population, increasing number of research institutions, and growing focus on reducing dependence on organ donors are key factors contributing to rapid market growth.

3D-Printed Organs Market Share

The 3D-Printed Organs industry is primarily led by well-established companies, including:

- Organovo Holdings Inc. (U.S.)

- CELLINK (Sweden)

- Aspect Biosystems (Canada)

- 3D Systems Corporation (U.S.)

- Stratasys Ltd. (Israel)

- RegenHU (Switzerland)

- Allevi Inc. (U.S.)

- Poietis (France)

- Cyfuse Biomedical K.K. (Japan)

- EnvisionTEC (Germany)

- BICO Group AB (Sweden)

- Oceanz 3D Printing (Netherlands)

- Advanced Solutions Life Sciences (U.S.)

- BioBots (U.S.)

- TeVido BioDevices (U.S.)

Latest Developments in Global 3D-Printed Organs Market

- In June 2025, researchers at Stanford University unveiled a new platform that can rapidly design and 3D-print organ-scale vascular networks, solving a critical barrier to fabricating full organs. Their method generates vascular “trees” hundreds of times faster than previous techniques, and demonstrated that a thick cell-laden tissue with 25 micro-vessels could be kept alive by nutrient flow — a major step toward viable, large 3D-printed hearts or other organs

- In March 2024, a comprehensive review published in Regenerative Biomaterials highlighted that advances in “bioinks” — hydrogels containing living cells and biomaterials — are now enabling the creation of biocompatible, biofunctional constructs. This reinforces 3D bioprinting as a leading avenue for tissue engineering and brings the possibility of transplantable printed organs closer to reality

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.