GCC Identity Verification Market Analysis and Size

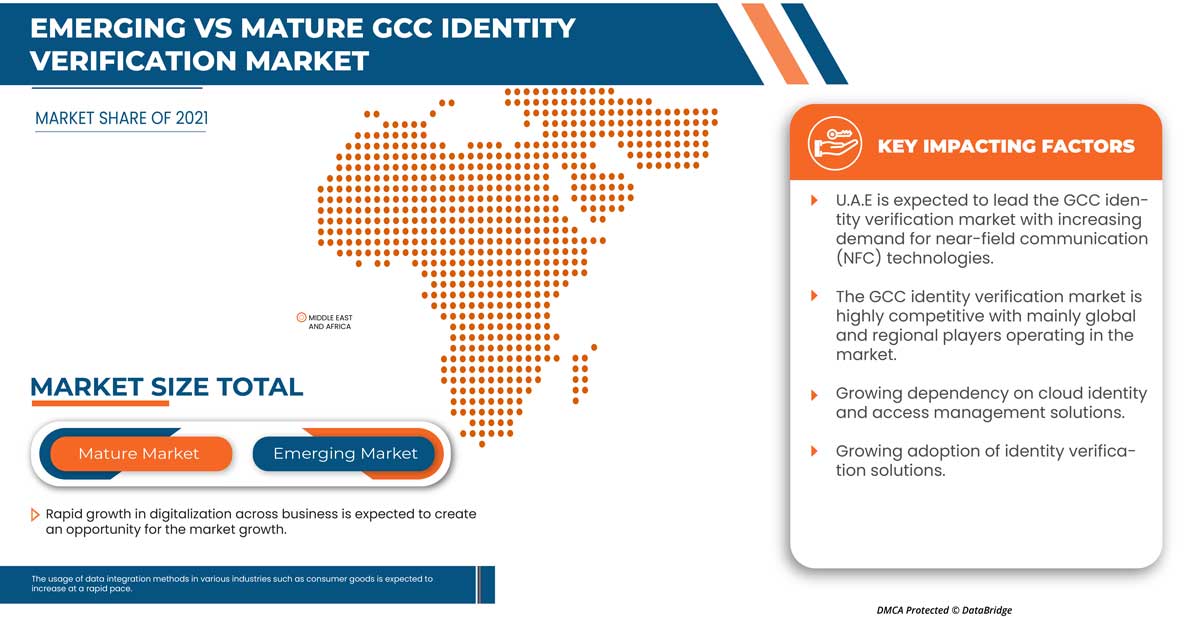

The growth of the GCC identity verification market has been highly boosted by the increasing adoption of digital payments by customers. Growing technological innovations in industries are boosting the market growth. Identity verification requires high initial capital for installation, maintenance, and other technical expertise costs, which act as a major restraint factor for the market.

Data Bridge Market Research analyzes that the GCC identity verification market is expected to reach a value of USD 996,843.09 thousand by 2029, at a CAGR of 11.9% during the forecast period. Solutions in identity verification account for the most prominent modules mode segment. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Base Year |

2021 |

|

Forecast Period |

2022 to 2029 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

USD Thousand |

|

Segments Covered |

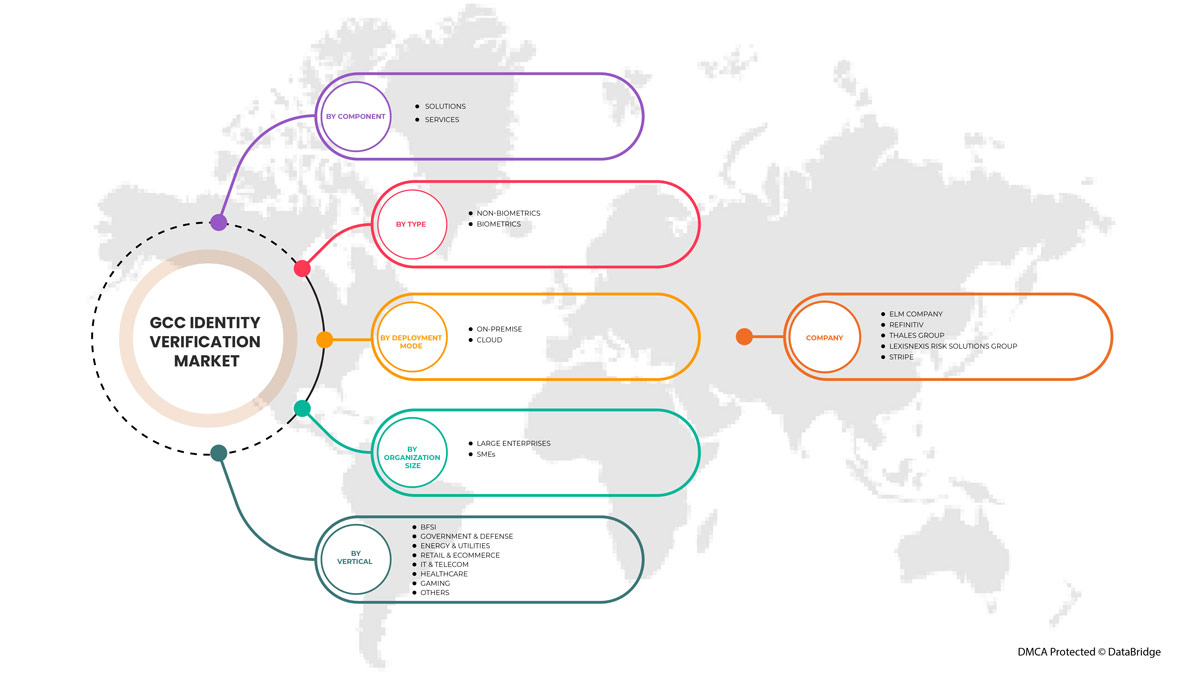

By Component (Solutions and Services), Type (Non-Biometrics and Biometrics), Deployment Mode (On-Premise and Cloud), Organization Size (Large Enterprises and SMEs), Vertical (BFSI, Government & Defense, Energy & Utilities, Retail & E-commerce, IT and Telecom, Healthcare, Gaming, and Others). |

|

Countries Covered |

U.A.E, Kingdom of Saudi Arabia, Qatar, Kuwait, Oman, Bahrain |

|

Market Players Covered |

Experian Information Solutions, Inc. (A Subsidiary of Experian plc), LexisNexis Risk Solutions Group., Onfido, GB Group plc ('GBG'), Acuant, Inc., IDEMIA, Thales Group, Shufti Pro, Uqudo, Western Union Holdings, Inc., Plaid Inc., IDMERIT., AccuraTechnolabs, Ping Identity, IDnow., AML UAE., Stripe, Elm Company, Refinitiv, Trulioo., QlikTech International AB, among others. |

Market Definition

Identity verification refers to the services and solutions used to verify the authenticity of a person's physical identity or their documents, such as a driver's license, passport, or a nationally issued identity document and others. Identity verification is an important process that ensures a person's identity matches the one it is supposed to be. Identity verification solutions and services ensure that a real person is operating behind a process and proving the one they claim to be, preventing false identities or fraud. Identity verification is an essential requirement in many business processes and procedures.

GCC Identity Verification Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

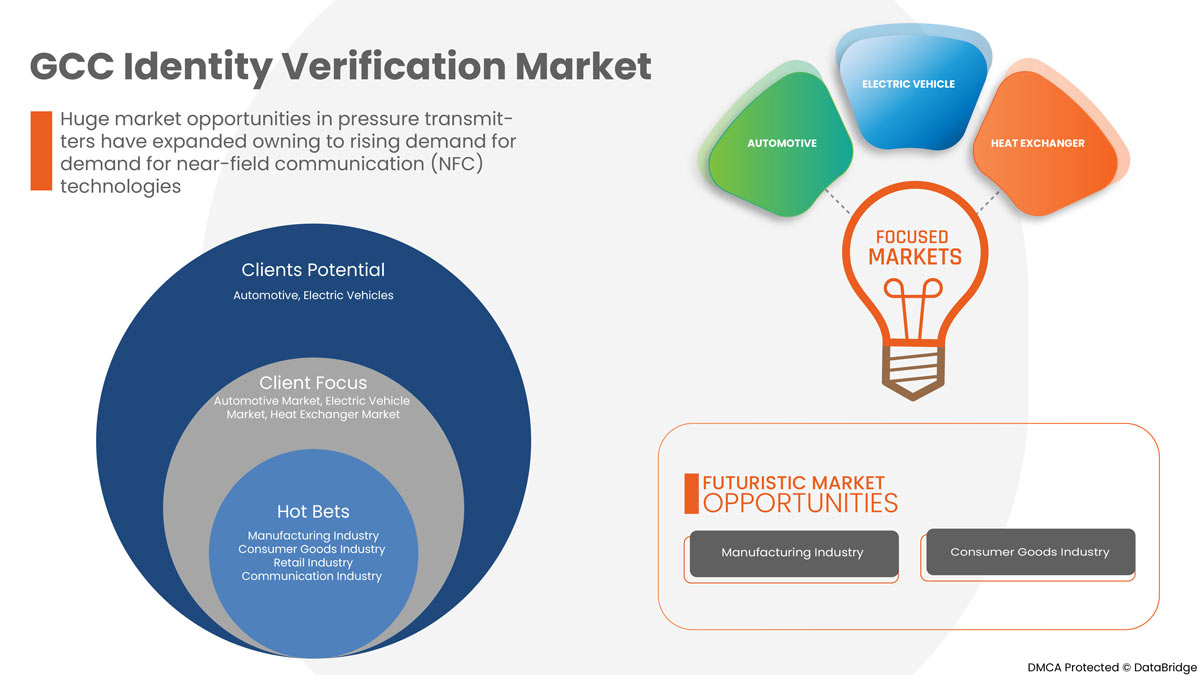

- Increasing demand for near-field communication (NFC) technologies

Near field communication (NFC) is a contactless communication technology based on a radio frequency (RF) with a working frequency of 13.56 MHz. NFC technology is designed to exchange data between two electronic devices through a simple touch. In recent times NFC technology has gained immense popularity owing to factors such as COVID cries across the globe and the contactless services offered by these devices during these cries.

- Heighten dependency on cloud identity and access management solutions

Identity and access management (IAM) solutions are a set of security disciplines that enables the right individuals to access the right content for the right intention. Identity and Access Management solutions ensure the user's identity before the content's usage. Identity and access management (IAM) solutions have existed for quite some time. Initially, companies and enterprises deployed on-premises identity and access management (IAM) software to manage identity and access strategies. But in recent times, technological advancement has led to the growth of cloud-based identity and access management (IAM) solutions or cloud-based Identity-as-a-Service (IDaaS). Cloud technologies aided with artificial intelligence (AI), machine learning (ML), and deep learning have the upper hand on on-premises technologies.

- Growing adoption of identity verification solutions

Identity verification refers to the services and solutions used to verify and authenticate a person's physical identity or documents such as a driver's license, passport, or nationally-issued identity document. Identity verification is an important process that ensures a person's identity matches the one it is supposed to be.

Restraints/Challenges

- Surge in fraudulent activities

Identity verification solutions and services ensure that there is a real person operating behind a process and prove that the one is who he or she claims to be, preventing false identities from committing fraud. Identity verification and authentication is an essential requirement in various businesses.

- Lack of awareness regarding identity verification solutions

There is a huge demand for digitization and technological advancement across industries in various countries. Identity verification and authentication solutions allow organizations to quickly verify the digital identities of new and existing customers.

- High initial cost

Identity verification involves software, solution, and services that ensure that a real person is operating behind a process. Verification and authentication of a person's identity is a crucial and important process for a business and incurs high cost.

Post-COVID-19 Impact on GCC Identity Verification Market

COVID-19 significantly impacted the GCC identity verification market as almost every country opted to shut down every production facility except those dealing in producing essential goods. The government took some strict actions, such as shutting down the production and sale of non-essential goods, blocking international trade, and many more to prevent the spread of COVID-19. The only business operating during this pandemic was the essential services allowed to open and run the processes.

The market growth is rising due to government policies to boost international trade post-COVID-19. Also, the benefits offered by industrial hoses for optimizing costs and routes are raising the demand for the market. However, some nations' congestion associated with trade routes and trade restrictions is restraining the market growth. The shutdown of production facilities during the pandemic significantly impacted the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities to improve the technology involved in the industrial hoses. The companies will bring advanced and accurate solutions to the market. In addition, government initiatives to boost international trade have led to market growth.

Recent Developments

- In September 2022, Elm participated in a global AI summit in Riyadh. The participation has helped the company to look for future aspects of artificial intelligence and solve complex problems. This will help to improve the brand image of the company.

- In September 2019, Refinitiv announced the launch of 'QUAL-ID,' integrating digital identity technology with KYC due diligence. The solution has been launched to avoid fraudulent activities and protect data. The company will be able to enter a new cover market and attract more customers.

GCC Identity Verification Market Scope

The GCC identity verification market is segmented into five notable segments based on component, type, deployment mode, organization size, and vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Component

- Solutions

- Services

On the basis of component, the GCC identity verification market has been segmented into solutions and services.

By Type

- Non-Biometrics

- Biometrics

On the basis of type, the GCC identity verification market has been segmented into biometrics and non-biometrics.

By Deployment Mode

- On-Premise

- Cloud

On the basis of deployment mode, the GCC identity verification market has been segmented into cloud and on-premise.

By Organization Size

- Large Enterprises

- SMEs

On the basis of organization size, the GCC identity verification market has been segmented into large enterprises and SMEs.

By Vertical

- BFSI

- Government & Defence

- Energy & Utilities

- Retail & Ecommerce

- It & Telecom

- Healthcare

- Gaming

- Others

On the basis of vertical, the GCC identity verification market has been segmented into BFSI, government & defense, energy & utilities, retail & ecommerce, IT & telecom, healthcare, gaming, and others.

GCC Identity Verification Market Regional Analysis/Insights

The GCC identity verification market is analyzed, and market size insights and trends are provided by the country, component, type, deployment mode, organization size, and vertical, as referenced above.

Some countries covered in the GCC identity verification market are U.A.E, Kingdom of Saudi Arabia, Qatar, Kuwait, Oman, and Bahrain, among others.

U.A.E is expected to grow in the market as it is a technologically advanced region with a wide presence of major market players, which subsequently increases the adoption of identity verification.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of GCC brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and GCC Identity Verification Market Share Analysis

The GCC identity verification market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the GCC identity verification market.

Some of the major players operating in the GCC identity verification market are Experian Information Solutions, Inc. (A Subsidiary of Experian plc), LexisNexis Risk Solutions Group., Onfido, GB Group plc ('GBG'), Acuant, Inc., IDEMIA, Thales Group, Shufti Pro, Uqudo, Western Union Holdings, Inc., Plaid Inc., IDMERIT., AccuraTechnolabs, Ping Identity, IDnow., AML UAE., Stripe, Elm Company, Refinitiv, Trulioo., QlikTech International AB, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GCC IDENTITY VERIFICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1.1 AI

4.1.2 INTERNET OF THINGS (IOT)

4.1.3 5G & LTE

4.1.4 NFC TECHNOLOGY

4.1.5 SMART BIOMETRIC TECHNOLOGIES

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING

4.2.3 MARKETING AND DISTRIBUTION

4.2.4 END USERS

4.3 USE CASE

4.3.1 FINANCIAL SERVICES

4.3.2 E-COMMERCE AND RETAIL

4.3.3 HEALTHCARE

4.3.4 GOVERNMENT

4.3.5 EDUCATION

4.4 REGULATION COVERAGE

4.5 KEY FEATURES OFFERED BY IDENTITY VERIFICATION SOLUTIONS

4.5.1 DIGITAL ONBOARDING

4.5.2 E KYC

4.5.3 REGTECH SOLUTIONS

4.6 PORTER'S MODEL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES

5.1.2 HIGH DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.3 GROWING ADOPTION OF IDENTITY VERIFICATION SOLUTIONS

5.1.4 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINTS

5.2.1 SURGE IN FRAUDULENT ACTIVITIES

5.2.2 LACK OF AWARENESS REGARDING IDENTITY VERIFICATION SOLUTIONS

5.2.3 HIGH INITIAL COST

5.3 OPPORTUNITIES

5.3.1 HIGH ADOPTION OF RAZOR-SHARP BIOMETRICS IDENTITY VERIFICATION SOLUTIONS

5.3.2 INCREASING DEMAND FOR IDENTITY VERIFICATION SERVICES IN SMARTPHONES

5.3.3 WIDE RANGE ADOPTION OF IDENTITY VERIFICATION SOLUTIONS ACROSS BFSI

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS WHILE OFFERING SERVICE FOR IDENTITY VERIFICATION SOLUTIONS

5.4.2 STORAGE CHALLENGE FOR HUGE VARIANTS OF DATA/INFORMATION

6 GCC IDENTITY VERIFICATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 DOCUMENT/ID VERIFICATION

6.2.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION

6.2.3 AUTHENTICATION

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 IMPLEMENTATION

6.3.2.2 TRAINING AND SUPPORT

6.3.2.3 CONSULTING

6.3.3 INTEGRATION SERVICES

7 GCC IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

8 GCC IDENTITY VERIFICATION MARKET, BY TYPE

8.1 OVERVIEW

8.2 BIOMETRICS

8.3 NON-BIOMETRICS

9 GCC IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMES

10 GCC IDENTITY VERIFICATION MARKET, BY VERTICAL

10.1 OVERVIEW

10.2 GOVERNMENT AND DEFENSE

10.2.1 SOFTWARE

10.2.2 SERVICES

10.3 BFSI

10.3.1 SOFTWARE

10.3.2 SERVICES

10.4 RETAIL AND ECOMMERCE

10.4.1 SOFTWARE

10.4.2 SERVICES

10.5 HEALTHCARE

10.5.1 SOFTWARE

10.5.2 SERVICES

10.6 IT AND TELECOM

10.6.1 SOFTWARE

10.6.2 SERVICES

10.7 ENERGY AND UTILITIES

10.7.1 SOFTWARE

10.7.2 SERVICES

10.8 GAMING

10.8.1 SOFTWARE

10.8.2 SERVICES

10.9 OTHERS

10.9.1 SOFTWARE

10.9.2 SERVICES

11 GCC IDENTITY VERIFICATION MARKET, BY COUNTRY

11.1 UAE

11.2 KINGDOM OF SAUDI ARABIA

11.3 QATAR

11.4 KUWAIT

11.5 OMAN

11.6 BAHRAIN

12 GCC IDENTITY VERIFICATION MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GCC

12.2 COMPANY SHARE ANALYSIS: UAE

12.3 COMPANY SHARE ANALYSIS: KSA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ELM COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 REFINITIV

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 THALES GROUP

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SOLUTION PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 LEXISNEXIS RISK SOLUTIONS GROUP.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 STRIPE

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 GB GROUP PLC

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SOLUTION PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AML UAE.

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICES PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ACCURATECHNOLABS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 ACUANT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 SOLUTION PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 EXPERIAN INFORMATION SOLUTIONS, INC. (A SUBSIDIARY OF EXPERIAN PLC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 SOLUTION PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 IDNOW.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 IDMERIT.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 IDEMIA

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 JUMIO

14.14.1 COMPANY SNAPSHOT

14.14.2 SOLUTION PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 NUANCE COMMUNICATIONS, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 ONESPAN.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 ONFIDO

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PLAID INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PING IDENTITY.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 QLIKTECH INTERNATIONAL AB

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 SHUFTI PRO

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 TRULIOO.

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 UQUDO

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.24 WESTERN HOLDING INC

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCT PORTFOLIO

14.24.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 BELOW MENTIONED ARE A FEW REGULATORY LANDSCAPES FOLLOWED IN GCC:

TABLE 2 GCC IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 3 GCC SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 GCC SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 GCC PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 GCC IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 7 GCC IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 GCC IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 9 GCC IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 10 GCC GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 GCC BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 GCC RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 GCC HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 GCC IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 GCC ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 GCC GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 GCC OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 GCC IDENTITY VERIFICATION MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 19 U.A.E. IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 20 U.A.E. SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 U.A.E. SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 U.A.E. PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 U.A.E. IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 24 U.A.E IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 U.A.E. IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 26 U.A.E. IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 27 U.A.E. GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 U.A.E. BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 U.A.E. RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 U.A.E. HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 U.A.E. IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 U.A.E. ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 U.A.E. GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 U.A.E. OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 36 KINGDOM OF SAUDI ARABIA (KSA) SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 KINGDOM OF SAUDI ARABIA (KSA) SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 KINGDOM OF SAUDI ARABIA (KSA) PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 40 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 42 KINGDOM OF SAUDI ARABIA (KSA) IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 43 KINGDOM OF SAUDI ARABIA (KSA) GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 KINGDOM OF SAUDI ARABIA (KSA) BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 KINGDOM OF SAUDI ARABIA (KSA) RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 KINGDOM OF SAUDI ARABIA (KSA) HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 KINGDOM OF SAUDI ARABIA (KSA) IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 KINGDOM OF SAUDI ARABIA (KSA) ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 KINGDOM OF SAUDI ARABIA (KSA) GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 KINGDOM OF SAUDI ARABIA (KSA) OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 QATAR IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 52 QATAR SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 QATAR SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 QATAR PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 QATAR IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 56 QATAR IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 QATAR IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 QATAR IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 59 QATAR GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 QATAR BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 QATAR RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 QATAR HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 QATAR IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 QATAR ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 QATAR GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 QATAR OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 KUWAIT IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 68 KUWAIT SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 KUWAIT SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 KUWAIT PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 KUWAIT IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 72 KUWAIT IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 KUWAIT IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 74 KUWAIT IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 75 KUWAIT GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 KUWAIT BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 KUWAIT RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 KUWAIT HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 KUWAIT IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 KUWAIT ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 KUWAIT GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 KUWAIT OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 OMAN IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 84 OMAN SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 OMAN SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 OMAN PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 OMAN IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 88 OMAN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 OMAN IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 90 OMAN IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 91 OMAN GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 OMAN BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 OMAN RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 OMAN HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 OMAN IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 OMAN ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 OMAN GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 OMAN OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 BAHRAIN IDENTITY VERIFICATION MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 100 BAHRAIN SOLUTIONS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 BAHRAIN SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 BAHRAIN PROFESSIONAL SERVICES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 BAHRAIN IDENTITY VERIFICATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD THOUSAND)

TABLE 104 BAHRAIN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 BAHRAIN IDENTITY VERIFICATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 106 BAHRAIN IDENTITY VERIFICATION MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 107 BAHRAIN GOVERNMENT AND DEFENSE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 BAHRAIN BFSI IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 BAHRAIN RETAIL AND ECOMMERCE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 BAHRAIN HEALTHCARE IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 BAHRAIN IT & TELECOM IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 BAHRAIN ENERGY AND UTILITIES IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 BAHRAIN GAMING IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 BAHRAIN OTHERS IN IDENTITY VERIFICATION MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 GCC IDENTITY VERIFICATION MARKET: SEGMENTATION

FIGURE 2 GCC IDENTITY VERIFICATION MARKET: DATA TRIANGULATION

FIGURE 3 GCC IDENTITY VERIFICATION MARKET: DROC ANALYSIS

FIGURE 4 GCC IDENTITY VERIFICATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GCC IDENTITY VERIFICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC IDENTITY VERIFICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GCC IDENTITY VERIFICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GCC IDENTITY VERIFICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GCC IDENTITY VERIFICATION MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES IS EXPECTED TO DRIVE GCC IDENTITY VERIFICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GCC IDENTITY VERIFICATION MARKET IN 2022 & 2029

FIGURE 12 TECHNOLOGICAL TRENDS IN IDENTITY VERIFICATION SOLUTIONS

FIGURE 13 SUPPLY CHAIN OF GCC IDENTITY VERIFICATION MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GCC IDENTITY VERIFICATION MARKET

FIGURE 15 FIGURE 2 GROWTH IN NFC TECHNOLOGIES USAGE

FIGURE 16 GROWING PREVALENCE OF BIOMETRIC SOLUTIONS AMONG CONSUMERS

FIGURE 17 FIGURE 4 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2016 TO 2020

FIGURE 18 GCC IDENTITY VERIFICATION MARKET: BY COMPONENT, 2021

FIGURE 19 GCC IDENTITY VERIFICATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 20 GCC IDENTITY VERIFICATION MARKET: BY TYPE, 2021

FIGURE 21 GCC IDENTITY VERIFICATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 GCC IDENTITY VERIFICATION MARKET: BY VERTICAL, 2021

FIGURE 23 GCC IDENTITY VERIFICATION MARKET: SNAPSHOT (2021)

FIGURE 24 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2021)

FIGURE 25 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 GCC IDENTITY VERIFICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 GCC IDENTITY VERIFICATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 GCC IDENTITY VERIFICATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 29 UAE GCC IDENTITY VERIFICATION MARKET: COMPANY SHARE 2021 (%)

FIGURE 30 KSA GCC Identity Verification MARKET: company share 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.