European Union Application-Specific Integrated Circuit (ASIC) Market Analysis and Size

Manufacturers are continuously trying to find out ways to increase the precision of work, enhance services and work with growing technology. The requirement for these reasons is being fulfilled through the implementation of application-specific integrated circuit (ASIC) systems as they are used to provide enhanced, uninterrupted, free and timely services to end-user applications.

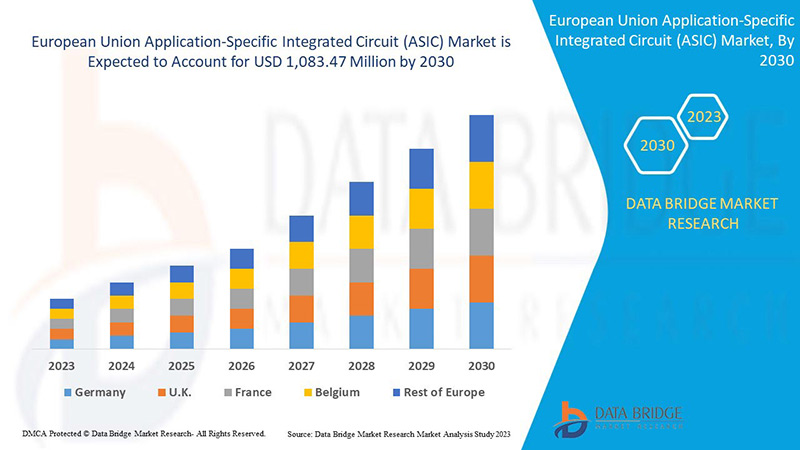

Data Bridge Market Research analyses that the European Union application-specific integrated circuit (ASIC) market is expected to reach the value of USD 1,083.47 Million by 2030, at a CAGR of 6.8% during the forecast period. The application-specific integrated circuit (ASIC) market report also covers pricing analysis, patent analysis and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Design Type (Full Custom, Semi-Custom and Programmable ASIC), Technology (SRAM, Anti-Fuse, EPROM, Flash-Based/EEPROM and Others), Functionality (Real-Time and Standalone), Application (Defence Equipment, Aircraft, Weapons, Spacecraft, Ships and Others) |

|

Countries Covered |

Germany, France, Netherlands, Belgium, Italy, Spain, Poland, Sweden, Denmark, Austria and Rest of European Union. |

|

Market Players Covered |

STMicroelectronics, Intel Corporation, Lattice Semiconductor, Cobham Advanced Electronic Solutions, Texas Instruments Incorporated, ARQUIMEA GROUP, S.A. IC’Alps SAS, QuickLogic Corporation, Tekmos Inc., NanoXplore, Achronix Semiconductor Corporation, Renesas Electronics Corporation, EnSilica, Infineon Technologies AG, Microchip Technology Inc., Advanced Micro Devices, Inc., Honeywell International Inc., TTTech Computertechnik AG, Marvell and Semiconductor Components Industries, LLC, among others. |

Market Definition

An application-specific integrated circuit (ASIC) is an IC chip tailored to a specific application rather than being designed for broad usage. An ASIC is, for example, a chip that runs in a digital voice recorder or a high-efficiency video encoder (such as AMD VCE). Application-specific standard product (ASSP) chips are a middle ground between ASICs and industry-standard integrated circuits such as the 7400 or 4000 series. As MOS integrated circuit chips, ASIC chips are generally produced using metal-oxide-semiconductor (MOS) technology.

The greatest complexity (and hence usefulness) available in an ASIC has expanded from 5,000 logic gates to over 100 million as feature sizes have dropped and design tools have improved over time. Microprocessors, memory blocks such as ROM, RAM, EEPROM, flash memory and other significant building blocks are frequently included in modern ASICs. An SoC is a common moniker for such an ASIC (system-on-chip). A hardware description language (HDL), such as Verilog or VHDL, is frequently used by designers of digital ASICs to define the functioning of ASICs.

European Union Application-Specific Integrated Circuit (ASIC) Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

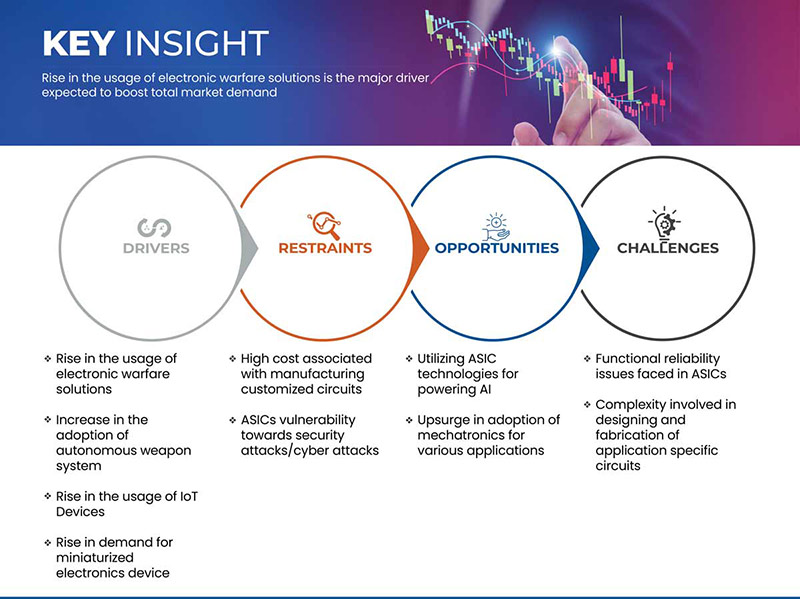

- Rise in usage of electronic warfare solutions

Electronic warfare refers to using electromagnetic spectrum signals such as radio, infrared, or radar to sense, protect and communicate to protect military assets from potential threats. Moreover, electronic warfare cadets help to protect an aircraft or helicopter from radar or infrared-guided missiles. These cadets were invented over 50 years ago and grew advanced over the years with the development of new technologies.

The rise in innovation and adoption of modern technologies, such as augmented reality, artificial intelligence and others, in various marine sectors, has driven the acceptance of electronic components and modern solutions, such as smart ships and autonomous work processes in war. These solutions will help to defend and attack the enemies without any human interference and this will lower the lifetime risk of cadets.

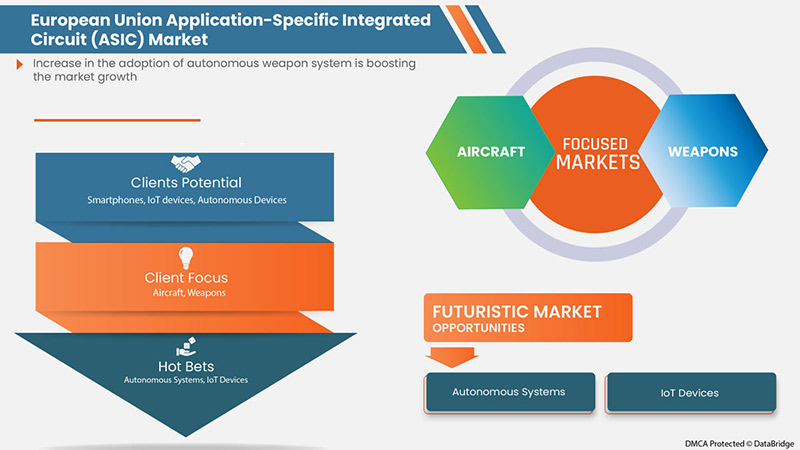

- Increase in the adoption of autonomous weapon system

Autonomous is the ability of a machine to execute tasks without human input using interactions of computer programming and electronic component. This will recognize the human-machine command and control relationship and the sophistication of a machine’s decision-making capability may vary from one function to another. Some weapon systems require a greater level of self-governance through electronic components and software technology.

Moreover, the development of autonomous weapon systems will adopt the software algorithms to identify, select and kill the targets without human intervention. Similarly, there is a wide range of benefits that have made many European countries, such as Germany, France and many others, form a coalition agreement to promote autonomous weapons systems.

Opportunities

- Upsurge in the adoption of mechatronics for various applications

Mechatronics systems are systems that are designed with a combination of mechanical, electrical, telecommunications, control and computer science technologies. Mechatronics systems are largely used in automotive applications such as the manufacturing of automobiles, Self-Driving Vehicles chassis, drive train and safety systems. Nowadays, mechatronics systems have gained a major role in the aerospace and defence industry.

Over the decades, mechatronics systems have been used in the automobile industry to develop autonomous manufacturing systems of vehicles. Moreover, such systems have also gained importance in the vehicle control system. In recent times, autonomous vehicles have gained immense popularity owing to factors such as advanced mechatronic capabilities, advanced processors & Software and advanced AI & computer vision.

Restraints/Challenges

- High cost associated with manufacturing customized circuits

The cost associated with the manufacturing of application-specific integrated circuits (ASIC) chips or masks is significantly high. These technologies are widely adopted in the automotive, manufacturing and transportation industries.

According to various press publications globally, there is the rising use of custom ASICs among various tech industries. This is driving the adoption of creating and designing cutting-edge ASIC artificial intelligence chips and cloud-computing services.

The design of the chip involves various processes, such as raw material requirements, fabrication and testing costs. An ASIC chip has various numbers of layers ranging from 4 to 12. Generally, the bottom 3 to 4 layers contain the transistors and some interconnectivity components, which also adds to the fabrication cost.

The upper layers are almost entirely used for connection purposes. Then various kinds of transparent masks are used for photo-etching. Combining all the components required for designing an ASIC chip, the cost becomes significantly high.

- Complexity involved in designing and fabrication of application-specific circuits

ASIC technology design is a method of fabricating cost-effective electronic circuits through miniaturization and integration of various individual components functioning into a single unit. A semiconductor electronic device consists of various electronic components, such as integrated circuits (ICs) which are intertwined with each other to perform a particular function. I have various components such as resistors, transistors, capacitors, logic gates and others.

With the advancement in VLSI/CMOS technologies, complexity has grown from 5,000 logic gates to over 100 million logic gates in a single chip of ASIC design. According to Moore’s Law, the number of gates or transistors used in integrated circuits (ICs) will change every 18 months. Technology advancement in logic, parallelization, VLSI/CMOS and CAD tools will further hoist the complexity of the ICs.

Post COVID-19 Impact On the European Union Application-Specific Integrated Circuit (ASIC) Market

COVID-19 created a negative impact on the application-specific integrated circuit (ASIC) market owing to the shutdown of manufacturing facilities.

The COVID-19 pandemic has impacted the application-specific integrated circuit (ASIC) market to an extent in a negative manner. Increasing adoption of electronic and autonomous warfare in the defence sector has helped the market to grow after the pandemic. Also, it is expected that there will be considerable sectoral growth in the near future.

Manufacturers make various strategic decisions to enhance their offerings in the post-COVID-19 scenario. The players are conducting multiple research and development activities to improve the technology involved in the application-specific integrated circuit (ASIC). With this, the companies will bring advanced technologies to the market. In addition, government initiatives for using artificial intelligence technology in the aerospace and defence sector have led to the market's growth.

Recent Development

- In October 2023, Cobham Advanced Electronic Solutions announced the partnership with SkyWater to manufacture rad-hard integrated circuits. This will help the company to enhance the design and manufacturing of ASIC, which expands the product portfolio to accelerate the revenue growth

- In October 2022, QuickLogic Corporation announced the availability of its first customer-defined eFPGA block from the Australia IP Generator for the UMC 22nm process. The Australia tool enables rapid eFPGA IP generation for nearly any foundry and node. This product launch enhances the product portfolio of the company

European Union Application-Specific Integrated Circuit (ASIC) Market Scope

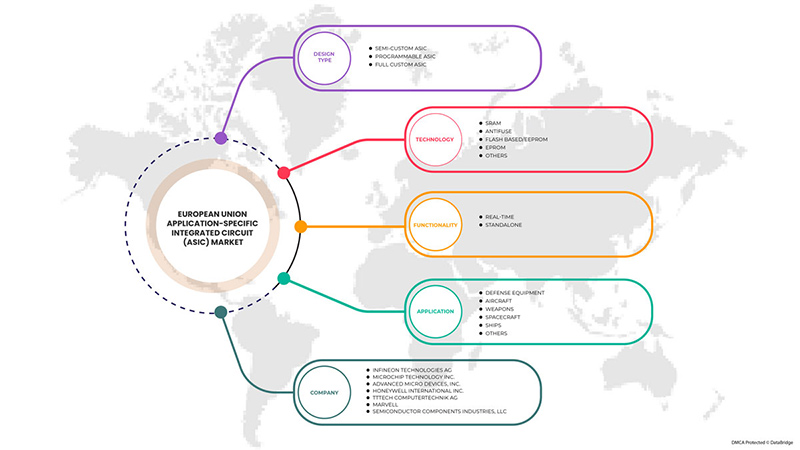

European Union application-specific integrated circuit (ASIC) market is segmented into four notable segments, which are based on design type, technology, functionality and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Design Type

- Full Custom

- Semi-Custom

- Programmable ASIC

On the basis of design type, the European Union application-specific integrated circuit (ASIC) market is segmented into full custom, semi-custom and programmable ASIC.

Technology

- SRAM

- Anti-Fuse

- EPROM

- Flash-Based/EEPROM

- Others

On the basis of technology, the European Union application-specific integrated circuit (ASIC) market has been segmented into SRAM, anti-fuse, EPROM, flash-based/EEPROM and others.

Functionality

- Real-Time

- Standalone

On the basis of functionality, the European Union application-specific integrated circuit (ASIC) market has been segmented into real-time and standalone.

Application

- Defence Equipment

- Aircraft

- Weapons

- Spacecraft

- Ships

- Others

On the basis of application, the European Union application-specific integrated circuit (ASIC) market is segmented into defence equipment, aircraft, weapons, spacecraft, ships and others.

European Union Application-Specific Integrated Circuit (ASIC) Market Regional Analysis/Insights

European Union application-specific integrated circuit (ASIC) market is analysed and market size insights and trends are provided by country, design type, technology, functionality and application, as referenced above.

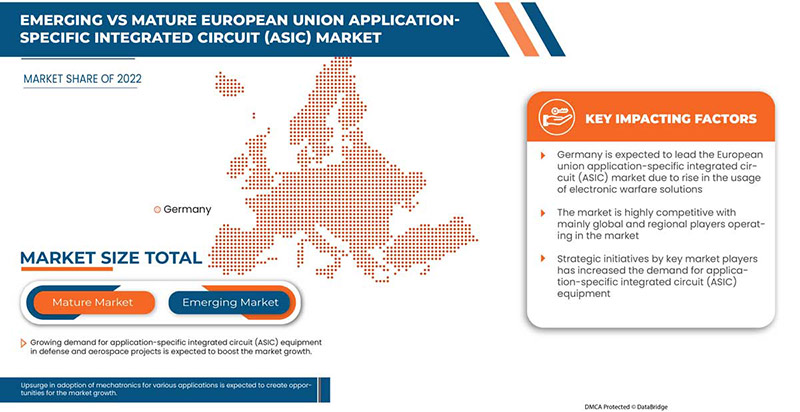

The countries covered in the European Union application-specific integrated circuit (ASIC) market report are Germany, France, Netherlands, Belgium, Italy, Spain, Poland, Sweden, Denmark, Austria and Rest of European Union. Germany dominates in the Europe region due to increasing research and development activities in integrated circuit technologies for the aerospace & defense sector.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of European Union brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and European Union Application-Specific Integrated Circuit (ASIC) Market Share Analysis

European Union application-specific integrated circuit (ASIC) market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the application-specific integrated circuit (ASIC) market.

Some of the major players operating in the European Union application-specific integrated circuit (ASIC) market are STMicroelectronics, Intel Corporation, Lattice Semiconductor, Cobham Advanced Electronic Solutions, Texas Instruments Incorporated, ARQUIMEA GROUP, S.A., IC’Alps SAS, QuickLogic Corporation, Tekmos Inc., NanoXplore, Achronix Semiconductor Corporation, Renesas Electronics Corporation, EnSilica, Infineon Technologies AG, Microchip Technology Inc., Advanced Micro Devices, Inc., Honeywell International Inc., TTTech Computertechnik AG, Marvell and Semiconductor Components Industries, LLC, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC)MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 DESIGN TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.2 SUPPLY CHAIN ANALYSIS

4.3 TECHNOLOGICAL ANALYSIS

4.3.1 AI

4.3.2 INTERNET OF THINGS (IOT)

4.3.3 VLSI TECHNOLOGY

4.3.4 NANOTECHNOLOGY

4.4 CRITICALITIES IN THE MARKET

4.4.1 DEBUGGING ISSUES WITH DESIGN

4.4.2 SYSTEM INTEGRATION ISSUES

4.5 CASE STUDY

4.5.1 ARQUIMEA GROUP, S.A.

4.5.2 IC’ALPS SAS

4.6 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN USAGE OF ELECTRONIC WARFARE SOLUTIONS

5.1.2 INCREASE IN THE ADOPTION OF AUTONOMOUS WEAPON SYSTEM

5.1.3 RISE IN THE USAGE OF IOT DEVICES

5.1.4 RISE IN DEMAND FOR MINIATURIZED ELECTRONIC DEVICE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH MANUFACTURING CUSTOMIZED CIRCUITS

5.2.2 ASICS VULNERABILITY TOWARDS SECURITY ATTACKS/CYBER ATTACKS

5.3 OPPORTUNITIES

5.3.1 UTILIZING ASIC TECHNOLOGIES FOR POWERING AI

5.3.2 UPSURGE IN THE ADOPTION OF MECHATRONICS FOR VARIOUS APPLICATIONS

5.3.3 RISE IN THE DEPLOYMENT OF DATA CENTERS AND HIGH-PERFORMANCE COMPUTING

5.4 CHALLENGES

5.4.1 FUNCTIONAL RELIABILITY ISSUES FACED IN ASIC

5.4.2 COMPLEXITY INVOLVED IN DESIGNING AND FABRICATION OF APPLICATION-SPECIFIC CIRCUITS

6 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE

6.1 OVERVIEW

6.2 SEMI-CUSTOM ASIC

6.2.1 STANDARD –CELL-BASED

6.2.2 GATE-ARRAY-BASED

6.2.2.1 CHANNEL LESS GATE ARRAYS

6.2.2.2 STRUCTURED GATE ARRAYS

6.2.2.3 CHANNELED GATE ARRAYS

6.3 PROGRAMMABLE ASIC

6.3.1 FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY

6.3.1.1 BY TYPE

6.3.1.1.1 HIGH-END FPGAS

6.3.1.1.2 LOW-END FPGAS

6.3.1.1.3 MID-RANGE FPGAS

6.3.1.2 BY NODE

6.3.1.2.1 LESS THAN 28 NM

6.3.1.2.2 28-90 NM

6.3.1.2.3 MORE THAN 90 NM

6.3.1.3 BY SECURITY

6.3.1.3.1 DEFENSE GRADE SECURITY

6.3.1.3.1.1 DESIGN SECURITY

6.3.1.3.1.2 DATA SECURITY

6.3.1.3.1.3 SECURE HARDWARE

6.3.1.3.1.4 OTHERS

6.3.1.3.2 PHYSICAL MEMORY PROTECTION (PMP)

6.3.1.4 BY MEMORY

6.3.1.4.1 BLOCK MEMORY

6.3.1.4.2 DISTRIBUTED MEMORY

6.3.1.5 BY FUNCTIONAL BLOCK

6.3.1.5.1 LOGIC BLOCKS

6.3.1.5.1.1 COMBINATIONAL GATES

6.3.1.5.1.2 MULTIPLEXES

6.3.1.5.1.3 TRANSISTOR PAIRS

6.3.1.5.1.4 OTHERS

6.3.1.5.2 ROUTING

6.3.2 PROGRAMMABLE LOGIC DEVICES (PLDS)

6.3.2.1 SIMPLE PROGRAMMABLE LOGIC DEVICE (SPLDS)

6.3.2.2 HIGH CAPACITY PROGRAMMABLE LOGIC DEVICE (HCPLDS)

6.4 FULL CUSTOM ASIC

7 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 SRAM

7.3 ANTIFUSE

7.4 FLASH BASED/EEPROM

7.5 EPROM

7.6 OTHERS

8 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY

8.1 OVERVIEW

8.2 REAL-TIME

8.3 STANDALONE

9 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DEFENSE EQUIPMENT

9.3 AIRCRAFT

9.4 WEAPONS

9.5 SPACECRAFT

9.6 SHIPS

9.7 OTHERS

10 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY COUNTRY

10.1 GERMANY

10.2 FRANCE

10.3 NETHERLANDS

10.4 ITALY

10.5 SPAIN

10.6 POLAND

10.7 SWEDEN

10.8 BELGIUM

10.9 AUSTRIA

10.1 DENMARK

10.11 REST OF EUROPEAN UNION

11 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPEAN UNION

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 INFINEON TECHNOLOGIES AG

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCTS PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 MICROCHIP TECHNOLOGY INC. (2021)

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 ADVANCED MICRO DEVICES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCTS PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 HONEYWELL INTERNATIONAL INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 TTTECH COMPUTERTECHNIK AG

13.5.1 COMPANY SNAPSHOT

13.5.2 SOLUTION PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 ACHRONIX SEMICONDUCTOR CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 ARQUIMEA

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 COBHAM ADVANCED ELECTRONIC SOLUTIONS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 ENSILICA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCTS PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 IC’ALPS SAS

13.10.1 COMPANY SNAPSHOT

13.10.2 SERVICE PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 INTEL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 SOLUTION PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 LATTICE SEMICONDUCTOR

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 SOLUTION PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 MARVELL

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 SOLUTION PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 NANOXPLORE

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 QUICKLOGIC CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 RENESAS ELECTRONICS CORPORATION

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 STMICROELECTRONICS

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 TEXAS INSTRUMENTS INCORPORATED (2022)

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 TEKMOS INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 2 EUROPEAN UNION SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 EUROPEAN UNION GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 EUROPEAN UNION PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 EUROPEAN UNION FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPEAN UNION FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 7 EUROPEAN UNION FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 8 EUROPEAN UNION DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 EUROPEAN UNION FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 10 EUROPEAN UNION FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 11 EUROPEAN UNION LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 EUROPEAN UNION PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 14 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 15 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 17 GERMANY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 18 GERMANY SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 GERMANY GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 GERMANY PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 GERMANY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 GERMANY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 23 GERMANY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 24 GERMANY DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 GERMANY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 26 GERMANY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 27 GERMANY LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 GERMANY PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 GERMANY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 30 GERMANY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 31 GERMANY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 FRANCE APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 33 FRANCE SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 FRANCE GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 FRANCE PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 FRANCE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 FRANCE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 38 FRANCE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 39 FRANCE DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 FRANCE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 41 FRANCE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 42 FRANCE LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 FRANCE PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 FRANCE APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 45 FRANCE APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 46 FRANCE APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 NETHERLANDS APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 48 NETHERLANDS SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NETHERLANDS GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 NETHERLANDS PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 NETHERLANDS FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NETHERLANDS FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 53 NETHERLANDS FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 54 NETHERLANDS DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 NETHERLANDS FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 56 NETHERLANDS FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 57 NETHERLANDS LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NETHERLANDS PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NETHERLANDS APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 60 NETHERLANDS APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 61 NETHERLANDS APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 ITALY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 63 ITALY SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 ITALY GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 ITALY PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 ITALY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 ITALY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 68 ITALY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 69 ITALY DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 ITALY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 71 ITALY FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 72 ITALY LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 ITALY PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 ITALY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 75 ITALY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 76 ITALY APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 SPAIN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 78 SPAIN SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 SPAIN GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 SPAIN PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 SPAIN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 SPAIN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 83 SPAIN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 84 SPAIN DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 SPAIN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 86 SPAIN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 87 SPAIN LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 SPAIN PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 SPAIN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 90 SPAIN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 91 SPAIN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 POLAND APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 93 POLAND SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 POLAND GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 POLAND PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 POLAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 POLAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 98 POLAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 99 POLAND DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 POLAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 101 POLAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 102 POLAND LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 POLAND PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 POLAND APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 105 POLAND APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 106 POLAND APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 SWEDEN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 108 SWEDEN SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 SWEDEN GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 SWEDEN PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 SWEDEN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 SWEDEN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 113 SWEDEN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 114 SWEDEN DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 SWEDEN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 116 SWEDEN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 117 SWEDEN LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 SWEDEN PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SWEDEN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 120 SWEDEN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 121 SWEDEN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 122 BELGIUM APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 123 BELGIUM SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 BELGIUM GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 BELGIUM PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 BELGIUM FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 BELGIUM FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 128 BELGIUM FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 129 BELGIUM DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 BELGIUM FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 131 BELGIUM FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 132 BELGIUM LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 BELGIUM PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 BELGIUM APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 135 BELGIUM APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 136 BELGIUM APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 137 AUSTRIA APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 138 AUSTRIA SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 AUSTRIA GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 AUSTRIA PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 AUSTRIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 AUSTRIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 143 AUSTRIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 144 AUSTRIA DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 AUSTRIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 146 AUSTRIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 147 AUSTRIA LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 AUSTRIA PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 AUSTRIA APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 150 AUSTRIA APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 151 AUSTRIA APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 152 DENMARK APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

TABLE 153 DENMARK SEMI-CUSTOM ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 DENMARK GATE-ARRAY-BASED IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 DENMARK PROGRAMMABLE ASIC IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 DENMARK FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 DENMARK FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE, 2021-2030 (USD MILLION)

TABLE 158 DENMARK FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECURITY, 2021-2030 (USD MILLION)

TABLE 159 DENMARK DEFENSE GRADE SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 DENMARK FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY MEMORY, 2021-2030 (USD MILLION)

TABLE 161 DENMARK FPGAS (FIELD PROGRAMMABLE GATE ARRAY) SECURITY IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONAL BLOCK, 2021-2030 (USD MILLION)

TABLE 162 DENMARK LOGIC BLOCKS IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 DENMARK PROGRAMMABLE LOGIC DEVICES (PLDS) IN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 DENMARK APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 165 DENMARK APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 166 DENMARK APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 167 REST OF EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 2 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DROC ANALYSIS

FIGURE 4 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: EUROPEAN UNION VS COUNTRY ANALYSIS

FIGURE 5 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DBMRMARKET POSITION GRID

FIGURE 8 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: MULTIVARIATE MODELING

FIGURE 10 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: TIMELINE CURVE

FIGURE 11 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE ADOPTION OF AUTONOMOUS WEAPON SYSTEM IS EXPECTED TO DRIVE THE EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 SEMI-CUSTOM ASIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN 2023 & 2030

FIGURE 15 TECHNOLOGICAL TRENDS IN EUROPEAN APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

FIGURE 17 (2020-2025) – GLOBAL ADOPTION RATE OF AUTOMATION IN INDUSTRIES

FIGURE 18 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2022

FIGURE 19 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TECHNOLOGY, 2022

FIGURE 20 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY FUNCTIONALITY, 2022

FIGURE 21 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2022

FIGURE 22 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SNAPSHOT (2022)

FIGURE 23 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2022)

FIGURE 24 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE (2023-2030)

FIGURE 27 EUROPEAN UNION APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY SHARE 2022 (%)

European Union Application Specific Integrated Circuit Asic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its European Union Application Specific Integrated Circuit Asic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as European Union Application Specific Integrated Circuit Asic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.