Germany At-Home Testing Kits Market Analysis and Size

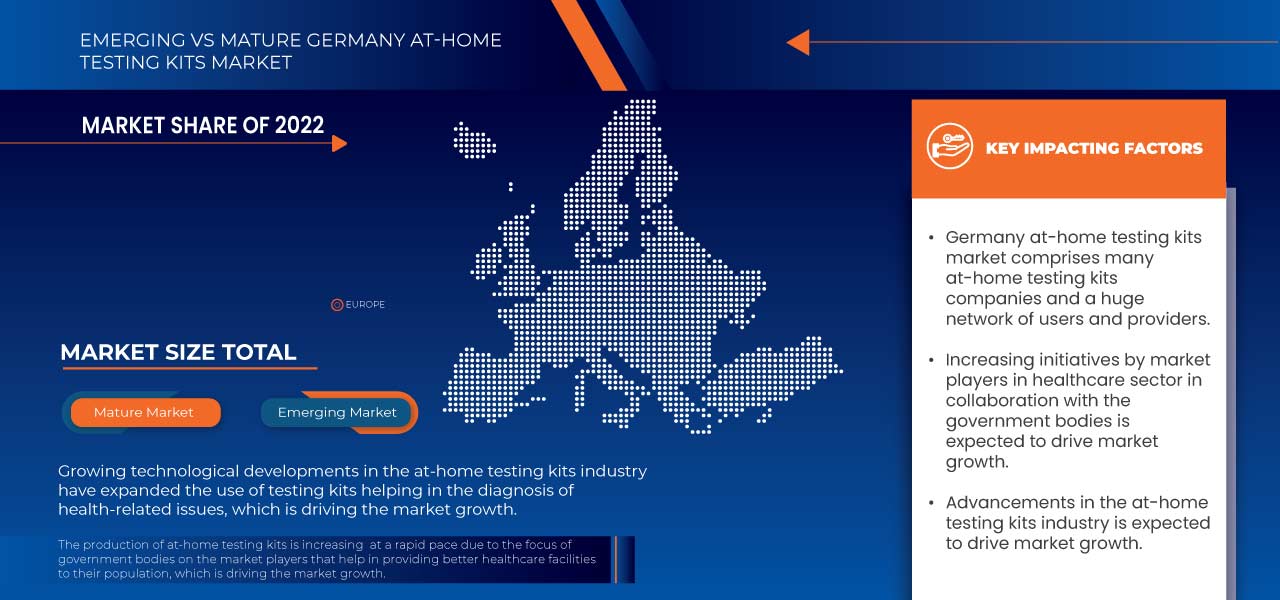

The Germany at-home testing kits market is expected to grow due to the rising awareness regarding several products. At-home or self-testing kits are easily available at pharmacies, and procuring them has become extremely easy. Various medical companies are venturing into this space as they rapidly manufacture self-test kits.

This widespread availability can also be attributed to online pharmacies' medical start-ups, making availability easier by clicking a button. In addition, these self-testing kits are available without a prescription, which can drive the at-home testing kits market. At-home testing kits allow end-users to collect their specimen at home and perform it at home or send it to the lab for testing. At-home testing kits have undoubtedly eased the process of confirming the person's concern, whether it is a home pregnancy test or HIV, or any other infectious diseases tests.

These home tests are easy to use and are affordable too. However, there is always doubt about the accuracy of the results, which is expected to restrain market growth. However, a false positive test result may cause anxiety and stress to the person, even if they do not have it. It is very upsetting and disturbing to the person to receive false positive or negative results. Today, many companies produce rapid diagnostic test kits for COVID-19, which can be performed at home. But there are various accuracy-related issues, so the distribution of those at-home test kits has been suspended from verifying their reliability.

Data Bridge Market Research analyzes that the Germany at-home testing kits market is expected to grow at a CAGR of 10.5% from 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in Million and Pricing in USD |

|

Segments Covered |

Test Type (Beauty and Wellness, Health, Nutrition, Pregnancy Test, STD Test, Ovulation Predictor Test Kit, Drug Abuse Test Kit, and Other Test Types), Type (Cassette, Strip, Midstream, Test Panel, Dip Card, and Others), Age (Pediatric, Adult, and Geriatric), Sample Type (Urine, Blood, Saliva, and Other Sample Types), Income (Low Income, Middle Income, and High Income), Usage (Disposable and Reusable), Distribution Channels (Retail Pharmacies, Drug Store, Supermarket/Hypermarket and Online Pharmacies) |

|

Country Covered |

Germany |

|

Market Players Covered |

Abbott, Siemens Healthcare GmbH, F. Hoffman- La Roche Ltd, Quidel Corporation, Cardinal Health, bioLytical Laboratories Inc., kiweno GmbH, Nova Biomedical, Johnson & Johnson Services, Inc., and B. Braun SE among others |

Market Definition

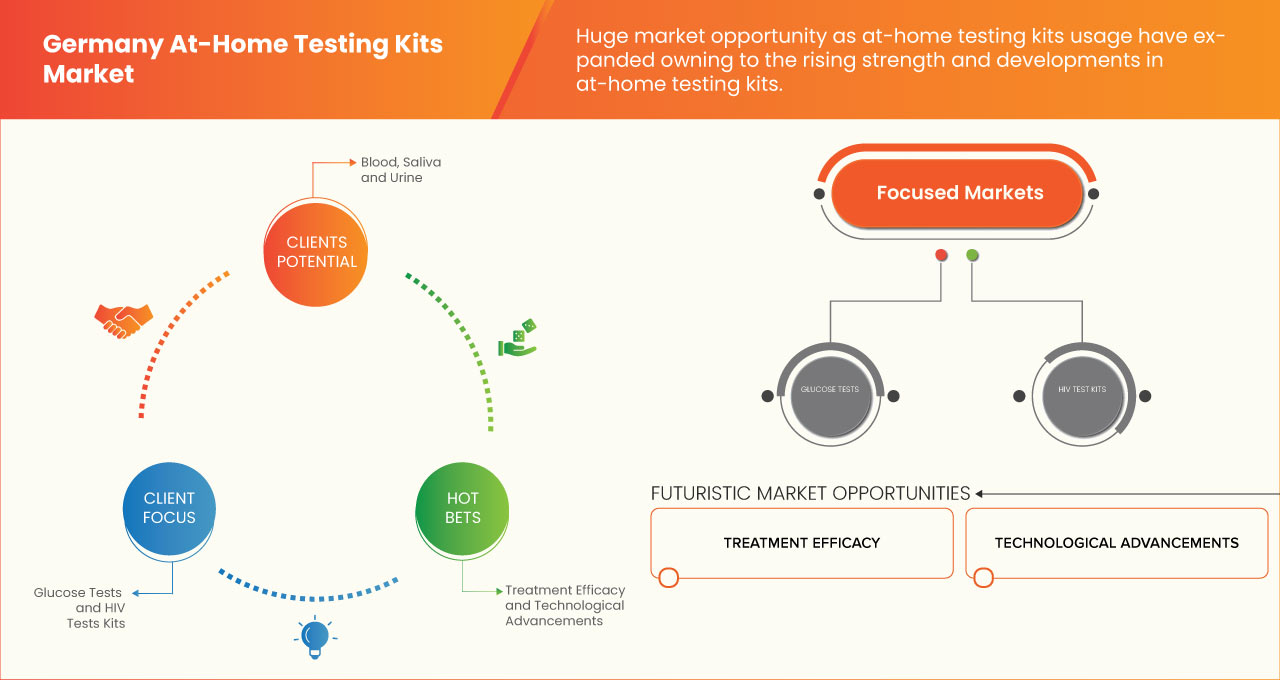

At-home testing kits help the person to perform tests at home and give them rapid results in a minute. They also include monitoring equipment to check and control the health of diabetic patients continuously. At-home tests are convenient to perform comfortably and are available at a very affordable rate. Self-tests are usually the advanced versions of rapid, point-of-care test kits originally designed for healthcare professionals and can be performed by the common person. Their processes, packaging, and instructions have been simplified to guide a person through the steps of taking a test. Various at-home test kits are available, including beauty test kits, H.I.V. tests, pregnancy tests, diabetes, ovulation test, and infectious diseases such as malaria, influenza, and others. Blood, urine, and oral fluid can be taken as a sample for performing these rapid at-home tests.

Germany At-Home Testing Kits Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in the adoption of at-home testing kits due to the increase in the prevalence of health disorders

With rising economic growth, people are more interested in long-term health and wellness. Diabetic patients need devices to monitor their sugar levels; checking pregnancy increases the demand for pregnancy strips; monitoring of blood pressure results in demand for devices such as blood pressure monitors and sphygmomanometers; stress and anxiety increase the demand for stress test kits and others. Along with managing the disorder, it also helps check skin and other body-related issues such as allergies.

Earlier, people often visited hospitals/clinics/diagnostic centers for basic problems. However, as awareness has grown regarding several products, such as at-home testing kits for beauty and wellness, health, nutrition, and others, this behavior has changed and has turned the trend. Nowadays, people prefer to get their basic tests done using test kits at home before visiting a doctor or technician.

This has become even more prominent due to this pandemic as people are adopting more self-help testing kits due to several restrictions in place. It has become a boon in disguise for hospitals/clinics/ diagnostic centers and patients, as hospitals/clinics/diagnostic centers are already stretched thin and can entirely focus on COVID-19 patients. The patients can save hefty costs of doctor visits and medicine fees. It has become highly convenient for consumers as they can quickly know their test results at their fingertips.

Thus, the rising adoption of at-home testing kits due to convenience and rapid results is expected to drive market growth.

- Easy availability of self-testing kits at pharmacies and online stores

At-home or self-testing kits are easily available at pharmacy stores and online stores, and it has become effortless to procure them. Various medical companies are venturing into this space as they rapidly manufacture self-test kits.

This widespread availability can also be attributed to online pharmacies' medical start-ups, making availability easier by clicking a button. In addition, these self-testing kits are available without any prescription.

Specialty online shops, emerging digital marketplaces, e-commerce, and internet advertising are further attracting the market. Online stores provide much-needed privacy options with doorstep delivery, widening their market reach.

Thus, self-testing kits have become widely available for various diseases due to the rapid manufacturing by medical testing companies and are expected to drive market growth.

Opportunity

- Expanding business through subsidiaries

Companies operate their business through subsidiaries around the world. This would help the company to generate more revenue by serving a large customer base through its subsidiaries, which will create the opportunity for the company to expand its business and generate more revenue. Players with a major percentage share in the market alone are continuously expanding the health wellness business through their subsidiaries; they have a presence almost globally. This helps them to attract more customers and create a database of customers across various regions, ultimately helping them to identify the region and countries which require more focus and plans for helping the healthcare customers to make structural decisions.

This syndicates that the company is operating its business through its number of subsidiaries in different regions of the world. This helped the company generate more revenue and create an opportunity for market growth.

Restraint/Challenge

- Inaccuracy of results by self-testing kits

At-home testing kits allow end-users to collect their specimen at home and perform it at home or send it to the lab for testing. At-home testing kits have undoubtedly eased the process of confirming the person's concern, whether it is a home pregnancy test or HIV, or any other infectious diseases tests.

These home tests are easy to use and affordable too. However, there is always doubt about the accuracy of the results. STD home monitoring can be more comfortable than visiting a hospital or doctor's office. It will also help reduce the risk of the STD being spread or acquired when you are screened.

However, a false-positive test result may cause anxiety and stress to the person, even if they do not have it. It is very upsetting and disturbing to the person to receive false positive or negative results. Today, many companies produce rapid diagnostic test kits for STDs, diabetes, and others, which can be performed at home. But there are various accuracy-related issues, so the distribution of those at-home test kits has been suspended from verifying their reliability.

Various factors can cause false results, such as manufacturing defects, low feasibility, incorrect instructions, or misinterpreting results.

Thus, end-users doubt the reliability of the rapid home testing kits, which is expected to restrain the market growth.

Recent Development

- In April 2023, Abbott announced that the U.S. Food and Drug Administration (FDA) had cleared a reader for its FreeStyle Libre 3 integrated continuous glucose monitoring (iCGM) system, which features the world's smallest, thinnest, and most discreet5 glucose sensor. With the FDA's clearance of a standalone reader, the company will have expected to generate more revenue.

Germany At-Home Testing Kits Market Scope

Germany at-home testing kits market is categorized into seven notable segments based on test type, type, income, age, sample type, usage, and distribution channels. The growth amongst these segments will help you analyze market growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

Test Type

- Beauty and Wellness

- Health

- Nutrition

- Pregnancy Test

- STD Test Kit

- Ovulation Predictor Test Kit

- Drug Abuse Test Kit

- Others Test Types

On the basis of test type, the market is segmented into beauty and wellness, health, nutrition, pregnancy test, STD test kit, ovulation predictor test kit, drug abuse test kit, and other test types.

Type

- Cassette

- Strip

- Midstream

- Test Panel

- Dip Card

- Others

On the basis of type, the market is segmented into cassette, strip, midstream, test panel, dip card, and others.

Income

- Low Income

- Middle Income

- High Income

On the basis of income, the market is segmented into low income, middle income, and high income.

Age

- Pediatric

- Adult

- Geriatric

On the basis of age, the market is segmented into pediatric, adult, and geriatric.

Sample Type

- Urine

- Blood

- Saliva

- Other Sample Types

On the basis of sample type, the market is segmented into urine, blood, saliva, and others sample types.

Usage

- Disposable

- Reusable

On the basis of usage, the market is segmented into disposable and reusable.

Distribution Channels

- Retail Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Online Pharmacies

On the basis of distribution channels, the market is segmented into retail pharmacies, drug store, supermarket/hypermarket, and online pharmacies.

Competitive Landscape and Germany At-Home Testing Kits Market Share Analysis

Germany at-home testing kits market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the market.

Some of the major market players operating in the Germany at-home testing kits market are Abbott, Siemens Healthcare GmbH, F. Hoffman- La Roche Ltd, Quidel Corporation, Cardinal Health, bioLytical Laboratories Inc., kiweno GmbH, Nova Biomedical, Johnson & Johnson Services, Inc., and B. Braun SE among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GERMANY AT-HOME TESTING KITS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE

2.8 MARKET POSITION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 STRATEGIC INITIATIVES

4.4 BRAND ANALYSIS

4.5 PRICING ANALYSIS

5 GERMANY AT-HOME TESTING KITS MARKET: REGULATIONS

5.1 REGULATION IN EUROPE

5.2 GUIDELINES FOR TESTING KITS

6 GERMANY AT-HOME TESTING KITS MARKET, MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE ADOPTION OF AT-HOME TESTING KITS DUE TO THE INCREASE IN THE PREVALENCE OF HEALTH DISORDERS

6.1.2 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES AND ONLINE STORES

6.1.3 INCREASE IN AWARENESS ABOUT THE IMPORTANCE OF STD DIAGNOSIS

6.1.4 LOW COST AND EASE TO USE AT-HOME TEST KITS

6.2 RESTRAINTS

6.2.1 PRODUCT RECALL OF AT-HOME TESTING KITS

6.2.2 INACCURACY OF RESULTS BY SELF-TESTING KITS

6.2.3 STRINGENT GOVERNMENT REGULATIONS FOR THE MANUFACTURING AND DISTRIBUTION OF TESTING KITS

6.3 OPPORTUNITIES

6.3.1 EXPANDING BUSINESS THROUGH SUBSIDIARIES

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.4 CHALLENGES

6.4.1 LOW AWARENESS IN SOCIETY

6.4.2 REDUCTION IN THE R&D BUDGET

7 GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 HEALTH

7.2.1 DIABETES KITS

7.2.2 KIDNEY FUNCTION TEST KITS

7.2.3 LIVER FUNCTION TEST KITS

7.2.4 PROTEIN KITS

7.2.5 IRON STATUS KITS

7.2.6 HEART DISEASE RISK TEST KITS

7.2.7 THYROID FUNCTION

7.2.8 RED BLOOD CELLS

7.2.9 WHITE BLOOD CELLS

7.2.10 CLOTTING STATUS

7.2.11 HORMONE

7.2.12 PSA

7.2.13 MENOPAUSE TEST

7.2.14 ANXIETY

7.2.15 ASTHMA

7.2.16 ATRIAL FIBRILLATION

7.2.17 GOUT

7.2.18 HDL AND LDL CHOLESTROL TEST KITS

7.2.19 HIGH BLOOD PRESSURE

7.2.20 OTHERS

7.3 BEAUTY AND WELLNESS

7.3.1 SKIN MICROBIME TEST

7.3.2 GENETIC BASED TEST KITS

7.3.3 FOOD SENSITIVITY TEST KITS

7.3.4 SEX HORMONE

7.3.4.1 FEMALE HORMONE TEST

7.3.4.2 MALE HORMONE TEST

7.3.5 HAIR, NAILS AND SKIN TEST KITS

7.3.6 STRESS TEST KITS

7.3.7 ALCOHOL FLUSH REACTION

7.3.8 CAFFEINE CONSUMPTION

7.3.9 DEEP SLEEP

7.3.10 MUSCLE COMPOSITION

7.3.11 SATURATED FAT

7.3.12 SLEEP MOVEMENT

7.3.13 ALLERGY TESTING

7.3.14 INTOLERANCE TESTING

7.3.14.1 LACTOSE INTOLERANCE

7.3.14.2 VEGAN INTOLERANCE TESTING

7.3.14.3 OTHER TEST

7.3.15 GUT MICROBIOME TEST

7.3.16 SKIN DNA TEST

7.4 STD TEST

7.4.1 HIV TEST

7.4.2 GONORRHEA TEST

7.4.3 SYPHILIS TEST

7.4.4 HERPES TEST

7.4.5 TRICHOMONIASIS

7.4.6 HEPATITIS B

7.4.7 HEPATITIS C

7.4.8 MEASLES

7.4.9 RUBELLA

7.4.10 VARICELLA

7.4.11 CHLAMYDIA TEST

7.4.12 OTHERS

7.5 NUTRITION

7.5.1 VITAMINS

7.5.1.1 D3

7.5.1.2 B12

7.5.1.3 ACTIVE B12

7.5.2 VITALITY

7.5.2.1 HEALTH MARKERS

7.5.2.2 IRON STATUS

7.5.2.3 MINERALS

7.5.3 OMEGA 3 TEST

7.5.4 IODINE DEFICIENCY TEST

7.5.5 ZINC TEST

7.5.6 SELENIUM TEST

7.5.7 MAGNESIUM BLOOD TEST

7.5.8 FERRITIN TEST

7.5.9 AMINO ACID TEST

7.6 PREGNANCY TEST

7.6.1 STRIP TESTS

7.6.2 MIDSTREAM TEST

7.6.3 CASSETTE TEST

7.6.4 DIGITAL TEST

7.6.5 HCG URINE TEST

7.6.6 HCG BLOOD TEST

7.6.7 LH URINE TEST

7.6.8 FSH URINE TEST

7.7 DRUG ABUSE TEST KITS

7.7.1 MARUUANA KITS

7.7.2 OPIATES KITS

7.7.3 ALCOHOL KITS

7.7.4 OTHERS

7.8 OVULATION PREDICTOR TEST KIT

7.9 OTHERS TEST TYPES

7.9.1 MALE INFERTILITY TEST TYPE

7.9.2 URINARY TRACT INFECTIONS TEST

7.9.3 MENOPAUSE TEST KITS

7.9.4 FECAL OCCULT BLOOD TEST

7.9.5 OTHERS

8 GERMANY AT-HOME TESTING KITS MARKET, BY TYPE

8.1 OVERVIEW

8.2 STRIP

8.2.1 RETAIL PHARMACIES

8.2.2 ONLINE PHARMACIES

8.2.3 DRUG STORE

8.2.4 SUPERMARKET/HYPERMARKET

8.2.5 CASSETTES

8.2.6 RETAIL PHARMACIES

8.2.7 ONLINE PHARMACIES

8.2.8 DRUG STORE

8.2.9 SUPERMARKET/HYPERMARKET

8.2.10 MIDSTREAM

8.2.11 RETAIL PHARMACIES

8.2.12 ONLINE PHARMACIES

8.2.13 DRUG STORE

8.2.14 SUPERMARKET/HYPERMARKET

8.2.15 DIP CARD

8.2.16 RETAIL PHARMACIES

8.2.17 ONLINE PHARMACIES

8.2.18 DRUG STORE

8.2.19 SUPERMARKET/HYPERMARKET

8.2.20 TEST PANEL

8.2.21 RETAIL PHARMACIES

8.2.22 ONLINE PHARMACIES

8.2.23 DRUG STORE

8.2.24 SUPERMARKET/HYPERMARKET

8.3 OTHERS

9 GERMANY AT-HOME TESTING KITS MARKET, BY AGE

9.1 OVERVIEW

9.2 ADULT

9.3 GERIATRIC

9.4 PEDIATRIC

10 GERMANY AT-HOME TESTING KITS MARKET, BY USAGE

10.1 OVERVIEW

10.2 DISPOSABLE

10.3 REUSABLE

11 GERMANY AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE

11.1 OVERVIEW

11.2 BLOOD

11.3 SALIVA

11.4 URINE

11.5 OTHER SAMPLE TYPES

12 GERMANY AT-HOME TESTING KITS MARKET, BY INCOME

12.1 OVERVIEW

12.2 MIDDLE INCOME

12.3 LOW INCOME

12.4 HIGH INCOME

13 GERMANY AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL PHARMACIES

13.3 ONLINE PHARMACIES

13.4 DRUG STORE

13.5 SUPERMARKET/HYPERMARKET

14 GERMANY AT-HOME TESTING KITS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ABBOTT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUS ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 F. HOFFMANN- LA ROCHE LTD

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 SIEMENS HEALTHCARE GMBH

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 QUIDEL CORPORATION.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 CARDINAL HEALTH.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ASCENSIA DIABETES CARE HOLDINGS AG.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 B. BRAUN SE MELSUNGEN AG

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOLYTICAL LABORATORIES INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BTNX INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CARE DIAGNOSTICA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 DEXCOM, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 DRÄGERWERK AG & CO. KGAA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 JOHNSON & JOHNSON SERVICES, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 KIWENO GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 MP BIOMEDICALS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NOVA BIOMEDICAL

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PIRAMAL ENTERPRISES LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 PRIMA LAB SA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SELFDIAGNOSTICS OU

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SA SCIENTIFIC LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PRICES OF PRODUCTS OFFERED BY SOME OF THE COMPANIES:

TABLE 2 GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 3 GERMANY HEALTH IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 4 GERMANY BEAUTY AND WELLNESS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 5 GERMANY SEX HORMONE IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 6 GERMANY INTOLERANCE TESTING IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 7 GERMANY STD TEST IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 8 GERMANY NUTRITION IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 9 GERMANY VITAMINS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 10 GERMANY VITALITY IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 11 GERMANY PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY PRODUCT, 2021-2030 (USD MILLION), 2021-2030 (USD MILLION)

TABLE 12 GERMANY PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 13 GERMANY DRUG ABUSE TEST KITS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 14 GERMANY OTHER TEST TYPE IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 15 GERMANY AT-HOME TESTING KITS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 GERMANY STRIP IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 17 GERMANY CASSETTES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 18 GERMANY MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 19 GERMANY MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 20 GERMANY MIDSTREAM IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNELS, 2021-2030 (USD MILLION)

TABLE 21 GERMANY AT-HOME TESTING KITS MARKET, BY AGE, 2021-2030 (USD MILLION)

TABLE 22 GERMANY AT-HOME TESTING KITS MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 23 GERMANY AT-HOME TESTING KITS MARKET, BY SAMPLE TYPE, 2021-2030 (USD MILLION)

TABLE 24 GERMANY AT-HOME TESTING KITS MARKET, BY INCOME, 2021-2030 (USD MILLION)

TABLE 25 GERMANY AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 GERMANY AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 2 GERMANY AT-HOME TESTING KITS MARKET: DATA TRIANGULATION

FIGURE 3 GERMANY AT-HOME TESTING KITS MARKET: DROC ANALYSIS

FIGURE 4 GERMANY AT-HOME TESTING KITS MARKET: GERMANY VS REGIONAL MARKET ANALYSIS

FIGURE 5 GERMANY AT-HOME TESTING KITS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GERMANY AT-HOME TESTING KITS MARKET: MARKET POSITION COVERAGE GRID

FIGURE 7 GERMANY AT-HOME TESTING KITS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GERMANY AT-HOME TESTING KITS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GERMANY AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 10 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES AND ONLINE STORES IS EXPECTED TO DRIVE GERMANY AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 HEALTH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GERMANY AT-HOME TESTING KITS MARKET, BY TEST TYPE IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GERMANY AT HOME TESTING KITS MARKET

FIGURE 13 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2022

FIGURE 14 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 15 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 16 GERMANY AT-HOME TESTING KITS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 17 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, 2022

FIGURE 18 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, 2021-2030 (USD MILLION)

FIGURE 19 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 GERMANY AT-HOME TESTING KITS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, 2022

FIGURE 22 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, 2023-2030 (USD MILLION)

FIGURE 23 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, CAGR (2023-2030)

FIGURE 24 GERMANY AT-HOME TESTING KITS MARKET: BY AGE, LIFELINE CURVE

FIGURE 25 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, 2022

FIGURE 26 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, 2023-2030 (USD MILLION)

FIGURE 27 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, CAGR (2023-2030)

FIGURE 28 GERMANY AT-HOME TESTING KITS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 29 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2022

FIGURE 30 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, 2021-2030 (USD MILLION)

FIGURE 31 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, CAGR (2023-2030)

FIGURE 32 GERMANY AT-HOME TESTING KITS MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 33 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, 2022

FIGURE 34 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, 2021-2030 (USD MILLION)

FIGURE 35 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, CAGR (2023-2030)

FIGURE 36 GERMANY AT-HOME TESTING KITS MARKET: BY INCOME, LIFELINE CURVE

FIGURE 37 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 38 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 39 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 40 GERMANY AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 GERMANY AT-HOME TESTING KITS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.