Global 3d Imaging Market

Market Size in USD Billion

CAGR :

%

USD

40.99 Billion

USD

179.84 Billion

2025

2033

USD

40.99 Billion

USD

179.84 Billion

2025

2033

| 2026 –2033 | |

| USD 40.99 Billion | |

| USD 179.84 Billion | |

|

|

|

|

What is the Global 3D Imaging Market Size and Growth Rate?

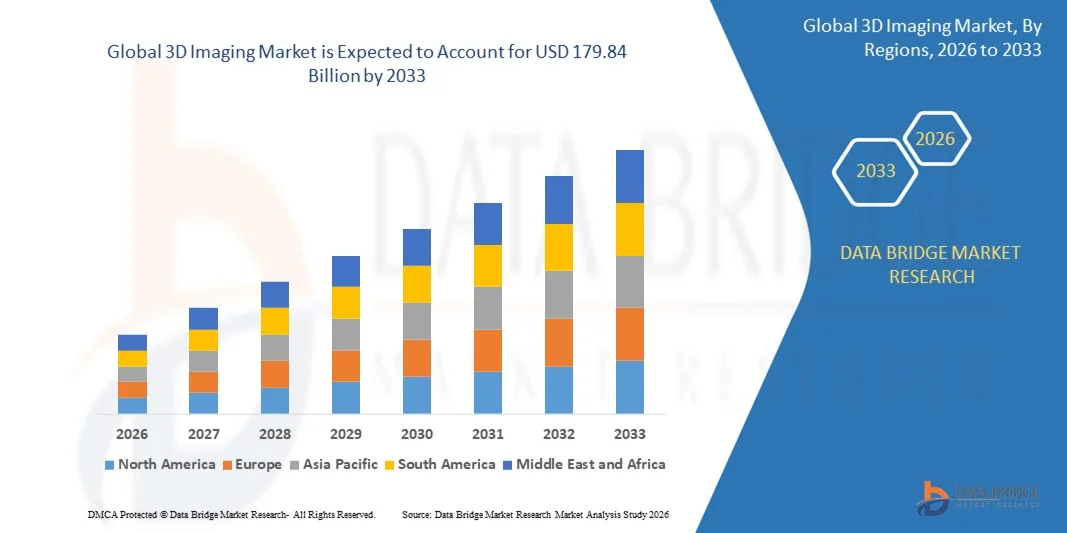

- The global 3D Imaging market size was valued at USD 40.99 billion in 2025 and is expected to reach USD 179.84 billion by 2033, at a CAGR of20.30% during the forecast period

- The high demand for 3D-enabled devices across verticals is expected to influence the growth of 3D imaging market. Also, the numerous advantages of 3D imaging in healthcare and medical industry are also anticipated to flourish the growth of the 3D imaging market

What are the Major Takeaways of 3D Imaging Market?

- The rapid urbanization, thrust for productivity and rise in environment concerns in the architecture and construction vertical are also such asly to positively impact the growth of the market

- Moreover, high adoption of the 3D technology and increase in the usage of technology in products such as smart phones, cameras and television are also expected create a huge demand for natural language processing (NLP)as well as lifting the growth of the 3D imaging market

- North America dominated the 3D Imaging market with a 42.05% revenue share in 2025, driven by rapid adoption of advanced 3D imaging solutions in healthcare, aerospace, automotive, and industrial inspection

- Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by rapid industrialization, semiconductor and electronics manufacturing expansion, and rising adoption of imaging technologies in automotive, healthcare, and construction

- The Hardware segment dominated the market with a 44.2% share in 2025, driven by high adoption of 3D cameras, scanners, sensors, and imaging devices across healthcare, automotive, aerospace, and industrial inspection

Report Scope and 3D Imaging Market Segmentation

|

Attributes |

3D Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the 3D Imaging Market?

Increasing Shift Toward High-Resolution, Real-Time, and Software-Integrated 3D Imaging Solutions

- The 3D Imaging market is witnessing growing adoption of high-resolution, compact, and software-driven imaging systems designed for healthcare diagnostics, industrial inspection, entertainment, and smart infrastructure applications

- Manufacturers are introducing advanced 3D imaging solutions integrating AI-based reconstruction, real-time rendering, multi-sensor fusion, and cloud-enabled visualization for enhanced accuracy and speed

- Rising demand for lightweight, portable, and cost-efficient 3D imaging devices is driving usage across medical imaging centers, manufacturing facilities, construction sites, and research institutions

- For instance, companies such as GE Healthcare, Philips, Sony, FARO, and Trimble have enhanced their 3D imaging portfolios with improved depth sensing, real-time processing, and AI-powered analytics

- Increasing need for precise spatial mapping, real-time object recognition, and immersive visualization is accelerating the shift toward software-integrated and PC-based 3D imaging platforms

- As industries increasingly rely on digital visualization and automation, 3D Imaging will remain critical for accurate modeling, inspection, diagnostics, and immersive experiences

What are the Key Drivers of 3D Imaging Market?

- Rising demand for accurate, real-time, and non-invasive imaging solutions across healthcare, automotive, aerospace, construction, and entertainment sectors

- For instance, in 2025, leading companies such as GE Healthcare, Philips, Autodesk, and Dassault Systèmes upgraded their 3D imaging solutions with AI-enabled rendering, faster processing, and enhanced visualization software

- Growing adoption of 3D imaging in medical diagnostics, digital dentistry, autonomous vehicles, robotics, and smart manufacturing is boosting global market demand

- Advancements in sensor technologies, AI-based image reconstruction, depth-sensing cameras, and cloud computing have significantly improved image quality and processing efficiency

- Rising use of AR/VR, digital twins, and metaverse applications is increasing demand for high-precision and real-time 3D imaging systems

- Supported by continuous investments in digital transformation, healthcare innovation, and industrial automation, the 3D Imaging market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the 3D Imaging Market?

- High costs associated with advanced 3D imaging hardware, software integration, and high-resolution sensors limit adoption among small enterprises and developing regions

- For instance, during 2024–2025, rising component costs, semiconductor supply constraints, and increased R&D expenditure raised overall system prices for several global vendors

- Complexity in data processing, calibration, and integration with existing IT and imaging infrastructure increases the need for skilled professionals and training

- Limited awareness and technical expertise in emerging markets regarding advanced 3D imaging capabilities slow market penetration

- Competition from alternative imaging technologies, traditional 2D systems, and cost-effective scanning solutions creates pricing pressure and impacts differentiation

- To overcome these challenges, companies are focusing on cost-optimized solutions, AI-driven automation, cloud-based platforms, and enhanced user training to expand global adoption of 3D Imaging

How is the 3D Imaging Market Segmented?

The market is segmented on the basis of component, component, deployment mode, organization size, display technology and end user.

- By Component

On the basis of component, the 3D Imaging market is segmented into Hardware, Solutions, and Services. The Hardware segment dominated the market with a 44.2% share in 2025, driven by high adoption of 3D cameras, scanners, sensors, and imaging devices across healthcare, automotive, aerospace, and industrial inspection. Hardware products are essential for accurate data acquisition, depth sensing, and real-time visualization, making them critical for both enterprise and research applications.

The Solutions segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing adoption of AI-powered 3D imaging software, cloud-based visualization platforms, and analytics tools that enable advanced reconstruction, object recognition, and immersive visualization. Rising integration of hardware and software solutions in digital twins, smart factories, and AR/VR applications is further accelerating demand for complete imaging solutions.

- By Deployment Mode

On the basis of deployment mode, the 3D Imaging market is segmented into On-Premises and Cloud. The On-Premises segment dominated the market with a 52.1% share in 2025, supported by enterprises’ preference for local data processing, low-latency operations, and high-security requirements in healthcare, aerospace, and defense applications. On-premises deployment ensures real-time image reconstruction, minimal network dependency, and high integration with enterprise IT infrastructure.

The Cloud segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of cloud-based AI processing, collaborative visualization, and remote access in architecture, construction, media, and retail sectors. Growing demand for scalable, cost-effective, and remotely accessible 3D imaging solutions is accelerating the shift toward cloud deployment.

- By Organization Size

On the basis of organization size, the market is segmented into Large Enterprises and Small and Medium Enterprises (SMEs). The Large Enterprises segment dominated the market with a 58.3% share in 2025, driven by extensive investments in industrial automation, aerospace, healthcare imaging infrastructure, and digital twin initiatives. Large organizations prefer high-end 3D imaging solutions with advanced sensors, AI analytics, and multi-user collaboration capabilities.

The SMEs segment is projected to grow at the fastest CAGR from 2026 to 2033, owing to declining hardware costs, availability of cloud-based solutions, and increasing demand for affordable 3D imaging applications in retail, small-scale manufacturing, healthcare diagnostics, and digital content creation.

- By Display Technology

On the basis of display technology, the 3D Imaging market is segmented into Anaglyph, Stereoscopy, Auto-Stereoscopy, Holography, and Volumetric Display. The Stereoscopy segment dominated the market with a 40.5% share in 2025, widely used in medical imaging, AR/VR, industrial inspection, and entertainment due to its high-quality depth perception and immersive visualization.

The Holography segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by technological advancements in holographic displays, real-time volumetric rendering, and increasing applications in retail, advertising, education, and entertainment. Rising demand for realistic, interactive, and immersive visualization experiences is driving adoption of advanced 3D display technologies.

- By End User

On the basis of end user, the 3D Imaging market is segmented into Aerospace and Defense, Healthcare and Life Sciences, Automotive and Transportation, Architecture and Construction, Retail and E-Commerce, Manufacturing, Media and Entertainment, and Others. The Healthcare and Life Sciences segment dominated the market with a 37.8% share in 2025, supported by increasing demand for 3D medical imaging, diagnostics, surgical planning, and telemedicine applications.

The Automotive and Transportation segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by adoption of 3D imaging for ADAS systems, autonomous vehicles, in-vehicle navigation, and smart manufacturing of automotive components. Rising digitalization, demand for safety-critical testing, and integration with AI and IoT technologies are key growth drivers for end-user adoption globally.

Which Region Holds the Largest Share of the 3D Imaging Market?

- North America dominated the 3D Imaging market with a 42.05% revenue share in 2025, driven by rapid adoption of advanced 3D imaging solutions in healthcare, aerospace, automotive, and industrial inspection. High concentration of imaging technology companies, strong R&D infrastructure, and early adoption of AI-powered 3D imaging software contribute to regional leadership. The increasing deployment of 3D scanners, LiDAR, and structured-light imaging in prototyping, quality control, and medical diagnostics continues to fuel market growth

- Leading companies in the region are introducing integrated imaging solutions with AI analytics, cloud-enabled processing, high-resolution capture, and multi-sensor fusion, strengthening the technological advantage. Continuous investment in industrial automation, smart manufacturing, and digital twin initiatives supports sustained expansion

- High engineering talent, strong startup ecosystems, and robust innovation infrastructure further reinforce North America’s market dominance

U.S. 3D Imaging Market Insight

The U.S. is the largest contributor in North America, supported by extensive use of 3D imaging in medical diagnostics, automotive design, aerospace R&D, and industrial inspection. Increasing adoption of AI and machine vision, high-resolution scanners, and multi-sensor imaging solutions drives demand across research labs, hospitals, and industrial facilities. Presence of major imaging solution providers, strong funding for R&D, and growing applications in AR/VR visualization further boost market growth.

Canada 3D Imaging Market Insight

Canada contributes significantly to regional growth, supported by government-funded innovation programs, expansion of healthcare imaging centers, and investments in industrial automation and aerospace R&D. Universities and research institutions increasingly leverage 3D imaging for prototyping, training simulations, and product development. Growing interest in AI-assisted imaging, robotics, and digital twin adoption accelerates market penetration across the country.

Asia-Pacific 3D Imaging Market

Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by rapid industrialization, semiconductor and electronics manufacturing expansion, and rising adoption of imaging technologies in automotive, healthcare, and construction. Countries such as China, Japan, India, South Korea, and Southeast Asia are witnessing high-volume production of consumer electronics, automotive components, and smart devices, increasing demand for advanced 3D imaging tools. Growth in AI-powered imaging, smart factories, industrial automation, and infrastructure development continues to accelerate market adoption.

China 3D Imaging Market Insight

China is the largest contributor in Asia-Pacific due to extensive semiconductor investments, world-leading electronics manufacturing capacity, and strong government support for digital innovation. High-speed digital systems, AI-based imaging, and smart city projects drive demand for high-resolution, multi-sensor 3D imaging solutions. Local manufacturing capabilities, competitive pricing, and export potential further expand domestic and regional adoption.

Japan 3D Imaging Market Insight

Japan shows steady growth supported by advanced healthcare infrastructure, precision manufacturing, and continuous modernization of automotive and industrial sectors. Focus on high-quality imaging tools, robotics, and AR/VR solutions drives adoption of premium 3D imaging devices. Increasing demand for low-latency systems and high-resolution visualization reinforces long-term expansion.

India 3D Imaging Market Insight

India is emerging as a major growth hub, driven by expanding healthcare facilities, electronics design centers, and government-backed smart manufacturing initiatives. Rising demand for embedded imaging solutions, prototyping, automotive design, and medical imaging accelerates adoption. Investments in digital infrastructure and imaging R&D support rapid market growth.

South Korea 3D Imaging Market Insight

South Korea contributes significantly due to strong demand for advanced processors, AI hardware, 5G systems, and high-performance consumer electronics. Rapid adoption of industrial automation, automotive imaging, and AR/VR applications drives utilization of high-resolution 3D imaging devices. Technological innovation and growing manufacturing capacity sustain long-term growth.

Which are the Top Companies in 3D Imaging Market?

The 3D imaging industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Autodesk Inc. (U.S.)

- STMicroelectronics (Switzerland)

- Panasonic Corporation (Japan)

- Sony Corporation (Japan)

- Trimble Inc. (U.S.)

- FARO (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Google (U.S.)

- Adobe (U.S.)

- HP Development Company, L.P. (U.S.)

- Dassault Systèmes (France)

- Lockheed Martin Corporation (U.S.)

- Topcon (Japan)

- Able Software Corp. (U.S.)

- MAXON COMPUTER GMBH (Germany)

- Esri (U.S.)

- BENTLEY SYSTEMS (U.S.)

- Pixologic, Inc. (U.S.)

- Pix4D SA (Switzerland)

What are the Recent Developments in Global 3D Imaging Market?

- In June 2025, Royal Philips announced the CE-marking of its SmartCT image reconstruction solution, designed to accelerate decision-making in the treatment of stroke and neurovascular conditions, built for the Philips Azurion neuro biplane system, enabling real-time 3D visualization of brain tissue, blood vessels, and interventional devices, significantly enhancing procedural efficiency and clinical accuracy

- In May 2025, GE HealthCare launched CleaRecon DL, a deep-learning-powered technology to improve cone-beam CT (CBCT) image quality, receiving 510(k) clearance and CE mark, allowing clinicians to maximize 3D image guidance for better clinical and operational outcomes, thereby strengthening precision in imaging workflows

- In July 2024, Alphatec Holdings, Inc. announced the commercial launch of EOS Insight, an advanced cloud-based platform supporting the entire spine surgery process, offering AI-driven alignment calculations, 3D surgical planning simulations, patient-specific rods, intra-operative adjustments, and post-operative analytics, enhancing patient outcomes while streamlining surgical procedures and clinical efficiency

- In March 2024, Siemens Healthineers received FDA clearance for the CIARTIC Move, a mobile C-arm with automated capabilities, enabling faster and standardized 2D fluoroscopic and 3D cone-beam CT imaging for trauma, orthopedic, and spine surgeries, as well as vascular and general surgical procedures, thereby reducing imaging time and improving procedural consistency

- In July 2023, GE HealthCare formed a distribution partnership with DePuy Synthes, Johnson & Johnson's orthopedics division, to expand access to the OEC 3D Imaging System in the U.S., combining advanced imaging technology with DePuy Synthes' product line, enhancing availability for surgeons and improving patient care in complex spinal procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.